When I started investing, I eased into it very gently.

I didn’t trust the stock market.

I was comfortable with saving the money. I wasn’t comfortable putting it in the “stock market.”

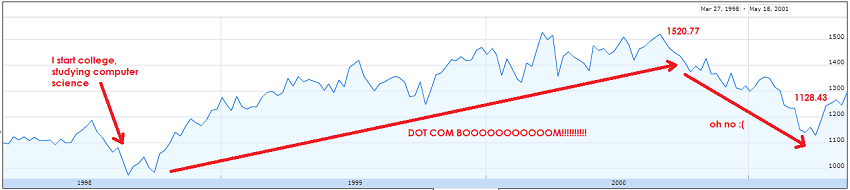

My formative adult years started in 1998, the year I started college. I was going to Carnegie Mellon in Pittsburgh and studying Computer Science. If you were around back then, you probably remember the dot-com boom and how the Internet was going to change the world. And make us computer nerds very rich.

Remember Pets.com?

I do! And I wanted a piece of the action!

Then, in the Spring of my Junior year, it all disintegrated. The dot-com bubble burst.

For years, I saw the career fair at Carnegie Mellon and it filled up our entire gym. Two full-length basketball courts packed with companies. My senior year, the Fall career fair barely fit half that gym and most companies weren’t hiring. They were there just to “maintain the relationship” with the school (as if they’d be turned away if they wanted to rent a booth!).

I wasn’t personally burned by the dot-com boom but I saw the after effects. I saw my friends, who took a leave from school to work at startups, come back. I heard stories of job offers being rescinded. I saw the stock market tank like crazy at a time when I just had a very small amount invested in a Roth IRA.

Today, I have the vast majority of our net worth invested in the stock market. How did I go from not trusting the stock market to where I am today?

Table of Contents

How I Learned to Trust the Market Again

What got me back into investing in the market was different than what kept me there.

Financial incentives urged me to invest in the stock market. Thinking about my money and my investments as a collection of “time capsules” kept me invested.

The incentives for retirement planning are very good. The Roth IRA is 100% tax-free growth. No matter how well I do, that money is mine and I won’t pay capital gains. That’s a pretty good perk.

My employer also offered a company match on my 401(k) contributions. It was a solid 50% match on up to 6% of my salary. I made $60,000 my first year so if I contributed $3,600 each year, they would put in an additional $1,800. That’s an instant raise, just for doing something I’d already be doing. Free money!

I was comfortable with saving money, I liked the incentives, and my investments needed someplace to grow. That place was the stock market.

The incentives were good enough for me to dip my toe back in. When you’re single, earning a good wage, and renting an apartment with a friend, you can save a lot of money.

While I was comfortable saving, I was not comfortable watching it go up and down based on the mood of the stock market. I was working for that money and because of a massive room of suits that money was moving up and down due to no fault, or credit, of mine. It was unnerving.

Since my money was captive, in those incentive-laden tax-favored accounts, did I fall in love with the market again because of Stockholm syndrome? (maybe? :))

Your Money is in Time Capsules

To help me manage my emotions, I started thinking about my money in terms of “time capsules.”

One of the ways I comforted myself was recognizing that money was untouchable for forty years. I could see the money today but it was effectively locked inside a glass case. A financial time capsule. My “retirement” capsule.

With my 401(k), I made a deal with Uncle Sam that I wouldn’t owe taxes on my contributions today and my growth would not be taxed until I took distributions in retirement. If I wanted my money, I could pay the tax plus a 10% penalty (ouch). Break in case of emergency!

With my Roth IRA, I would pay the tax up front but any growth would be tax-free. After five years, I could access the money without direct penalty (the real penalty is losing money that can grow tax-free).

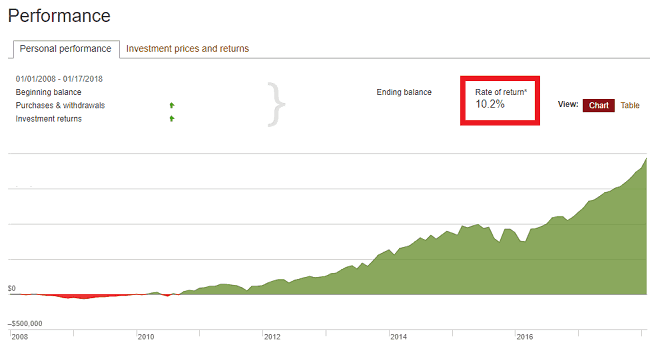

The time capsule let’s you eventually see one of these charts:

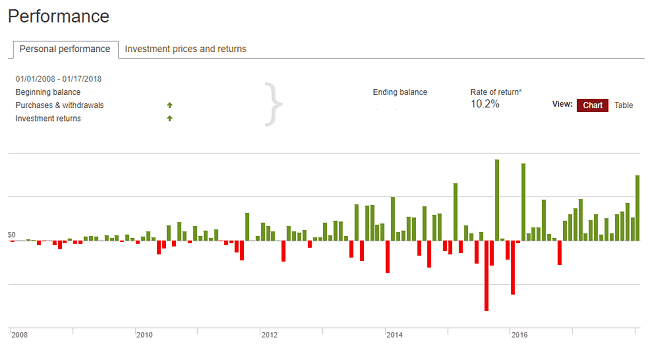

Even if the month to month chart was bumpy. Like super bumpy.

My psychological trick paid off because it gave me the courage to accept (and eventually welcome) these bumpy moments. When

I would eventually start putting non-retirement capsule savings into the stock market too, among other less-regulated investments. Those were put into my “short term” capsule. It let me invest in assets that could go up or down, as volatile assets tend to do, but retain my sanity.

I don’t care what anyone says, watching hundreds and thousands of dollars of money evaporate feels terrible no matter what. Watching it come back the next month is equally emotionally exhausting (and exhilarating!). Knowing you cannot and should not touch that money for decades helps moderate my emotional reaction either way. Keeping track of it for 14+ years helps solidify the long term view that the time capsule is locked, doing its work, and should not be messed with.

I rely on how the stock market averages high single-digit returns over a long enough period of time and I move on.

I asked UC Davis Graduate School of Management’s Dr. Brad Barber for his recommendation on figuratively burying your money.

Most individual investors should choose a mix of a low-cost stock index fund and low-cost bond index fund.

For the stock fund, starting with a US domestic total market index is a good choice, but even better is combining a US index and international index.

For the bond index, I prefer the short-term bond index (e.g., bonds with less than five years to maturity) as they tend to be a bit less volatile than indexes that include long-term bonds.

My Time Capsules

I have three of categories of time capsules (actual count is more than three, but this is a mindset so you can bucket them):

- Long Term (30+ Years Away… and counting down): My retirement accounts, 401(k) and my Roth IRA, fit into this retirement time capsule. I don’t intend to touch this money for 30+ years and so I can invest it in the most volatile investments because I know that over 30+ years, it’ll be fine. As this time capsule nears its opening (or at least part of it does), I’ll move it into less volatile investments so I run into unlucky sequence of return risk.

- Short Term (5+ Years Away): I view my taxable investment accounts, the “regular” brokerage accounts, as a time capsule that’s always at least five years away. It goes up, it goes down, whatever – in five years it’ll be fine. If I need it before then, I can access it, but the plan is to leave it buried.

- Near Term (Now): Anything I need less than 5 years away is in the equivalent of a savings account (like one of these short term investments). It’s a time capsule with a date of tomorrow. Or yesterday.

Bury The Time Capsules

Tim Ferriss has said that he liked startup investing (until he didn’t) because they were illiquid. He could react emotionally and sell investments as easily, which is what would happen if he invested in the stock market. He created time capsules because how he invested.

We are emotional people who react badly to negative news. We sell early, buy late, and it’s better to let a robot with an algorithm do the job.

That’s why I set it and forget it, pick some Vanguard funds, and move on. I bury the capsule (checking in every few months to make sure there aren’t any problems) and understand my long-term strategy is better than me meddling.

My approach to money, actual and psychological, are always a work in progress and for now that work involves filling time capsules with money and burying them in the proverbial ground. 🙂

How do you think of this?

Interesting perspective. Yes, knowing that you will not touch your investments for several years down the road can indeed help you alleviate some of the stress that comes with the (highly publicized) everyday ups and downs.

It’s hard to pull away, especially when you have thousand point drops! The swings are incredible… but then you think about to the feeling you had when we last went through this and it wasn’t as long ago as you’d think. Based on my memory, I thought the last time we had a big drop was the beginning of 2016 – the Dow 17425 in December 2015 and was under 16000 by Jan 15, 2016. Percentage wise it was sizable. We would have the 11th biggest daily point loss later that year, June, 24th, 2016 (Brexit vote). It was a… Read more »

Jim Wang,

Using point drop numbers is very misleading. Using the percentage drop (or gain) is much more meaningful. The point drop in a 25,000 Dow does not correlate to the same point drop in a 17,000 Dow.

In most cases, I agree. Percentages give you a better idea of what’s happening. Nominal figures often seem larger out of context. In this particular case, we’re talking about not freaking out. The first number people always see is the nominal point drop, not the percentage. 4% in one day? Eh, seems big. But we always gravitate towards the nominal figures, the thousand point drop or the Dow going over 26,000 – even though it’s all abstract anyway. The Dow isn’t even a good indicator of “the market.” But the point was to avoid freaking out, reading the headlines, and… Read more »

This was just what I needed to hear after the past 3 days!

I re-read my own post sometimes just to get back to the calmer frame of mind!

Jim, Great post. There really is no bear market, there is no bull market. It’s just “The market”. The fluctuations are not for the faint at heart, and oftentimes do not make sense. Of course, over time we look back and say “Why didn’t i see that?” but rarely do we see it in real time. This is all to say at some point it becomes exhausting and much easier to just buy boring stock and bonds funds. I would say for those of us who do enjoy picking stocks, or following the market, I see myself keeping a small… Read more »

They are certainly not for the faint of heart but if you are faint of heart, the best thing to do is not look! 🙂

It can get exhausting and everyone thinks they can beat the market, which is also how casinos are always packed, and they probably could if they had a time machine.