If you’ve been investing for any time, you’ve probably heard of Morningstar. The company is famous for providing ratings on mutual funds that are widely respected and heavily relied on throughout the industry.

But now, with Morningstar Investor, you’ll be able to take advantage of the insights and analyses the company provides to help you improve your investment performance.

The next question is, “Is a Morningstar subscription worth it?” We’re here to say yes because of the top-notch research tools, full fund screener tool, detailed fund costs/fees analysis, regularly updated ratings, and much more.

Table of Contents

- What Is Morningstar?

- How Morningstar Investor Works

- Morningstar Investor Tools and Features

- Stock Analysis

- Analyst Reports

- Morningstar Quantitative Ratings

- Morningstar Fair Value Assessment

- Best Investments and Fund Analysis

- Portfolio Manager

- Portfolio X-Ray

- Screeners

- Article Archive

- Similar Funds

- Mobile Apps

- Empower Tie-in

- How Much Does Morningstar Investor Cost?

- Morningstar Premium Pros and Cons

- Morningstar Trial and Promotional Offers

- Morningstar vs The Motley Fool

- Morningstar vs Zacks Premium

- Morningstar vs Professional Investor Sites

- Is a Morningstar Subscription Worth It?

What Is Morningstar?

Founded in 1984, Morningstar is an investment research firm based in Chicago. It’s considered to be one of the most influential in the industry. The company provides ratings, information, and tools to help investors make more informed investment decisions.

As an asset management company, it has more than $220 billion in assets under management.

Morningstar is famous for its star ratings for mutual funds. This rating measures a fund’s risk-adjusted return relative to similar funds. Funds are rated from 1 to 5 stars, with the best performers receiving five stars and the worst performers receiving a single star.

Morningstar also gives stock ratings that compare the ticker’s current market price to its fair value. This tool can help you determine if the stock is meaningfully overpriced, underpriced, or market-neutral at the moment.

Morningstar Investor, the product we’ll be reviewing, provides individual investors with news, analysis, and research on stocks, bonds, exchange-traded funds (ETFs), and mutual funds.

Get a 7-day free trial of Morningstar Premium

How Morningstar Investor Works

Morningstar provides analysis and ratings of individual securities like stocks, bonds, and ETFs, but its main focus is mutual funds. The service will mainly benefit long-term, buy-and-hold investors whose investing activities will be best served with mutual funds.

Morningstar Investor is a subscription service that provides detailed information on various investment types and ratings on mutual funds. This helps investors select the ones that will work best in their portfolios.

It combines Morningstar’s data, content, and research with redesigned tools. This enables investors to holistically manage their investments, discover and evaluate investment ideas, and track the markets.

The service comes with screening tools to help you narrow down which funds you might want to invest in. Services are available for both free and premium accounts, but a paid subscription is essential to view exclusive ratings, research reports, and screeners.

Consider this service if you enjoy holding a mixture of stocks, ETFs, and mutual funds in your portfolio. Further, Morningstar makes qualitative and quantitative fundamental analysis more accessible to everyday investors.

The free service is pretty limited, but it’s enough to give you a feel for the service. If you want analyst reports and top investment picks, Morningstar Investor costs $199 per year. There is a discount on the Morningstar Investor subscription price if you subscribe for multiple years. Your subscription starts with a seven-day free trial to give you a chance to evaluate the service.

For a limited time, Morningstar Investor is discounted by $50!

It comes with a 7-day free trial so you can lock in your savings, try the service, and cancel if you don’t think it’s for you.

What do you get with Morningstar Investor?

Morningstar Investor Tools and Features

The service provides tools and worksheets to help you prepare for investing. Examples include a budget worksheet, goal planning worksheet, net worth worksheet, and personal cash flow statement. It’s clear Morningstar focuses on your big-picture financial situation.

They also offer “Morningstar Investing Classroom,” a self-study course that teaches you about stocks, mutual funds, ETFs, bonds, and even proper portfolio construction. You’ll also have help familiarizing yourself with the hundreds of investing terms through the “Investment Glossary.”

Stock Analysis

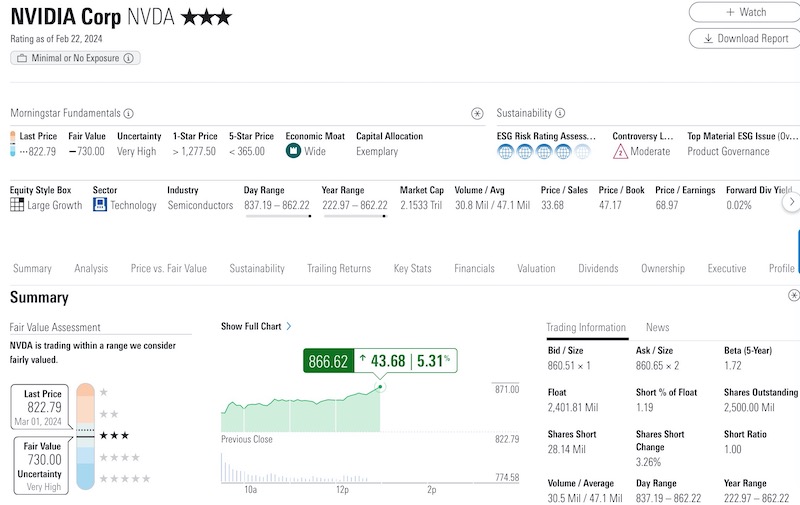

Most investors will find the stock and fund analysis as the most valuable membership perk. A high-level summary highlights key indicators and exclusive Morningstar ratings, such as an ESG risk rating and analyst rating.

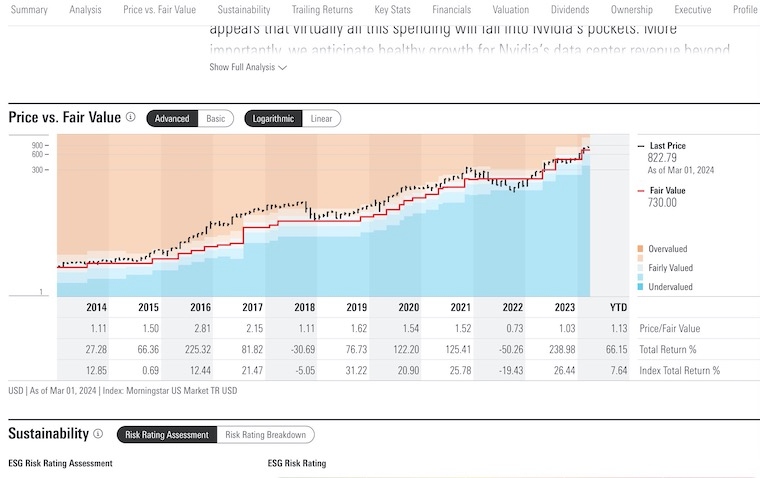

You can also enjoy the fair market assessment, which reflects the price that Morningstar believes the stock should be trading at versus its current market price. This indicator can help imply if a stock is overvalued, undervalued, or fairly priced under current market conditions.

There are many data tabs available that cover various topics, including:

- Morningstar fundamentals

- Price vs. Fair Value

- Sustainability

- Trailing Returns (daily, monthly, and quarterly increments for up to 15 years of data)

- Key Stats (i.e., growth, operating and efficiency, financial health, cash flow)

- Financial statements

- Valuations (i.e., price/earnings, price/book, PEG ratio, etc.)

- Dividend rate and historical payouts

- Ownership by funds and institutions

- Executive team

Much of this data is available from online brokerages and stock research websites. It’s more in-depth than investing apps like Robinhood, which may focus on a hassle-free trading experience instead of investing in research tools.

Analyst Reports

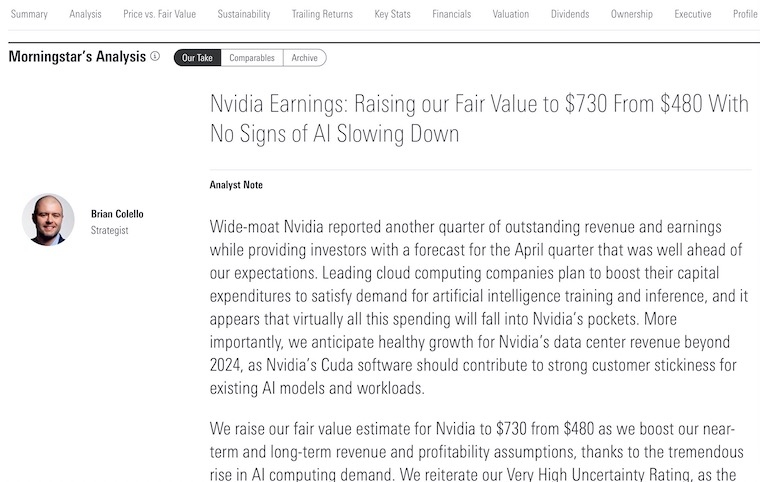

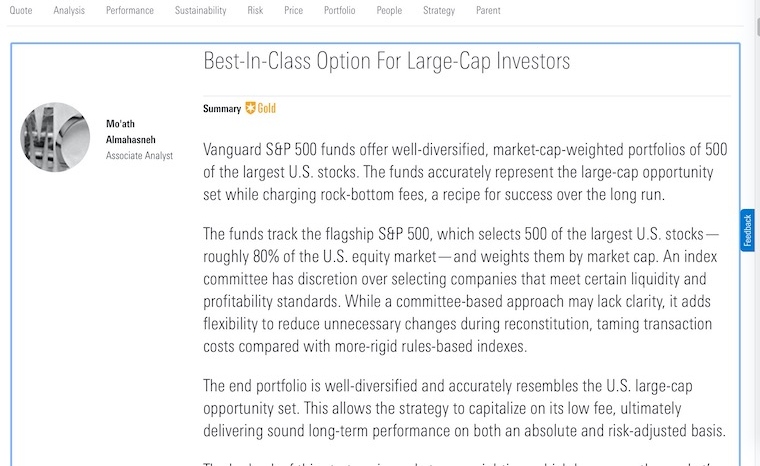

Analyst reports provide an in-depth summary of what Morningstar analysts think about a particular investment. The analysts develop a forward-looking assessment of the investment’s prospects and compare it to its Morningstar category and benchmark.

The Morningstar report is quite comprehensive, but the value is in the Full Analysis. In just a few minutes, you can get caught up to speed on the state of the business and where it might be and likely will be going.

The Full Analysis includes:

- Analyst Note

- Business Strategy and Outlook

- Economic Moat

- Fair Value and Profit Drivers

- Risk and Uncertainty

- Stewardship

For example, Nvidia’s Analyst Note, written by Brian Colello (an Equity Strategist), recaps the latest quarterly financial report and integrates everything the tech company has said leading up to it, such as upcoming business initiatives, earnings forecasts, and potential risks. It’s more than just a recap of an earnings call, which you can find anywhere; it puts it in context.

The Business and Strategy Outlook, dated February 21st, 2024, is also written by Colello, but it puts everything in context so you can understand the why behind a company. Why does Nvidia do well? “Nvidia has a wide economic moat, thanks to its market leadership in graphics processing units, or GPUs, hardware and software tools needed to enable the exponentially growing market around artificial intelligence. In the long run, we expect tech titans to strive to find second-sources or in-house solutions to diversify away from Nvidia in AI, but most likely, these efforts will chip away at, but not supplant, Nvidia’s AI dominance.”

If you noticed, Nvidia has just three stars at the time of this write-up. This is not an indictment of the company but of its valuation. For each stock, they calculate a Fair Value (3 stars), and they’ve determined that Nvidia is near its fair value assessment—thus, it’s just a three-star stock pick. With Investor, you also get a star rating, economic moat, stewardship grade, and fair value uncertainty.

If you knew nothing about Nvidia, reading this full analysis would give you an understanding that you couldn’t get anywhere else this quickly.

For example, I like that it describes its proprietary software system—Cuda—and how it helps make the company one of the best artificial intelligence investments at time of publication. Simultaneously, Colello states that NVDA’s price performance has a direct correlation to the nascent and ever-changing AI industry.

You can also view a “Bulls Say” and “Bears Say” section and an in-depth look at a company’s economic moat to gain a well-rounded view.

Morningstar Quantitative Ratings

Not every company has analyst reports. In some cases, like Wrap Technologies, Morningstar uses Quantitative ratings to compare a company to its peers. You’ll see a small Q next to the star rating:

Here is what the research platform says about these non-covered equities: “Morningstar Quantitative ratings for equities (denoted on this page by ) are generated using an algorithm that compares companies that are not under analyst coverage to peer companies that do receive analyst-driven ratings. Companies with ratings are not formally covered by a Morningstar analyst, but are statistically matched to analyst-rated companies, allowing our models to calculate a quantitative moat, fair value, and uncertainty rating.”

This robo-analysis primarily applies to penny stocks that tend to be highly volatile and have limited liquidity. You won’t receive expert insights but it’s still nice to see a fair market assessment and other core financial data that can make the fundamental research process easier.

Morningstar Fair Value Assessment

While this platform isn’t for technical traders, it’s not a bad idea for active investors to avoid overpaying for equity. Each stock and ETF has a price vs. fair value section.

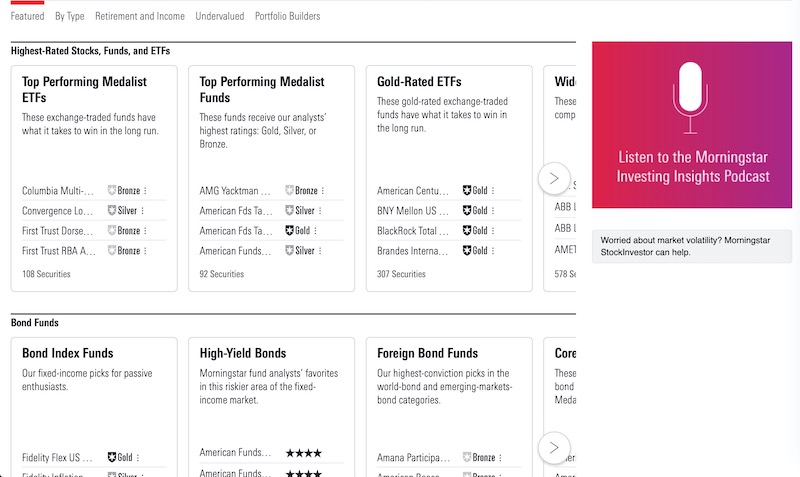

Best Investments and Fund Analysis

If you’re struggling with selecting the best funds for your portfolio, this feature provides what Morningstar determines as the best investment ideas compiled from 220 independent analysts.

Categories include five-star ratings for the following assets:

- Stocks

- ETFs

- Mutual funds

- High-yield bonds

- Core bond funds

- Foreign bond funds

- US index funds

- Foreign index funds

- Bond index funds

- “Inflation fighters”

- Target-date funds

- Starter funds

These rating lists can assist with building a three-fund portfolio or pursuing a more complex investment strategy.

What does Morningstar tell us about mutual funds? Let’s dig into VOO, Vanguard’s S&P 500 ETF:

The analysis of a fund includes a summary, followed by a look at the fund’s Process, People, Parent, Performance, and Price. The Process section for an index fund isn’t that interesting, as it just tracks the index, but it was interesting to read the People as they discuss the fund managers.

To be 100% honest, I’ve never looked at the managers of a fund, certainly not an index fund. It was interesting to read to get a little behind the scenes about how Vanguard does it (“Vanguard has a culture of promoting from within, as members of the Index Analytics team have been promoted to portfolio management and trading.”) but not something that I would need to invest.

Of course, the fund manager history can be pivotal when pursuing active funds that strive to beat its market benchmark year-in and year-out.If you prefer individual companies, another way to look at some of their best picks is to look at the 5-Star Stocks – these are companies that Morningstar has determined are priced lower than their Fair Value. You can then sort these companies by the Fair Value Uncertainty for the level of volatility you’re willing to accept in an investment.

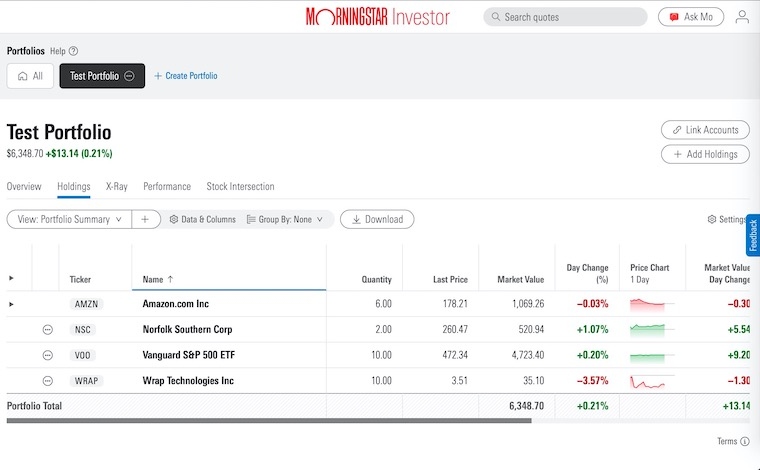

Portfolio Manager

The portfolio manager lets you track your investments, evaluate your strategy, and create watch lists of potential opportunities. The value is that it pulls in the Morningstar reports as links into the table so it’s easy for you to see them on a page. It’s one of the reasons why we list it on the list of best portfolio analyzers.

I put in a test portfolio:

It’s possible to link to your existing brokerage accounts to track your portfolio performance and see applicable Morningstar ratings.

This tool can make it easier to manage your current holdings and make Morningstar an all-in-one research platform. In my opinion, the most powerful features are the rating lists, screeners, and analyst reports.

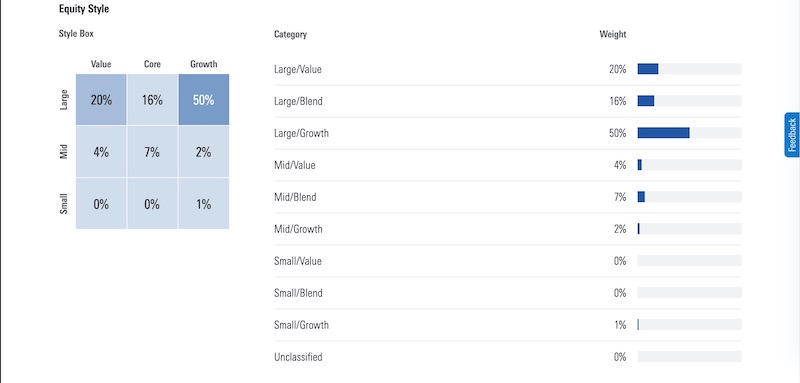

Portfolio X-Ray

Once you’ve built your portfolio, this tool evaluates asset allocation and sector weightings. It looks to reveal concentrated positions as well as the stock holdings in your mutual funds. This will help you to avoid duplication of the same companies in your portfolio (or at least let you know when it happens).

Our test portfolio of just Apple doesn’t yield that interesting of an X-Ray! 🙂

This tool makes it easier to see your current asset allocation by sector, market cap, and strategy (growth, value, balanced). Further, the stock intersection tool can identify overlapping holdings within funds to grade your portfolio diversification.

The Portfolio X-Ray and Stock Intersection tools are extensive and can go further than most free analyzers. It can be more robust than many micro-investing apps for that matter too.

Screeners

Morningstar offers a stock and fund screener that enables you to search and filter mutual funds by category, analyst grade ratings, or performance. Specific criteria include Morningstar rating and risk, sustainability, annual returns, trailing returns, load-adjusted returns, tax cost ratio, yield, and a host of other criteria.

In all, there are over 200 filters available that go beyond finding four-star and five-star stocks and funds.

The platform retired its free screener tools, although you can still glean investment ideas from the free research articles that mention some of the highest-rated stocks and funds.

There are also screeners available for stocks and ETFs.

Article Archive

Morningstar Investor offers various planning tools. It includes tax planning, personal finance, saving for college and retirement, and investing for retirement. Most of these planning tools involve a series of articles related to the particular planning activity.

Building wealth goes beyond picking highly-rated investments. These additional features can help you evaluate your entire financial picture.

Similar Funds

Another useful screener is their Similar Funds tool, which helps you find mutual funds similar to your target fund. This can be very useful if you are trying to perform some tax loss harvesting to reduce your capital gains tax.

The tool will show you similar funds in their performance, allocation, and loads/expense ratio. It’s a quick way to find replacement funds that you can use.

Mobile Apps

Morningstar has a free app for Android, iPhone, and iPad devices that allows you to sync up your portfolios from the website’s interface, so you get access wherever you are.

The Morningstar for Investors app still lags the website’s functionality, but it’s great if you get an idea and want to do some quick research on it without having to navigate the website on your phone.

Empower Tie-in

When you first sign up for the service, you’ll have the option to have a one-on-one financial review with a licensed advisor through Empower. This requires a minimum investment portfolio of $100,000. Along with a review, you’ll also be provided with free Empower tools to help you manage your investments.

If you’re interested in this, you don’t have to go through Morningstar because this is offered to every newly registered user to Empower with $100,000+ in linked assets.

Here’s our full Empower review.

How Much Does Morningstar Investor Cost?

Morningstar Investor has a 7-day free trial that lets you evaluate the service, and then it’s $199 for the first year. The renewal fee is $249 per year, due upfront, or $34.95 monthly.

We have a promotion code – WALLETHACKS – that gets you $50 off the one-year subscription. Just make sure you put WALLETHACKS into the promotion code field to get that discount and trial period.

Get a 7-day free trial of Morningstar Premium

Morningstar Premium Pros and Cons

Pros:

- Morningstar is highly respected.

- Easy to use fund screener.

- Gives a breakdown of costs and fees associated with funds.

- Ratings are updated regularly.

- The platform has numerous tools to help new investors improve their game.

Cons:

- The service focuses primarily on mutual funds.

- The monthly subscription fee of nearly $30 will be steep for small investors.

- There’s a free version available (“Basic”), but the information is limited.

Morningstar Trial and Promotional Offers

If you want to see the tool for yourself, Morningstar offers a 7-day free trial that gives you full access to the Morningstar Investor product. It’s a full-featured trial, too – so you can put the tool through its paces.

Morningstar vs The Motley Fool

If you want stock advice, picks, and analysis – Motley Fool Stock Advisor is probably your best alternative. It’s normally $199 a year, but they’re discounting it to $99 for the first year with a 30-day 100% membership refund period. It will renew at $199 a year.

They have a vast library of stock recommendations and analysis with new stock picks each month. The picks are just a part of the membership. They also have an extensive collection of advice columns that focus on various topics like how to start investing, best buys, market news, etc. The refund period means that you sign up and if you are not satisfied during the first 30 days, you get a full refund.

We also have a comprehensive review of the Motley Fool Stock Advisor service that goes into more detail.

(Stock Advisor is just one of their premium services, you can see the whole list of Motley Fool Premium Services here.)

Morningstar vs Zacks Premium

Zacks Premium has many overlapping features, although it caters to stock traders and short-term investors. The proprietary Zacks Score focuses on how likely a stock or ETF is to outperform the market over the next 90 days.

You can access free research reports and stock scores, but must pay to read the in-depth analyst reports and hands-on stock screener. There is also one model portfolio of long-term investing ideas to hold for at least one year.

If you have a sizable portfolio balance, you may also consider Zacks Trade which is this outlet’s flagship platform. It has the most extensive research tools and portfolio management features.

Morningstar vs Professional Investor Sites

At the institutional and professional investor sites, we have companies like Bloomberg, FactSet, and Thomson Reuters Eikon. Bloomberg Terminals are well known in the industry, but they cost an estimated $24,000 a year – that’s out of the price range of individual investors.

FactSet and Thomson Reuters Eikon don’t have brand recognition like Bloomberg, but they offer similar institutional-level data with subscription fees in the five-figure per year range.

For individual investors, you won’t get the depth of research available to Morningstar subscribers, but MarketWatch and Reuters are both sites that offer research for individual investors. They are newsier than Morningstar, with a greater focus on general personal finance and investing content, but it’s the closest comparison.

In the area of tools, you can get similar portfolio management tools from other sites, but you’ll be missing the research piece. We compare the five best free investment portfolio tools available today.

Get a 7-day free trial of Morningstar Premium

Is a Morningstar Subscription Worth It?

Morningstar Investor is designed primarily for self-directed investors. It doesn’t do the investing for you (that’s a robo-advisor), but it will give you all the tools, research, and analysis you need to be a better investor.

It’s also best suited for long-term investors, particularly those who prefer to invest through mutual funds. In that regard, the service offers one of the most comprehensive packages available in the industry. The screeners they provide will help you select the funds – and even the stocks – you want to invest in, as well as make suggestions for comparable securities. They also provide a breakdown of annual fees for both ETFs and mutual funds.

The X-Ray tool can be invaluable for self-directed investors because it’s not feasible to dig into the holdings of every mutual fund to figure out an accurate mix of assets. If you hold both individual stocks and funds, you may find your portfolio has an excessive allocation in certain stocks. That’s because your funds may also include significant positions in the same individual stocks you own elsewhere. Their tool can help you get that visibility without scouring the holdings report of each fund.

If you’d like more information or to sign up for the trial, visit the Morningstar Investor website. Remember, if you use a link on our site, you can get $50 off.

I’ve been a premium user since it’s beginning but it’s been “updated” to the point where it’s no longer a value. The biggest difference is that we can no longer make choose stocks from the screener to export to excel or a watch list in portfolio view. I’ve never used the free version much so I don’t know what it still offers but there is nothing premium about premium any more. I’ll be on free when the phone line opens up. It’s still useful to watch your portfolio but why pay for it…Actually I can do that at Fidelity for… Read more »

What are the pros & cons of Morningstar Fund Investor vs Morningstar Premium newsletters? Both cover mutual funds and are similarly priced.

Craig – as far as I know, the Morningstar Premium subscription doesn’t come with a newsletter. It gives you access to screeners, article archives, and other premium features over the Basic (free) version but you don’t get any newsletters.

I’ve been a Morningstar Premium subscriber for several years. During the 1st week of June 2020, Morningstar stopped sending me (email) my daily Portfolio updates. A reduction in service with no accompanying reduction in fees. Time to move on away from Morningstar Premium !

Did they stop sending it to everyone or did their email go to another folder in your inbox?

Any idea what the best price is currently(9/2020) for the premium subscription?

If I purchase a Morningstar account in the US, will I be able to access Morningstar Australia using this same account?

Unfortunately no. They’re the same brand but it’s a different product, the US membership is only for Morningstar.com.

I, too, am a longtime Morningstar user who has watched a number of useful functions go away in favor of more advertisements and useless graphics. For example, the Portfolio Monitor reports previously included individual mutual fund, ETF and stock reports. A few months ago, the individual stock reports were deleted from the Monitor report. The online mutual fund reports previously allowed sorting of data within the mutual fund holdings reports, my favorite column sorts included First Bought and Share Change %. Although this information is still provided, it is no longer sortable. The biggest loss for me was the deletion… Read more »

Jim, RE: Morningstar Review 2021: Is Premium Worth It? You should look at the new change Morningstar just made to its premium search engine for mutual funds, and update this review. Days ago, the search engine changed for mutual funds. They eliminated almost all of the criteria that you used to be able to enter to parse out the specific fund characteristics of interest. You said, “Specific criteria include Morningstar rating and risk, sustainability, annual returns, trailing returns, load adjusted returns, tax cost ratio, yield, and a host of other criteria.” They eliminated almost all of these criteria now. You… Read more »

Unfortunately the discount shown on your website appears to be no longer valid. Now you only get 7 days, not 14. Price reduction is now $199 not $169. 🙁

Darn, you are correct, I’m going to ask them to see what the status is on future discounts.

Please let me know what link you are referring to in your article to get a 3 year subscription to Morningstar for $349.

Larry – Morningstar recently transitioned from Morningstar Premium to Morningstar Investor – we are working on updating our content to reflect the new changes (which include pricing changes).