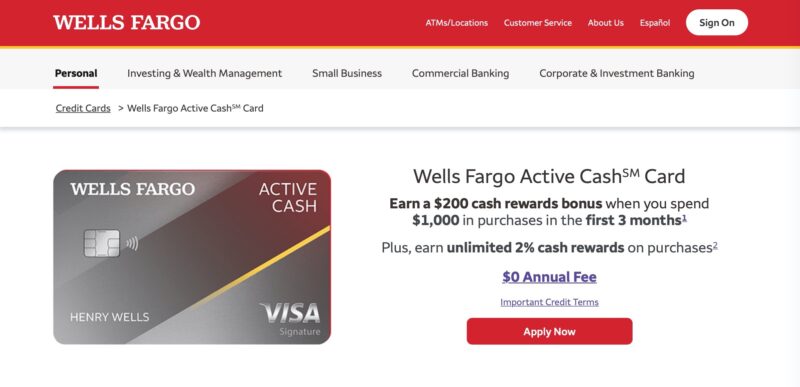

Cash back credit cards offer flexibility by giving you several ways to redeem your rewards. Most cards allow you to apply your earnings as a statement credit, purchase gift cards and other merchandise, and receive cash payments via a check or bank account deposit. The Wells Fargo Active CashSM Card is no different.

The no-fee card from America’s 3rd largest bank also features an earn rate higher than most flat-rate competitors, at 2%. But who is the card best suited for, and how does it compare to more expensive premium rewards cards?

This Wells Fargo Active Cash Card review covers the pros and cons and some Active Cash Card alternatives.

Table of Contents

- What is the Wells Fargo Active Cash Card?

- Wells Fargo Active Cash Card Fees

- Wells Fargo Active Cash Card Benefits

- $200 Signup Bonus

- Unlimited 2% Back

- No Annual Fee

- 0% Introductory APR

- Flexible Redemption Options

- Free Cell Phone Protection

- Visa Signature Benefits

- Wells Fargo Active Cash Pros and Cons

- Alternatives to Wells Fargo Active Cash

- Chase Freedom Unlimited

- Citi Double Cash

- Capital One Quicksilver Cash Rewards

- Fidelity Rewards Visa Signature

- Wells Fargo Active Cash vs. Travel Rewards

- Wells Fargo Active Cash FAQs

- Final Thoughts on the Wells Fargo Active Cash Card

What is the Wells Fargo Active Cash Card?

The Wells Fargo Active Cash Card is a flat-rate cash back credit card. Its main benefits are earning a steady 2% cash back on all purchases and a $0 annual fee.

This card doesn’t have any bonus categories as tiered rewards cards do. However, your earning potential can be higher if you’re spending habits don’t align with the bonus tiers.

You can redeem your cash rewards for online statement credits with a minimum $1 balance. The redemption minimum is higher for other redemption options like ATM withdrawals ($20) and gift cards ($25).

This card is also a Visa Signature product and has near-universal merchant acceptance. Unfortunately, it’s not international travel-friendly as overseas purchases incur a 3% foreign transaction fee. Still, this no annual fee credit card is an excellent option for most situations and domestic trips.

Wells Fargo Active Cash Card Requirements

You can improve your chances of approval by satisfying these basic guidelines:

- Are at least 18 years old

- You haven’t opened a Wells Fargo credit card in the last six months

- Have good or excellent credit (670+)

The current number of Wells Fargo credit cards you hold also influences the approval decision. The bank may adjust the credit limit on an existing account so you can qualify for the Active Cash Card.

Wells Fargo Active Cash Card Fees

The fees for this card are minimal and similar to other cash-back credit cards:

- Annual fee: $0

- Foreign transaction fee: 3%

- Late payment: Up to $40

- Purchase APR: 15.74% to 25.74% (0% for the first 15 months)

- Balance transfer APR: 15.74% to 25.74% (0% for the first 15 months)

- Balance transfer fee: 5% (3% for the first 120 days)

Wells Fargo Active Cash Card Benefits

Signup bonuses are one of the top reasons to apply for a new credit card, and you can earn bonus cash when you signup for a new Active Cash card. Here are the welcome bonus details along with some other key card benefits.

$200 Signup Bonus

Eligible new cardmembers can receive a $200 bonus cash after spending $1,000 within the first three months.

This spending bonus is similar to competing cards, but the spending requirement is higher than most. You may only need to spend $500 with other flat-rate cards.

Note that you may not qualify for the signup bonus or introductory APR offers if you have opened a Wells Fargo credit card in the last 15 months – even if you closed the account with a $0 balance.

Unlimited 2% Back

Each purchase with the Wells Fargo Active Cash Card earns 2% cash back. For every $50 in purchases, you’ll earn $1, which is the redemption minimum for cash statement credits.

This rate may not seem as high as some rewards credit cards offer 5% back, but those enhanced bonuses only apply to a handful of spending categories.

Most tiered rewards cards only earn 1% back on general purchases. If the bulk of your spending only earns the minimum reward, the Active Cash Card can earn more overall.

The 2% earning potential is also 50% higher than the industry-standard cashback rate of 1.5% for similar cards.

No Annual Fee

You won’t pay an annual fee for your primary card or authorized users. As a result, this card can be an excellent option if you’re not a big spender (whose spending can easily offset the fee) but still want to earn credit card rewards.

Not having a yearly fee also makes Active Cash an excellent way to build long-term credit. This card is a free way to build a credit history, as keeping your account open for multiple years extends the length of your credit history.

Maintaining a low balance can also optimize your credit utilization ratio.

One downside of not paying an annual fee is not having the additional benefits that many travel credit cards offer, like insurance coverage or airport lounge access.

0% Introductory APR

You may qualify for a 0% introductory APR on purchases and qualifying balance transfers. The initial balance transfer fee is only $5 or 3% (whichever is higher) during the first 120 days. After the introductory period, this one-time fee increases to 5%.

Any remaining balance after the introductory period begins accruing interest charges at your ongoing APR.

Related: Read these pointers before signing up for 0% balance transfers.

Flexible Redemption Options

You can redeem your points in several ways to offset recent purchases or cover upcoming expenses.

- Online statement credits: Offset recent purchases on your current monthly billing period in $1 increments.

- Debt payments: You can also apply your balance towards a monthly principal payment for a Wells Fargo mortgage, loan, or credit product. The redemption minimum is $1.

- Cash redemptions: Transfer your rewards to an eligible Wells Fargo banking account in $20 increments.

- Wells Fargo ATM withdrawals: Withdraw cash rewards in $25 increments at Wells Fargo ATMs via debit card.

- PayPal purchases: It’s possible to redeem your rewards when you make purchases online with PayPal. However, while convenient, you may be better off paying for the entire purchase with your credit card to maximize your rewards before redeeming it as a statement credit.

The digital statement credits are the most convenient option, though they don’t count towards your minimum monthly payment. Therefore, be sure to redeem your rewards before the billing period closes to reduce your statement balance due.

Free Cell Phone Protection

If you pay your monthly cell phone bill with the Wells Fargo Active Cash, you qualify for free cell phone protection. Each qualifying claim is eligible for up to $600 in protection (after a $25 deductible) against theft or damage.

You can file up to two claims per 12 months for up to $1,200 in annual coverage.

Visa Signature Benefits

You can also enjoy complimentary Visa Signature benefits that are standard with other Visa Signature products.

Some of these Visa-provided perks include:

- Roadside dispatch: Pay a preset fee for towing, tire changing, battery jump start, lockout service, standard winching, and fuel delivery.

- Travel and emergency assistance: If you need travel, legal, or medical assistance, you can call Visa Signature Concierge 24/7. The phone call is free, but third-party fees can apply.

- Visa Signature Luxury Hotel Collection: Discounts and complimentary on-site benefits at participating properties. Some benefits include breakfast for two, room upgrades, late checkout, and on-site amenity credits.

- Rental car insurance: Secondary collision and theft protection on qualifying car rentals when you decline the rental agency’s collision damage policy.

Like all other credit cards, unauthorized purchases qualify for zero liability protection. Report the fraudulent purchases to Visa and Wells Fargo as soon as you spot them. Unlike a debit card transaction dispute, you won’t have to pay for the purchase and wait for reimbursement.

Wells Fargo Active Cash Pros and Cons

Pros

- No annual fee

- Earn unlimited 2% back

- Low redemption minimum for online statement credits

- Free cell phone protection

Cons

- High spending requirement for the signup bonus

- Minimal additional benefits

- 3% foreign transaction fee

Alternatives to Wells Fargo Active Cash

The following cash-back credit cards share similarities with the Wells Fargo Active Cash. For one, they are all no-fee cards. That said, their rewards programs are different. I recommend that you take a close look at the competing cards to help you decide which one is best suited for you.

Chase Freedom Unlimited

You can earn up to 5% back on the following types of purchases:

- 5% back on travel purchases through Chase Ultimate Rewards

- 3% back on dining, takeout, and eligible delivery services

- 3% back on drugstore purchases

- 1.5% back on remaining purchases

You can redeem your rewards for cash statement credit, bank deposits, and award travel with no redemption minimum. Gift cards are also available but require a minimum $10 balance.

The signup bonus is Additional 1.5% cash back on everything you buy (on up to $20,000 spend in the first year) - worth up to $300 cash back . The annual fee is $0, and the foreign transaction fee is 3%.

Citi Double Cash

There are no redemption minimums when redeeming your rewards for statement credits or bank account deposits. It’s also possible to redeem them for gift cards, a check in the mail, or you can convert them into Citi ThankYou points.

Unfortunately, Double Cash doesn’t offer a signup bonus. As a tradeoff, the 0% introductory APR for purchases and balance transfers lasts 18 months.

The annual fee is $0 intro annual fee for the first year, then $95, and the foreign transaction fee is 3%.

Capital One Quicksilver Cash Rewards

The Capital One Quicksilver Cash Rewards earns unlimited 1.5% cashback on every purchase. In addition, hotel and car rental bookings through Capital One Travel earn 5% back.

There are no redemption minimums for statement credits, direct bank deposits, or paper checks.

The annual fee is $0, and there is no foreign transaction fee. Its signup bonus is $200 Cash Back after you spend $500 on purchases within 3 months from account opening.

Fidelity Rewards Visa Signature

If you don’t need to use your credit card rewards to pay your bills, the Fidelity Rewards Visa Signature can be an excellent option.

The Fidelity Credit Card earns 2x points on purchases. You can deposit your rewards into a Fidelity investment account (brokerage, retirement, 529 plan, or HSA) or cash management account.

The annual fee is $0, and the foreign transaction fee is 1%.

Wells Fargo Active Cash vs. Travel Rewards

A classic debate is whether earning cash back or travel miles is the better option. Ultimately, the best answer depends on your redemption options and the card options available for your preferred travel brand.

Travel miles can have a higher redemption value for award flights as each point can be worth more than $0.01. Each Active Cash reward is worth one cent for the various redemption options.

When Cash Back Cards Are Better

Cash back credit cards lack the ‘fun’ features of travel rewards credit cards. For example, you won’t be cashing in your points for “free” flights or hotel nights. You also won’t get special perks like elite loyalty status, free checked bags, or annual travel credits.

Despite lacking the cool factor, many cash-back cards allow you to earn more rewards per dollar spent. You also get to redeem your rewards for cash which you can use for anything from offsetting recent purchases to requesting gift cards. Typically, no-annual-fee travel credit cards have lower earning potential than a cashback card.

When Travel Credit Cards are Better

Travel credit cards are better if you plan to spend regularly on, you guessed it, travel. They often have bigger signup bonuses too. However, plan on paying an annual fee of at least $99 for the best rewards – worth the investment if the perks save you money on services you already use.

Wells Fargo Active Cash FAQs

The minimum credit limit is $5,000 – the starting amount for Visa Signature products, regardless of the bank. A potential exception to the minimum spending limit is when you’re upgrading an existing Wells Fargo credit card. Several data points indicate the bank keeps the same limit or might increase it slightly. As a result, the limit for card upgrades can be as low as $1,000.

Wells Fargo doesn’t disclose a minimum credit score requirement. However, my best research would suggest that you need a credit score of at least 670 to be eligible. Other decision factors include your income, expenses, current credit card portfolio, and history of recent credit applications.

The foreign transaction fee is 3% on all purchases outside the United States. Consider using a travel credit card for foreign purchases, as most cash back cards charge a fee between 1% and 3%.

Final Thoughts on the Wells Fargo Active Cash Card

The Wells Fargo Active Cash Card offers one of the highest rewards rates at 2% back on every purchase, with no annual fee. And with a payout threshold as low as $1, they make it easy to redeem your rewards.

In my opinion, it’s a solid choice for anyone who wants generous rewards without worrying about targeting their spending to specific categories, like gasoline or groceries. Existing Wells Fargo customers can utilize all reward redemptions options by applying their points towards their mortgage and loan balances.

If you want to maximize your earnings, including travel perks, you may want to consider a more premium rewards card, keeping in mind that you will have to pay an annual fee.