When it comes to investing, our biggest challenges are usually ourselves.

As I write this in early 2022:

- The stock market is down about 20% on the year.

- There’s talk of a recession.

- Inflation is soaring.

- Series I bonds are set to pay interest of close to 10%.

- And we still have the Covid-19 pandemic.

It’s natural to be a bit fearful.

And human beings are strongly loss averse – we feel the pain of loss far more acutely than we feel the joy of gains. It’s has an evolutionary benefit because when a lion bites off your face, that’s the ball game. It doesn’t matter how many berries you’ve gathered, how many offspring you have, or how many dollars you’ve accumulated – your face is gone.

We take this into modern life and we see a sea of red in the stock market and wonder if it’s time to slow down on our investing. Perhaps we want to stop.

We know it’s still market timing but we don’t care. There’s so much red.

Today, I’m going to share with you how I convince myself to continue to invest during periods of volatility and loss:

Table of Contents

🤖 Automate Your Investing

When I worked a corporate job, I regularly contributed to a 401(k). It was set up when I started, I reviewed it each year, but I never had to manually transfer money.

Saving for our retirement was automated.

This meant that from 2003 to 2008, when I was working full-time, I made regular contributions into a nest egg that I haven’t contributed to since 2008.

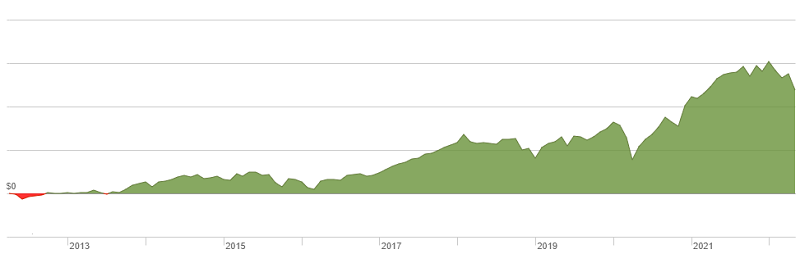

Here’s what my Rollover IRA performance looks like [my current retirement contributions go to a Solo 401(k)]:

By saving regularly, this nest egg is able to grow over time to a significant sum. Not surprisingly, the investment returns have exceeded my contributions.

Automating your savings is valuable because it takes that monthly decision out of your hands. We can do this because this is money we don’t need for a few decades. I’m locking it up in a time capsule and hiding away the key.

Inertia is real. If you have to take steps to save, you’re less likely to save. Right now, we have to take steps to NOT save…

When I started working for myself, I continued this automation because it was important to take myself out of the process. Each month, we make a contribution to Vanguard. I even turn off the notifications because it’s still irritating to get the notification email on a down market day (the confirmations are sent the day after a contribution).

If you do nothing else, automate your savings and take yourself out of the process. The rest of this stuff won’t matter.

If you’re curious about our numbers, we automatically transfer about 10% of our income into taxable and retirement accounts each month.

⌛ Increase Your Time in the Market

The biggest advantage you have in investing is time – time in the market trumps all else. If you have a long time horizon, it’s almost impossible to lose. The longer you can invest in the market, the higher the probability you will leave a winner.

Despite comparisons between the stock market and gambling, it’s the exact opposite of a casino. The longer you’re in a casino, the more likely you’ll leave a loser.

This is because the market enjoys a lot of tailwinds. Inflation sucks at the gas pump and grocery store but it’s built in gains in the stock market. If you purchase shares of an index fund, like VTI or VOO, you get a large swath of the market and can go to sleep knowing that on a long enough time horizon, you’ll win.

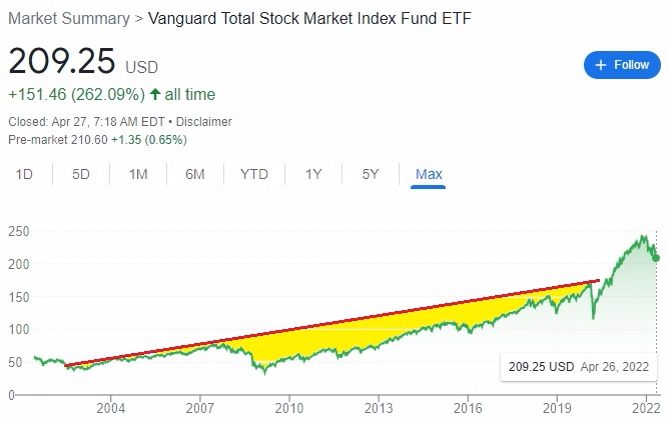

Without getting too technical, here’s the 5 year chart of Vanguard Total Stock Market Index Fund ETF:

It’s had a bumpy ride but the thing is up 70% over 5 years.

Now check it out over the MAX, which goes back to June 1, 2001:

The point is that if you can wait long enough, you’ll win.

✈️ Take a 30,000′ View

Think back to the MAX chart for VTI – there was a lot of turmoil in the markets (and in life) since 2001. We’ve had some massive swings in the market.

Twenty of the Dow’s largest point changes (not percentage changes) were all in that time frame above. VTI isn’t the Dow but there’s some overlap. If you look at the VTI chart, you can barely see them. And the market was already down in June 2001 – the dot-com bubble burst in 2000.

But when you take a 30,000′ view – it doesn’t look so bad.

The drop in 2000 (Covid-19) looks pretty gnarly but that’ll happen with a worldwide pandemic.

The latest drop looks pretty nasty too and maybe that’s why you’re hesitant. But peek back to 2008, the Financial Crisis, and see how it’s just a bump in the road.

This too will be a bump in the road and as long as you keep on investing, you’ll come out ahead.

💸 You’re Getting a Discount

As the market falls, consider it a discount.

This, of course, is easier said than done (or in this case, believed).

Look at it like this – imagine the stock market, by magic, just went up a little bit each day. Pick two arbitrary points as I’ve done:

If the market just went up, you’d feel great the whole way up. But you’d have made less money. Making less money doesn’t feel that great. 😊

Because the market goes up and down, and you’re investing the entire time at regular intervals, you’ve actually gotten a discount (represented by the yellow) between those two arbitrary points.

Sometimes, the market drops immediately after you’ve contributed. Sometimes, it goes up immediately. The key here is that over time, it goes up and drops are discounts. This is how a regular investor makes money when the stock market falls.

This is, of course, convenient use of past data and picking two points but we’re talking psychology here and what we need to do to keep our head (and our money) in the game.

🛠️ Is It Falling or “Correcting?”

Stock market pundits have a lot of funny terms (euphemisms, if you will) and one of them is a “market correction,” for when the stock market falls more than 10% from a recent high.

In this case, however, I think it’s a useful term.

The pandemic juiced up a lot of stocks. Now that pandemic restrictions are lifting or have been lifted, now that life is moving back towards normalcy, a lot of those stocks have fallen from their highs. Some of stocks have fallen very far from their highs.

But that assumes that highs mean anything. Remember the stock market is a collection of buyers who discover prices based on supply and demand. If you want to think about “inherent value,” you can look towards the Price / Earnings ratio (PE ratio) as a measure of how overvalued or undervalued a stock is.

If a company makes $5 per share and the stock price is $10, the PE is 2.

A lot of folks look towards the CAPE ratio (cyclically-adjusted price-earnings ratio) of the broader stock market as a signal whether it’s overvalued or undervalued.

Well, if you looked at the PE ratio at pandemic highs, many of them were insanely high. Like 50x.

That’s when a company making $5 per share has their stock traded at $250 per share.

The stock can fall 90% to $25 and still be trading at 5x earnings.

FWIW, the CAPE Shiller Index is at around 32 on May 7th, 2022. That imaginary stock that was selling for $250 could fall 36% to $160 and still be trading at 32x earnings.

👀 Stop Watching the Market

If you have a long time horizon and daily market movements don’t impact you, because you don’t intend to sell your investments, then stop looking at the market. Just stop.

During the Covid-19 pandemic, the constant barrage of pandemic news and information was having a negative impact on my outlook and my mood. I had all the information I needed. We were locking down until vaccines were available. No new news on outbreaks, transmission rates, mobile morgues, etc. were going to change that approach – it was only going to contribute to a feeling of helplessness.

We had to manage a household with four little kids, virtual school, food, etc. If you were in a similar situation and haven’t yet blocked it out, you know how that felt. Watching the news wasn’t going to help.

What did help was blocking it all out, putting one foot in front of the other, and doing the work.

I take that approach to the stock market, especially during these times when things look ugly. Just stop looking. If you have a long time horizon, the market movements do not matter.

Stop looking.

Go outside. 😂

I love the yellow area under the line between two (arbitrary) points. It’s a great way to illustrate the discount concept to those of us that are visual processors. Thanks for the post.

Thank you BruinBones!

RE: If you have a long time horizon and daily market movements don’t impact you, because you don’t intend to sell your investments, then stop looking at the market. Just stop.

And if one does not have a long time (> 25 years) but only 10, then what do you recommend for a market like this.

I believe 10 years is a long enough time frame that you don’t have to worry about the near term market movement. Also remember that with a 10 year time horizon, you won’t need your entire portfolio in 2032. If you’re retiring, you’ll only need your annual expenses each year. You can draw down your investments and some of your money will still be invested into a longer time frame.