There are two kinds of people in the world: those who use spreadsheets to track their budget and those that don’t. 🙂

I’ve been tracking our net worth for many years using an Excel spreadsheet. For years, I logged into every single account to pull my data each month. That turned out to be a good thing because it pushed me to simplify our finances because our financial network map was a complete horror show. Even today, manually pulling the data is a time suck, even if you just do this once a month.

As it turns out, the folks at Tiller Money had similar issues and solved it by building a tool to automate the process. They basically give your budgeting spreadsheets, including Google Sheets, the power of automation. It’s like magic.

Learn if it might be the tool your budget needs in our Tiller Money review.

Table of Contents

About Tiller

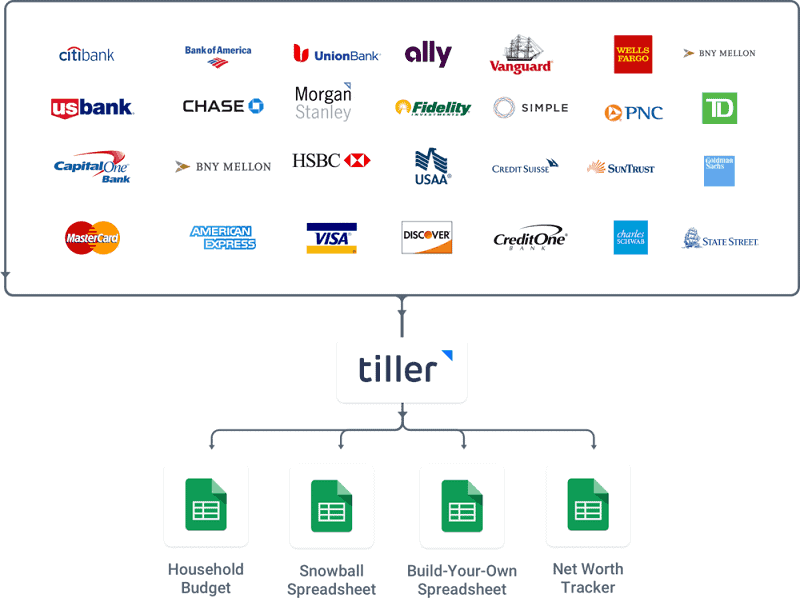

Tiller was founded by Peter Polson, who previously founded Junxion (which was acquired by Sierra Wireless) and was CEO of Dashwire (which was acquired by HTC), in Seattle, Washington in 2014. When they first started, their automation tools only worked with Google Sheets but they’ve since expanded to include Microsoft Excel as well.

The easiest way to get started is to use their Tiller Money Foundation Template. When you connect your bank accounts and link them into the template, your financial data will get pulled in. It comes with separate tabs for your Transactions, Balances, Monthly Budget, Yearly Budget, and Categories. You can customize it to whatever you want but starting from a template makes it super easy.

If you need help, they have a Tiller Money Feeds Tour in the sidebar that’ll walk you through picking things like categories, running the AutoCat, setting budget targets, and updating your sheet. After that, you can use their other templates and tools on the Tiller Community Solutions add-on for net worth tracking, debt progress, business reporting, and other little extensions of the sheet. They expand the capabilities but may be intimidating to start.

When most people think of spreadsheets, they think of rows and columns of boxes. If that’s your experience, then prepare to be blown away. Spreadsheets can do so much more than a ledger of transactions.

They are more like complex databases, with the ability to produce automatic reports and charts, and they can support all types of budgeting systems. (and if Tiller doesn’t have a template you like, you can just download a free budgeting spreadsheet and use their Feeds to make it automated)

For example, the Savings Budget spreadsheet (available through a separate Tiller Community Solutions Add-on) can do envelope budgeting based on how you categorize your spending. It can track savings goals and adjust your budgets on the fly in case you go over one area and need to shift things around. If you want to allocate every penny, it can do that too.

The biggest difference is that a spreadsheet is like a tailored suit and many of the other tools are like buying off the rack. It’s perfectly fine to buy off the rack, but it won’t fit perfectly. To get it just right, you’ll need to bring it to a tailor… which you can do with clothes, you can’t do that with software. 🙂

So expect to do a little more work setting it up, but then it’ll be perfect.

And all the mundane data collection work will be handled by Tiller!

Setting Up Tiller

After you sign up and enter in your credit card information for the 30-day trial, you are asked to connect your first bank account.

The way you connect an account will depend on the bank.

I opted to connect my Bank of America account to Tiller and for that the system will be using Yodlee. The authentication is straightforward and requires you to log into your Bank of America account and give permission to Tiller (via Yodlee).

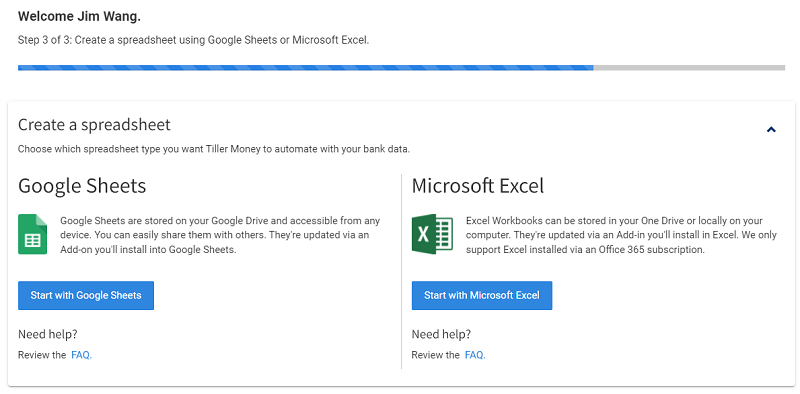

Once you do that, you’re greeted with this screen:

You can build a Google Sheet, which is stored on Google Drive, or you can use Microsoft Excel, which can be stored on your computer or your One Drive. Within Excel, you will be using an Add-in, which is like a plugin for Excel.

If you choose Google Sheets, you’re taken to the Google Template “Tiller Foundation Template” with instructions on how to set up your spreadsheet. It includes a 2-minute set up video to help facilitate the process – you can watch the video here to see what you’re getting into.

If you choose Microsoft Excel, you’ll download the Tiller-Money-Tracker.xls spreadsheet with instructions on how to get the Tiller Money Feeds Add-in (on the Get Started sheet). Once you install it, you will have to Sign in to Tiller to activate the add-in. The template spreadsheet has all the sheets you need to pull in your transactions and you can immediately begin playing with it. (it was all very intuitive, I was able to do it without reading any instructions)

Update for 2022: Tiller just announced a partnership with Microsoft where they now have full support for Excel through Tiller Money Feeds, a Foundation Template, and a Daily Account Summary Email. Microsoft has sunset their Money in Excel product and now Tiller is the solution they recommend.

Using Tiller After Set Up

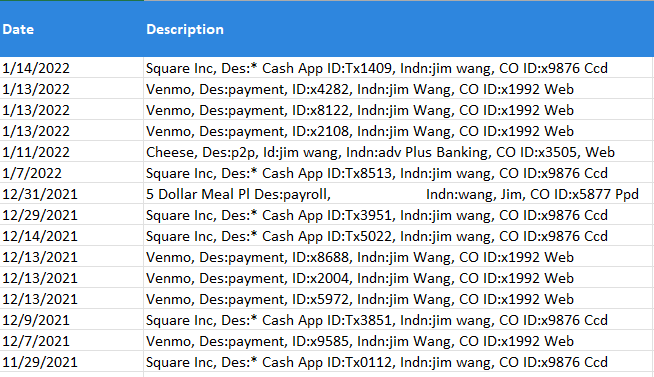

After you connect an account, Tiller can pull in all of your transactions into the Transactions tab. In the beginning, it can be a little gnarly because it’s raw data all based on what the bank gives you. My list of transactions consists of a payroll and then Venmo and Cash App transactions:

But you can categorize them (and update and change the categories in the Categories sheet) and get nicely formatted reports in the process.

From here, you can just play with the spreadsheet to tweak it to what you need.

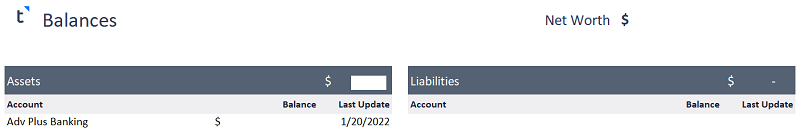

Once really useful sheet is the Balances one, for when I update our Net Worth Spreadsheet. No more logging into multiple accounts!

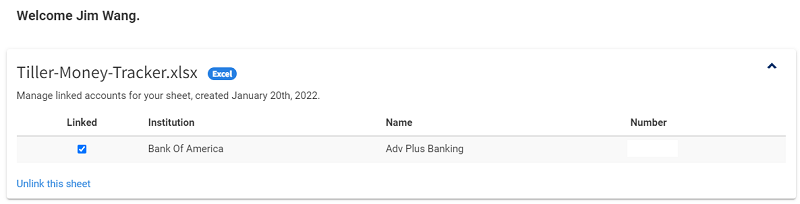

Tiller Shows You Connected Spreadsheets

One nice feature, to help you keep track of what spreadsheets are linked, is that they show you the spreadsheets when you log in. I only have the one Excel spreadsheet set up so it just lists that one:

This is great because it allows you to disconnect spreadsheets from one location, rather than having to track down each spreadsheet.

Is Tiller Safe?

Like many similar financial aggregators, Tiller uses Yodlee to securely aggregate banking information. Tiller doesn’t store any of your bank transactions locally, everything is handled through Yodlee (by data aggregation or newer Open Banking connections now available for several large U.S. banks). Then Tiller gets read-only tokens. Tiller uses those read-only tokens to pull your data – so Tiller cannot do anything in your accounts, it can only read the transactions and import them into your spreadsheets.

As you’d expect with any company of this nature, there is 256-bit AES encryption as well as Google’s built-in 2-step authentication.

In terms of internal controls, no human at Tiller ever sees your data. You log in through the third party APIs, Tiller only gets the read-only token, and the data is pulled directly into your spreadsheet. You don’t have to worry about someone within Tiller being compromised because no one within Tiller ever sees your full account numbers, balances, or transaction details.

✨Related: Best Budgeting Apps for Couples

How Does Tiller Make Money?

Subscription fees.

Not ads. Not by selling data. Not by pitching you products.

Tiller does not sell data and does not advertise to you (the classic “ad-supported” business model). A lot of companies, armed with rich transaction data, love to sell this data to third parties as a way to increase revenue. A lot of companies will look at all this financial data and use it to make commission-based offers that will help you but also their bottom line. If you are using a free tool with no premium up-sell, chances are they’re making money off the data.

Tiller has a 30-day free trial and then is $79 a year. That’s it.

Conclusion

If you are a spreadsheet junkie, then Tiller just might save you a boatload of time every month, if not every day. And it’s no surprise that spreadsheets are often considered one of the best personal finance apps out there, albeit time consuming without automation like Tiller.

If you are more of a spreadsheet novice, it can be a little overwhelming at first. The templates have a lot of features and Tiller offers quite a bit of support with their tutorials and libraries, but it will still take some time to get up to speed. If you invest that time, you’ll find it to be very rewarding.

Also one thing that’s very cool is that Tiller Money offers free live weekly webinars on their Foundation Template to help you get started and ask your questions to their support team, you can sign up here.

When it comes to money management, you really can’t get any closer to your money than with a spreadsheet.