The software engineer in me never liked the idea of credit scores.

Here’s this number that’s supposed to define your likelihood of defaulting on a loan but it doesn’t include anything about your ability to pay? It doesn’t include income anywhere. It doesn’t include your non-debt obligations (like rent). It doesn’t include any trends, like if your credit is falling or rising.

It’s just one static number… and not only that, it’s all about negativity.

If you get dinged, just once, it hurts.

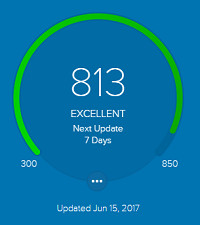

That number, 813, is my credit score as reported by Credit Wise by Capital One (here’s a list of places you can get a legitimately free credit score).

They have a credit simulator and here’s how that number changed with these negative items:

- Allow one account to become delinquent 30 days – 712 (-101)

- Allow one account to become delinquent 60 days – 672 (-141)

- Allow one account to become delinquent 90 days – 648 (-165)

- Allow all accounts to become delinquent 30 days – 627 (-186)

- Allow all accounts to become delinquent 60 days – 580 (-233)

- Allow all accounts to become delinquent 90 days – 551 (-262)

- Have my property foreclosed on – 755 (-58)

Yikes. Fortunately, even if a negative item is reported… it doesn’t last forever. Even the worst things are gone in a decade.

Now, with any of these items, the negative impact is greatest soon after the negative item is reported. As time passes, the impact of the negative information diminishes pretty quickly to the point that it may not even affect your credit despite being listed.

Table of Contents

Hard Inquiries – 2 years

Hard inquiries are those from creditors looking to extend credit – credit cards, banks, etc. They’re negative since someone looking for credit from a lot of sources is probably riskier, but they’re not anywhere near as bad as the other items on this list.

One exception to this are the ones classified as “rate shopping inquiries,” like a grouping of inquiries for mortgages, auto, or student loans. You can request quotes from three banks for a mortgage but the credit models know you’ll only get one, you can’t get three mortgages. If you apply for three credit cards, you could get three credit cards and thus riskier. They treat these groupings as less than the actual sum of inquiries.

Hard inquiries remain listed for 2 years but their impact diminishes relatively quickly. Six months ago I opened a new business credit card (only 1 inquiry) and my credit score is already back to its former range. (it was 820 before the inquiry, fell to 803 after, and is at 813 now)

If you have incorrect or fraudulent hard inquiries on your report, don’t wait! You can get hard inquiries removed if there is a legitimate reason – you don’t have to wait for them to fall of on their own.

Negative Information on an Account – 7 years

If you miss a payment, that’s recorded on an individual account. That piece of negative information will remain on your account for 7 years from the date it’s reported. If you miss a series of payments but were then current, it drops off 7 years after the first miss. If you close the account, the account will remain on your credit report until the 7 year period ends, at which point it will be removed.

Even the most negative of events, a charged-off account will only remain on your credit for seven years. (though there are ways to remove a charge-off without paying)

Many companies will not report a payment if it is less than 30 or 60 days late. Nearly all will report it if it’s 90 days late. The impact of a reported 30-day late diminishes fairly quickly but there’s no way to quantify how quickly it diminishes.

One way to get it removed is to get the creditor to remove it. I’ve missed payments before, early on in my adult life, and was successful in asking if it could be removed from my record since it has never happened before. Most credit card companies, especially if you’ve been a long-time customer with no history of missing payments, are happy to do this.

(For what it’s worth, an account with only positive information will be removed from your history 10 years after you close it)

Collection Accounts – 7 Years + 180 Days

A collection account is when you fail to make payments for so long that the creditor sells it to a collection company. At this point, it will remain on your report for 7 years plus 180 days from the time the account was reported as delinquent. It is not from when it was sent to collections, but from the first time it was reported late.

Some collectors will try to “re-age” the debt, or make it appear as though the debt was delinquent later than it was first reported. They do this because:

- Debt collection companies will sell your debt to each other for cents on the dollar,

- Some of them are less the scrupulous… I bet you’re shocked to learn,

- It gives them more time and leverage to get you to pay it.

Even if you pay off the debt, it doesn’t get removed from your account! A paid collection is better than an unpaid collection, but worse than not having a collection in the first place. 🙂

To get it removed, you need to get the collector to agree to a Pay for Delete. In return for paying off some or all of the debt, you want the collector to send you a Pay for Delete Letter. Get everything in writing before you hand over the money and do your homework!

(if you already paid and are surprised it’s not off, you can ask the collector for a Goodwill Letter to get the item removed)

Bankruptcy – 7 or 10 years

There are several kinds of bankruptcies and all are removed after 10 years from the filing date. Some are removed as soon as 7 years from filing.

Chapter 13 bankruptcies, which are called reorganization bankruptcy, can stay on for 10 years but most agencies will remove them after 7. Chapter 13 bankruptcy is the one where you have steady income and you work towards a plan to repay part or all the debts over 3-5 years.

Chapter 7 is total liquidation where you sell everything but it wipes out your unsecured debts, like credit cards and medical debts. These will always be left on for 10 years.

Civil Judgments – 7 years

Civil Judgments are simply debts as a result of a court ruling and when you owe someone money as a result of a judgment, the credit reporting agencies will list it on your credit report. Even if you pay off the debt immediately, it’s still listed because at some point this obligation existed and potentially accrued interest. Once you pay, it’ll become a satisfied judgment but still remains on your report.

Federal Tax Liens – 7 or 10 years

While rare, tax liens are one of the worst negative items on your report (besides bankruptcy) because it can last for so long. They remain on your report for 10 years from the filing date. Once you pay it off, then they only remain for 7 years from the date it was filed.

If you’ve never heard of this before, it’s because it can be issued when you owe federal taxes in excess of $10,000. The IRS will issue you a Notice of Federal Tax Lien, put it on your property, and then it will be listed in your credit reports.

If you get hit with a federal tax lien, you may be able to get it withdrawn (after coming to an agreement) through the Fresh Start Initiative – specifically Form 12277, Application for Withdrawal. This is faster than waiting for it to fall off.

Where is the best places to get a FREE credit report to print ?

Annualcreditreport.com is the official site, you can go through there to each of the bureaus to get your credit report. It’s free once every 12 months.

Having 7 years of bad credit can really stink! My wife got hers dinged a bit when we moved to a new house. She had $20 on a Kohl’s card, and she forgot to update it to our new address. About 11 months later she was contacted by collections. That $20 had turned into more than $100 with interest and late fees! They also put it in her credit record as a late payment – all for just some stupid $20 amount :-(. Thankfully, it should drop off in about one more year… Had we more closely monitored our credit… Read more »

Thankfully it’s not THAT bad – it’s on your report for 7 years but the impact to your score diminishes over time. It stinks that a $20 bill (that you would’ve paid had you known) blew up that much.

Some of my debts were so old (5+ years) and for small amounts, so I decided not to pay them off. I doubt paying them would have helped my credit much since they’re so aged.