2022 has not been kind to the stock market.

With inflation at highs and the Federal Reserve raising rates to those we haven’t seen in decades, you’re not alone if you’re thinking about other investment options.

One area I’ve turned to is investing in farmland. And in the last few years, there are a few companies looking to fill this need. One of those platforms is FarmTogether.

FarmTogether offers accredited and institutional investors the opportunity to invest in farmland through a variety of offerings – from crowdfunded farmland offerings, sole ownership bespoke offerings, 1031 exchange, to their Sustainable Farmland Fund.

Admittedly, farmland doesn’t exactly come up as a topic in most discussions on investing. But perhaps that’s why it’s been such a steady performer for so many years. After all, all of civilization relies on farmland – particularly US farmland – to feed itself. Food doesn’t go through cycles – it’s always needed. And that need plays well with farmland.

As you’ll see in reading through this review, farmland has proven to be a durable investment in good times and bad. An investment manager like FarmTogether can make it easy to add farmland to your existing portfolio for the broadest possible diversification.

Table of Contents

About FarmTogether

FarmTogether is based in San Francisco, California, and is a farmland investment manager that’s been specializing in farmland real estate for more than a decade. It’s run by a management team with cross-industry experience across farmland investing, agriculture, and tech demonstrated by $1.2B of collective capital deployed. The crowdfunding product enables you to buy slices of small independent farms in multiple states across the country.

They also offer a Sustainable Farmland Fund that enables you to invest in a diversified portfolio of both permanent and row cropland via a single investment. Lastly, if you prefer sole ownership of a farm, they also offer a bespoke product for that as well.

Much like investing in stocks, through the flagship crowdfunding product you’ll invest in shares of dedicated limited liability companies (LLCs) that own the land. You’ll then be eligible to receive pro rata shares of both the rents received on the land and the capital gains when the underlying farm is finally sold.

FarmTogether is not a real estate investment trust (REIT) and should not be confused as one. When you invest in a REIT, you’re purchasing a ready-made portfolio of commercial real estate. Instead, FarmTogether’s crowdfunding product operates similarly to a real estate crowdfunding platform, which enables you to select the individual properties you want to invest in.

FarmTogether projects investment returns that are very favorable when compared to other investments, including stocks and commercial real estate. The company focuses on farmland investments targeting average annual returns between 6% and 13%, as well as target average yearly cash yields ranging between 2% and 9%. What’s more, you may continue to earn these returns, no matter what’s going on with the financial markets.

There is one caveat with FarmTogether – to participate on the platform, you must be an accredited or institutional investor. That means you must have either a high income, a high net worth, or both. We’ll discuss this requirement in detail.

Is Farmland the Ultimate Alternative Investment?

Before we get any deeper into the specifics of investing with FarmTogether let’s first tackle the more basic topic of farmland as an investment. It is, after all, the whole purpose for considering an investment through FarmTogether.

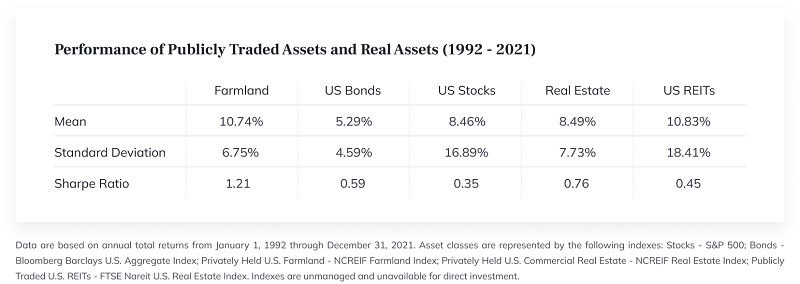

Let’s start with the long-term investment performance of farmland.

As it turns out, farmland has outperformed other asset classes over most of the past half-century. The screenshot below, published on FarmTogether, shows the performance of farmland compared to all other major asset classes between 1972 and 2021:

An investment with that kind of track record deserves investor attention.

Other Reasons Why Farmland is a Good Investment

While investment performance is something of the gold standard when it comes to investing, there are other reasons for investing in farmland, including some that are strategic in nature.

Inflation protection. As you can see from the screenshot above, farmland has easily outperformed not only stocks, but also bonds, gold, and real estate.

You can also see that the return has outpaced inflation by more than six percentage points per year. That means an investment in farmland grew dramatically in real terms, between 1972 and 2021. Farmland is negatively correlated with the Dow Jones index and positively correlated with the CPI (consumer price index).

Farmland performs when other investments don’t. According to the NCREIF Index, farmland gained 3.84% from October 1, 2019, through September 30, 2020. This was a one-year timeframe that featured extreme instability in the financial markets due to COVID-19. Yet farmland still produced a positive return.

It should also be noted that farmland has outperformed other assets over a space of time that includes several wars, inflation, disinflation, and multiple economic and financial crises. Put another way, farmland functions as a true “uncorrelated investment”.

Farmland is the source of the world’s most important commodity – food. The demand for cars, houses, TVs, industrial commodities, and even energy may ebb and flow over time. But the demand for food is relatively constant. In fact, as the global population continues to increase, future demand for food will only get bigger.

Farmland is a hard asset. When you invest in farmland, you’re investing in productive land – which is about as far away from paper assets as you can get. If you’re looking to diversify into hard assets, but you’re not comfortable with precious metals or energy, farmland is a definite alternative.

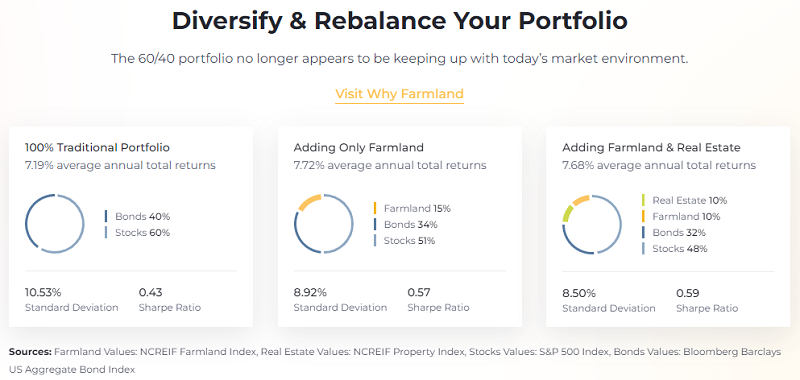

FarmTogether crunched numbers to show how adding a 15% allocation of farmland in your portfolio would have increased your investment return by nearly a half percentage point per year over the past 30 years. That half-percentage point gain can make a real difference in your portfolio over several decades.

How FarmTogether Works

FarmTogether is an online marketplace for farmland investing. Iit’s a platform where you can choose how you’d like to invest in farmland, and with their crowdfunding & bespoke product, the properties you want to invest in.

For example, if you invest $10,000 in a property with an overall value of $1 million, you’ll be entitled to 1% of the rents received on the land, as well as 1% of the capital appreciation when the farmland is sold.

FarmTogether’s team of professionals vet every available property. They focus on well-managed farms with row- and permanent-crops in prime production regions throughout the US. Factors taken into consideration include confirming water rights and quality, environmental compliance, title, soil testing and crop production. Production is centered on organics, fruits, vegetables, and nut trees, all of which are high-value crops. Farm properties are in California in the Pacific Northwest.

To invest, you’ll need to be an accredited investor (see description below).

One important distinction is that you’re not investing in farms, but rather the land the farms occupy. FarmTogether is not engaged in the business of farm management. The LLCs that you invest in own the land, which is leased out to farmers who handle the actual production. The farmer pays rent to the LLC, which is passed on to investors. Tenant farmers are typically large agricultural operators, not independent farmers.

When you purchase shares in an LLC, understand it’s a long-term investment. The expected time horizon on the investment can be anywhere from five years to 15 years. There’s very little liquidity if you want to sell your shares before the property is sold. For that reason, you should expect your investment to be tied up for at least the number of years listed in the initial investment offering.

At the end of that term, the property is expected to be sold at a profit. Once it is, you’ll also participate in the capital appreciation based on your share of ownership in the LLC.

Accredited Investor Requirement

There are certain risks inherent in any long-term investment, particularly one as illiquid as farmland. One is that you need to tie your investment up for many years. Another is the potential that the underlying farmland may be sold at a loss, rather than at a gain.

For that reason, investing in FarmTogether requires that you are an accredited investor. Accredited investor requirements are as follows:

- You must have an individual income in excess of $200,000 in each of the two most recent years or joint income with that person’s spouse in excess of $300,000 in each of those years, with a reasonable expectation of reaching the same income level in the current year, OR

- You must have individual net worth, or joint net worth with that person’s spouse, in excess of $1 million not including your primary residence.

- You must qualify as an Investment Professional, meaning you have the professional knowledge, experience, or certifications in addition to the existing tests for income or net worth.

As you can probably tell from the above requirements, accredited investor status ensures that a person investing in farmland has sufficient financial wherewithal to sustain a potential loss, without compromising their long-term financial security, or the knowledge and experience required.

Please be aware that FarmTogether does certify accredited investor status through third-party verification services, though they will accept income and net worth documentation submitted directly.

FarmTogether Features and Benefits

Minimum initial investment. $15,000 for their crowdfunding product, $100,000 for their Sustainable Farmland Fund, $1,000,000 for their Bespoke row crop offerings, or $3,000,000 for their Bespoke permanent crop offerings.

Investment term. May be as short as five years, but 7 to 12 years is more common. It may be longer on certain investments.

Frequency of net rent distributions. Depending on the specific investment, rent payments may be paid quarterly, semiannually, or annually.

Eligible investors. You can invest as an individual, an LLC, a limited partnership (LP) or a trust. Investors can be either US citizens or permanent residents, or foreign citizens.

Eligible accounts. Taxable investment accounts, but can be held in a self-directed IRA account. FarmTogether partners with Alto IRA and other IRA custodians for this purpose.

Income distributions. Income from rent payments can be made quarterly, semi-annually or annually. Distributions are direct deposited into a linked bank account.

Year-end tax reporting. With the LLC structure of individual investments, year-end results will be reported on IRS Form K-1. This will include rental income and expenses, which will be taxable for each year. Once the property is sold, any gains will be taxable under more favorable long-term capital gains tax rates.

FarmTogether Fees. The specific fee structure will vary with the product and investment offered. You can generally expect a 2% one-time admin fee, 1-2% annual management fee, and 5% net operating income fee for their permanent crop crowdfunded offerings. Their row crop offerings generally have the following fee structure: 1% one-time admin fee, 20% of the gross rent (typically 0.75%-1.0% annual management fee). Please refer to their Private Placement Memorandum for each deal for more information. Their fees differ for their Fund and Bespoke product. You can see more of their fees on their Product Overview.

Customer service. Phone contact is limited since you’ll need to schedule a call. The limited phone contact is typical in the real estate crowdfunding space.

FarmTogether Pros & Cons

Pros:

- Farmland has been one of the most reliable investments over the past 50 years, even during times of recession and financial instability.

- Farmland has shown itself to be an uncorrelated and reliable investment even when financial assets are in a downturn, making it a true alternative investment.

- Investments are fully secured by the underlying farmland, which is much more secure than the general liens on most paper investments.

- Annual returns are projected at between 6% and 13%. This includes both annual rent income and capital appreciation upon disposition of the property.

- Investments are available for both taxable accounts and self-directed IRAs.

- Investing is open to foreign residents, as well as US investors.

- Minimum investment as low as $15,000.

Cons:

- You must be an accredited investor to invest on the platform.

- Limited liquidity – farmland is a very long-term investment that will require tying up your capital for many years. There’s currently no capability to liquidate your shares.

- An investment for an IRA account must be through a specialized IRA custodian.

- Limited customer service– phone contact is available by appointment only.

FarmTogether Alternatives

The biggest alternative to FarmTogether is another investment platform AcreTrader. We compare AcreTrader vs. FarmTogether in this post.

The main difference is that AcreTrader offers investments in crops and timberland, with more frequent offerings (roughly one a week, but it’s not one a week every week, it tends to bunch together as they find good offers). They both offer fractional ownership and the investment minimums are similar.

The only major difference is that with FarmTogether you can get more customization if you have $100,000 or more to commit.

If you want to learn more about AcreTrader, our full review of AcreTrader goes into much greater detail.

Should You Invest in FarmTogether?

Investing in farmland is fairly unusual. That’s why it’s best limited to high income or high net worth individuals. It’s the whole reason why accredited investor status is required.

At best, an investment in farmland should occupy a minority percentage of your total portfolio. That’s not only because of the potential for loss in any given year, or even upon the disposition of the underlying farmland, but also because it’s a very long-term investment. You’ll be tying up your funds for many years, which will only be possible if you have other, more liquid investments.

There’s no question farmland has long-term investment benefits not offered by more traditional assets. It’s proven itself to be a steady long-term performer, and resists economic and financial dislocations better than most assets classes.

But you should be fully aware of the risks involved in investing in farmland. Though FarmTogether does everything possible to limit the risk associated with any particular property, some degree of risk is inherent with farmland.

For example, geographic risk could develop if a property is located in a part of the country that is experiencing adverse weather conditions. There may also be crop risk, where the harvest for a particular crop is poor for a year or longer. Market prices for farm commodities can also affect annual returns, and even the long-term prospects for selling the farmland.

In short, investing in farmland is a classic high reward/high risk investment that should occupy no more than a slice of your overall portfolio.

Summary

If you decide to invest in farmland, FarmTogether is one of the very best ways to do it. They make investing in farmland as easy as buying stocks for funds through a broker. And the investment is expected to provide both annual income through net rents, as well as capital appreciation upon the sale of the property.

Meanwhile, you don’t need any specific knowledge about farming, nor will you need to be involved in that process. You’ll effectively be operating as a landlord, not as a farmer, though you’ll have the benefits of a farmland investment.

You can open an account and begin investing by visiting the FarmTogether website.