I’ve been tracking our net worth like a weirdo since I started working in 2003.

That’s nearly 20 years of data. Sweet sweet data.

This post was originally written in 2017 but after the years we’ve had in 2021-2022, it rings even truer. I’ve updated it with two more lessons at the end.

That first row is so simple. 2 bank accounts, 1 brokerage account, and what I considered an impressive net worth of $8,745.69. That’s the equivalent of $14,105.27 today (July 2022).

$4,519.44 was my Roth IRA, accumulated during high school and college. The rest was a sizable signing & moving bonus from Northrop Grumman. My side hustle proceeds played a role too.

Except I didn’t do it completely accurately.

It didn’t include $35,000 in student loans… whoops. 🙂

What’s most enlightening are the comments I left. They’re little notes in some cells to help jog my memory on what happened that month. They’re typically tentpole moments in my life, like moving, getting married, selling a business, or something similarly significant. Sometimes they’re mundane, like making estimated tax payments.

After nearly twenty years, a lot of my behavior has changed. There are things I used to do that I’ve stopped. Some of them were intentional changes, most of them weren’t.

Here are all the lessons I learned in the last almost twenty years of tracking our net worth:

Table of Contents

Maintain Long-Term Thinking

When I was younger, I was very impatient (still am probably). I didn’t understand why older people took so long to make decisions and take action – my impatient brain wanted to go NOW.

Not NOW NOW, but NOW YESTERDAY.

As I’ve aged, I’ve slowed my decision-making process (my execution is still that impatient, go as fast as possible) because it pays to be more deliberate. Measure twice, cut once.

With 20 years of data, I’ve realized that life is less a Formula 1 race and more like a cruise around the world. It takes time to turn a cruise ship so take a few extra moments to think about the course. You won’t lose anything by spending an extra day or two.

The (financial) decisions you make today won’t have a big impact on your life tomorrow. Or the next day. But in ten years, they will matter a lot.

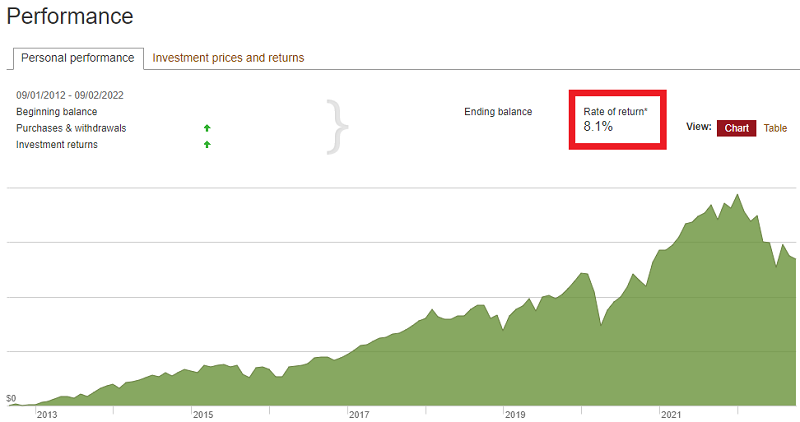

I made my first Roth IRA contribution in high school, at the urging of my father. On less than $20,000 of contributions over the last 20 years (it’s almost all front-loaded, but everyone should be saving more and more often), it’s grown to nearly over $145,000. The rate of return from 2012 (Vanguard only lets you look back 10 years) until now is over 25% a year. (this rate of return atypical – it’s largely holding shares of Apple)

Seeing rows and rows of data reinforces this longer-term view.

But the long term is the right term. It stops you from freaking out in the short term.

Consider this – you won’t be touching your 401(k) until you retire. 65.

How many years is that? 10? 20? 40?

Take a peek back at the stock market during any of those periods. There have been several huge shocks and recoveries. Past history is not indicative of future results, but over the long-term, the market moves up and to the right.

Check this chart of the S&P 500 index (ends November 2017):

- The red line begins near the high of late 2007 before things went south.

- October 2007: The S&P500 is ~1,560.

- March 2009: The S&P 500 hits a low of 683.

- April 2013: The S&P 500 is back to ~1,560.

One of the worst economic recessions (nothing great about the Great Recession!) and our stock market recovered from its low in four years. FOUR YEARS!

Personally, we’ve had months where our net worth battled six-figure increases and decreases (not often, but it has happened). We try to note the reasons behind them (it’s almost always the stock market and sometimes quarterly estimated taxes on top of it) and then move on.

Mr. Market has a nasty temper but has never lost his way.

Stop Checking Stocks Daily

Like everyone else, I like checking stuff. You get that dopamine hit when something exciting happens.

Whether it’s my email, blog earnings, or stock holdings on Google Finance… I was checking it multiple times a day. Right before the market opened, I looked at SSO – the ticker for the ProShares Ultra S&P500 (ETF). It’s designed as a 2x of the S&P500 but it’s traded pre-market.

When the market opened, I would look at my portfolio to see what was happening.

As soon as I typed “F,” my browser would fill in the rest of finance.google.com!

Sometimes I look and there’s an unexpected spike, so I get the dopamine hit. Sometimes I peek and there’s an unexpected drop, so I get anxious.

I would read some of the news articles, I’d look at other stocks, I’d see how the broader market was doing… but that was it. I was doing that because I was bored at work and didn’t want to find more work to do.

More importantly, it was unproductive. Checking doesn’t spur action (nor should it!) so I worked towards stopping that behavior. It didn’t cut it off cold turkey but I replaced it with more productive activity. I stopped looking at my stocks. Now that I work for myself, I replaced it with other, seemingly more productive, things (not Facebook!).

Also, checking is counterproductive because it places a higher priority on what happens in the short term. The movements of today will not be important in a year. It certainly won’t be important in five. Definitely not in 10+. If you trust in the trend, that it goes up and to the right, then you might as well avoid the emotional swings in the near term.

I still check the news during important periods, like quarterly reports, because they can reveal changes in the business that affect my investment decisions. Most of the time, I just check tools in my financial dashboard every month and mostly leave it at that.

Investments Matter More Than Wage Income

When I first started working, my net worth rose on payday and slowly slid down.

As I got older and was able to save more, my net worth stopped rising and falling significantly (percentage-wise) based on my pay. The tumultuous stock market, especially 2008, had a bigger impact. (5 of the largest point gains in the S&P were in 2008, 4 of the largest point losses were also in 2008)

I was escaping financial gravity.

There will come a time, and it’ll feel strange when it does, that the stock market will have a greater impact on your net worth than your job’s income.

If you have $25,000 in your 401(k), a 1% move is $250. That’s not a big move.

If you have $250,000 in your 401(k), a 1% move is $2,500. OK, that tickles.

If you have $750,000 in your 401(k), a 1% move is $7,500. Hmmm…

If you have $1.5 million in your 401(k), a 1% move is $15,000. OK, that’s significant.

If the market moves 1% down and you make $15,000 a month, you might feel like you worked for free.

(you didn’t, but your monkey brain thinks that way)

That takes getting used to but you will, over time, and there’s really no way to force the adjustment.

The Point Isn’t More

Our net worth is high. And on an annual basis, it continues to go even higher.

When we look at Maslow’s Hierarchy of Needs, a relatively high net worth covers the bottom few levels. We’re not worrying about food, shelter, etc. We’re focused on relationships, connection, and self-actualization. The work we do has to matter to us and not chasing a paycheck has been an adjustment.

When I would interview for jobs in college, interviewers asked me why I wanted the job and my honest answer was “to make money.”

I needed to eat!

The work had to be interesting but, to be frank, it had to pay well. I always gave a BS answer like “I enjoy programming because I like to solve interesting problems and the immediate gratification of seeing my code work is appealing.”

I felt it was disingenuous because while it was a true reason (I do like solving interesting problems, I do like seeing my code work, so it wasn’t a lie) – the #1 reason is $$$$$.

Once you’ve gotten to the escape velocity and no longer feel financial gravity, it’s time to use that freedom. There’s no point chasing more.

You have to work jobs and projects that matter to you for reasons other than money. All work can be hard and you need that motivation to push through the difficult parts to succeed. I suffered through all kinds of hardship to earn money because I needed to. When you don’t “need” it, in the moment, you have to draw on other motivations.

It’s a hard transition… for 30+ years I learned a key lesson from my hard-working immigrant parents (immigrant being significant because it meant we had no local family as a safety net) – get a good paying job and keep it.

As you age and move towards a freer financial situation, it’s time to work on other needs outside of accumulating more money.

Predictability is key

When I was younger and read about models and projects, I scoffed at them. Human beings are terrible at predictions but we still do it. Why?

It’s better than nothing.

And keeping to a prediction is better than nothing. It’s better to be slow, steady, and predictable than anything else. Doing too much is as bad as doing too little (perhaps you’ve taken on too much risk).

It’s also why I read stories about Bitcoin and don’t really care. I need massive gains in a speculative bet on Bitcoin like I need the little plastic ball to fall in a red slot in Roulette.

Over the long term, blockchain will be important. Smart contracts will be important. Bitcoin may not. Who knows and I don’t care.

That said, I will never make a large enough bet that a win would be significant. If it’s not significant, why bother betting? If I don’t experience joy in a win and I still feel the loss when I lose, that’s a bad bet! (loss aversion is something humans loathe)

It’s About How Much You Keep

One of the sheets in my Net Worth Record collects data from my tax return (I write down the Line number because I only do this once a year and don’t want to search for it, though the lines tend to change a bit from year to year because of pesky tax laws):

- Total Income – Line 9

- Adjusted Gross Income – Line 11

- Taxable Income – Line 14

- Wages – Line 1

- Interest – Line 2

- Dividends – Line 3

- Capital Gains – Line 13

- Business Income – Line 8

- Total Tax – Line 24

- Effective Tax Rate – Total Tax / AGI

It’s fascinating how our finances have changed over the years. In the beginning, the largest numbers were in the wage column. Wages are great but they don’t come passively – you have to work to earn those wages.

One of the treasures coming out of the financial independence / retire early (FIRE) movement is that it has shown people that you can retire early if you save diligently. You can build an investment portfolio that generates income to replace your wage income. That stream of income is yours regardless of how many hours you work and that’s a powerful idea.

Every year, we get our dividends and interest no matter what. I consider it our own form of basic income. The difference is that it comes from the money made from active work but it’s completely passive. (and, taxed favorably in the case of qualified dividends)

In my first three years of working, I had a hundred dollars or so of bank interest and $0 in dividends. In 2016, dividends were 40% of our adjusted gross income (granted, given the ebbs and flows of small business, our wage income is quite low). It’s not free money since it relies on savings in years past, but we don’t have to work for it.

It’s You vs. You, Not You vs. Anyone Else

Lastly, and this is exacerbated by social media, compare you vs. you from a year ago. Versus you from five or ten years ago. Don’t compare you versus your current friends, your high school, and college friends, or your partner’s ex. 🙂

Social media has given us everyone’s highlights. The awesome trip they took, the amazing meal they had, the incredible car they bought, the house they live in, the family they spawned, the whatever – it’s Keeping Up With All The Joneses At Once and it’ll drive you nuts.

It’s far better to practice stealth wealth, for a variety of reasons, but the biggest reason is for your own mental health. That type of competition, and ostentatious shows of wealth, just isn’t healthy.

When I look at the last 14 years, I see a growth that is often uneven but trending upwards. My goal isn’t to beat someone else, it’s to stay ahead of Yesterday Me.

It’s like the stock market. Don’t fall in love or compare yourself with the Bitcoins of the world, just fall in love with the onward and upward growth. Take one step each day and you’ll get there. Focus on that and you will keep your sanity.

Try to keep up with others and you will run yourself ragged.

Spend Time Where It Matters

One of the benefits of investing in the stock market, specifically index funds, is that it’s easy. You pick a mix that matches your target asset allocation, rebalance every so often, and then move on.

After I sold my first business, I invested in a few startups because I thought that’s what you were supposed to do. I’ve written about how I angel invested and why I wouldn’t ever do it again.

There’s a reason why money managers charge you a fee to handle your money. It takes quite a bit of time to do it responsibly. And that time, and stress, will take you away from your other priorities.

And the challenge with money is that it’s important. So you justify spending time on gaining more money (working & earning, or analyzing & investing, etc.) because money is important.

But you can get most of the investment gains with a fraction of the work by simply going with index funds. There’s no need to analyze investments, pick stocks, follow crypto, or do any of that stuff because the time you spend will generally not move the needle.

If you enjoy it and aren’t sacrificing elsewhere, by all means enjoy yourself. But if you’re sacrificing your health or your friends or your family in pursuit of a higher bank balance, you’ll regret it later.

It’s Just Money

In the end, and I’m learning this as a result of getting older and not necessarily from tracking our net worth, money matters very little.

It’s like oxygen. When you don’t have enough of it, you will struggle and desire more.

Once you have enough, chasing more won’t fill whatever holes were there before. This is why you hear so many tragic stories from people who seem to have all the money in the world or all the fame and career success in the world.

And the only difference is that you’ll be older and all the sacrifices you made will be laid bare before your feet. Just make sure you’re OK with it.

Your Turn

Have you been tracking your net worth for a while? What have you learned?

Hi Jim, thank you for such an interesting article! I’ve been tracking my net worth for just over 3 years now, and even in that short time I can see a HUGE change in my financial behaviour. I literally cringe when I think I what I’ve spent my money on in the past. My mindset couldn’t be more different these days. I must confess though that – still being quite new to the FI movement – I check my stocks (well, index funds!) regularly. Hopefully in time this will change and I can relax as you can. However, I feel… Read more »

Like anything else, your mindset towards anything will slowly change over time and those changes aren’t obvious as they’re happening. When you track things for a long time, and 3 years is quite a bit of time even if it doesn’t feel like it, you can start to see the differences. Checking isn’t necessarily a bad thing, especially early on (it’s like checking a map to see if you’re going the right way), it’s a problem when it starts interfering with good behavior.

I think that is a key point of what you are saying. We have seen the enemy and he is us.

Whatever helps you stick to a solid financial plan and not bail out in a bad bear market is the key (whether this is taking the “long view” or looking back at historical trends).

I think this is a fantastic perspective post, and really hits the nail on the head! Thanks for the reminder to stay on track!

Hey Jim, I enjoyed this post from a fellow money nerd. I had a spreadsheet tracking net worth from around 2003 that I updated every month too. It tracked investments, debts, and every account I owned to the penny. I only stopped tracking when I started using Personal Capital a year or two ago. PC does the job nicely, though I kind of wish I continued the manual version. The biggest lesson I’ve learned tracking net worth is that it’s not a good measure of financial security for most of us. Having a healthy positive monthly cash flow, to me,… Read more »

I was using PC to help me collect the data – log in once vs. log in X times – but I loved the continuity of the spreadsheet so I kept it going. It’s probably as useful as some of the paper I keep around, stuff that at this point I know I don’t need but shredding would take effort. 🙂 You are right about that feeling of financial security with a monthly cash flow. Part of it is also a sense of fulfillment. Not from the actual money being paid but from creating value of some kind in the… Read more »

Hi Jim, I enjoyed reading your post. I have only been tracking net worth for a decade or so. It is so true that at a certain point, your net worth swings are higher than anything you could earn from a day job. If you had a net worth of $2.7M, invested 100% in S&P 500, you ” make” or “lose” $1000 for each point change in the index. It is great to hear that dividends are covering 40% of your expenses. I assume those are just the divvies from taxable accounts, correct? I do look at stock quotes daily,… Read more »

DGI! — the divvies are from taxable accounts. I don’t want to hide that sweet sweet 10%/15% (and now 20% for some) taxable rate inside anything! 🙂

Awesome article, Jim. Love the quote: “I need massive gains in a speculative bet on Bitcoin like I need the little plastic ball to fall in a red slot in Roulette.” Lol. The part I resonated with the most was about Maslow’s hierarchy of needs. Actualizing as a human being is an important need, but it’s tough to do when you’re always spending your time in survival mode. But a big cushion of money that pays for your bills without you having to work frees up your time to do any project that fulfills you. I’m a financial nerd too,… Read more »

Great post! Despite being an obsessive budgeter and tracker of my money, I only recently started tracking my ‘net worth’ on a spreadsheet. Even at month 3 I’m noticing the points mentioned here. I’m definitely excited to train myself to stop checking my accounts/investments daily, and it’s a great reminder that it’s me vs me, not me vs. colleague, friend, family member. Finally, I’m pumped about seeing my investments grow over time. It’s easy to get stuck in the weeds, wondering if I’m actually making progress or not. A tracker like this is a great tool to see the progress… Read more »

We do track our net worth but maybe not as detailed as your spreadsheet. The way it’s set up in my household was my wife will track our expenses including our Bank savings and checking accounts. She’s a CPA and she’s really more detailed than I am. I do take care of our stock investments including IRA’s and a rental property. Every quarter, I will print a copy of our statements and that includes ending balances (net worth) and we both will talk about it for a good 30 minutes usually at a coffee shop (weird). But I would be… Read more »

I’ve been tracking our debts and assets since 2012… it’s amazing. I can say that just the keeping-track bit matters for me. Even if I don’t feel like I’m “doing” anything else, it helps me stay focused on my goals and then I make better decisions. (Same with food. In fact, I wrote a Man Vs. Debt post about how my commitment to Weight Watchers was the same as my commitment to getting out of debt!)

Hey Joan! It definitely helps with the focus, even if you aren’t “doing” anything. I hardly touch my investments but tracking them helps me understand how they move better, which is part of the value in tracking.

Man vs. Debt… those were the olden days (now)!

Great post Jim and all great reasons to track your net worth. I’ve been doing it for about 3 years and it really is an insightful exercise. I really like the last point of just comparing yourself to yourself. Most people think of wealth in terms of income and possessions, but you will probably have a crappy net worth if you think that way.

Focus on increasing assets and decreasing liabilities. That’s all there is to it!

Yeah, it’s rarely about stuff. I think it’s about time. 🙂

I’ve tracked for over a decade but skipped a few years of sharing because I didn’t know how to show our combined net worth statements. Last year I collected all the data that I’d shared on the blog over the years to visualize our progress (http://agaishanlife.com/2017/10/historical-net-worth-10-years-of-money/) and it was pretty neat to see except for that deep debt line 🙂

I suppose we’ve learned that it’s true, slow and steady gets you somewhere after all, if fast and steady aren’t an option!

Ha, fast and steady rarely go together!

Great post, Jim. “Don’t lose what you need and have in order to chase what you don’t have and don’t need”. This important quote of Buffett came to mind when I read your post. This is why I have massively toned down my equity holdings after enjoying the run of last 5 years at near 100% equity portfolio. We should learn to avoid FOMO that goads people to take on too much risk even after you have “won the game”. It has an avoidable bad result as much as an overly risk-averse person who never invests in the stock market… Read more »

Yes! That’s a great quote.

One of the risks of FOMO is that you put what you hold dear at risk FOR NO FLIPPIN’ REASON.