If you’ve been looking for a low-cost way to transfer funds to family, friends, and businesses in countries around the world, Wise (formerly TransferWise) provides a low-cost way to move money easily and instantly.

Unlike some international transfer services, Wise uses real currency values, not inflated ones that increase the real cost of sending money. The recipients need to have a bank account, and you’ll have the option to send funds through your bank account, debit card, or credit card. The service is available on mobile apps, so you can send money and monitor your activity on the go.

Table of Contents

About Wise

Founded in 2011, and based in New York City, Wise (formerly TransferWise) is a money transfer system specializing in international money transfers. More than 8 million people and businesses use the system to send money and can do it using real exchange rates. They charge the lowest fees possible and maintain complete transparency. That means no inflated exchange rates and no hidden fees.

The company has 14 offices around the globe, 2,200 employees, and claims they move more than $5 billion every month, saving users $3 million in hidden fees each and every day.

You can receive money with international bank details and track your transactions on your smartphone. The app also comes with a debit MasterCard giving you immediate use of the funds in your account or transferred. Using the service, you can hold and transfer more than 50 currencies and convert them anytime you like.

Wise has a Better Business Bureau rating of “B“, which ranks organizations on a scale of A+ to F. The company also has a rating of 4.2 out of five stars from more than 88,000 Android users on Google Play, and or 4.7 stars out of five from over 20,000 iOS users on The App Store.

In early 2021, Wise went through a rebranding in which they went from their old name, TransferWise, to their new name, simply Wise. They started as a way to transfer money internationally but they’ve expanded to be much more. As a result, they dropped the “transfer” in their name to reflect their broader offering.

How Does Wise Work?

Wise can be used from both the website and its mobile app. When you open your account, you’ll be able to hold more than 50 currencies in your account and arrange transfers with recipients in more than 70 countries.

You’ll be able to get bank details enabling you to receive Australian dollars (AUD), euros (EUR), British Pounds (GBP), New Zealand dollars (NZD), Polish Zloty (PLN), and US dollars (USD). It’s also set up for direct debits in British pounds for euros.

Sending Money

You can send money from an individual or joint bank account. If you have Wise for Business, you can send funds from a bank account in the name of your business. Money can be sent to most participating countries, but in some countries, transfers must be completed using the local currency. These are typically the less popular currencies.

You can generally both send and receive money using a connected bank account, or a credit or debit card. You can also use the SWIFT system, which is one of the largest international transfer systems in the world.

Receiving Money

To receive money in your account, you just need to give the bank the details of the currency you want to be paid in, as well as the name of the person who wants to pay you. However, you can only receive money directly into your account in Australian dollars, British pounds, euros, Hungarian forints, New Zealand dollars, Polish zloty, Singapore dollars, and US dollars. (Romanian leu are available only for residents of the United Kingdom and Romania.)

US residents are limited to receipt of no more than $250,000 per transaction, per day, and no more than $1 million per year. Business account users are limited to $3 million per transaction per day and $5 million per year. However, there are no limits to the amount of non-US currency you can receive in your accounts.

The Wise Debit Card

The Wise Debit MasterCard is available when you open your account. It’s currently available in Europe, the US, Australia, New Zealand, and Singapore. You can spend using the debit card in any currency, and all with low fees.

Wise for Business

The service also has a business account available. It’s a free, online multi-currency account that lets you make payments, get paid, and spend money internationally at the real exchange rate. It can be used to pay invoices, buy inventory, and handle payroll in more than 70 countries. The company claims it’s 14 times cheaper to use than using PayPal.

Wise has an open API that lets you connect your account with your business tools, enabling you to automate payments and workflows. For example, the service works with Xero and various accounting software tools.

Wise Features & Benefits

Platform availability: The Wise website and mobile app.

Number of countries where you can transfer funds: 70+.

Available currencies: 50+, including the Australian dollar, Brazilian real, Canadian dollar, Swiss franc, euros, Indian rupee, Japanese yen, and US dollar. However, with a large number of currencies, you can send but not receive funds. Examples include Chinese yuan, Israeli shekels, South Korean won, Mexican peso, Russian ruble, and many others.

Funding options: Bank account, credit cards, and debit cards.

Maximum transfers: $15,000 on your first transfer, then $20,000 on subsequent transfers. However, you can transfer up to $1 million per transfer when you use a bank wire for funding.

Security: Wise does not have any type of government-sponsored insurance, such as FDIC. However, since Wise is not a bank it does not hold your money, it’s more of a clearinghouse. They only have your money for the short amount of time it takes to make the transfer, not for months or years like a bank. They claim your funds are 100% safe.

Wise is required by law to keep all your money accounts that are completely separate from those they use to run their business. That means even if Wise were to go out of business, your money would still be safe. Funds are held in major financial institutions, like Barclays and J.P. Morgan Chase. In the US, Wise is regulated by the Financial Crimes Enforcement Network (FinCEN), an agency of the US government.

Customer service: Available by phone, Monday through Friday, from 8:00 AM to 8:00 PM, Eastern time.

Mobile app: Available on Google Play for Android devices 5.0 and up, and on The App Store for iOS users for iOS devices 11.0 and later. It’s compatible with iPhone, iPad, and iPod touch.

Wise Pricing and Fees

Wise has a separate fee schedule for sending money, using the Wise debit card, fees for the multicurrency account, and for using Wise for Business.

Fees for Sending Money

Wise uses what’s referred to as the mid-market rates when converting one currency to another. This is the rate banks use when sending funds between one another.

How much you’ll pay for a transfer depends on a combination of the exchange rate on the particular day of transfer, plus a transaction fee. The amount of each will depend on how much money you are sending, and how you pay (credit card, debit card, bank ACH, or wire transfer).

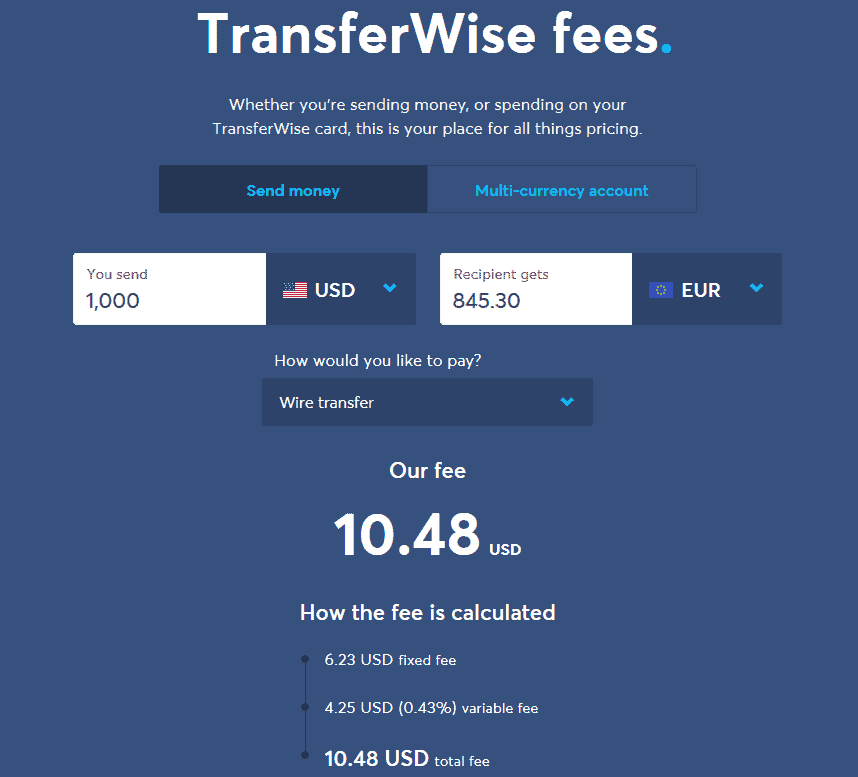

The screenshot below shows the cost of sending $1,000 to a recipient who will receive those funds in euros using a wire transfer:

To send money, I worked an example of US$1,000 sent to a recipient who will receive the funds in euros. However, both the exchange rate and the transaction fee vary with each of the four funding methods – credit card, debit card, bank ACH and wire transfer.

To help us calculate the total cost, we take into account two numbers:

- Conversion rate – what the platform uses as the conversion rate, which is typically worse than the real conversion rate.

- Transaction fee – what the platform charges for the transfer, which is often a small percentage or a flat fee.

The breakdown is as follows (at the time of this writing, the real conversion rate was US$1,000 to 854.20 euros):

| Credit card | Debit card | Bank ACH | Wire transfer | |

|---|---|---|---|---|

| Conversion rate | US$1,000 to 817.99 euros | US$1,000 to 840 euros | US$1,000 to 847.21 euros | US$1,000 to 845.30 euros |

| Conversion spread vs. real rate (of 854.20) | 36.21 euros ($42.39 USD) | 14.20 euros ($16.62 USD) | 6.99 euros ($8.18 USD) | 8.90 euros ($10.42 USD) |

| Transaction fee | $42.45 | $16.68 | $8.24 | $10.48 |

| Total cost in US dollars (%) | $84.84 (8.48%) | $33.30 (3.33%) | $16.42 (1.64%) | $20.90 (2.09%) |

As you can see from the table above, you’ll pay about 1% for the conversion fee and 1% for the transaction fee for a wire transfer, and a little bit less if you use a bank ACH. However, the combined exchange rate and transaction fee for a debit card transfer is more than 3%, and nearly 9% for a credit card.

The fees are proportionately lower on larger amounts transferred, especially when using a wire transfer. For example, the fee for sending $1,000 is $20.90 while the fee for sending $10,000 is $49.02. You can send 10 times more money for only 2.5 times the cost.

Fees for Using the Wise Debit Card

If you have currency in your account, the debit card is free. But if you don’t, there’ll be a conversion fee for use of the card ranging between 0.24% and 3.69%. However, if you are making an online purchase, the seller may charge their own conversion fee. You may be able to minimize or avoid that fee by asking the seller to charge you in the currency of your choice.

Wise allows you to withdraw up to $350 from your account with no fee. But once you exceed that limit, there’s a 2% withdrawal fee. A conversion fee will be charged if the funds are not in your account, but that can be avoided if you withdraw funds in the local currency where the ATM is located.

Fees for the Multi-currency Account

There are no fees to open a multi-currency account, even with more than 50 currencies in the account. There is also no monthly or annual account fee, and no fees to send or receive money, or add funds to the account.

However, there are transfer fees if you convert between the currencies within your account, or if you send or withdraw money to or from a bank account outside Wise .

Use of the Wise Debit MasterCard with the account is free if you have funds in your account, otherwise, you’ll be charged a conversion fee.

Fees for Wise for Business

You can open a Wise for Business account free of charge, though there is a small one-time setup fee to get your own international bank details. There’s also a small fee to convert between currencies, either in your account or if you spend using the debit card in a currency you don’t have in your account.

If you convert money within your account it’s always based on the real exchange rate, plus any transaction fees charged by Wise.

How to Open an Account with Wise

You can sign up for a Wise account free of charge. Sign up can be completed either online or on the mobile app. The only information you need to supply is your email address or a Google or Facebook account.

Wise Pros & Cons

Pros:

- Transfer money to recipients in more than 70 countries using more than 50 currencies.

- Wise uses mid-market exchange rate pricing, comparable to what banks use in transactions between one another. This is substantially lower than what many international transfer services use.

- Transfers made by bank wire or ACH are about 2% or less, which is about half the cost of an international transfer using PayPal.

- Your account comes with a debit MasterCard which will be accepted anywhere MasterCard is welcomed.

- Wise is also available for business use.

Cons:

- Fees for debit and credit card transfers can range between 3% and 9%.

- Customer service is limited to regular business days, for 12 hours per day. This can be a limitation with international transactions where the recipient is in a distant time zone.

Should You Use Wise?

If you have family and friends in other countries where you regularly send funds, a Wise account will be a valuable service to have. If you use a bank wire transfer or ACH to make the transfer, the total cost will be less than 2%, which is about half what it will cost using PayPal or other international transfer services.

Wise can also be an excellent choice for businesses that do a significant amount of international business, particularly involving financial transfers. The fees are lower than they are with other transfer systems.

The major downside with Wise is that fees are higher with debit and credit cards, and especially credit cards where fees can be as high as 9%. But you can avoid that extra cost by using bank wire and ACH transfers.

If you’ve been looking for a lower-cost way to send and receive money internationally, you need to consider Wise.