Arrived

Product Name: Arrived

Product Description: Arrived is a real estate crowdfunding platform that lets you invest in single-family homes for as little as $100.

Summary

Arrived is a crowdfunded, online real estate investment marketplace that lets you purchase shares in individual residential properties for as little as $100. You don't need to be an accredited investor and the company promotes average annual returns of 10%.

Overall

Pros

- Invest in real estate with as little as $100

- Accredited investor status is not required

- Expected annualized returns can be 10% or more

- Truly passive investment

Cons

- Limited number of properties available

- No early redemptions

Arrived is a real estate crowdfunding platform that lets real estate investors invest in single-family homes without having to come up with an entire down payment — you can diversify your investments by purchasing shares in single-family residential properties for as low as $100.

Average returns are 10% or more and Arrived handles all aspects of the transaction, including property selection and acquisition, renovations, tenant and property management, and the sale.

At a Glance

- Real estate crowdfunding platform for investments in single-family properties.

- Minimum investment is between $100 and $20,000, depending on the property.

- You don't have to be an accredited investor to invest.

- Income is distributed quarterly.

- Early redemption is currently not permitted.

Who Should Use Arrived?

Arrived requires a low minimum investment of just $100, making it suitable for people who are new to real estate investing, who don't have the funds to invest thousands of dollars, or who want to diversify across multiple properties.

Plus, you don't need to be an accredited investor to use Arrived — another factor that makes it appealing to new real estate investors.

The only requirement for Arrived is that you be a U.S. citizen or resident and at least 18 years of age. It is open to individuals, specific entities, or (pending) self-directed IRA accounts (SDIRAs) that can accommodate alternative investments like direct property ownership.

Arrived Alternatives

|  | ||

| Specialization | eREIT (fund) | Secure, collateralized short-term debt | Short-term, high-yield debt |

| Minimum Investment | $10 | $10 | $1,000 |

| Accreditation required? | No | No | Yes |

| Learn More | Learn More | Learn More |

🔃Updated April 2024 with their latest offerings and platform changes. This includes the addition of a Single Family Residential Fund, which a portfolio of individual holdings, as well as other changes.

What Is Arrived?

Arrived is a real estate crowdfunding platform where you participate in investments in single-family residential properties. The company was founded in Seattle, Washington, in June 2019.

Arrived enjoys an A+ rating with the Better Business Bureau, the highest on a scale of A+ to F. While it's debatable whether a high BBB rating means anything, the fact that there haven't been a large number of complaints in the last four years is a good sign.

(Arrived was formerly known as Arrived Homes; they dropped the “Homes” in their name in January 2023.)

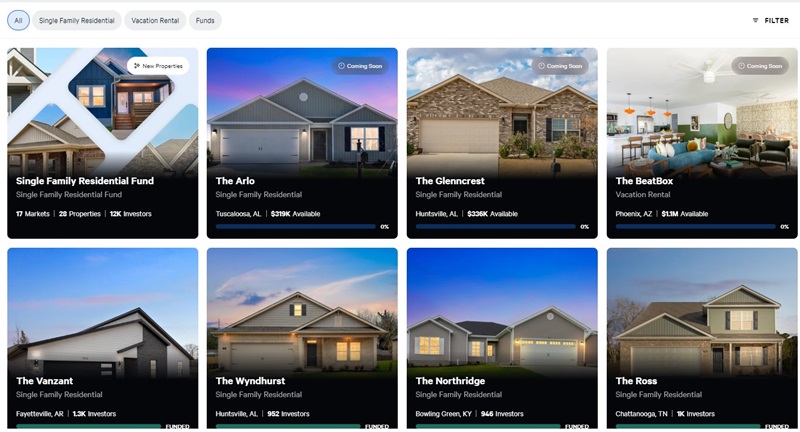

Arrived serves as a crowdfunded, online real estate investment marketplace. You can purchase shares in individual properties for as little as $100. They provide a list of current and previous properties, and you can choose from any that are currently available.

The low barrier to entry means you can diversify your investment across multiple properties — which is important when it comes to single-family homes.

Like all real estate platforms, Arrived says that they pick investment properties using a data-driven decision-making process where they collaborate with local real estate experts. They vet each property and while they can produce passive income, the objective is property value appreciation.

Properties offered for investments are primarily along the southern tier of the United States. The largest concentrations are in Georgia, Alabama, Tennessee, and the Carolinas.

As an investor, all you need to do is contribute money. Arrived handles the transaction itself — property selection and acquisition, renovations, tenant and property management, and eventually the sale.

You might notice that in the image above, and if you visit the Arrived site, the top left image is for a fund. In addition to single properties, they also offer a fund that holds multiple properties, called the Single Family Residential Fund. It holds 28 properties in 17 markets — a total of $11.1 million in assets.

With these funds, there is liquidity (you can redeem shares after 6 months) if you're willing to pay a cost (1-2% if redeemed within 5 years).

Arrived Features

The following list of key features will help you decide if Arrived is suitable for you:

- The minimum investment is between $100 and $20,000.

- Open to individuals, specific entities, or (pending) SDIRAs that can accommodate alternative investments.

- Income is distributed quarterly.

- Income is reported via IRS Form 1099-DIV.

- Early redemption is not permitted (except with the Single Family Residential Fund), but the company is working on a plan to accommodate early liquidations of shares at a future date.

- Phone and email customer support during business hours.

How Does Arrived Work?

As mentioned earlier, Arrived serves as an online real estate marketplace for investment properties.

When I signed up for the platform in 2021, they were offering their 100th property investment. It was the only one available at the time — they had already fully funded the other 99. As of 2024, Arrived boasts over 370 properties funded to date, with $152 million in assets under management.

Finding properties with a positive cash flow is challenging in today’s high-cost and high-interest real estate market. But Arrived concentrates their investment activities in areas of the country where they expect positive results.

In addition, Arrived carefully screens prospective tenants and rents their properties with two-year leases. The combination creates increased rental income stability by reducing tenant turnover.

With each property, Arrived indicates the amount of the first dividend payment, the expected payment date, and the first-year dividend yield.

Arrived Returns

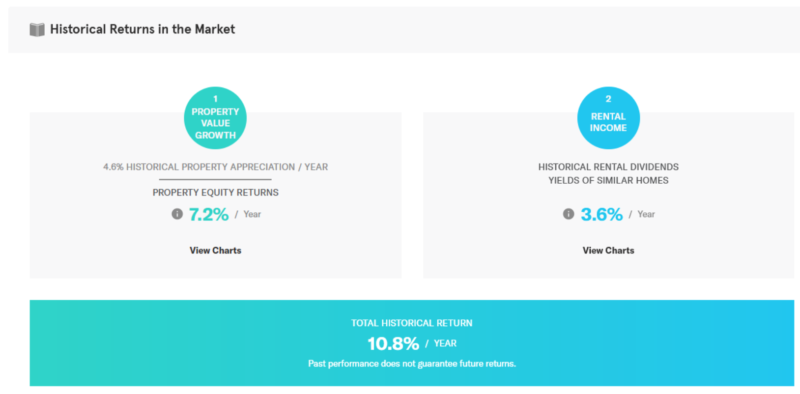

The screenshot below shows the annual dividend and historical property appreciation of one of Arrived's now-funded properties.

In this instance, with a property equity return of 7.2% and an annual dividend of 3.6%, Arrived expects this property to return 10.8% yearly if held until disposition.

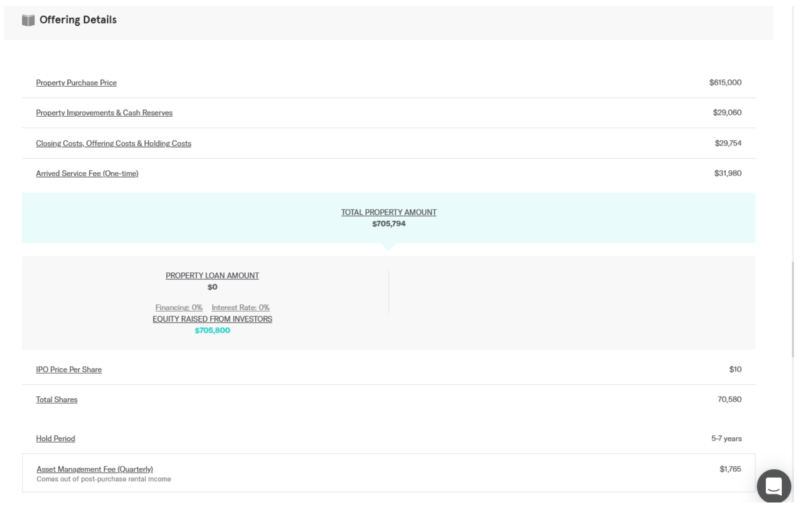

Next, Arrived provides details of the offering. That includes the property’s purchase price, improvements, cash reserves, closing costs, offering costs and holding costs, and the one-time Arrived service fee (covered below).

In the screenshot above, Arrived discloses the price per share, which is $10, and the total shares offered (70,580).

The same table indicates the expected hold period of the property, which is between five and seven years. But also notice in the middle of the screenshot, Arrived will finance the investment entirely with equity raised from investors. That means no loan on the property — therefore no debt service or interest expense.

The company also discloses other details, including the use of the proceeds raised, the series overview, risk factors, and provides the offering circular.

Arrived vs. REITs

Arrived itself is not a real estate investment trust (REIT), but each investment property is set up and taxed as one.

At least one purpose for this investment structure is to avoid the Unrelated Business Tax (UBIT) for investments held in self-directed IRA accounts.

Arrived Pricing

The Arrived online marketplace is free to use for browsing, investigating, and selecting properties you want to invest in. However, there are fees when you invest in real estate.

Arrived Sourcing Fee (one-time)

Arrived collects two fees on each investment. The first is the one-time Arrived Sourcing Fee.

According to their FAQ, the fee is based on the asset class.

- Long-term rentals: 3.5% of the property purchase price

- Vacation rentals: 5% of the property purchase price

The Arrived Sourcing Fee is the fee charged by Arrived for acquiring the property and preparing it for investment. The result is included in your per-share investment and does not represent an additional cost.

Arrived Asset Management Fee (quarterly)

The second fee is the Asset Management Fee — a quarterly fee based on the initial equity raised from investors. The fee is paid out of rental income from the property and covers the cost of managing the investment.

Long-term rentals have an AUM fee of 0.15% of the property purchase price (quarterly).

Arrived doesn't list an AUM for Vacation Rentals, but rather a Gross Rents Fee of 5% of gross revenue.

Agent Rebates

The company discloses a third fee, which investors do not pay. When Arrived purchases a property from the original seller, they collect a real estate agent fee from the seller, also known as the Agent Rebate.

Arrived Fund Fees

The Single Family Residential Fund has a slightly different structure since it's not a single property but a portfolio of properties.

First, there are all the fees that are part of the offerings themselves: “Other potential fees and expense reimbursements incurred by the Arrived Single Family Residential Fund may include but are not limited to closing costs, offering costs, property renovation costs, sourcing fees, holding costs, operating expenses, financing, legal, & property management expenses.”

These are related to the acquisition and operation of the properties in the fund.

Next, there is an asset management fee of 1%, taken as 0.25% every quarter.

There is also a redemption fee if you redeem your shares (sell them) within 5 years of investing. The fee is:

- Redeem after 5 years – 0%

- Redeem within 1 to 5 years – 1%

- Redeem within 6 months to 1 year – 2%

- Redeem within 6 months – not permitted

How to Sign Up With Arrived

Arrived is free to sign up. If you have any interest in this asset class, it makes sense to sign up so you can take a look at the investment options yourself.

To sign up with Arrived, you must be a U.S. citizen or resident and 18 years old. Unlike some real estate crowdfunding platforms, Arrived doesn’t require you to be an accredited investor to participate.

Once again, Arrived is free to sign up for browsing properties. You need to provide your full name and email address, and you can begin taking advantage of the platform.

Once you decide on a property, you’ll choose how much you want to invest. You will then review the contract terms and sign it if everything is agreeable.

You’ll need to link your bank account to Arrived to fund your investment. But the same bank account can be the destination for the quarterly dividends earned on your investment. You can link only one bank account per Arrived account.

Arrived vs. Fundrise

Fundrise is a great choice in real estate crowdfunding platforms for beginners. Like Arrived, you don’t need to be an accredited investor, however, you can begin investing with as little as $10 versus Arrived's minimum of $100.

Investors also love the diversified investment options Fundrise has to offer. For example, you can invest in their eREITs for just $10 and eventually trade up to more sophisticated investment choices.

They offer five different plans, each with its own mix of risk and reward.

Check out our full Fundrise review for all of the details.

We earn a commission from Fundrise partner links on WalletHacks.com. We are not a client of Fundrise. All opinions are my own.

Arrived vs. Groundfloor

Like Arrived and Fundrise, Groundfloor doesn't require you to be an accredited investor. It also comes with a much lower minimum investment than Arrived, of just $10.

With Groundfloor, you invest in short-term, high-yield real estate debt. This means that instead of owning equity in a property, your investment is used to fund loans for real estate developers to flip properties or for new constructions. Groundfloor's loans have terms of 12 to 18 months.

Groundfloor says its returns have historically averaged 10%.

Check out our full review of Groundfloor for more details.

👉 Learn more about Groundfloor

Arrived vs. Upright

Upright also specializes in debt investments, by offering fractional shares in residential rehab and new construction loans. (The company used to be known as Fund That Flip but re-branded in September 2023.)

There is a much higher minimum investment, requiring at least $1,000. You'll also need to be an accredited investor. However, the company does offer high annual returns, of up to 13% and promotes a very strict underwriting process, with only 6% to 8% of submitted projects approved.

With Upright, you can invest in individual mortgage debts or two funds: a pre-funding line of credit that finances every Upright loan or a managed portfolio of short-term, residential bridge mortgages.

Summary

Arrived is an excellent choice if you would like to expand your portfolio to include real estate. You don’t need to be an accredited investor — you can begin investing with as little as $100 and spread a small amount of money across multiple properties.

They've now been in business for five years and the track record remains pretty strong, with over 370 properties funded and $152 million in assets under management.

What's also impressive is they list the returns of their properties — whether they did well or have not done well. It's a list of all their properties (I assume, the list is 324 properties as of April 2024)!

The combination of net rental income (paid quarterly) and long-term capital appreciation can produce double-digit returns. That is a welcome addition to any portfolio.