When we bought our first house, it took quite some time to find the right house.

We purchased our first home in 2005 and documented the entire process on my previous blog, Bargaineering, and it was a stressful and scary experience.

We looked at square footage, we looked at bedrooms and bathrooms, we looked at neighborhoods and schools, and we looked at the number of parking spots and whether it had a garage. One of the things we didn’t really look at as closely was the price.

We had a budget, but we never really dug down as to why our budget was our budget. Ultimately, we were just fine. The mortgage was only slightly higher than my previous rent payment, and so, financially, we were solid. This was also during a period when banks were eager to lend you as much money as possible and required very little by way of documentation!

However, accidentally buying the right amount of house is not the way to do it. When we moved to our second home, a much larger one, we were a little smarter with deciding what our budget was. This article will walk you through our thought process and how you can borrow it to help decide how much house you can afford.

Table of Contents

How Much House Can I Afford?

If you ask the banks, they are willing to lend you as much as your income will support. They use a simple calculation known as the “Debt-to-Income Ratio” (DTI), which is your total monthly debt payments divided by your total (gross) monthly income. In other words, how much of your monthly income is going towards your debts?

The Consumer Finance Protection Bureau released rules amending Regulation Z, which is the Truth in Lending Act, that included standards for the “Ability to Repay” and “Qualified Mortgage” in response to the shenanigans of the housing crisis in the late 2000s. Banks have to make assessments of a borrower’s ability to repay and one of those determinations involves debt-to-income ratio.

The rule states that the consumer must have a total debt-to-income ratio less than or equal to 43%.

Additionally, Fannie Mae and Freddie Mac’s guidelines require a 36% debt-to-income ratio, so some banks prefer that lower percentage.

Not surprisingly, both figures are above what is recommended when it comes to how much you should spend on housing. If you subscribe to the 20-30-50 budgeting ratio, you shouldn’t spend more than 30% of your income on housing. Perhaps the 36%-43% takes into account the accumulation of equity, but I doubt it.

If you want to work your way back from the 30% number, you can use mortgage calculators to help determine what your mortgage can be given a specific monthly payment. This will only be ballpark figures because your mortgage’s interest rate will depend on your credit score. If it’s good, you’ll pay less. If it’s bad, you’ll pay more.

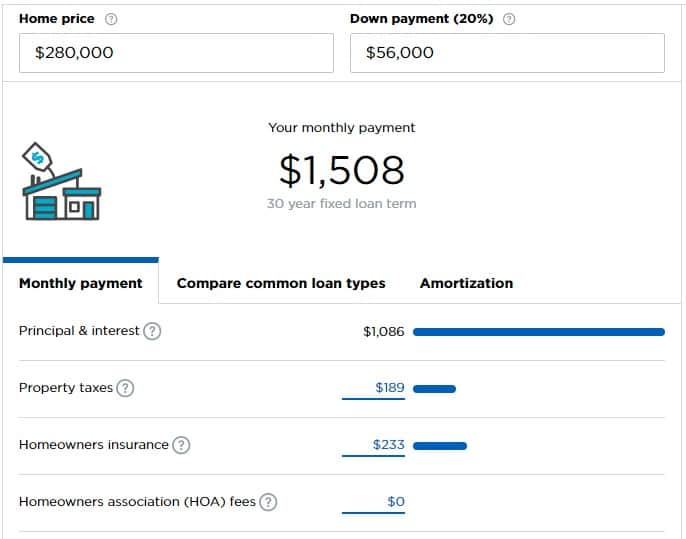

Let’s say you make $5,000 a month ($60,000 a year) and can afford to spend $1,500 a month on your mortgage (30%). According to Nerdwallet’s mortgage calculator, you can afford a home that costs $280,000 if you have $56,000 to put down as a down payment.

The calculator makes a few assumptions that you may have to adjust based on your situation.

How Much House Do I Need?

Sometimes, this is the better question but the one not asked.

How much house do you really need? Is it one bedroom for you and your partner plus one for each kid? Plus, an office? A workshop? How many kids do you want?

These are all good questions and only you know the answer.

Then you have to ask yourself, is this your “starter house,” your “forever house,” or is it just a house along the way?

Unless external factors compel you, I believe you should only ever buy one house. The transaction costs are astronomical (6% on a sale, plus all the taxes and fees). The carry costs are astronomical (property taxes alone are brutal; don’t even look at the mortgage interest or maintenance).

In an ideal world, you would rent until you buy a house, live in that house for the years you are raising children (or not, if you decide you don’t want to), then downsize in retirement.

Try “Playing House” Financially

Once you’ve decided how much house you can afford, try making the “mortgage payments” into a house fund.

Take your future mortgage payment, deduct what you pay in housing right now, and put the excess into savings.

For example, let’s say you decide you can afford a $1,500 monthly mortgage payment but you pay $1,200 in rent. Take the extra $300 and put it into a separate savings account.

Does your budget handle it without issue? Great! You aren’t over-extended.

Does your budget strain a little? Are you just aching for your annual bonus or a raise? Considering a side hustle to supplement your income? Perhaps you’re buying too much house. It’s better to know right now than to find out after you’ve moved in!

Consider Your New Expenses

If you want to take it to another level, consider all the future expenses you’ll have with the home.

Will your utilities be higher? Will you have to pay for extra services?

Try to roll all those added expenses, while deducting any expenses you won’t have in the new house, into a savings account so your budget gets a feel for life with a bigger housing payment.

What are some new expenses you might not have had as a renter?

- Maintenance and repair on appliances – You are now responsible for your: refrigerator, oven, stove, hot water heater, HVAC or furnace, and other appliances. A home warranty or service plan can help defray some of the cost but it’s still a new expense.

- More furniture for a larger square footage – If it’s bigger, you’ll need furniture to fill those areas.

- Homeowner association fees

- Homeowner’s insurance

- Other maintenance and repairs – A lawn to mow? Shrubs to maintain?

- Carpeting, painting, other cosmetic improvements

- Higher utilities – A larger space means more electricity and energy to heat and cool.

You’ll be surprised how many things cost money in a house!

If you put those funds aside, you’ll have one positive down the road: when it comes time to buy the house, the extra savings can act as your down payment.