If you’re a fan of Greek mythology, you may have heard of the king who, as punishment for his greed and deceit, was forced to push a boulder up a hill. Whenever the boulder neared the top, it would magically roll away from the king and back down the hill. His name was Sisyphus.

I think of that story whenever I read financial advice that focuses on small things without looking at the bigger picture. The much maligned morning cup of coffee seems to get the most attention.

It’s important to be intentional with your money but focusing on these small issues, at the expense of larger ones, is like pushing a boulder up hill – sometimes it’ll roll back down.

“But but but… if you drink a $3 coffee every weekday (260 days), that’s $780 in savings!” – they say.

While true, ask yourself this – “how much work does it take to skip that coffee? Do you make the coffee at home for less? Do you buy a machine and employ the Upgrade and Save Strategy?”

Or can you do on something else that can get you $780+ in savings but is much easier? (you could cut your cable!)

I’m not saying that you should ignore the small things, (they add up) but there are a few key money decisions in your life that require your full attention.

If you get these right, you won’t need to worry about your coffee.

Table of Contents

Your Career

Your full-time job is the primary driver of your financial engine. Side hustles, investments, and other financial tasks take a back seat to your job.

Get your job right and you will get your financial life right.

When I was a teenager, I wanted to work. I wanted to make money, gain some financial independence, and begin my adult life. My parents let me work on the weekends but the weekdays were off limits – my #1 job was to be a good student. My job was to get good grades in high school, get into a good college, graduate, and find gainful employment. No questions asked.

But they were okay with me working on weekends. I worked at a takeout Chinese food place (the only place I’ve ever been fired from!) for 8 hours a week, pocketing a cool $40. The joys of minimum-ish wage!

If that were my full-time job, earning minimum wage with limited advancement opportunities, my long term prospects would be dim.

A college graduate stands to earn over $1 million more in a lifetime compared to a high school graduate, according to The Economic Value of College Majors published by Georgetown University. Pew Research Center found that college graduates made $17,500 per year compared to high school graduates (median yearly income gap for ages 25-32).

I was fortunate because I had other options. I was fortunate in that my parents recognized this and pushed me in the right direction.

Not everyone has this so if you do, don’t squander it!

If you want to get rich (which is different than feeling rich), you need to earn more money at the job where you spend the most time. It’s just common sense.

If you want to change the trajectory of your life, you need to make smart investments in yourself. It’s the only way.

What about side hustles? I like side hustles. My first personal finance blog was a side hustle. I think the best side hustles are those where you can build an asset that can grow in value. It’s not necessarily a passive income source but one that has the potential to become one.

Side hustles are best for when you’ve exhausted your near-term opportunities with your full-time job. If you just convinced your boss to give you a raise or switched companies, there are no near-term opportunities for a pay raise. That’s when a side hustle for a little extra cash makes sense.

Job first, then hustle. (or find a new job)

Your Relationships

Relationships are hard. Bad relationships are even harder.

When I read this story about Melanie’s worst financial mistake in her life, it really hammered home how important it is to find the right partners in life. The wrong partner can cost you money but also years of your life. Time is your most precious resource.

I was lucky. I met my lovely wife in college and while we’ve had our struggles, it’s nothing at all close to what Melanie dealt with. Our challenges felt large at the moment but have been relatively tame when you consider the universe of possibilities.

We’ve largely avoided problems we could and could not control. Neither one of us had significant debt (I don’t count my low-interest student loans as significant debt, even though the balance was significant). We been fortunate to avoid any major medical issues. We’ve been able to control the things can and lucky enough to avoid the things we can’t.

Unfortunately, I have no advice or thoughts on how to get this right other than you should talk to your close friends and family to get another perspective. They almost always see it, even if you don’t, so if you’re doubtful – just ask.

Your Investments

Specifically, your retirement.

Your retirement is going to be many years in the future so it’s easy to set it and forget it.

The biggest key to winning the retirement game is to save enough. The median balance in a 401(k) is a mere $46,000, that’s across ALL 401(k)s for all age groups. The median for those under 35 is just $14,000.

The problem is we aren’t saving enough. Our savings rate in February 2018 was just 3.4%, according to the Federal Reserve Bank of St. Louis. It has improved to ~7.0% in November 2019 but we need to save more.

(the savings rates were exceptionally high during the height of the pandemic but have since settled back down)

The second biggest thing is making sure you don’t overpay in fees. 1% in fees will cost you 3 years of retirement. Fees are unavoidable but you can avoid ridiculously high fees, especially when you have options like Vanguard and their fantastic low-cost index funds.

As for what to invest in, you have a lot of options but don’t let them cloud your judgment. You can go with a robo-advisor like Betterment or you can get a mix of low-cost index funds by doing it yourself. Just get yourself in the game.

Your Home

You need a place to sleep and I’ve long recommended you keep that cost of that place to 30% of your take-home pay. That ratio is important because when you spend more than 30%, it eats into the most important ratio – that 20% you save for the future (or help pay down debt).

Your home is likely going to be the biggest purchase you’ll ever make in your life.

The large dollar amount isn’t what makes it so important to get this right.

It’s a big money decision because this purchase locks you into a monthly payment for up to 30 years.

If your monthly payment, plus utilities and expenses, exceeds 30% – watch out. The excess is eating into how much you can save.

Remember, your home isn’t a good investment. Historically, median home values have appreciated in line with inflation. It’s a place to live. If you happen to live in an area where home prices appreciate rapidly (here’s how to figure out how much your house is worth), consider yourself lucky and now your housing will cost less (or even profit).

We bought our first home near the peak of the housing market in 2008. We sold it about six years later for a loss. When I calculated the numbers, it turns out we lived in a 3,000 square foot townhouse for just $600 a month. We “lost” money on the investment but we got a fantastic deal on housing.

The mortgage interest rate deduction is one of the biggest red herrings in personal finance. It’s only available if you itemize your deductions, which are items you have already paid for. The standard deduction of $12,550 for single and $25,100 for couples – but the standard deduction doesn’t require you to pay any expenses. You just get the deduction and you keep your money in the first place. Remember that.

Your Car

Your car is probably the second biggest purchase you’ll make and you get the joy of making this purchase several times in your life!

There are two important decisions:

- Deciding which car to buy – You’ll want to narrow down your list of vehicles based on qualitative factors, then hone in based on quantitative factors. (how much car can I afford?)

- How you buy the car – Used if available, then read this article from Lifehacker and then employ this strategy from Nerdwallet

What are some quantitative factors? The biggest number is total cost of ownership, a figure you can look up on Edmunds. That figure includes depreciation, interest on a loan (if applicable), taxes, fees, insurance, fuel, maintenance, and repairs. It’s not enough to know the purchase price because different cars have different maintenance and repair needs.

- A 2018 Honda Accord EX (1.5L 4-cyl. Turbo CVT Automatic) has a true cost to own of $35,037, based on a cash price of $27,988.

- A 2018 Ford Fusion SE (2.5L 4-cyl. 6-speed Automatic) has a true cost to own of $34,561, based on a cash price of only $22,731.

(this isn’t meant to be a head to head comparison of the two cars – just a look at how the true cost to own compares to sticker price)

The Ford Fusion is cheaper up front but over five years the price is comparable to the Honda Accord. The cars look similar but the Ford Fusion has a bigger engine and that’s reflected in lowered fuel economy, it’ll cost nearly $2,000 more in fuel over the 5 years.

Make sure you understand the total cost of ownership before you buy anything!

Your Kids

Kids are awesome! They’re also very expensive. The Department of Agriculture estimates that it costs $233,610 to raise one child. Just one. And that doesn’t even include college!

How many kids do you have or want? 🙂

The point of this number isn’t to scare you away from kids but to explain that it’s a financial decision too. Be aware.

Bonus: Your Health

This isn’t a decision, per se, and more of a “Hey, pay attention!”

Being wealthy means being healthy. You have to be healthy enough to enjoy the wealth you’ve accumulated otherwise it’s for naught.

My uncle helped get his business associate’s daughter into an American school for kids with special needs. This business associate was wealthy beyond imagination – owning billions in property in China – but his health was rapidly deteriorating due to personal choices, genetics, and the poor environment in China. My uncle described how his friend had to take a handful of pills each morning to help manage all kinds of health issues.

All the money in the world couldn’t solve those problems.

If your body isn’t in good shape, the medical costs will very quickly erode your savings.

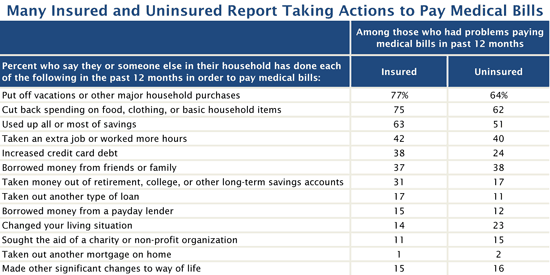

Medical bills are one of the biggest financial risks in life, let alone in retirement. The Kaiser Family Foundation (KFF) did extensive research into this and discovered some sobering statistics:

One of the difficult things about your health is that it’s easiest to take care of when you’re young and harder to recover when you’re older.

Conclusion

Not every “decision” on this list is equal in their importance – your health is far more important than what car you drive. Your choice in a partner or whether you have kids is orders of magnitude more important than your house.

But we can agree that each of these are light years away from how much coffee you buy or whether you car pool into work.

To focus on coffee is like focusing on your side hustle at the expense of your career. It’s nice to be efficient with your money but don’t lose sight the important things in your life.

If you get the major decisions right, you can have all the coffee you want. You can keep your cable, eat out more frequently, and spend more than 2x your salary on an engagement ring for the right person!

Get these wrong and cutting back won’t make up the difference.

Great article. You pulled me in with the coffee headline (I like my coffee!) I’m considering a few financial choices and your points made me think about them a bit differently.

Jim, I enjoyed this post. I got two more. One that could be way too

Personal but is at the core of who I am and another one that I believe could be tied to some of the ones you mentioned. The first one is MY FAITH. If my faith is not in order then wealth is meaningless to me. The second one is happiness. I can have all the money in the world but if I’m miserable or extremely unhappy what is the point?

A lot of people approach this in the reverse. They think that money will bring them happiness… and to a certain extent, it does. Money can remove a lot of the discomfort in life but money itself doesn’t always bring happiness.

I agree with everything you say and am following your advise What don’t you know?

Ha – plenty. 🙂 But thank you!

Awesome list, you stole my playbook! I went from x to 24x pay at the same company, my wife and I are in our 44th year of marriage, I maxed every retirement account available and invested in a taxable brokerage account as well mostly in stock mutual funds, we are still in our first home 40 years long since paid off, my job provided me free cars and my wife only gets one every 15 years, we have three wonderful grown kids who all are off the payroll and who all earned merit scholarships that covered 100% of their four… Read more »

That’s because I’ve been studying you for years!

Hey Jim, Great blog – I especially enjoyed the bit about the big items needed to get right – I have a few friends just starting out in life and they could use some good advice, going to forward this to them. Just wondering about the Personal Capital app. I use Vanguard’s services and want to know if you think PC would be more helpful/additionally helpful in tracking and planning my retirement. I’m 10 years before retirement and have been using Vanguard’s new-ish tool to project out what you’ll need to retire on. What do you think? Does Vanguard have… Read more »

I haven’t used Vanguard’s tool, which one is it? If you’re nearing retirement, a tool I recommend is NewRetirement. It’s a powerful tool that lets you build a plan in like 5-10 minutes and see whether you’re on track. You can pay for their upgraded to run scenarios and other complex items. Personal Capital is OK but even without knowing 100% what Vanguard is offering (I logged in but I couldn’t see a planning tool), I suspect the two give you similar information. Personal Capital is useful if you have a lot of different accounts and want to pull them… Read more »