Is there a better alternative to Mint? After all, who wouldn’t be interested in a free budgeting app, and one of the most popular ones in the world at that?

But Mint is not without competition and plenty of it. A relative newcomer – at least when compared to Mint – is EveryDollar. In many respects, it works similar to Mint in that it provides basic budgeting capabilities.

However, it differs in that those budgeting capabilities are based on a very specific set of financial strategies, designed by an immensely popular personal financial advisor, Dave Ramsey.

Both budgeting apps have their virtues and their limitations. Which is the better of the two? There’s no doubt either can work for you, depending on your personal needs and preferences. But between the two, one stands out as being the better choice for you if you’re more serious about building a better financial future.

Let’s look at both apps and see which one comes out on top.

Table of Contents

🔃 Updated February 2023 with new EveryDollar pricing of $79.99 per year after a 14-day trial. This is down from $129.99 per year.

About EveryDollar

If you’re a fan of Dave Ramsey, you’ll seriously appreciate EveryDollar. It’s a budgeting app that closely follows Dave Ramsey’s zero-based budgeting strategy. They offer both free and paid versions, either of which can be set up in a matter of minutes.

EveryDollar incorporates the strategies Ramsey advocates in his Financial Peace University course, as well as his seven Baby Steps strategy The basic goal is to make sure all your money is regularly accounted for, and that you “give every dollar a job”.

You’ll have to begin EveryDollar on the web, but the app is available for both iOS and Android devices once it’s in place.

About Mint

Mint is a completely free budgeting app, but one of the most established and perhaps the most popular in the very crowded field. The app has been in existence since 2006, which makes it practically ancient in cyber years. But that hasn’t dimmed its popularity. In fact, the company is now part of Intuit, which is the same organization that provides TurboTax, itself probably the most popular personal tax preparation software in the industry.

Though it does offer some other services, Mint is primarily a budgeting app. It’s available in both the Web version and for mobile devices, including iOS and Android.

Here is our full review of Mint if you’d like to learn more.

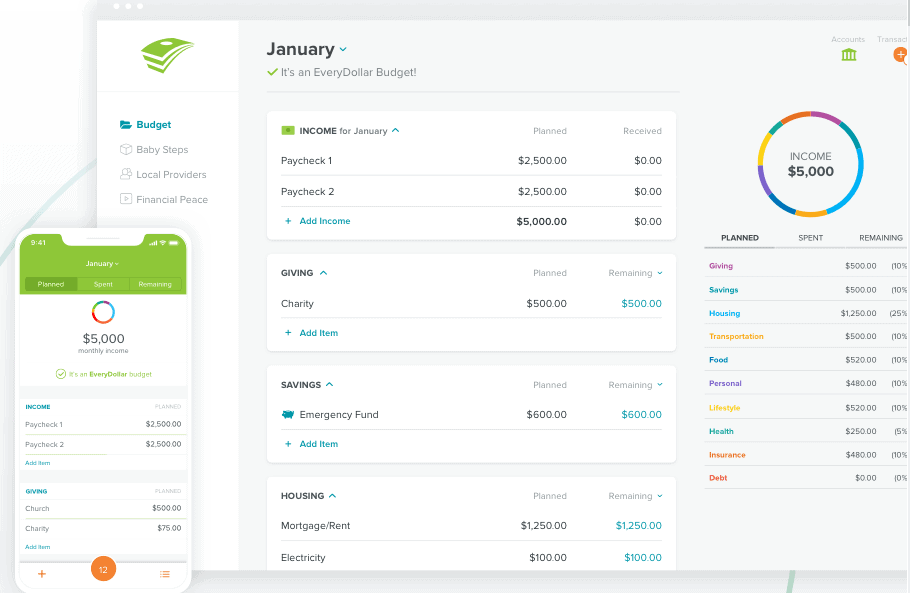

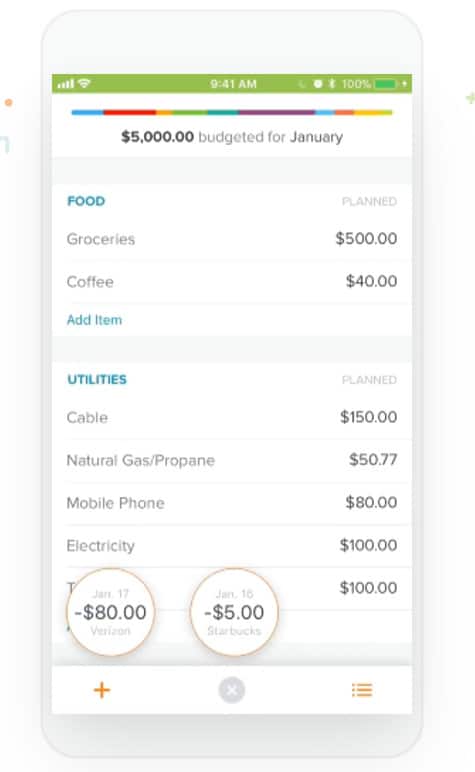

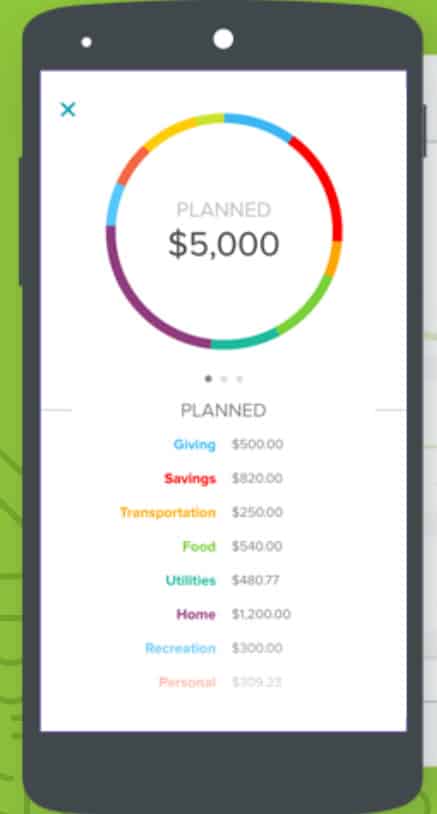

What EveryDollar Budgeting Does

The zero-based budgeting system used by EveryDollar puts every dollar in your budget into an assigned category. Each month, you’ll need to enter your income and layout your expenses in advance. From there, you can establish different budget categories, and even assign a certain amount of income to each. The app will monitor your spending on a day-to-day basis.

One disadvantage with the free version is that you’ll need to enter your financial information manually. However, if you sign up for the paid version, known as EveryDollar Plus, you’ll be able to link your various financial accounts, and the app will automatically import your transactions.

When you enter your anticipated income for the month, the app will tell you when the deposits were made. From there, it will let you know how much you’ll have available for spending, savings, and other categories. And since the app is based on Dave Ramsey’s budgeting, it will also provide for church tithing and charitable giving.

The savings allocations can be split into different accounts. You’ll start with a basic emergency fund, which is a Dave Ramsey fixture. But you can also add other savings goals, like a vacation fund, saving for the down payment on a car or a home, or even for a future college education for your children.

On the spending side, the app starts with eight default spending categories. Those will include housing, food, transportation, insurance, debt payments, health, recreation, and personal categories. You’ll be able to create subcategories and even add entirely new ones.

For example, you can break transportation down between gasoline, annual registration fees and taxes, regular maintenance, and major repairs. The same can be done with housing, insurance, and other broad categories.

EveryDollar Plus

This is the EveryDollar paid edition. It does everything the free app does but adds a few very valuable perks:

Automatic account syncing. EveryDollar Plus syncs with your financial accounts and automatically imports your transactions. That avoids the need for manual transaction entry that’s required for the free version.

Financial Peace University. The course comes with your paid subscription. One of the most popular personal finance courses ever created, Financial Peace University has had participation from more than 5 million people. It’s a motivating, nine-lesson class that will teach you how to save money, get out of debt, and build wealth. You’ll be able to complete the course either online or locally.

Phone support. The free version comes only with email support, but Plus provides live contact by phone.

Here’s our full review of EveryDollar if you want to dive deeper.&

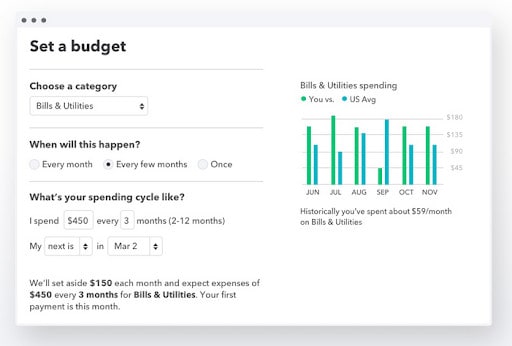

What Mint Budgeting Does

Mint aggregates all your financial accounts through the app. It has the advantage that your transaction information is updated automatically. In fact, it gets updated each time you visit the site.

Not only does the app present your updated financial information, but it does so with a considerable degree of flair. That includes an easy-to-use interface, complete with graphs and other visual representations to make it a more attractive platform.

Though it primarily provides budgeting, the dashboard can provide quick summaries of your entire financial situation in one place.

Once you enter your financial accounts, they’ll be saved on a regular basis, then automatically categorized into predefined categories. However, you can create subcategories within each expense category to provide greater detail in your finances. And though your accounts will be auto-populated, you will have the ability to make adjustments as needed.

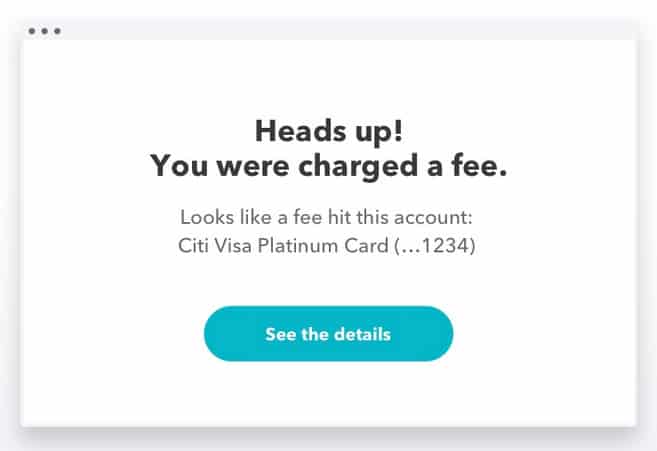

You’ll also receive alerts anytime a major financial event happens, like an upcoming bill or a late payment.

Mint’s goals feature isn’t as exact as EveryDollar. There’s nothing comparable to Dave Ramsey’s 7 Baby Steps. But it will enable you to create goals, like paying off a loan or credit card debt – or saving for a specific goal – that can be built into your regular monthly budget.

What EveryDollar has that Mint Doesn’t

Based on Dave Ramsey’s 7 Baby Steps, EveryDollar will direct you to incorporate these in your budget. The baby steps include:

- Save $1,000 for a “starter” emergency fund.

- Use the “debt snowball” (a Dave Ramsey concept) to pay off debt.

- And 3-to-6 month living expenses to fully fund your emergency fund.

- Save 15% of your income for retirement.

- Start a college fund for your children.

- Pay off your mortgage ahead of schedule.

- Build wealth and give, which includes faith-based tithing and giving to charities.

All seven steps can be implemented simultaneously, but they’re specifically designed to be done one at a time. That is, you complete one, then move on to the next. The divide-and-conquer strategy makes it more likely you’ll accomplish all the steps on the list – or a least as many as you choose to.

What Mint has that EveryDollar Doesn’t

Mint’s list of exclusive features (compared with EveryDollar) is impressive.

Credit score monitoring. It’s not your actual FICO Score, but it is free. Instead, they offer the VantageScore 3.0 from TransUnion, which is an educational credit score that approximately tracks your FICO Score and is based on the same credit information. You’ll be able to check your credit score as often as you like, without impacting your score.

In addition, you’ll be notified anytime there are changes in your personal information, including new credit inquiries. That will give you an opportunity to head off credit troubles before they start, including potential identity theft.

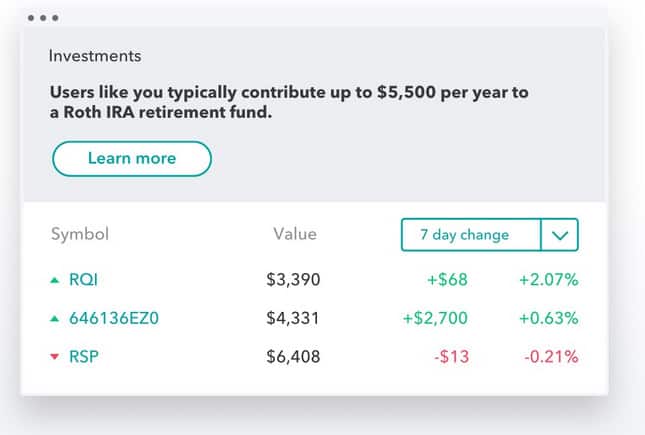

Investment Tracker. Not only does Mint track your investment portfolio, but it also helps you find hidden fees. That includes those charged by investment advisors, brokerages, and 401(k) providers. You’ll also be able to compare your portfolio to market benchmarks, to see how well your portfolio is performing. It’s not a comprehensive investment management service, but it does provide some valuable investment services at no cost to you.

Budget App Fees: EveryDollar vs. Mint

The basic EveryDollar app is free to use. How much does EveryDollar Plus cost?

$79.99 per year, but that’s only after you complete a 14-day free trial. It does everything the basic EveryDollar plan does, but it provides customer support by phone, automatic importing of transactions, and includes the Financial Peace University course.

Perhaps not coincidentally, $79.99 is the price you would pay for the Financial Peace University course as a standalone purchase. You can think of it as buying Financial Peace University and getting EveryDollar Plus for free.

Mint is completely free to use. But in exchange for that free status, you will be subject to a steady stream of advertisements. Every venture in existence has to generate cash flow from somewhere to stay in business, and this is how Mint gets that job done. But if you don’t mind putting up with the ads, Mint is a truly free budgeting app.

Who is EveryDollar Better For?

Dave Ramsey fans will love EveryDollar. After all, it’s provided by Dave Ramsey’s company and makes full use of his proven personal financial strategies. It offers an opportunity to break down financial management into manageable baby steps, that will be easier to accomplish than trying to tackle every challenge in your financial life at one time.

If you’re not a Dave Ramsey fan, you probably won’t find the free version of EveryDollar particularly appealing – especially when compared to Mint. But then you don’t need to be a Dave Ramsey fan to benefit from his financial advice and strategies. Millions of others already have.

But if you’re interested in completing the Financial Peace University course – which is widely recommended by financial planners and on personal finance blogs – you’ll absolutely want to choose EveryDollar Plus. Hundreds of thousands of people have literally turned their financial lives around after participating in the course.

Who is Mint Better For?

Mint will likely be the better choice if you’re mostly interested in a basic budgeting app. Though it doesn’t lay out specific steps to help you achieve your financial goals, you can set goals on your own. And if you have the discipline to adhere to the budget and goals you’ve created, you can accomplish much the same with Mint as you can with the free version of EveryDollar.

However, be aware that if you don’t have that motivation, Mint is unlikely to help you in that category. Any budget app, or any financial app for that matter, will only be as effective as you make it. The lack of a specific structure with Mint can make it unworkable if you don’t have serious determination to make it happen.

But if you do, you’ll also get the benefit of access to free credit score monitoring, as well as investment tracking. While neither of those services is likely to help you transform your financial life, they are nice benefits to have with an otherwise free budgeting app.

And the Winner Is…

EveryDollar and Mint are good at a few things, and lacking in certain others. For example, there’s little doubt EveryDollar is the better choice if you’re looking to improve your financial situation and even achieve financial independence. It lays out the basic steps and framework necessary to move in that direction.

EveryDollar Plus will be especially helpful in that effort. You’ll be able to use the basic EveryDollar app, but also get a complete financial education through Financial Peace University. The automated syncing of your financial transactions will put the budgeting portion on a par with Mint. And the live phone contact is something Mint doesn’t offer.

But if you’re just looking for a basic budgeting and financial aggregator, Mint will get the job done. And it will do it completely free of charge – as long as you don’t mind putting up with the steady stream of advertisements.

If we have to declare a winner, it’s got to be EveryDollar. The basic framework of Dave Ramsey’s proven financial strategies gives this app a level of substance that Mint lacks. That’s especially true of the EveryDollar Plus version, but even of the free version, though to a lesser degree.

So the winner is – EveryDollar. Free or Plus.

If neither of these platforms look interesting and you want some other options, here is our list of free budgeting tools.