Despite how much has been written about credit scores, there are always posts about little hacks or tips or tricks you can do to give yourself a little boost. I know because I’ve read them all and most of them are junk.

When it comes to your score, the key idea is that you have to show responsible use over a long period of time. There’s no trick – just make regular on-time payments and you’re good.

Ok but are there any hacks that can help?

Sure, kind of – have you heard of the 15/3 Credit Card Payment “Hack?”

It sounds silly at first but once I explain why it works, it’ll make sense.

Table of Contents

What is the 15/3 Credit Card Payment Hack?

It’s just a fancy name for making three payments to your credit card each month.

The first is made 15 days before the date your statement closes.

The second is made 3 days before the date your statement closes.

Hence, 15/3.

(the third payment is after the statement closes)

In many cases, you have to do this manually. There won’t be a way to schedule mid-month payments, plus since you aren’t charging the same amount each time, you’ll want to set the amount.

What does this accomplish?

It reduces your credit utilization, which is a factor in your credit score.

Credit utilization is the sum of all of our outstanding balances divided by all of your credit limits. It’s meant to measure how much of your total credit limit is being used at any one time. A higher utilization means you’re using more of your credit, which is seen as a risk.

Credit utilization is calculated using your balances, which are reported when your statement closes.

When you make payments before your statement closes, a smaller number is reported because you’ve paid off the debt. Credit card companies don’t report the total amount charged to the card, they simply report what you owe them when the statement closes.

Making extra payments lowers your utilization.

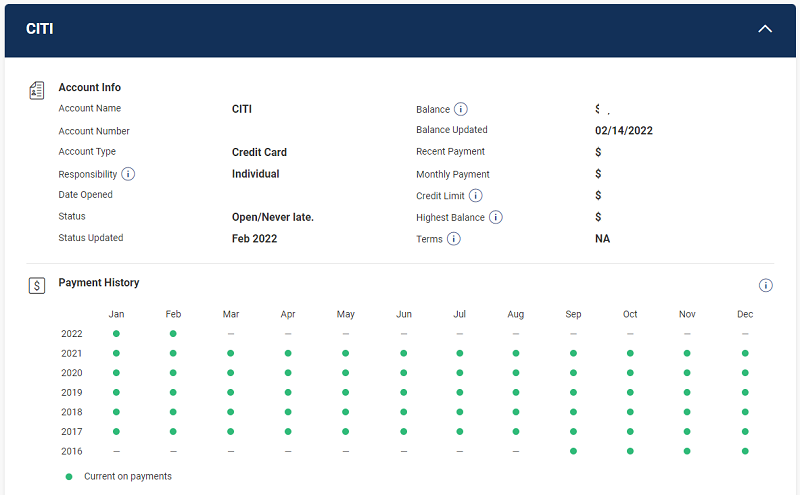

When someone reviews my report, they will see regular, on-time payment of my revolving credit card debt. That’s good.

It won’t, however, show multiple payments each month. It just shows that I’m on-time and current on the account. This won’t speed up your history of on-time payments or anything like that.

If you look at your credit report, you can see that it simply lists the months and whether you’re on-time:

How 15/3 works in practice

It’s simple – let’s say I charge $1,000 a month on my credit card. After about 15 days, my credit card balance might be around $500. I log into my account online and schedule a payment for $500.

Then, in about 12-ish days, I log in and pay off the rest of my balance.

In the three days between the 2nd payment and the statement close, I might charge a little bit on the card. That’s the amount that gets reported.

Then I make a third payment, paying off my statement in full so I don’t get charged any interest.

That’s it!

Should you be doing this?

I think keeping a lower utilization might have short term benefits in improving your score but nothing significant in the long run. A lower utilization is better but are a lot of other factors involved.

If you check your score and see that you are on the border between an average and a good score, you may wish to lower utilization to give your score a minor bump. This is important if you are going to need a loan soon, because this bump can save you money.

If you don’t need a loan and/or your score is already pretty good, this is a bit of unnecessary work. Making multiple 15/3 payments for a year won’t improve your score more than on-time regular payments would. It won’t hurt to make these extra payments but it takes time – time you could use on other tasks. (consider these spring cleaning tasks!)

Finally, I don’t see why paying 15 days out and then again 3 days out would make a difference. It might be useful if you’re paid bi-weekly and this helps you budget better, but the 15 day payment is redundant.

If you make a larger payment 3 days out, it serves the same purpose because it’ll lower your statement balance, which is the amount reported to the bureaus.