When I moved from Pittsburgh to Baltimore, I needed a new bank account and settled on Bank of America. With a massive geographic footprint as one of the largest banks in the nation, a branch or ATM was always around the corner.

That’s because, over the years, Bank of America has expanded their locations as a result of acquiring other banks and now boasts over 4,600 branches and an ATM network of nearly 16,000. It’s huge and ubiquitous.

It also means that it has a huge list of ABA routing numbers – which can get tricky if you need to know your number and don’t have a check handy.

So, if you’re looking for your Bank of America routing number, we can help you find it using one of three easy ways:

- Look up your routing number by state (you can do this below)

- Show you how to find your routing number on your personal checks, if you have one nearby

- Call Bank of America customer service and ask them for your routing number

💵 U.S. Bank – up to $700

Earn up to $700 when you open a new U.S. Bank Smartly® Checking account and a Standard Savings account and complete qualifying activities. Subject to certain terms and limitations. Offer valid through June 27, 2024. Member FDIC.

Offer may not be available if you live outside of the U.S. Bank footprint or are not an existing client of U.S. Bank or State Farm.

Table of Contents

Bank of America Routing Number by State

Your Bank of America ABA routing number will be based on the state in which you opened your account, not where you live now.

| Bank of America Location | Routing/Transit Number |

|---|---|

| Alabama | 051000017 |

| Alaska | 051000017 |

| Arizona | 122101706 |

| Arkansas | 082000073 |

| California | 121000358 |

| Colorado | 123103716 |

| Connecticut | 011900254 |

| Delaware | 031202084 |

| Florida, East | 063100277 |

| Florida, West | 063100277 |

| Georgia | 061000052 |

| Hawaii | 051000017 |

| Idaho | 123103716 |

| Illinois, South | 081904808 |

| Illinois, North | 071000505 |

| Illinois, Chicago Metro | 081904808 |

| Indiana | 071214579 |

| Iowa | 073000176 |

| Kansas | 101100045 |

| Kentucky | 051000017 |

| Louisiana | 051000017 |

| Maine | 011200365 |

| Maryland | 052001633 |

| Massachusetts | 011000138 |

| Michigan | 072000805 |

| Minnesota | 071214579 |

| Mississippi | 051000017 |

| Missouri East/St. Louis | 081000032 |

| Missouri West/Kansas City | 081000032 |

| Montana | 051000017 |

| Bank of America Location | Routing/Transit Number |

| Nebraska | 051000017 |

| Nevada | 122400724 |

| New Hampshire | 011400495 |

| New Jersey | 021200339 |

| New Mexico | 107000327 |

| New York | 021000322 |

| North Carolina | 053000196 |

| North Dakota | 051000017 |

| Ohio | 071214579 |

| Oklahoma | 103000017 |

| Oregon | 323070380 |

| Pennsylvania | 031202084 |

| Rhode Island | 011500010 |

| South Carolina | 053904483 |

| South Dakota | 051000017 |

| Tennessee | 064000020 |

| Texas, North | 111000025 |

| Texas, South | 113000023 |

| Texas, South | 111000025 |

| Utah | 123103716 |

| Vermont | 051000017 |

| Virginia | 051000017 |

| Washington | 125000024 |

| Washington, D.C. | 054001204 |

| West Virginia | 051000017 |

| Wisconsin | 051000017 |

| Wyoming | 051000017 |

It gets a little messy for those states in which you have to figure out where in the state you live – where’s the line for north Texas vs. south Texas? And which south Texas are you? That’s why we have backup ways to find this.

Finding the Routing Number on Your Check

This is, by far, the easiest way to find your number but it requires a personal check. If you don’t have one, you’ll have to call Bank of America.

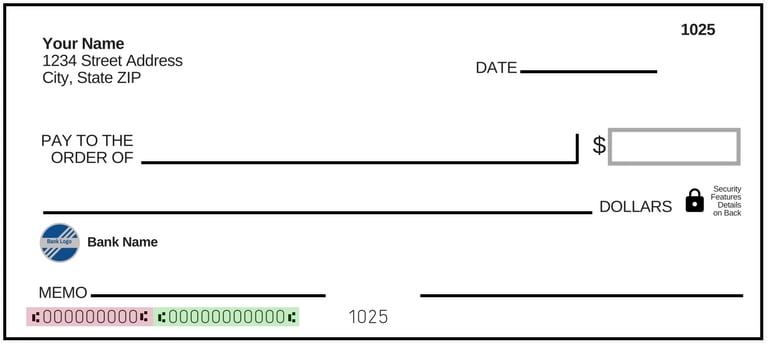

Once you have your personal check, the number is printed on it directly. Your checks contain a tremendous amount of important banking information, which is why you need to keep them secure, and here’s an example of one:

The numbers at the bottom are your account number and the bank’s ABA routing number. The nine-digit number highlighted in red is the ABA routing number. The other one, which we highlighted in green, is your account number. Sometimes the order of the numbers are switched but your ABA routing number is always a nine-digit number. If you’re unsure, you can use American Bankers Association Routing Number lookup tool to confirm or check it against the above list.

Contact Bank of America for Your Number

There are three ways you can “ask” Bank of America. You can call them at 844-375-7028, go through the verification process, and then ask.

Next, you can review their FAQ on their website and update your ZIP code to show your ABA routing number. Remember, it is the zip code where you opened your account, not where you live right now.

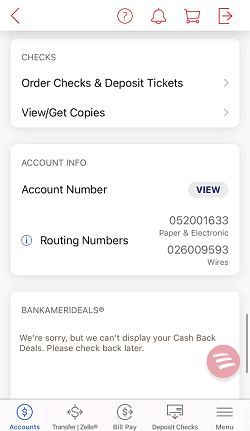

Finally, you can log into your account to find it. If you are using the website, sign in and go to the Information and Services tab. If you are using their mobile app, get to your account details and scroll down. You will see it under the Account Info section.

Different Routing Number for Wire Transfers

The ABA routing numbers are useful only for ACH transfers. If you are receiving a wire transfer, then the code will be different – fortunately, it’s a simpler system with one number for domestic wire transfers and one for international wire transfers.

Wire transfers are “better” than an ACH transfer because they’re faster by a few days – they’re also more expensive. An ACH transfer is free whereas incoming and outgoing wire transfers may cost a fee. The fee varies based on the type of account you have with Bank of America.

- Domestic wire transfer (Wire Routing Transit Number) – 26009593

- International wire transfer (SWIFT/BIC Code) in U.S. Dollars – BOFAUS3N

- International wire transfer (SWIFT/BIC Code) in Foreign Currency – BOFAUS6S

For international wire transfers, if you are unsure if it’s in U.S. Dollars or foreign currency, use BOFAUS3N.

If you’re receiving a wire transfer, here’s the other information you may need to provide:

For U.S. Dollars (or if you aren’t sure):

| Bank Name | Bank of America, NA |

| Bank Address | 222 Broadway New York, New York 10038 (regardless of where your account is located) |

| BNF/Field 4200 Beneficiary acct. # | Your complete Bank of America account number including leading zeros |

| Beneficiary account name and address | The name and address of your account as it appears on your statement |

For foreign currency:

| Bank Name | Bank of America, NA |

| Bank Address | 555 California St San Francisco, CA 94104 (regardless of where your account is located) |

| BNF/Field 4200 Beneficiary acct. # | Your complete Bank of America account number including leading zeros |

| Beneficiary account name and address | The name and address of your account as it appears on your statement |

There you have it – an easy way to find the ABA routing number (and the SWIFT code) for Bank of America!

Leave a Comment: