One of my favorite movies of all time is The Goonies.

And one of my favorite moments is when Mikey finds One-Eye Willy’s treasure map (really, it’s when Chunk drops the frame) and the Goonies go on their quest to find his treasure.

We love treasure maps.

And we have one too – it’s a map of our treasure.

We have two Master documents that outline our finances – Net Worth Spreadsheet and the Treasure Map.

The Net Worth Spreadsheet is a Microsoft Excel document that calculates our net worth. It is a monthly accounting of our financial accounts and sticks strictly with numbers.

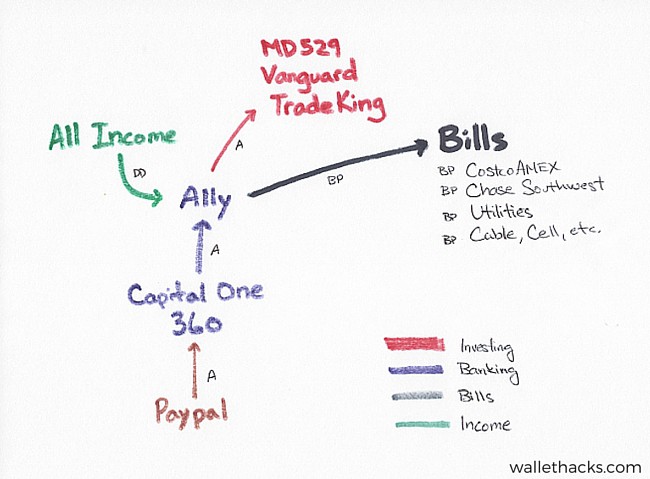

The Treasure Map is the qualitative explanation of our financial setup. It is a Word document that explains the purpose of each account, the point of contact, and how each of the pieces fit together. Our treasure map starts with our financial map – which is a drawing of how our accounts are interconnected.

Together, they give you a complete picture of our finances.

The Treasury Map shows someone where our stuff is so that it can be found if I’m unavailable (unreachable, dead, incapacitated, whatever). It’s taking all of the knowledge I have in my brain and dumping it into a document so someone doesn’t have to guess what I was doing.

And it’s written in a way that is as basic as possible, making no assumptions on the part of the reader.

What I call a Treasure Map, my friend Chelsea of Smart Money Mamas calls an ICE Binder – In Case of Emergency Binder.

I already built mine (here’s what you need in an ICE binder) but if you haven’t and want a beautiful set of templates that you can take today and build an ICE Binder – get hers. It’s a great deal to have it all laid out in front of you in an easy-to-fill-out manner.

It has five sections:

Table of Contents

Treasure Map Legend

The Treasure Map is a straightforward document but anything can be misinterpreted so I keep a legend at the front explaining what it is and what you can find in it.

Plus, whenever someone will need this will be a stressful time… so I tried to make it as simple as possible.

It explains how all the sheets are related, what updates where, and someone reading the document will be able to continue the accounting (not that they will). This also acts as a reminder for myself in case I forget how I set something up.

This is where our financial network map is included.

A map is great… but what we need is the explanation for what’s what. We have to take what’s in my brain and put it on paper for those times when I’m unavailable.

💡There is never too much detail in this document. You can never overexplain – the more information the better. You want the person reading to get the whole picture, including your rationale and thinking, so they don’t misinterpret what you write. If necessary, you can record video or audio too if that’s more comfortable.

Personal Finance Tools

Do you use any online tools to help manage your money? Whatever 30,000 foot view tool you use, you’ll want to identify it in the document. Preferably at the very top so the person reading it can log in and see everything.

We primarily use a spreadsheet to track our net worth so our Treasure Map is stored in the same folder as the spreadsheet. We also use Empower Dashboard so the login details for that are included as well in case you want up to the minute details, though our spreadsheet has more information since it includes a few private investments.

The goal is to make this as easy as possible. If you’re using a tool, make sure the reader gets access to it.

Bank Accounts

We explain the purpose and reasoning behind each account.

Someone looking at the spreadsheet and at our list of bank accounts is going to wonder why we have so many – so this section plains how it fits together.

For example, we have a total of five banks and each one plays a specific role:

- Checking account that gives us a way to deposit cash and get document signed/notarized.

- Our main online checking and savings account.

- Business checking account.

- Online high yield checking account that allows free wire transfers

- One account that acts as a firewall for other payment accounts (Cash app, Paypal, etc.)

It also explains how they are all related and any specific account information you may need to access them.

Investment Accounts

We have simplified our investment life into two brokerage accounts and this section explains the purpose of each.

The investing strategy section is more detailed than the banking, with my target asset allocation as well as how those assets are distributed within each of the accounts.

I use Vanguard as one of my custodians and I have a Rollover IRA, Roth IRA, and a taxable brokerage account. One of the tricky things about those different types of accounts is that it’s often a challenge to get your asset allocation right. It’s even harder to reverse engineer what I was doing if you start with just the accounts.

The document explains what’s what. For example, I don’t put our bonds into our Rollover IRA, which is a tax-deferred retirement account. The general rule of thumb is that you put bonds in a tax-deferred account because bonds generate income and you’d be taxed on that income if it were outside of a tax-deferred account.

Bonds have had low yields recently and so it’s actually better to have stocks in those tax deferred accounts, but that’s not why we do it. If we needed to access our funds quickly, we’d liquidate our bonds first because they’re the least volatile. If they’re in tax deferred accounts, we’d take a massive penalty. That’s the #1 reason why… how it’s more tax efficient right now, due to low yields, is simply a bonus.

OK so that whole explanation is not possible unless I write it out in a Word document.

Direct Investments

For a while I made a few direct investments, or angel investments, in companies. I don’t do that anymore but we still have a few legacy investments held in different places.

This section of the document contains all the contact information of each investment, who was the lead investor, my relationship, who to call if you have a question (in case it’s not the lead investor), as well as anything else that could provide clarity on the deal.

Some of these are deals that don’t exist outside of legal documents. You can’t log in somewhere and see them. Without this and the listing in the spreadsheet, it would be difficult for someone piecing it together to even find them because they wouldn’t know where to look.

For others, they’re managed in Carta.

Insurance

Pretty straightforward here – a list of all the different insurances we have, levels of coverage, and the company we have them with. Ours are all with one company so it’s pretty easy to explain.

If yours is slightly more complicated, try to put in as much detail as you can. For example, if you have term life insurance from several companies (it’s not uncommon to get $1,000,000 from two companies at $500,000 each), list them and their details.

Remember to Update It!

While you may update a net worth spreadsheet frequently, you might forget to update your Treasure Map simply because your situation might not change all that much from month to month. I make it a point to review it every quarter or so and this check often just takes a few minutes.

If there are updates, like new accounts or new investments, I quickly jot down notes so the manual is complete and up to date. I think that updating it on an annual basis is sufficient unless you make a lot of changes and think it’ll be hard to remember.

While having an outdated copy is better than having nothing, an updated one is best.

Do you have a Treasure Map or something similar?

How would you augment or improve mine?

Saw this post from Rob Berger’s newsletter.

Thank you!