Seeking Alpha

Strengths

- Ability to interact with other investors/subscribers

- Emphasizes fundamental value rather than technical analysis

- Three different service plans are available

- Various stock metrics to help you choose suitable investments

- 14-day free trial

Weaknesses

- Specific investment recommendations not provided

- The PRO plan is pricey at $2,399 upfront

- Ten thousand monthly investment ideas can be overwhelming

- No refunds once you have paid the subscription fee

While it’s true that investing through automated services, like robo-advisors, has become increasingly popular in recent years, you’ll probably need some investment help if you prefer the self-directed route.

Choosing your investments and developing the right strategy are some of the most challenging parts of investing. Seeking Alpha can provide the information and analysis you need. They don’t offer investment recommendations. But they do provide plenty of research, news, and analysis to help you make those choices for yourself.

In this Seeking Alpha review, I’ll tell you how the platform works and cover the essential features.

Table of Contents

- What is Seeking Alpha?

- Seeking Alpha Features and Benefits

- My Portfolio

- Top Stocks

- Stock Ideas

- ETFs

- Stock Quant Ratings

- Dividend Grades

- Idea Screener/Filter

- Seeking Alpha Author and Performance Rating

- Seeking Alpha Plans and Pricing

- Signing Up with Seeking Alpha

- Seeking Alpha Pros & Cons

- Seeking Alpha Alternatives

- Should You Sign Up for Seeking Alpha?

💵 Seeking Alpha Premium Spring Sale – 25% Off

Seeking Alpha offers a 7-day free trial for Seeking Alpha Premium so you can see whether it’s right for you. If it is, the regular price is $239 for an entire year and now you can get 25% off – making it just $179 for the year.

If you don’t like it, you can always downgrade to the Basic plan and still use all the portfolios, screeners, and research you’ve done without paying the premium fee.

The trial is a great way to test-drive Seeking Alpha Premium.

👉 Get the Seeking Alpha Premium 7-Day Free Trial

(Offer expires April 3rd, 2024)

What is Seeking Alpha?

Founded in 2004, Seeking Alpha is a widely quoted financial information source for the entire investment industry. It all starts with the Seeking Alpha website, which is available to anyone and everyone free of charge. You can get a ton of value from Seeking Alpha without paying a penny.

There are three different plans available, two of which require a subscription fee. Each provides a higher level of service, including more in-depth information and analysis than what is freely available on the website.

The company has a stated mission of providing ordinary investors with exclusive investment tools, the kind that was once available only to investment professionals.

Seeking Alpha is also an investment community. The company claims more than 20 million visitors to the platform each month. The website itself has plenty of content. But premium plans are where you’ll get the most actionable data.

More than 10,000 articles are published each month by more than 7,000 contributors. However, not all articles are available to users of the website alone. The best content is reserved for those who pay a subscription fee.

Seeking Alpha Features and Benefits

When you’re on the Seeking Alpha website, the top bar will show the various services offered by the platform. But in most cases, you’ll have only limited access to those services and features. For example, you may be provided with a basic list of companies, with much of the most important information grayed out. To get deeper information, you’ll need to sign up for one of the three subscription services.

Let’s take a closer look at the Seeking Alpha features, including premium-level access.

My Portfolio

You can create a portfolio right on the Seeking Alpha platform. In addition to assembling your current holdings, you can also get email alerts and push notifications about stocks you’re considering. This service is free, just for using the website.

Top Stocks

This feature is at the core of the Seeking Alpha program. It offers the following categories:

- Top Rated Stocks

- Top Rated Dividend Stocks

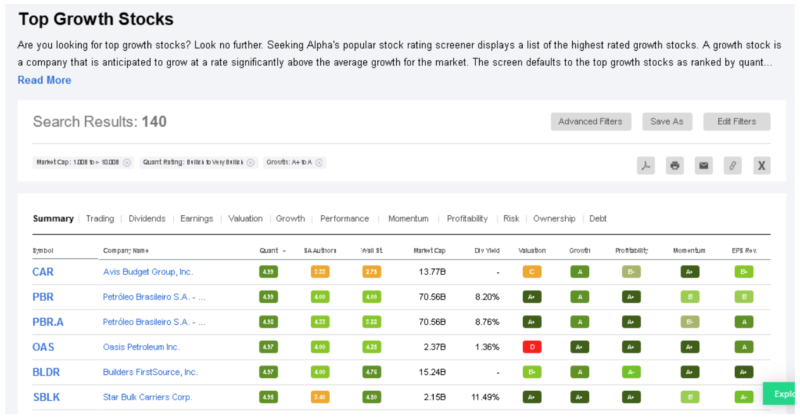

- Top Growth Stocks

- Top Stocks by Quant

- Top Value Stocks

- Top Short Squeeze Stocks

- Seeking Alpha’s Quant Performance

- Stock Screener

- ETF Screener

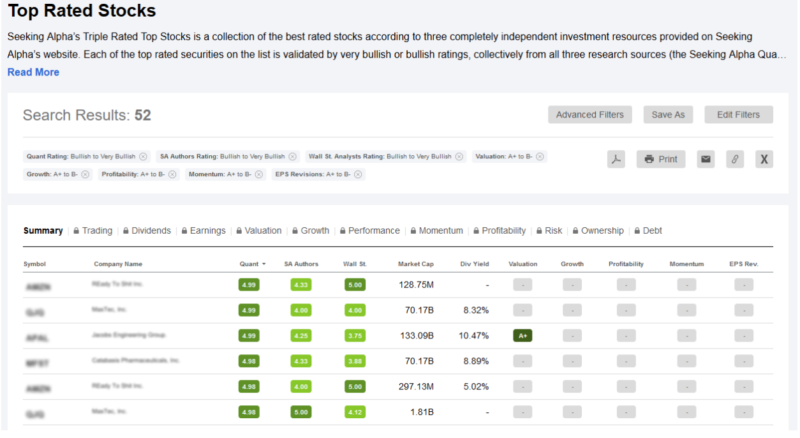

Look at the Top Rated Stocks screenshot below as an example of how the plan levels work.

If you access this page directly from the website, you’ll see the possible search results and certain numeric information.

If you sign up for either the Seeking Alpha Premium or PRO plans, you’ll receive full information, including company names, symbols, complete rankings, and more.

Learn more about Seeking Alpha

Stock Ideas

This is an even more detailed feature category. It includes the following topics:

- Long Ideas

- Short Ideas

- IPO Analysis

- Investing Strategy

- Quick Picks and Lists

- Editor’s Picks

- Fund Letters

- Portfolio Strategy

- Closed-Ended Funds

- Financial Advisor

- Stocks Ideas Editor’s Picks

- Bonds

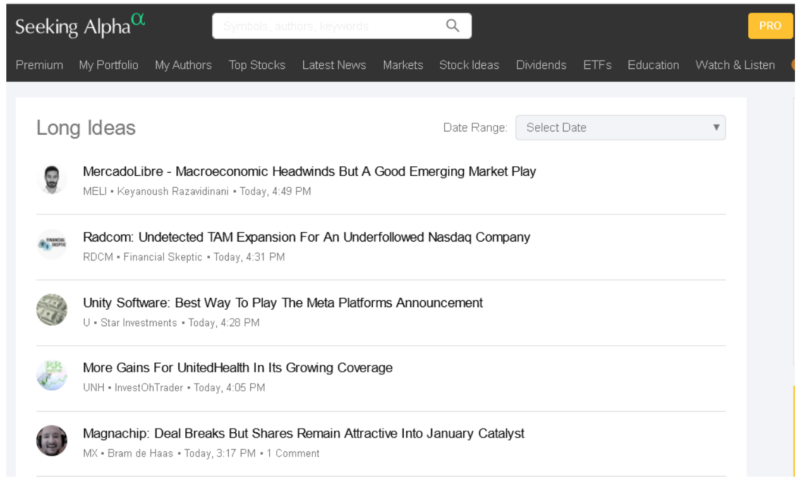

Looking at Long Ideas, the screenshot below shows the articles that will be available to you about individual companies.

The format is similar to the other categories under the Stock Ideas section. Each will provide a very long list of articles about the topic at hand.

However, you won’t get specific stock or investment recommendations. Instead, Seeking Alpha provides you with the data to help you decide how you invest and which companies to invest in.

ETFs

Exchange-traded funds (ETFs) have become one of the preferred ways to invest in recent years. Seeking Alpha dedicates an entire category of topics related to ETFs. Examples include:

- ETF Analysis

- ETFs for Bonds

- ETF Screener

- ETFs for Emerging Markets

- ETFs Editor’s Picks

- ETF Performance – Sectors

- ETF Performance – Countries

- ETF Performance – Market Cap

- Let’s Talk ETFs

- ETFs for Commodities

The ETF section also includes lists of articles in some categories. But for others, they provide more technical data, like market performance or analysis.

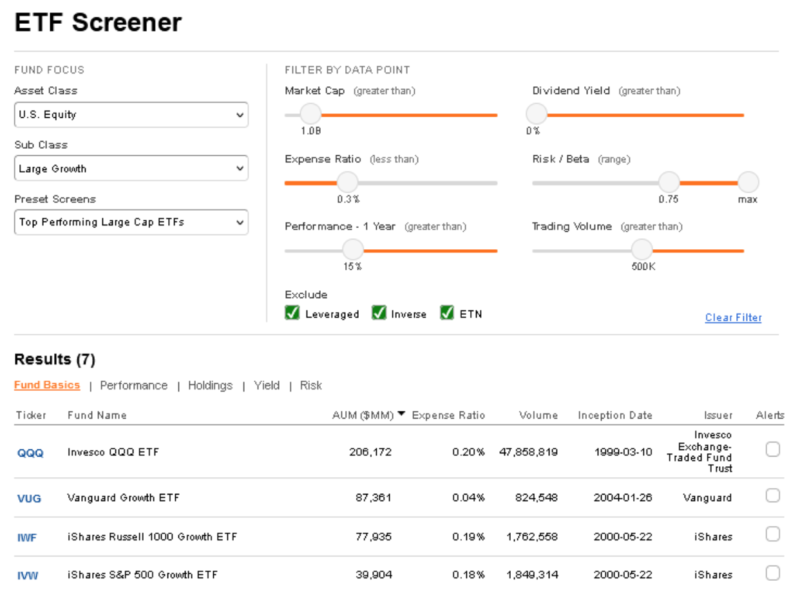

For example, below is the ETF Screener. You’ll be able to narrow down your list of ETF choices by asset class, subclass, preset screens, market cap, dividend yield, expense ratio, risk/beta, one-year performance, and trading volume. The screener will filter the choices based on your criteria and provide you with a list of eligible funds.

Stock Quant Ratings

Even though Seeking Alpha emphasizes fundamental values, they provide quiet ratings, including qualitative ratings of stocks based on over 100 metrics. Ratings are based on value, growth, profitability, momentum, revisions, and other factors.

Dividend Grades

Seeking Alpha rates dividend-paying companies based on several metrics and is a helpful tool for dividend investors. Those include safety, growth, yield, and consistency.

Idea Screener/Filter

This feature is available only under the PRO plan. It enables users to filter investment ideas, either for long or short trading positions.

Various filters let you narrow down your list, like growth, value, market capitalization, sector, and even geographic location.

There’s also a Ratings Screener provided that uses ratings to list the top stock in each investment sector.

Seeking Alpha Author and Performance Rating

This feature is critical, given the reliance Seeking Alpha places on the thousands of articles they offer on the site each month. Each article will include ratings by the author as very bullish, bullish, neutral, bearish, or very bearish to make it easier to identify the author’s conviction and the particular security recommended.

Seeking Alpha Plans and Pricing

Seeking Alpha Basic

Seeking Alpha Basic is free but does require you to register for an account. That’s because it offers certain features above and beyond what you can get directly on the website itself.

This plan comes with the following services:

- Stock analysis email alerts

- Real-time news updates

- Investing newsletters (up to 15 by email)

- Access to stock prices and charts

- Wall Street Ratings for every stock

- Limited access to in-depth news and analysis

This plan will also come with limited access to Quant Ratings, financial statement reviews, and side-by-side stock comparisons. In addition, you will be able to sync your stockbroker portfolio with the Seeking Alpha portfolio.

Seeking Alpha Premium

The normal subscription fee for Seeking Alpha Premium is ~$19.99 per month when you pay the entire year upfront ($240).

It offers all the features of the Basic plan but adds the following:

- Unlimited access to Premium content and investing ideas

- Stock Quant Ratings

- Seeking Alpha Author Ratings

- Seeking Alpha Performance Ratings

- Unlimited Stock Quant Ratings

- Stock Dividend Grades

- Listen to earnings and conference call recordings

- Screen for top-rated stocks with the rating screener

- Download and print financials, earnings, and company presentations

- See three types of ratings for each stock in your portfolio

- Get alerts on upgrades and downgrades on securities in your portfolio

You should also know that the Premium plan comes with “Ad-lite.” You won’t get as many ads as you will with the free Basic plan, but there will be some nonetheless.

Seeking Alpha PRO

This is Seeking Alpha’s top-of-the-line plan. The fee for this plan is as low as $199.99 per month – if you pay the entire annual fee of $2,400 upfront. If you choose to pay monthly, the price will be $299.99, increasing your annual cost by $1,200. It has all the features and benefits of Premium but adds the following:

- Top Ideas

- PRO content and newsletters

- Short ideas portal

- Idea screener/filter

- VIP Service

- Ad-free experience

Learn more about Seeking Alpha

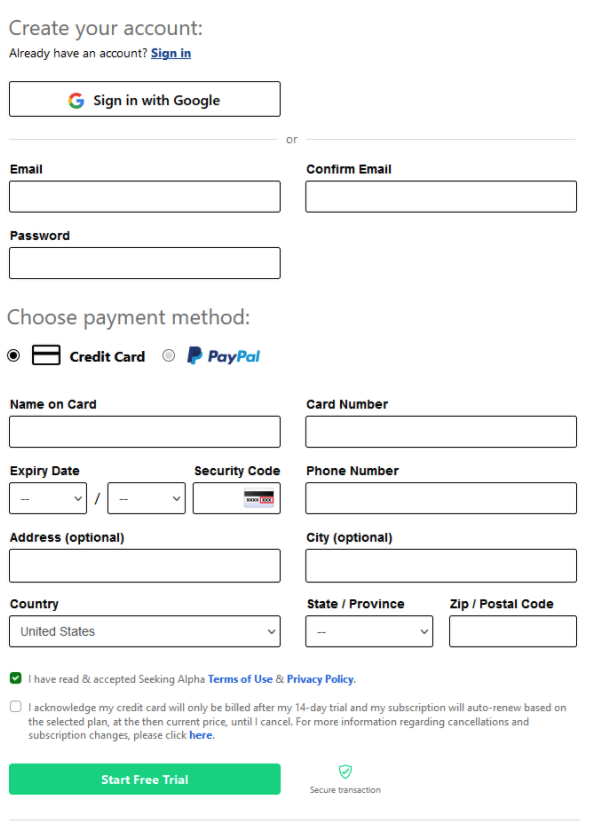

Signing Up with Seeking Alpha

You can get started with Seeking Alpha by clicking the Subscribe button on the top right bar of the webpage. You’ll have the option to either sign up using your Google account or complete the single-page application that will appear on the subscription page.

You’ll need to enter your email address, create a password, and enter your credit card information and home address.

Next, you’ll need to indicate you’ve read and accepted the terms of use and privacy policy and acknowledge that you understand Seeking Alpha will bill your credit card after your 14-day free trial. Automatic subscription renewal is also included in the terms of use.

14-Day Free Trial: All subscription plans come with a free trial. You’ll need to put your credit card on file when you sign up for the service. Seeking Alpha will automatically charge your card if you do not cancel before the free trial is over.

Refund Policy: Once Seeking Alpha charges your credit card for your subscription, whether monthly or annually, you will not receive a refund if you cancel the service after the 14-day free trial. Instead, you’ll continue to have access to the service until the end of the term agreed upon at sign-up.

Customer Service: Seeking Alpha representatives are available by email and phone, Monday through Friday, 8:00 AM to 4:00 PM, Eastern time.

Mobile App: Seeking Alpha’s mobile app is available for download by iOS users on The App Store and Android devices at Google Play.

Seeking Alpha Pros & Cons

Pros:

- Ability to interact with other investors/subscribers

- Emphasizes fundamental value rather than technical analysis

- Three different service plans are available

- Various stock metrics to help you choose suitable investments

- 14-day free trial

Cons:

- Specific investment recommendations not provided

- The PRO plan is pricey at $2,399 upfront

- Ten thousand monthly investment ideas can be overwhelming

- No refunds once you have paid the subscription fee

Seeking Alpha Alternatives

While it can often seem as if all investment advisories provide the same basic information, which is partially true, each fills a particular niche. If Seeking Alpha doesn’t offer all of the services you’re looking for, consider the following alternatives.

Morningstar Investor

Morningstar is one of the most respected information sources in the investment industry. Major financial media relies on information from the company, and many investment firms use their five-star rating service.

You can sign up for Morningstar Investor to find the best investment choices in mutual funds, ETFs, stocks, and bonds. They offer a free 7-day trial, after which you’ll be charged a monthly fee of $34.95. However, the cost is significantly reduced if you sign up for their annual plan, which has a yearly fee of $249.

For a limited time, Morningstar Investor is discounted by $50!

It comes with a 7-day free trial so you can lock in your savings, try the service, and cancel if you don’t think it’s for you.

Learn about Morningstar Investor

(at the Morningstar.com)

Motley Fool

Motley Fool differs from Seeking Alpha and is more of a stock-picking service than an investment information source. They provide precise stock recommendations, along with weekly picks. The service is available for an annual subscription fee of $199, but you’ll pay only $99 for the first year because of a limited-time discount. Motley Fool offers other advisory services with additional subscription fees.

*Billed annually. Introductory price for the first year for new members only. First year bills at $99 and renews at $199.

Motley Fool claims its stock pics have significantly outperformed the S&P 500 index over most of the past 20 years. The company is one of the most popular stock-picking services available.

Learn more about Motley Fool

(at the Fool.com)

Should You Sign Up for Seeking Alpha?

If you’re serious about investing and prefer to manage your own portfolio, Seeking Alpha has a useful suite of tools that can help you research better and faster. The Basic plan is a good choice for new investors since it offers essential tools and is free. I can’t think of a reason not to sign up.

But should you pay for a premium subscription?

As you become more advanced, you can upgrade to the Premium plan, which offers comprehensive services for a relatively low annual fee. With a 14-day trial, you can test drive it to see if it’ll be a good fit.

But if want even more, such as a dedicated stock picking service, Motley Fool may be a better fit, but Seeking Alpha provides plenty of actionable information from a variety of sources too. If you’re comfortable digesting information and doing your analysis, Seeking Alpha is worth the price.

💵 Seeking Alpha Premium Spring Sale – 25% Off

Seeking Alpha offers a 7-day free trial for Seeking Alpha Premium so you can see whether it’s right for you. If it is, the regular price is $239 for an entire year and now you can get 25% off – making it just $179 for the year.

If you don’t like it, you can always downgrade to the Basic plan and still use all the portfolios, screeners, and research you’ve done without paying the premium fee.

The trial is a great way to test-drive Seeking Alpha Premium.

👉 Get the Seeking Alpha Premium 7-Day Free Trial

(Offer expires April 3rd, 2024)