When I first started investing, I was enamored by Initial Public Offerings (IPO). There was always fanfare around a new stock joining the stock market, sometimes execs got to ring the bell, and they often jumped in price.

Much like everything else with the stock market, there is always a bit of gamesmanship involved.

IPOs tend to immediately jump in price because:

- Bankers tend to list the stock a wee bit low so they get good press when it jumps

- Bankers offer some pre-IPO shares to their most lucrative customers as a “wink wink” thanks for the biz

- Pedestrian companies don’t tend to IPO because there are cheaper ways to get funding than selling equity

That said – IPOs are still sexy and if you’re wondering how you could get a piece of the action, you may have heard of something called IPO Access.

Table of Contents

How Does IPO Access Work?

IPO Access is the name that Robinhood calls their service that gives you access to IPO shares.

Here’s the rub – these are not pre-IPO shares. They are literally shares that investment bank (the ones who underwrite the offering) has allocated to Robinhood. Robinhood then allocates them, at random, to their customers who indicate an interest in those shares.

To participate, you have to go to the IPO Access list of Robinhood and indicate you are interested. You essentially put in an order and they will fill it as they can (and at random).

The order is known as a “Conditional Offer to Buy” and it is not binding. Once the IPO is priced, you can edit or cancel your order until the end of the “confirmation window,” which is listed for each offering. If the price ends up being 20% above or below your conditional offer price, you’ll have to reconfirm your offer or it’ll be cancelled.

As of this writing, they don’t have any IPOs “In Flight” so the list is blank:

30 Day “Flipping” Rule

You’re allowed to sell the shares you get whenever you want. There is, however, a “flipping” rule.

If you sell your shares within 30 days, you “may” be prevented from participating in IPOs on IPO Access for 60 days. It doesn’t appear to be a strict rule but investment bankers don’t like flipping and it sounds like Robinhood wants to keep them happy too!

Remember: IPOs Are Speculative!

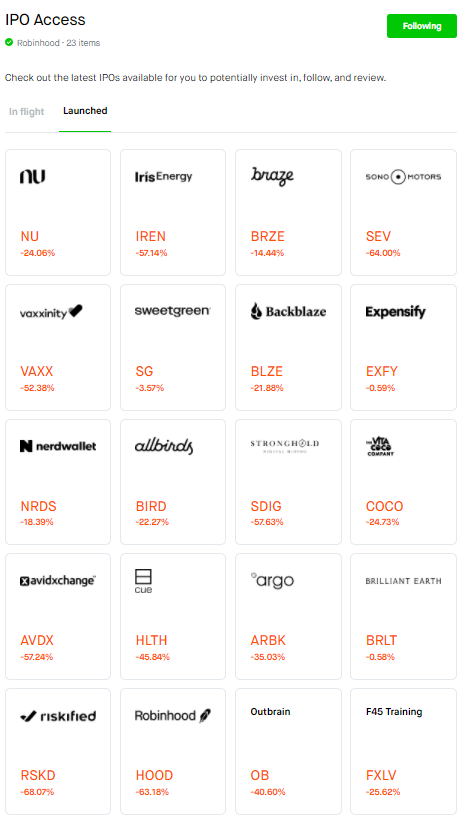

They’re speculative in the sense that, like any stock, it can go up or down after an IPO. Check out this list of the recent IPOs they had access to… it’s pretty gnarly. 🙂

Other Brokers Offer This Too

Robinhood isn’t the only brokerage that offers IPO Access to its customers. Not everyone calls it IPO Access (though it doesn’t appear Robinhood has trademarked the term either) but you can check your brokerages to see if it’s something they have available.

For example, Webull offers the ability to access IPOs through a partnership with ClickIPO. ClickIPO works with issuing companies, underwriters, and brokerages to give retail investors access to IPOs. They’re SEC registered since October 2014 with their headquarters in Arizona.

What about Pre-IPO Shares?

If you want access to pre-IPO shares, then you’ll have to turn to companies and services that offer it. IPO Access and ClickIPO only offer “early” access to an IPO. A company that offers this is Linqto. Linqto is a California based company that offers accredited investors the ability to buy shares from company insiders. It’s one of the few ways you can get pre-IPO shares and our Linqto review goes into greater detail.

The benefit is that you get pre-IPO shares but the drawback is you don’t know when you can liquidate them. When you get shares through IPO Access, you know the shares are being traded on the market. When you buy them pre-IPO, you don’t know when they’ll be on the market, if ever!

Access Isn’t Guaranteed

In the end, IPO Access gets you “early” access, as early as you could get that isn’t pre-IPO, but only to shares that Robinhood has access to.

If this is something you want to do, I recommend signing up for all the brokerages so you increase your chances of getting access to shares since the banks will be allocated them across all of their partners to varying degrees.