If you’re looking for your USAA Federal Savings Bank routing number, you’re in luck because it’s super easy – it’s 314074269.

It doesn’t matter which state you opened your account, they’re all the same.

Your USAA Routing Number is 314074269.

Many banks have multiple routing numbers, like Bank of America and Wells Fargo, but USAA is super simple because they didn’t go through a bunch of mergers and acquisitions. That’s why some of those national banks have as many numbers as they do.

USAA Federal Savings Bank was founded in 1922 when 22 Army officers joined together to insure each other’s vehicles. They quickly expanded and today they are one of the most respected and well regarded insurers in the nation.

I personally had a run in with USAA when a covered driver hit my car and it was totaled. USAA called me up, took my story, and a short time later cut me a check for the value of my car. It was the smoothest insurance experience I’d ever had and I was the counterparty!

Table of Contents

How to Find Your USAA Routing Number

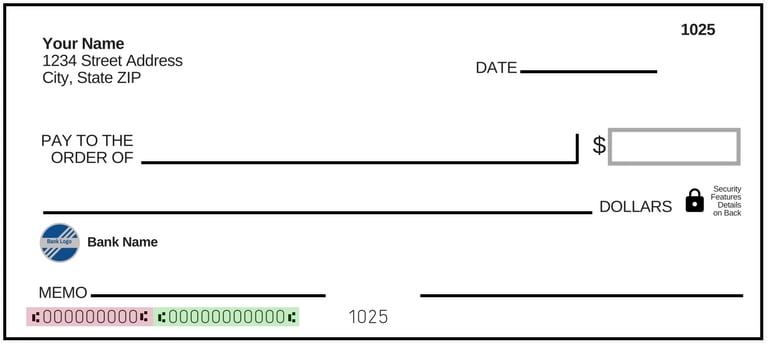

If you ever find yourself without a way to look up your USAA routing number on your phone but you do have a check, you can find the ABA routing number on the personal check. At the bottom of each check there are typically three sets of numbers:

- ABA routing number (nine digits) – highlighted in red below

- Account number (a lot of digits) – highlighted in green below

- Check number (a much smaller number, usually 3-4 digits)

The ABA routing number is always a nine digit number, the others can vary depending on the bank. The routing number and account number are flanked by those three squares since they’re machine read.

Sometimes the account number is exceptionally long with a few leading zeroes, just so there’s no ambiguity.

If you’re unsure, you can confirm the ABA routing number with the American Bankers Association ABA Routing Number lookup tool.

Different Routing Number for Wire Transfers

If you need to receive wire transfers, either domestic or international, there is a different number. The ABA routing number is just for ACH transfers.

When sending wire transfers, this is USAA’s address:

USAA Federal Savings Bank

10750 McDermott Freeway

San Antonio, TX 78288

Domestic Wire Transfers

For domestic wire transfers, you will want to use the Wire Routing Transit Number 121000248.

International Wire Transfers

International wire transfers are slightly trickier because USAA uses The Bank of New York Mellon as an intermediary when receiving international wire transfers that require a SWIFT code.

Their International wire transfer (SWIFT/BIC Code) is IRVTUS3NXXX and you will need to provide this information:

| Bank Name | The Bank of New York Mellon |

| Bank Address | 225 Liberty Street, New York, NY 10286 |

| Beneficiary bank acct. # | 8900624744 |

| Beneficiary bank account name and address | USAA Federal Savings Bank 10750 McDermott Freeway San Antonio, TX 78288 |

Then in the final credit to recipient fields, make sure to include your account number, full name, and physical address.

If it does not require a SWIFT code, you can use the Transit Routing Number 314074269 with the same address. Credit to the recipient will be your account number, full name, and physical address.

If you are unsure what you should be entering, you can always call up USAA and ask – 1 (800) 531-8722.