Action Alerts PLUS

Active stock trading requires a lot more time and effort than a typical buy-and-hold investing approach. To increase your chances of success, you have to spend hours monitoring positions and researching potential buying opportunities.

That’s where a good stock-picking investment newsletter can come in handy.

I subscribe to several of the best investment newsletters to see what stocks and funds are being highlighted to maximize investment returns in the current market. I also get lots of hands-on communications for a competitive subscription fee.

Action Alerts PLUS from TheStreet is one of the more popular investment newsletters. In this Action Alerts PLUS review, I’ll let you know how the publication can make it easier to spot investment ideas that you can use in your portfolio. I’ll share the key features, pros and cons, and some alternatives to help you determine if Action Alerts PLUS is worth signing up for.

Table of Contents

What Is Action Alerts Plus from TheStreet?

Action Alerts Plus (AAP) is a premium stock-picking newsletter from TheStreet. It follows a medium to long-term investment strategy, so you should expect to hold your positions for several months to over a year.

Veteran stock analysts Bob Lang and Chris Versace run the newsletter and recommend several model portfolio actions each week, which can include:

- Open a new position

- Close a position

- Add to an existing position

- Trim an existing position

In addition to receiving investment ideas from a model portfolio, you can read daily articles about the latest market news. There are also videos, podcasts, and subscriber-only conference calls with the editors.

What Happened to Jim Cramer Action Alerts Plus?

CNBC personality Jim Cramer founded the Action Alerts Plus Investing Club and TheStreet. The stock-picking service began in 2001, but Cramer stopped contributing in late 2021 when the current editors (Lang and Versace) took over the model portfolio.

Cramer also sold his stake in TheStreet in 2019 and is no longer affiliated with the platform. However, the Action Alerts Plus investment strategy is still similar to the Cramer days with an active investment strategy of value and growth stocks.

Action Alerts Plus Pricing

New subscribers can test drive the platform during a 14-day free trial before choosing a monthly or annual subscription:

- Monthly: $29.99 per month

- Annual: $199.99 due upfront ($16.67 per month)

- Two Years: $299.99 due upfront ($12.50 per month)

There isn’t a free version of Action Alerts Plus, although you can read five articles for free each month without a subscription. Remember that the five-article limit also includes research from TheStreet’s other premium publications.

Action Alerts Plus Portfolio

The model portfolio uses an active strategy to buy stocks on weakness (value investing) or when a company appears to have plenty of upside (growth investing), even if shares are relatively expensive to the market. The portfolio has approximately 30 active holdings plus a handful of names on the Bullpen watchlist.

Periodically, the service recommends ETFs to maximize the momentum of a specific sector (i.e., energy) or market index (i.e., S&P 500 or Nasdaq). There are occasional recommendations for inverse ETFs as well, which can be easier than shorting a stock, which this service doesn’t do.

Open positions include companies from many industry sectors, such as:

- Amazon

- Apple

- Axon

- ChargePoint

- Chipotle

- Costco

- Lockheed Martin

- PepsiCo

- SPDR Gold Shares ETF

- United Rentals

- Vulcan Materials

The holding period varies by position, but most stocks are held for one year or less. As of July 29, 2023, only five of the approximate 30 open positions have been held for at least 12 months.

So, you must be comfortable with short-term capital gains or losses and a potentially lengthy year-end tax form if you make these trades in a taxable brokerage account. You might consider a Roth IRA for optimal tax treatment.

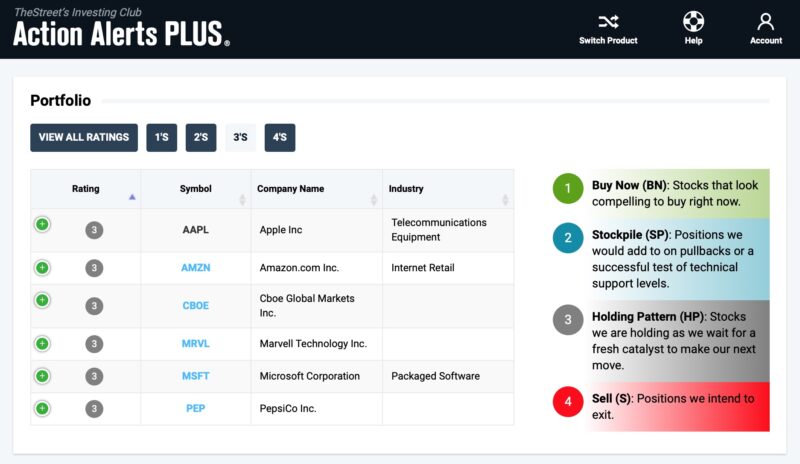

Portfolio Ratings

Each stock in the model portfolio is assigned a rating from one to four:

- 1: Buy Now – Stocks that look compelling to buy right now.

- 2: Stockpile – Add shares during pullbacks or a successful test of technical patterns.

- 3: Holding Pattern – Market-neutral holdings waiting for a fresh catalyst before buying or selling.

- 4: Sell – Close your full position as soon as practical.

You can tap the “Portfolio Ratings” button in the member dashboard and click the rating level to filter stocks by their scores, 1, 2, 3, or 4.

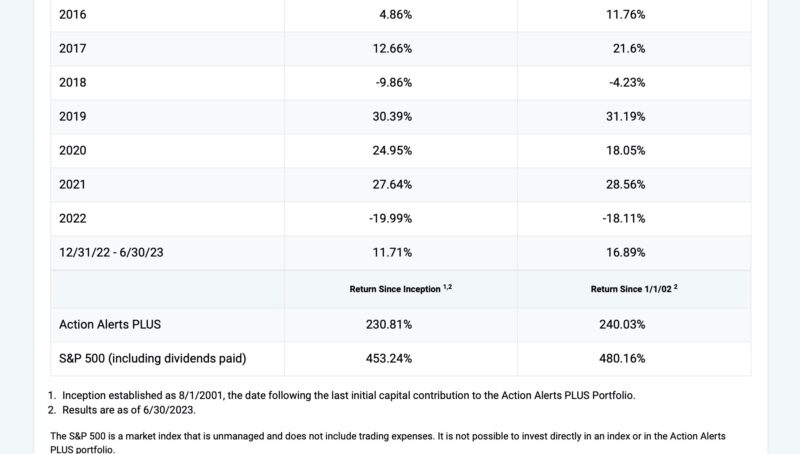

Action Alerts Performance

The portfolio benchmark is the S&P 500, which is the standard for most newsletters and stock mutual funds.

I find that the Action Alerts Plus portfolio is more transparent regarding its historical performance than most competing publications. You can view the open positions, closed positions, trading log, and portfolio performance by year.

From its inception on August 1, 2001 through June 30, 2023, the total performance is 230.81% vs. 453.24% for the S&P 500 (including dividend payouts). While making money using this service is possible, the lifetime performance substantially trails the market. This performance gap will most likely deter casual investors who prefer the simplicity of index funds and passive investment strategies.

From 2016 to 2022, Action Alerts Plus from TheStreet has only outperformed the S&P 500 once. That was in 2020, with a performance of 24.95% vs. 18.05%. Admittedly, the last decade has been one of the S&P 500’s best periods, and it’s usually hard to beat the stock market.

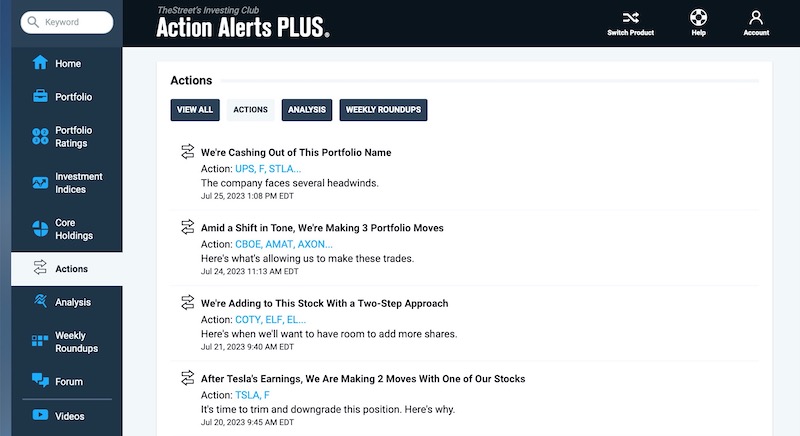

Trading Alerts

You should expect to receive several weekly trade alerts with buy and sell recommendations. Below is an example of trading suggestions, which include the target trading price and position size.

“After you receive this Alert, we will make the following trades:

— Sell 235 shares of CBOE at or near $142.75. Following the trade, CBOE shares will account for roughly 2.0% of the portfolio.

— Buy 120 shares of AMAT at or near $137.45. Following the trade, AMAT shares will make up about 1.0% of the portfolio.

— Buy 80 shares of AXON at or near $177.90. Following the trade, AXON shares will account for around 3.4% of the portfolio.”

Each alert also includes a brief synopsis about why it can be an opportune time to buy or sell shares. However, the publication doesn’t provide an in-depth report like monthly publications. I recommend performing your own fundamental analysis and taking the time to read stock charts to determine your best buy-in price and your support and resistance levels.

A critical difference between Action Alerts Plus and most stock newsletters is that this platform doesn’t utilize stop losses as downside protection. You may decide to use a stop loss matching your personal risk tolerance, such as 5% for conservative appetites or low-conviction trades.

You will find the latest portfolio actions in the “Moves” tab.

Action Alerts Plus Research Studies

In addition to investment ideas, the stock newsletter analysts produce daily and weekly research content that sheds more light on the model portfolio moves. Here’s a closer look at what’s included.

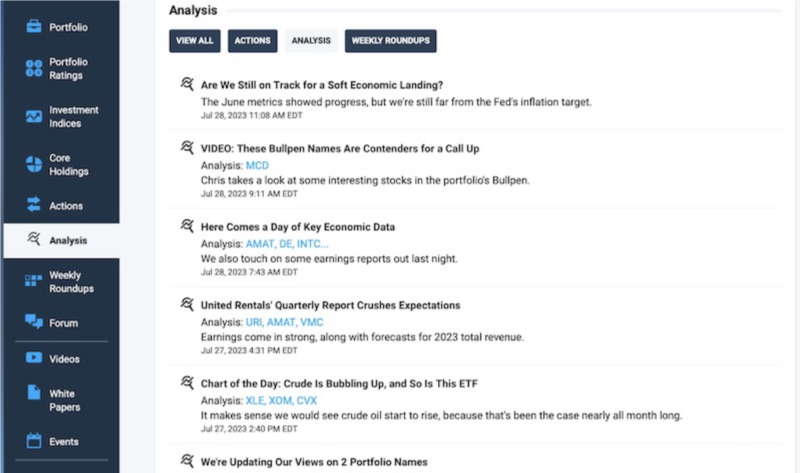

Analysis

At least one short article or video is published each trading day analyzing major market trends or announcements from stock recommendations.

You can read each article within a few minutes to learn more about quarterly earnings from a certain holding or how the latest Fed rate hike might impact the investment club’s model portfolio and the financial markets in general.

Premium members can also watch daily videos that are shorter than five minutes and highlight which stocks to keep an eye on.

Weekly Roundup

You may not have time to read the daily portfolio updates, which is where the Weekly Roundup comes in handy.

This content is somewhat lengthy, but you can quickly jump to the parts you want to read. Some of the sections can include:

- A brief synopsis of what happened in the markets last week

- Notable moves within the AAP portfolio

- Links to the Daily Rundown videos and portfolio podcasts

- Key global economic readings

- Chart of the week

- Key events to pay attention to in the upcoming week

- Updates on select portfolio holdings

Regarding updates on the portfolio recommendations, you can read why the editorial team is highlighting the stock this week. The summary also includes the investment thesis, target price, and risks. Readers can also find links to relevant commentary and the company’s website.

Conference Call

Members can also participate in a monthly conference call where Chris Versace or Bob Lang answer reader-submitted questions. Replays are available later in the day if you cannot attend the live stream.

This is a nice feature, as most newsletters don’t let you interact with the newsletter editors this closely.

Forums

You can get your investment questions answered outside of the monthly calls by visiting the community forums. Browse current inquiries and responses about specific positions and macroeconomics. It’s a helpful tool when you’re trying to research potential investments or rebalance your portfolio.

Pros and Cons

Action Alerts PLUS is packed with helpful tools, but like any investment newsletter, it’s not for everyone. Here’s my list of pros and cons:

Pros

- Daily portfolio updates

- Multiple investment ideas

- Can view closed positions

- Interactive conference calls and forums

- Affordable

- 14-day free trial

Cons

- Requires frequent buying or selling (12 months or less)

- Doesn’t use stop losses to minimize downside

- Has significantly underperformed the S&P 500

- Information overload for infrequent traders

Alternatives to Action Alerts Plus

The following investment research services may be better for buying individual stocks if you prefer a long-term strategy or want different tools.

Morningstar Investor

Long-term investors who prefer a more passive investment style can benefit more from Morningstar Investor. This platform doesn’t offer a model trading portfolio, but subscribers can use the stock screener and highest-rated lists to find stocks, ETFs, and mutual funds with upside potential.

The Morningstar analysts also routinely provide commentary and in-depth research reports regarding stocks, funds, and the markets. You can also use the Morningstar rating system to help compare investment ideas against several risk factors.

Read our Morningstar Investor review for more.

Learn More About Morningstar Investor

Motley Fool Stock Advisor

Long-term investors may prefer Motley Fool Stock Advisor as it offers two monthly investment ideas and has less portfolio turnover. The target holding period is three to five years, and the advisory team considers stocks with the potential to outperform the S&P 500.

Similar to Action Alerts Plus, you can view the investment performance of every open and closed position. There are weekly portfolio updates plus lots of daily content. Read our Motley Fool review to find out more.

Motley Fool Stock Advisor is also $99 for the first year, making it much cheaper than Action Alerts PLUS. The regular price is comparable though.

*Billed annually. Introductory price for the first year for new members only. First year bills at $99 and renews at $199.

Seeking Alpha

Research-hungry investors may appreciate Seeking Alpha Premium, which provides bullish and bearish commentary from independent contributors on nearly every publicly traded stock and fund.

You won’t see a model portfolio, but the platform assigns proprietary ratings that can help fundamental and technical investors screen stocks. A free membership is also available for infrequent investors who may only need to research one or two companies per month. Our Seeking Alpha review provides more details about the stock research tools.

Zacks Investment Research

Zacks offers free and premium research tools. A free membership lets you view the Zacks Score, which is a proprietary rating estimating a stock’s potential of outperforming the market over the near future.

You can also read basic research reports, but a paid subscription is necessary to access the stock screener and a long-term model portfolio.

Is Action Alerts PLUS Worth It?

Sadly, no. Recall, from it’s creation (August 2021) through June 2023, it’s lagged the S&P 500 significantly. It gained 230.81% through that period… which sounds great, except the S&P 500 gained 453.24%!

Even if you looked at a calendar year basis, it only ever beat the S&P 500 in 2020. It’s lost every other year, which is to be expected.

That said, it’s hard to beat the market and if you want to try, this service may be able to help.

Action Alerts PLUS from TheStreet can be valuable if you enjoy trading stocks with a target holding period of several weeks or months. You won’t have to spend as much time monitoring your positions as you would with swing trading, which has a holding period of several days. Still, daily or weekly portfolio maintenance can be necessary when you buy into multiple ideas.

You may want to try paper trading some of the investment ideas before allocating hard money to decide if you can keep up with the trading frequency if this investment strategy is new to you.

Further, other short-term investments with higher yield potential can require less effort.

Consider subscribing to Action Alerts Plus from TheStreet if you’re comfortable with routinely buying or selling stocks every few weeks or months. Using a stock trading app makes it easy to get proper position sizing with fractional trading and no trading fees. However, you should avoid this service if you only want a single monthly idea or only buy stocks a few times each year.

Learn More About Action Alerts PLUS

FAQs

You can cancel your subscription anytime by contacting the Action Alert Plus Customer Service Department at 1-866-321-8276 during business hours (Monday-Friday, 8 AM-6 PM).

If you cancel your subscription during the free trial period, you will not be billed. If you cancel a monthly or quarterly subscription, you will not be refunded for the most recent subscription fee. Annual subscribers will only be eligible for a refund if they cancel their subscription within 30 days of the end of the free trial period.

Investment newsletters can help investors with stock picking, saving them hours of research. They are also a great educational resource. However, it’s important to ensure the newsletter you’re subscribing to aligns with your investment style. Also, make sure you’re getting your money’s worth. Some investment newsletter subscriptions cost hundreds of dollars annually and may not be worth the investment.