When I was in my twenties, I had no idea how anyone under the age of forty was able to save up for a down payment on a house.

It was the early 2000s, townhomes were going for about $250,000-$300,000. I was making a great salary of $60,000 per year but I had no idea how I was ever going to save the 20% I’d need for a downpayment. I would soon find out that the housing boom was fueled by people buying homes they couldn’t afford, skirting on their down payment in favor of 2nd mortgages!

Looking back, there were some strategies that I used and others I’d share with my younger self, if I had a time machine, and that’s what I’d like to share with you today.

Table of Contents

Calculate How Much You Really Need & When

You can’t start saving unless you really know how much home you can afford and when you’ll want to buy it.

Personally, I like sticking with the key money ratio of 20-30-50– 20% towards a savings goal or debt, 30% maximum on housing, and 50% on anything else.

If you make $100,000 a year after taxes, you can spend $30,000 a year on housing. That’s is $2,500 per month.

Let’s call it $2,300 a month because we’ll need to pay for utilities and other housing-related items.

A $2,300 monthly mortgage payment at a 4% interest rate on a 30-year loan is a cool $481,761.

Let’s say you want to save $80,000 – how long would it take for you to do that? How does that fit in with your broader plans?

You need to make these types of calculations to figure out how much you need to save and in what time frame.

I sat down with New York University’s Stern School of Business Professor and Chair of the Finance Department, Dr. David Yermack, about saving for a house more quickly.

There are only three ways to save for a down payment on a house.

1. Cut your expenses so that you have more income left over for savings.

2. Get a higher paying job.

3. Buy a cheaper house, so that the down payment is smaller.

Search for Missing Money

One of the first things I tell everyone on my email newsletter is to check for missing money.

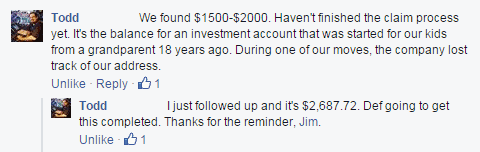

There are billions of dollars sitting in state coffers because they don’t know where to send it. Some of it might be yours.

If you’ve never checked, you may be pleasantly surprised. I’ve gotten emails from folks telling me they’ve found hundreds to thousands of dollars. Most of the time, they find nothing. That’s OK – it’s good to check because you never know!

(you will only be doing this every few years, more if you move around a lot, so this isn’t something you can do on a regular basis)

Pay Down High Interest Debt

High-interest debt, like credit card debt, can be a huge drain on your finances.

It may sound counterintuitive to pay down debt when you’re trying to save up for a downpayment but it isn’t. Let’s say you have a high-interest debt that’s charging you 15% and you are saving money into a high yield savings account getting you somewhere around 1% – that’s a brutal 14% spread.

You are trying to store water in a leaky bucket.

What you should try to do is pay down that debt as quickly as possible, potentially putting your home ownership plans on hold until you do. You can take advantage of 0% balance transfer offers so you get a little extra breathing room, but don’t do this if you plan on buying a house in the next year or so. When you open a credit card you trigger a hard inquiry on your credit report, which can ding your score a few points.

Put Savings in a Safe Place

When you have saved up some money, don’t be a fool and try to invest it somewhere volatile. If you plan on buying a home within the next five years, it needs to be put in a safe short-term investment.

Don’t get cute and try to time the stock market. Don’t invest it with your friend’s new restaurant. Don’t loan it to a real estate investor. Don’t try to get a high rate of return on it while it’s sitting around. It’s a recipe for disaster.

Just keep it somewhere safe so that it’s still there when you need it.

Sell Your Stuff

I’ve accumulated a lot of hobbies over the years and some of them I haven’t touched in quite a while. If you’re the same, why not look to sell some of your stuff? You can not only turn some of that stuff into cash but it’s also fewer things for you to move when the time comes!

You can sell all kinds of things on eBay but Craigslist works quite well for larger items not suitable for shipping.

Start a Side Hustle

The best way to boost your savings is to boost your earnings too. You’ve probably considered asking for a raise from your day job (if not, figure out how you might!) but have you considered starting a side hustle?

I started blogging to help me understand personal finance better but it eventually grew beyond being a simple journal. It soon became a nice side income that would eventually replace my full time income. The blogging income helped pay off my student loans and eventually helped me buy my first house. You never know when a small side job can turn into a much larger one.

Don’t Stop Saving

If you are in a position to save fairly quickly for a down payment, don’t stop saving just because you reached your goal. You’ll want to save a little extra buffer for all those incidentals that creep up when you own your own home. It’s very easy to put as much cash forward as you can when you buy a home and any emergencies that appear soon after a sale can be very detrimental.

If you have reached your goal, keep saving. Bolster that emergency fund and safety net you need to help weather anything that appears soon after.

Finally, learn what you need to do to make a good offer on a house. It’s not always about offering the highest dollar amount.

A thing to note is that money in regular saving account earns very little interest so to reach your savings goals faster, you can look into a high-yield savings or money market account for saving your down payment funds. Also you can check certificate of deposit which has good principal protection and its yields can be attractive when compared to savings account.