Lending money to friends and family can be a bit of a minefield. While it’s great to help out those you care about it can easily lead to bad feelings and ruined relationships.

If you decide to go ahead with the loan, be sure to never loan more than you would be comfortable losing. Consider the loan a gift, that way, if it doesn’t get repaid your relationship will remain in tact. It’s also important to set clear loan terms, including payment due dates. Luckily, there are several apps that can assist with setting up loans and tracking payments and even interest.

Table of Contents

- Quick Facts about Friends and Family Loans

- Best Practices for Lending Money to Family

- Only Lend to People You Trust

- Don’t Risk Your Relationship

- Lend Only What You Can Afford to Lose

- Consider Charging Interest

- Write a Loan Contract

- Avoid These Money Lending Mistakes

- Lending More Than You Can Afford

- Family Loans Might Be Taxable

- Applying for a Loan Instead of Your Friend

- Not Keeping Proper Documentation

- Best Lending Money Apps

- Summary

🔃UPDATED: Updated the new gift tax exclusion for 2023 which is now $17,000 a year.

Quick Facts about Friends and Family Loans

The fastest way to borrow small amounts of money can be from a friend or family member. These loans are an easy way to help someone going through a rough patch. They may be unemployed, going through a divorce, or have a pricey medical emergency.

Life happens – and can drain a well-stocked emergency fund.

While many friends and family repay the loans, you should be selective with who you lend money to.

A PayPal Money Habits Survey shares these stats about lending money to friends and family:

- 55% (of the 4,000 survey respondents) feel embarrassed to ask friends for cash

- 50% of those who lend money are afraid to ask their friend for payment

- One-third of respondents lost a relationship over debt

The PayPal study also shows the average friends and family loan if for $450. You may not go bankrupt if your friend doesn’t repay the loan. But there can be long-term repercussions that you won’t experience when spotting $20 for your friend’s dinner.

Best Practices for Lending Money to Family

Lending money can feel like walking a tightrope. You want to help someone you trust as you’re a true friend. However, lending money can quickly tarnish a relationship if your friend doesn’t pay you back on time.

Here are several smart moves for lending money without ruining a friendship.

Only Lend to People You Trust

You should only lend money to people you trust. Perhaps these are the friends and family that you vacation with or are the first person to support you during your tough times.

Lending money to friends you don’t trust with money can be a recipe for disaster. For example, most of us know someone who always seems to live on the brink of financial collapse and repeats the same money mistakes. That’s not someone you lend money to.

Don’t Risk Your Relationship

One-third of friendships that dissolve due to lending money to friends and family may seem high. Financial problems were a leading cause for 36% of divorces in 2019, according to a recent National Center for Biotechnology Information poll.

Rely on your gut instinct before lending money to friends or family. You might decide against lending money to a friend that has yet to return your tools even after you ask them to.

You may also disagree with the reason why your friend wants to borrow money. Lending money for a financial emergency can be a legit reason. However, you may not lend money if your friend can’t pay their daily bills but somehow finds a way to take expensive vacations.

If you don’t feel comfortable lending money, politely decline their offer. Feelings might be temporarily hurt but true friendships should rebound.

Lend Only What You Can Afford to Lose

A good rule of thumb is not to lend more than you can afford to lose. Before making the loan, consider how you will feel if the loan is not paid back. If you are comfortable just giving the money to your friend then you are in the clear to move forward.

If the thought of not getting the money paid back makes you upset or stressed, then take a step back. Consider if there is an amount you would be ok lose?

For example, maybe your friend is asking for $400 but you are only comfortable lending $100. You can still help your friend without risking your finances.

Knowing your limits will protect your wallet and preserve your relationships.

Also, don’t feel obligated to lend the same amount of money to everyone. You might have a friend who is typically responsible but is going through a hard time and you feel comfortable lending them more than your cousin who is notoriously bad with money. That’s ok.

Consider Charging Interest

You may decide to make an interest-free loan or only have your friend pay the same amount of interest as your current savings account yields. Charging your friend some interest can make this endeavor worth your effort – even if it’s less than a bank loan. At least you won’t be out the interest that money would have earned.

For larger loans, you may need to charge a minimum IRS-approved interest rate to avoid potential tax penalties. Short-term loans with a repayment period of three years or less have a 0.18% annual applicable federal rate in June 2020. The rates adjust monthly as the treasury yields ebb and flow.

Many small loans go unreported each year. Your tax professional can help you navigate the potential tax implications of a family loan.

Write a Loan Contract

Both the lender and the borrower should write the loan terms on paper and agree to a repayment schedule.

This agreement doesn’t need to be rigid but should address these topics:

- Payment due date

- Minimum monthly payment

- Planned repayment term

- Loan interest rate (if you decide to collect interest)

- What happens if your friend misses a payment? Or defaults?

- Can you claim items as collateral?

You can use an app like Zirtue to schedule automatic payments so your friend doesn’t forget a payment. Scheduling payments can be wise if you’re too timid to ask your friend to repay your loan.

It’s also possible to find printable templates online. These agreements are easy to understand. Make sure you and the borrower each keep a copy of the loan agreement to avoid potential confusion in the future.

Avoid These Money Lending Mistakes

Lending money can strengthen your family and friend bonds if you follow the best practices. However, these loans can quickly turn into a nightmare if you make these common lending mistakes.

Lending More Than You Can Afford

Loaning more than you can afford to lose or need your friend to repay fast can cause unnecessary tension. If you will feel resentful if the loan is not paid back on time, consider lending less or none at all.

Large family loans can also jeopardize the underwriting process if the borrower is buying a house. A conversation with the loan officer can help you determine a maximum loan amount. You might also act as a cosigner instead of lending money if you’re comfortable being responsible for making the loan payments if the borrower doesn’t.

Family Loans Might Be Taxable

You may need to file IRS Form 709 if you lend over $17,000 to a single person but don’t charge interest. Parents can each lend up to $17,000 ($34,000 total) to a child and avoid the gift tax. Even on smaller loans, you should charge the applicable federal interest rate to avoid any potential tax penalties if the IRS gets involved.

Applying for a Loan Instead of Your Friend

Having great credit gives you the option of applying for a personal loan instead of your friend or family member. You might also consider drawing from your home equity line of credit or a credit card.

All of these options may be unwise. Ultimately, you’re financially responsible for paying back the balance.

As the loan is in your name instead of your friends, they may have less motivation to pay it off on-time. It’s your credit score at risk if you tap your credit to lend money.

Not Keeping Proper Documentation

Not keeping a physical copy of the loan agreement can strain your relationship if a dispute arises. No documentation for large loans can also create a headache if you need to report the interest income on your tax return.

Best Lending Money Apps

You may decide to lend money the old-fashioned way – cash. Lending cash can be your best option for small loans. You might go to the nearest ATM and hand the bills to your friend.

Money transfer apps like PayPal, Venmo, and Zelle let you transfer funds for free. But you may appreciate using a lending app to streamline the loan agreement and repayment process.

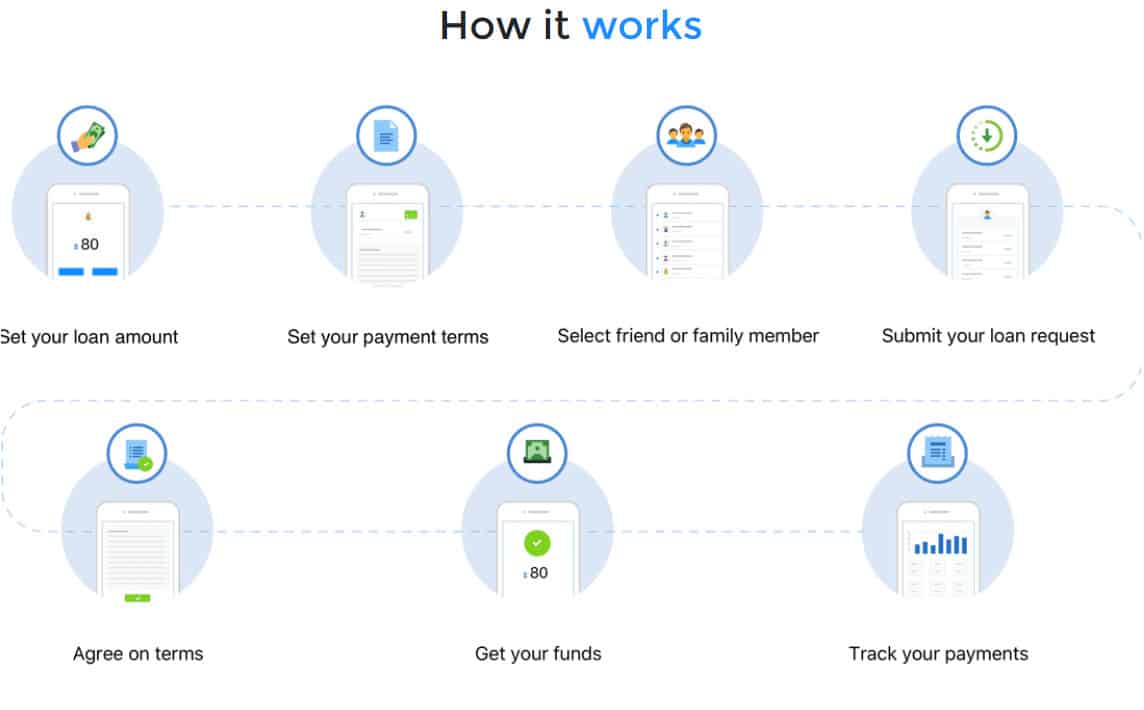

Zirtue

Zirtue lets you lend money to the contacts in your cellphone. You can lend between $20 and $10,000 for up to 24 months with a fixed 5% interest rate. The borrower pays a one-time 5% service fee to Zirtue for the loan amount.

Zirtue collects the loan payments and creates the loan agreement. The borrower can receive their funds within three business days via direct ACH bank deposit and payments are set up as an auto-pay from the borrower to the lender through the app.

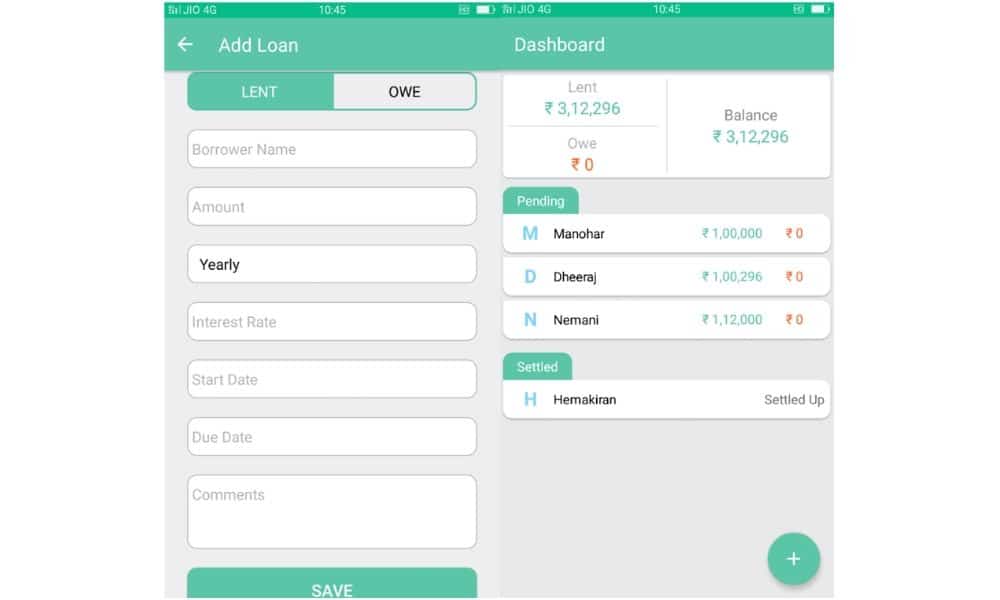

LendPal

Not all lending money apps charge a fee. LendPal is a free mobile app (Android and iOS) that tracks the items and cash you lend to friends and family. The people you lend to don’t have to be in your phone contact list.

The app will calculate and record monthly and annual interest payments. However, LendPal doesn’t create loan agreements or collect payments. It’s more of an organizational tool. You must manually add payments to the app when they are received.

It’s possible to send payment reminders on these platforms:

- Skype

- Snapchat

- Google Drive

LendPal lets you send reminders in the app as well.

Agree it

You have more flexibility with lending money using Agree it than with most peer lending platforms including LendingClub. Agree it lets you and the borrower view the other’s profile and previous Agree it loan histories. Other peer lending apps only let you view the applicant’s personal information such as their annual salary, state of residence, and credit score.

It’s possible to set your interest rate and loan amount. You can send the loan offer to your friends. If they agree to the loan terms, you can receive payment by PayPal or other methods.

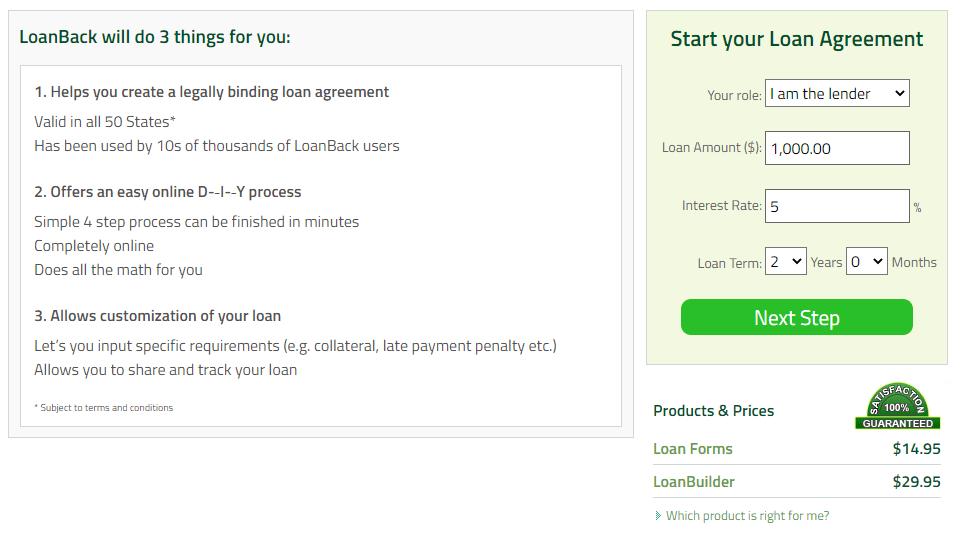

LoanBack

Building a loan agreement is one of the most important steps to successfully lending money. LoanBack helps you create a legally-binding loan agreement in all 50 US states. Hopefully, you won’t need to take your borrower to court, but it’s a possibility if you lend a substantial sum.

There are two different LoanBack products you can use:

- Loan Forms (one-time $14.95 fee): Build a printable PDF or downloadable Word document for secured and unsecured loans. This product doesn’t calculate payments.

- LoanBuilder (one-time $29.95 fee): Make a printable PDF and calculate payments using the interest rate guidelines. You have 30 days to make unlimited edits. Optional email payment reminders make it easy to track your loan activity.

Most users spring for the LoanBuilder option according to LoanBack. This premium option can be your best choice as you can accurately calculate interest payments and customize your agreement.

You can also set up payment reminders and record loan payments in the app

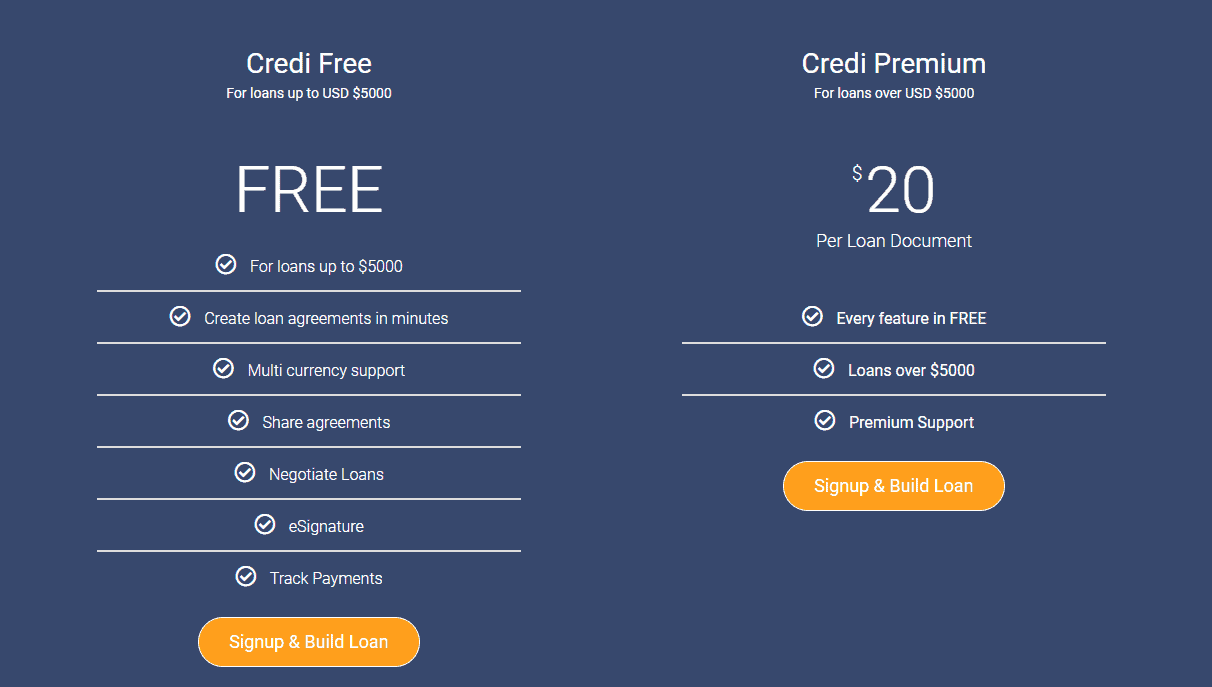

Credi

Credi offers free loan agreements and payment tracking for loans of $5,000 or less. Larger loans cost $20. It’s possible to make loans in multiple currencies if your lending money to family in distant places. You will need to use a digital wallet like PayPal or your bank app to collect payment.

You can make changes to the loan agreement as changes to the repayment schedule arise. Your friend might only make a partial payment, for instance. Credi lets you account for a balloon payment if there’s still a balance remaining when the loan term ends.

Summary

Be careful when lending money to family and friends as it could ruin your relationship. The best thing to keep in mind is to never loan more than you are comfortable losing. If the idea of not being paid back makes you angry or stressed then you should avoid the loan.

If you decide to go ahead there are several apps that will allow you to set up clear loan agreements and payment schedules. They will even allow you to charge interest and track payments received.