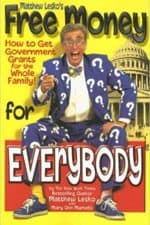

Anyone remember this guy?

He was on TV all the time back in the day. He’s quirky, he’s energetic, and I always thought that Matt Lesko was a scam. I mean how can someone be that energetic? And how can someone just get money from the government…

then I grew up…

… and realized the government is huge. And complicated.

And there are a ton of programs out there subsidizing a lot of activities.

There are many layers of “government,” and some of them make money available for certain very specific purposes so let’s look at seven examples:

Table of Contents

🔁 Updated April 2023 with updated information about Pell Grants and different state programs.

Unclaimed Money

There’s actually a website that can help you with this, the National Association of Unclaimed Property Administrators.

This isn’t “free” money though, it’s your money. It’s money you are owed but have never claimed.

It could be an unclaimed income tax refund, a tax overpayment, a forgotten safe deposit box or bank account, uncashed checks, or even certain government benefits that you applied for in the past, but never received.

You can check with your state government to see if there are any unclaimed funds waiting for you. Many states have a website dedicated to this purpose. For example, you can search for benefit money that may be owed to you in California at the state government’s Unclaimed Property Search website.

Down Payment Assistance on a Home

To encourage homeownership, many states, counties and some municipalities offer down payment assistance on the purchase of a home. These are typically available in conjunction with FHA mortgages. You are required to make a down payment equal to 3.5% of the purchase price when you apply for an FHA mortgage. But the down payment itself can come from a state agency.

You can even find out what programs are available in your state by checking the HUD website. For example, in Georgia, you may be eligible for the Georgia Dream Homeownership Program. Check your own state to see what’s available.

The loans are usually available for either first-time homebuyers or for people who have less than the median income in their county of residence. In most situations, the assistance will be in the form of a very low-interest rate loan. But some will offer debt forgiveness after a certain period of time, such as 10 years.

Help Paying Utility Bills

The US Department of Housing and Urban Development (HUD) provides the Low-income Home Energy Assistance Program (LIHEAP). It’s for low-income households who are having difficulty paying their utility bills. This is particularly true of heating bills during the winter months.

To qualify, your household income must be below 150% of the federal poverty level in your area. Programs are also available for the elderly and the disabled. The aid you won’t get generally will cover the entire utility bill, but a large percentage of it.

You can get more information either on the HUD website above, or even through the utility company itself.

SBA Business Loans

If you have a small business, or you’re looking to open one, it can be very difficult to get financing from traditional sources, like banks. The federal government offers loans to businesses through the Small Business Administration (SBA). There are various requirements, and you will have to repay the loan. But it’s a way for new and small businesses to get financing that otherwise won’t be available.

SBA loans are offered by banks and other lenders. You can check with these institutions to see if they are offered, and then submit an application. SBA loans can be as high as $5 million.

College Grants

In addition to federal student loans, the US government also offers Pell Grants. The maximum amount for the 2023-2024 school year is $7,395. They are grants by the government, and (generally) do not need to be repaid. They are available primarily to students who have not obtained a degree yet.

To be eligible for a Pell Grant, you will need to complete the Free Application for Federal Student Aid (FAFSA), and show a financial need.

Health Insurance Subsidies

Under the Affordable Care Act (ACA), low- and lower-income individuals and households are eligible for a federal tax subsidy to reduce the cost of health insurance premiums. The subsidy is actually a tax refund, and you have the option to either receive it when you file your tax return, or to have applied to your health insurance premium to reduce the cost.

You may qualify for the subsidy if your modified adjusted gross income falls between 100% and 400% of the federal poverty level. You can get information on the subsidies, and see if you qualify, by visiting Healthcare.gov.

Federal Work-Study

These programs are sponsored by the federal government and are available for postsecondary students who have a demonstrated financial need. It isn’t direct financial aid, but rather part-time jobs in community service. Your wages are paid by a combination of your employer, your school, and the federal government.

Once again, you’ll have to complete the FAFSA to be eligible.

So there you have it, seven ways to get money from the government. It’s not the kind of money that will be just handed to you. But if you have a specific need, and you qualify, you can get either direct assistance or financing to help you on your way.

Before you go, here’s a short video that VICE did profiling Lesko – there’s a lot more to him than meets the eye:

Yes, I used to love watching this guy.