Linqto

0 USDStrengths

- Provides access to lucrative pre-IPO investing to millions of accredited investors worldwide

- Low minimum initial investment of $10,000

- Fund your account with cryptocurrencies through the Uphold wallet.

- Available for both regular investment accounts and IRAs.

- Ability to liquidate your positions early, by selling shares back to Linqto.

Weaknesses

- Accredited investor status is required to participate

- Customer service is limited to email only.

Imagine participating in blockbuster pre-IPO stock purchases involving top-name companies like Robinhood, Impossible Foods, and Coinbase? Seem like something only for billionaires?

At one time, it was, but no more. A platform called Linqto provides fast, low-cost access to shares of rising private companies before they go public. That’s often where the very best investment opportunities are and why they’re so popular among the wealthy.

Linqto operates under the motto of “private investing made simple,” making both the purchase and sale of pre-IPO stocks seamless for accredited investors. In this Linqto Review, I’ll let you know how the platform works, and share a few Linqto alternatives.

Table of Contents

What Is Linqto?

Based in Pacific Grove, California, and founded in 2010, Linqto is a platform that specializes in pre-IPO stocks. As specialists in the field, they commonly offer a large selection of stock in private companies about to go public. Not only can you purchase shares on the platform, but you may also be able to sell your shares back to Linqto in case you want to make an early exit.

This kind of investing has been available for a long time, but it usually requires a huge upfront investment, accompanied by high fees – not so with Linqto. You can invest with as little as $10,000 – most competitors require a minimum of $100,000 – and the company maintains a zero-fee investment platform.

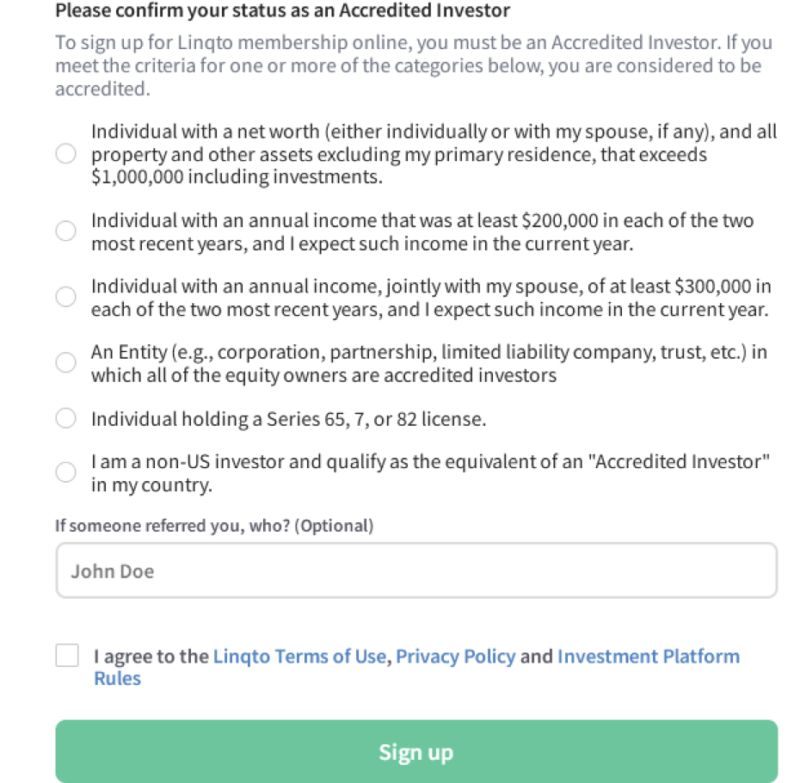

Linqto participation does require accredited investor status, which is defined as follows:

“An accredited investor, in the context of a natural person, includes anyone who:

- earned income that exceeded $200,000 (or $300,000 together with a spouse or spousal equivalent) in each of the prior two years, and reasonably expects the same for the current year, OR

- has a net worth over $1 million, either alone or together with a spouse or spousal equivalent (excluding the value of the person’s primary residence), OR

- holds in good standing a Series 7, 65 or 82 license.”

Linqto requires you to upload documentation confirming your accredited investor status to complete the verification process.

The company estimates that out of 45 million accredited investors worldwide, only about 2% actively invest in pre-IPO stocks. That’s because most have no access to this asset class. Linqto fills that niche, giving accredited investors access to this unique investment opportunity. The company now has participation by more than 100,000 accredited investors.

Linqto Features

- Minimum initial investment: $10,000

- Accredited investor requirement: Yes

- Investments offered: Pre-IPO stocks

- Available account types: Taxable brokerage accounts and self-directed IRAs (SDIRAs)

- Mobile apps: Android and iOS

- Customer service: Email only

How Linqto Works

Linqto works something like an investment brokerage, but with a much more limited scope. It offers purchases and sales only of pre-IPO stock.

Along that line, they offer several specializations.

Liquidshares Portfolio

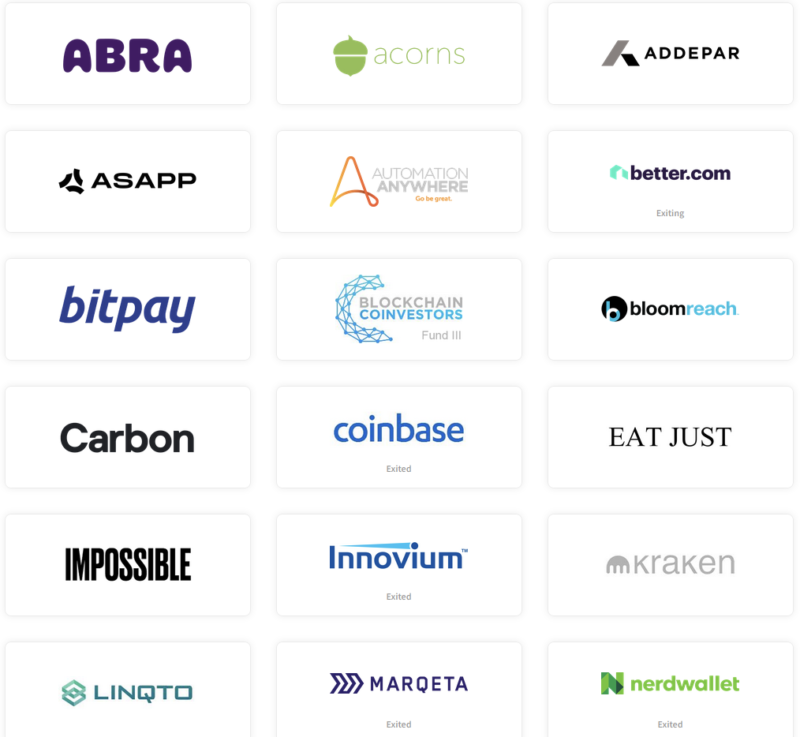

The Liquidshares Portfolio gives investors access to 152 investments in 32 companies. Altogether, more than 4,600 members have more than $70 million invested.

Some of the more prominent investments available include Acorns, Coinbase, Kraken, Nerdwallet, SoFi, Upgrade, Uphold, and Varo, among many others.

Linqto Bucks Referral Program

Linqto offers a referral program where you’ll get two rewards with just one referral.

Because the company is trying to grow its investment community, they’ll pay $250 in Linqto Bucks to any friend or family member you refer to the platform.

Once your referral completes their first investment, you’ll get $750 in Linqto Bucks. Both you and your referral(s) will be able to use those Bucks toward applying for a Linqto account.

Your referral must be an accredited investor who opens an account and makes an investment within 60 days of opening it. The referral will expire if they don’t invest during that timeframe.

Uphold Wallet

The normal channel to fund your Linqto account is via wire transfer. But if you prefer convenience with faster funding, you can sign up for an Uphold Wallet.

Uphold is an outside provider, not connected to Linqto. You’ll create an account on the Uphold website, sign in to your Linqto account, and connect your Uphold Wallet. Once activated, you’ll be able to fund your Linqto investments instantly.

Uphold offers a digital wallet that can accommodate US dollars, foreign currencies, cryptocurrencies, commodities and other assets.

Pre-IPO Shares Liquidity

in most cases, buying pre-IPO stock means you will need to hold on to your position until the company formally goes public. Fortunately, that’s not the case with Linqto. They don’t provide a secondary market for the pre-IPO stock, but they offer to buy back shares you’ve already purchased.

You can even sell pre-IPO shares to Linqto that you purchased elsewhere, including directly from the issuing companies. However, the shares must be in a company that Linqto works with, and you must also be the original shareholder or optionee and currently listed on the issuer’s cap table.

To arrange a sale of pre-IPO shares to Linqto, you can go to the website, then click the “Sell” tab on the top bar of the page. It will bring you to the “Sell Your Shares” page, where you only need to enter your name, phone number, email address, the name of the company, and general information about the shares you own.

Direct purchase of pre-IPO shares by Linqto is the system they currently have in place for early redemptions. LIngto also does not guarantee repurchase under all circumstances. But the company is working with regulators to develop a secondary market exchange for stock in private companies. In the meantime, you can take advantage of selling your shares to LInqto, even though that capacity may be limited.

Linqto Pricing

Linqto claims it operates as a zero-fee investment platform, charging no management fees, brokerage fees, or carried interest.

However, provision 28 of Investment Platform Rules, which provides legal requirements for the use of the Linqto service, specifically states the following:

“The Member hereby acknowledges and accepts that Linqto is entitled to earn an Introduction Fee (in amounts or percentages as notified to them by Linqto from time to time) as payable by the Member or any other expense or fee, as agreed between Linqto and the Member or any other person dealing in a Security.”

The provision is vague regarding the fee amount, but it appears to be 0.50% of the original value of your investment, applied each year.

How to Sign Up with Linqto

You can sign up to invest on the platform, either on the website or mobile app. To do so, you’ll need to complete a simple, one-page application:

The application will also require you to confirm your accredited investor status:

As described earlier, you will need to be an accredited investor to invest with Linqto. That will require verification of your accredited investor status, which will be part of the application process. Accredited investor status is necessary because pre-IPO stocks represent a higher than average level of risk. That requires specific knowledge of the asset class and the financial wherewithal to deal with potential losses.

You can invest with Linqto as an individual, an LLC, a trust, or another entity, and Linqto will create the entity through which you can invest.

To fund your account, Linqto will provide you with wire instructions and confirm receipt of the funds. Existing investors must fund their orders within five business days, while new investors must fund within 10.

You’ll also have the option of putting your orders through the Uphold Wallet (see description above) for faster funding.

Why Invest In Pre-IPO Stock and Private Equity?

Linqto points out that the median term for tech companies to go public has increased substantially in the past 20 years, going from fewer than five years up to the current average of 12 years.

The extended private status is a period when companies are raising capital and making some of the most significant advances as they work to raise their profile for a public offering.

Like most types of investing, timing is everything. Investing in a stock early on can often mean the difference between mediocre returns and exponential returns. That’s because you’ll be getting into private companies before their stock is available to the general public.

There’s no question; this is speculative investing. After all, some investments may not pan out, and some may even go out of business. But for those that do create valuable new products and services, a big payday can come when the company finally goes public – or even before.

Even as an accredited investor, you should be careful to limit your investments in private equity to no more than a small percentage of your total portfolio. It’s a classic high reward/high-risk asset class, where winning positions can pay off big, but some losers can end up in the dustbin of history.

Linqto Pros & Cons

Pros:

- Provides access to lucrative pre-IPO investing to millions of accredited investors worldwide.

- Simplifies IPO investing

- Low minimum initial investment of $10,000

- Fund your account with cryptocurrencies through the Uphold wallet.

- Available for both regular investment accounts and IRAs.

- Ability to liquidate your positions early, by selling shares back to Linqto.

Cons:

- Accredited investor status is required to participate

- Potentially long investment hold period – investments may take years before finally going public. (though this is a function of the investments and not the platform)

- Customer service is limited to email only.

Linqto Alternatives

Linqto is not the only platform where you can participate in IPO or pre-IPO stocks opportunities.

If Linqto isn’t the solution for you, consider the following alternatives:

Yieldstreet

Yieldstreet is a platform that started in real estate but has since expanded to offer funds that invest in a variety of alternative investments. Their open offerings change from time to time but the various themes include single family real estate, commercial real estate, mixed-use property financing, resort financing, art, and more recently venture-style investing in private shares of companies.

Back in April 2023, they had a Fetch Rewards Private Shares offering courtesy of Greycroft. Fetch Rewards is a consumer app and Greycroft is a venture capital company with $2 billion in investments with companies you’ve definitely heard of (Bird, Bumble, Goop, Venmo, etc.). The fund has since been closed (fully invested, not shut down) but is an example of the type of investment they offer. Minimum investment was $25,000.

What’s appealing about this platform is that you can get a wide variety of investments under a single platform.

👉 Learn more about Yieldstreet

Equitybee

With Equitybee, accredited investors can gain investment access to high-growth, venture-backed startups before they IPO by funding employee stock options. Get started to see what companies are available now and get notified when companies are available.

Here’s our full review if you want to learn more.

Robinhood

Robinhood is an investment trading app that lets you trade stocks and options commission-free. They also offer exchange-traded funds (ETFs) and cryptocurrencies. But it’s also an app where you can invest in IPO stock, placing your order for the day when the stock goes public (you can’t buy the stock at pre-IPO prices). It’s called IPO Access and while it’s not pre-IPO, it’s as close as you can get.

It isn’t a full-service IPO dealer like Linqto, but it does offer a small selection of pre-IPO stocks. The advantage with Robinhood is that you can dabble in IPO stocks right alongside your other investments. Still another advantage is that you are not required to be an accredited investor to participate in IPO deals.

Webull

Webull works much the same way as Robinhood, in that it’s a trading app where you can trade stocks and options commission-free. It similarly also offers ETFs, ADRs, and trading in cryptocurrencies. Webull is partnered with ClickIPO Securities to provide limited access to pre-IPO stocks through the IPO Center on the app.

Webull offers much the same advantage as Robinhood in that you’ll be able to dabble in pre-IPO stocks, along with your regular investing in individual stocks, options, ETFs, and even cryptocurrencies. And similarly, you are not required to be an accredited investor to participate.

AngelList Venture

AngelList Venture comes the closest to LInqo as a direct competitor since it deals specifically in the stock of pre-IPO companies. It’s a serious player in the pre-IPO space, with more than $7 billion in assets under management. The company claims to have participated and 56% of all top-tier US venture seed deals.

Investors can participate in rolling funds, managed funds, and syndicates. Syndicates are the method by which you can invest in startups on a deal-by-deal basis. They require a minimum of $1,000 to invest, but accredited investor status is needed, much like Linqto.

Lingto Review: Final Thoughts

Many investors, especially accredited investors, are looking to diversify their portfolios away from one comprised entirely of stocks and bonds. That will require being open to alternative investments, like pre-IPO stock.

These are highly unconventional investments, historically held only by the wealthy because they don’t necessarily follow the activity in the mainstream financial markets. Even when the general stock market declines, a privately-held tech company can see its revenues and earnings skyrocket.

If you are interested in pre-IPO stock, Linqto offers a compelling service. You get access to pre-IPO stock from the most promising tech companies in the world, with the potential to sell your shares back to Linqto, reducing your risk.

If you plan to invest through Linqto, be sure to invest no more than you can afford to lose. Pre-IPO stock is high reward/high risk investing at its best. For that reason, it should represent no more than a small slice of your portfolio.

Hi Kevin, excited to see Linqto coverage! However, some of this review is out of date. For example: (Customer service): Linqto has fantastic customer service. Members have active break out groups on Telegram and Discord with key leaders on the team. They also spend a good deal of time on calls, texting, or zoom with members, engaging on their preferred mode of communication. The company also hosts Twitter Spaces, and in person events picking up as covid (knock wood) becomes more manageable. (2) Fees: There are no additional fees beyond the investment price per share. Period. There may be antiquated… Read more »

Susan – thank you for sharing your experiences but it’s not antiquated language when it’s included in the Investment Platform Rules. If it were antiquated, I’d expect Linqto to remove it from the document?