TradeStation

Strengths

- In-depth charting and trading tools for active traders

- Supports several investment types

- Paper trading account

- Desktop, web, and mobile platforms

- Free stock and ETF trades

Weaknesses

- Potential inactivity fees

- Trading fees apply to high-volume trades

- Hard-to-use layout for long-term investing and fundamental research

- Doesn’t offer 24/7 live customer support

Few online brokerages cater to technical traders and active investors by providing extensive research and charting tools and making it easy to submit in-depth trading tickers.

TradeStation, however, may be an exception. TradeStation offers multiple trading platforms and enables investors to research and trade stocks, exchange-traded funds (ETFs), options, futures, and crypto. You can also access real-time data and customizable charts and utilize its trading simulator. All of this makes TradeStation a one-stop shop for self-directed investors.

Our TradeStation review examines the broker’s best trading tools, platform options, and trading fees.

Table of Contents

What Is TradeStation?

TradeStation is an online brokerage geared toward short-term traders and active investors who need extensive data inputs, charting features, and advanced order tickets. It offers quick order execution speeds with desktop, web, and mobile trading platforms.

The company’s roots can be traced back as far as 1982 when it was founded under the name Omega Research, Inc. The online investing platform launched in 2001, and the company was acquired by Monex Group, of Japan, in 2011.

Whether you stick to trading stocks and ETFs or invest in options, futures, and crypto, TradeStation puts the tools you need at your fingertips.

You can open individual or joint taxable accounts, a variety of retirement accounts, such as a Traditional IRA, Roth IRA, or SEP IRA, as well as a range of non-personal accounts, i.e., corporate, LLC, partnerships, trusts, etc.

Who Should Use TradeStation?

Let’s start with who shouldn’t use TradeStation. Beginner and buy-and-hold investors who want to place basic buy orders may find the TradeStation user experience overly complex. For example, you cannot buy fractional shares of high-dollar stocks and must maintain a $5,000 minimum balance or place 10 trades within a 90-day period to avoid a $25 account inactivity fee.

If that’s you, there are more user-friendly platforms out there (check out our list of the best discount brokers for other options.)

TradeStation is best suited for active traders, who will appreciate and make use of TradeStation’s day, swing, options, and futures trading strategies.

Best TradeStation Features

Here’s a closer look at some of the features that make TradeStation a top pick amongst active traders.

Customizable Platforms

You can access your trading accounts from a desktop or mobile device via several free platforms. You can also customize the layout and make customized trading programs that help you quickly track your stock positions, grasp current market conditions, and compare investment ideas.

Furthermore, TradeStation’s API allows you to build customizable data feeds with programming languages like C++, Python, and Ruby. It’s possible to integrate third-party services into the platform, too.

Charting Tools

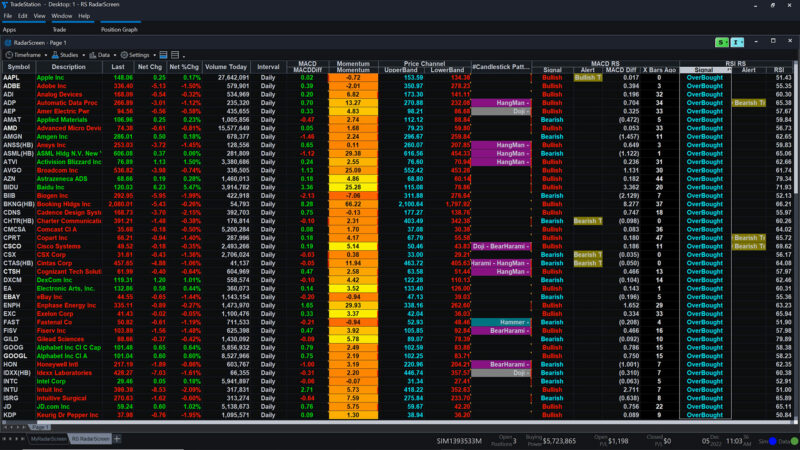

TradeStation provides some of the best stock charting tools for the purpose of technical analysis. The software comes standard with 10 chart types and 150 technical indicators. You can also create or download custom indicators.

You can create single or multiple charts using the charting window feature to display the expandable chart bordering other data boxes.

Paper Trading

Not many brokerages offer paper trading, which can be a valuable learning tool for beginners and experts. It allows you to make unlimited trades and try out any strategy available on the platform without using real money.

Some of the trading simulator functions include:

- Advanced orders

- Alternate market types

- Backtesting stocks, options, and futures

- Indicator tests (Trend, momentum, mean reversion, and relative strength)

- Strategy automation

Related Post: How to Read Stock Charts

Trading and Research Tools

When trading, you can search for investments using the stock ticker or add customized filters to make placing a trade easier.

The trading dashboard emphasizes your current portfolio value, trade order tickers, and charts. The information provided is sufficient for most traders who rely primarily on stock charts instead of fundamental data and third-party research, which can take several months or years.

TradeStation allows you to view news headlines and analyst ratings provided by Benzinga.

Education

Multiple educational articles and shot guides cover the basics of available investment offerings and how to use the platform. Admittedly, most of the content is for traders who already have a good sense of how the stock market works.

Investment Options

You can trade the following assets with TradeStation:

- Individual stocks

- Penny stocks and OTC stocks

- ETFs

- Options

- Futures contracts

- Crypto

You can place market orders to buy or sell at the current price for the above products. It’s possible to place advanced orders, such as limit orders, to minimize downside risk.

TradeStation supports mutual fund trading but charges an expensive transaction fee for all products. Other discount brokers have a similar practice to encourage investing in ETFs instead of mutual funds. ETFs are generally more cost-efficient and trade frequently.

Learn More: Best Short-Term Investments

Trading Platforms

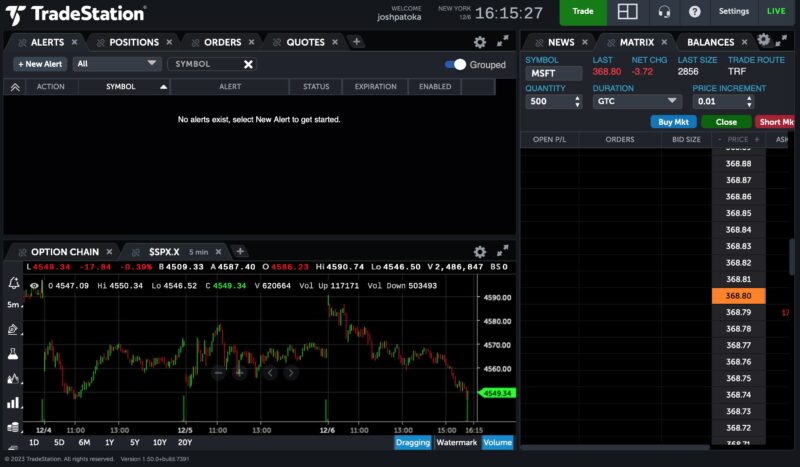

As mentioned, you can access TradeStation’s trading platforms from your mobile device or desktop computer. All platforms work well, although the downloadable desktop trading platform is the most powerful.

When tapping the login button, you will receive a prompt asking which platform you wish to log into. Your login credentials are the same for each, but the specialized platforms can perform different functions.

Desktop Trading

The TradeStation desktop platform is compatible with Windows 10 32-bit and 64-bit operating systems. Mac OS devices must download a Windows emulator first to use this free desktop trading software.

This downloadable platform offers advanced capability and makes sense for frequent traders and people using multiple screens.

Some of the features include:

- Scan over 1,000 stocks in real-time

- Program customized trading strategies

- Matrix and options chains tools

- Advanced options trading analysis tools

Web Trading

The TradeStation web trading platform is compatible with any online browser and doesn’t require special downloads. There are many tools to analyze stocks, ETFs, options, and futures with highly detailed information.

You can customize your dashboard to view features, such as:

- Open positions

- Order book

- Options chains

- Charts

- News

- Alerts

Short-term traders will find the platform comparable to many desktop apps. The personalization factor also makes it easy to use once you master the layout.

Mobile Trading App

Android and iOS users can analyze chains, customize charts, and place trades from the TradeStation mobile app.

You can also view analyst ratings, hotlists, and news releases to research potential investments. It lets you switch between paper trading and live trading with ease. Finally, the app uses touch or facial ID plus two-factor authentication (2FA) to prevent unauthorized logins.

FuturesPlus

Serious futures and future options traders may want to enable the FuturesPlus feature in their accounts. This allows you to access a complimentary standalone options trading platform and mobile app.

You don’t need to use this service to access futures trading, which is also accessible through the standard desktop, web, and mobile platforms. But it’s worth a try if you have a dedicated futures trading account.

The Vol Curve Manager and Trade Monitor tools complete analysis with first and second-order Greeks. There are pre-built templates for vertical spreads and butterflies too.

Tradestation Crypto

While it’s separate from your stock trading portfolio, you can initiate cryptocurrency trading through TradeStation’s TSCrypto platform. It can be more convenient than using a standalone crypto exchange as you can quickly switch between your investment accounts without leaving TradeStation.

TradeStation’s crypto analysis tools are similar to the advanced-level crypto sites for volume traders. You can view the advanced charts, order books, and recent trading logs.

Most of the trading opportunities are for Bitcoin (BTC), Ethereum (ETH), and the USDC stablecoin. Other altcoins can also be available for trading, albeit with less liquidity.

Simulated Trading

TradeStation’s standalone trading simulator helps you avoid confusing a mock account with your real money account. You have access to the same data as the trading side and have unlimited dollars to test out strategies. Advanced trading tools exist for experienced traders, although beginners can benefit significantly from this platform.

TradeStation New Account Promotion – up to $3,500 Cash

If you’re new to TradeStation, you may be excited to know they offer a new account promotion where they will give you a cash reward based on how much you deposit. This can be in the form of cash or assets that you transfer into the account with 45 days of account enrollment. You must then keep your assets there for at least 270 days to get the bonus.

This is the bonus schedule:

| Qualifying Assets | Cash Reward |

|---|---|

| $5,000 | $150 |

| $25,000 | $300 |

| $100,000 | $400 |

| $200,000 | $1,000 |

| $500,000 | $2,000 |

| $1,000,000 | $3,500 |

TradeStation Fees

Before signing up with TradeStation, make sure you’re aware of the following trading fees and other service charges.

Trading Fees

Commission-free trading is available on select securities:

- Stocks and ETFs: $0 on the first 10,000 shares per trade on stocks and funds trading with a minimum $1.00 share price and then $0.005 per excess share.

- Stock Options: $0 plus $0.60 per contract

- Futures: $0 plus $1.50 per side

- Micro Futures: $0 plus $0.50 per side

- Future Options: $0 plus $1.50 per side

- Crypto: $0 (although the spread is no more than 1% of the midpoint)

While it’s possible to avoid commission fees on most stock and ETF trades, casual investors may consider free stock trading apps to avoid charges completely.

Related Post: Best Stockbrokers Offering Free Trades

Margin Rates

TradeStation’s margin interest rate depends on your account balance:

- 13.5% for balances below $50,000

- 12.5% for balances between $50,000 and $499,999

- Negotiated (as low as 6%) for balances above $500,000

Inactivity Fee

There are no account minimums to open a brokerage or retirement account. It’s a perfect opportunity to test drive the platform’s research tools, simulators, and trade tickets. However, a $10 quarterly inactivity fee can apply once you start investing.

You can achieve the $10 inactivity fee minimum activity fee waiver by completing one of the following:

- Maintain a minimum $5,000 average end-of-month equity balance

- Place 10 trades within the last 90 days

The inactivity fee applies to equity and futures accounts.

IRA Administration Fees

Unfortunately, you will pay an annual administration fee for a TradeStation IRA. The fee amount depends on which assets you hold:

- Equities: $35

- Crypto: $100

- Futures: Varies

These accounts are also subject to a $50 account termination fee if you transfer out your assets. If you find yourself in that situation, you may want to consider an IRA rollover promotion to offset the expense.

Data Fees

Basic data packages are available for free to retail traders, but you can purchase add-on packages for a nominal monthly fee to get real-time data for a specific market index.

Here are some of the market data price examples:

- S&P indices: $5.50 per month

- Russell indices: $6.00

- Dow Jones indices: $4.00

- Nasdaq Levels 1, 2, and TotalView package: $17.00

- OTC markets: $6.00 to $16.00

- European region data package: $10.00

- COMEX Commodity Exchange: $2.00 (delayed) or $131.00 (real-time)

These prices are competitive with other apps and allow you to research and trade on TradeStation.

Service Fees

The following miscellaneous service fees also apply:

- Receiving wires: $0

- Sending wires: $25 (equities) or $35 (international)

- Outgoing account transfer: $125

- Options exercise or assignment: $14.95

- Option liquidation: $75

- Early assignment or early exercises: $1.50 per contract ($5.95 minimum)

- Broker-assisted trade: $25

- Mutual funds trade: $14.95 per transaction

TradeStation Alternatives

TradeStation has a lot to offer, but it’s always good to shop around. Before you open a TradeStation account, you may want to compare it with the following alternatives.

Fidelity

Fidelity offers platforms for investors of any experience level and trading strategy. It’s possible to buy fractional shares through the mobile app and make commission-free trades without worrying about inactivity fees or minimum balance requirements.

You may qualify for Fidelity Investments promotions to earn bonus cash by opening a new account.

Interactive Brokers

Interactive Brokers has many overlapping similarities to TradeStation. Consider comparing the platform layout, trading tools, and pricing to choose the better option. This is a popular platform for short-term and high-frequency traders.

You can see if this platform offers the best broker promotions, which can be easy for active traders to earn.

Learn More About Interactive Brokers

tastytrade

Stock, options, and futures traders can benefit from tastytrade, which offers extensive research and trading. For example, it offers unlimited commission-free stock and ETF trades. In-platform features include video and follow feeds so you can easily access the information you need the most.

You can also scoop up bonus cash with these Tastytrade promotions.

Webull

New and experienced investors can utilize Webull through its web, mobile, and desktop platforms. There are no trading or account service fees, and fractional investing is available. Webull also has a paper trading platform.

Check out the latest Webull stock promotions to get several free shares of stock upon joining.

Read our Webull review to learn more.

TradeStation Pros and Cons

TradeStation is well-suited for experienced investors and active traders, but like anything, it has some drawbacks. Here’s our list of TradeStation’s pros and cons:

Pros

- In-depth charting and trading tools for active traders

- Supports several investment types

- Paper trading account

- Desktop, web, and mobile platforms

- Free stock and ETF trades

Cons

- Potential inactivity fees

- Trading fees apply to high-volume trades

- Hard-to-use layout for long-term investing and fundamental research

- Doesn’t offer 24/7 live customer support

FAQs

The TradeStation platform is suitable for active traders as it has a trading simulator, powerful charting tools, and an ample supply of data feeds. There are better options for beginners and those who prefer to stick to index fund investing.

There are no minimum deposit requirements, but you’ll need enough money to buy full shares of stock and cover any trading commissions. Keep in mind there is a $10 inactivity fee if you don’t maintain a minimum $5,000 end-of-month equity account balance or place at least 10 trades in a rolling 90-day window.

Live chat and phone support are available on weekdays during normal business hours from 8 a.m. to 5 p.m. Email support and an online knowledge library are also available.

TradeStation Review: The Bottom Line

TradeStation is an excellent online brokerage for active traders who want the ability to quickly chart and trade stocks, ETFs, options, futures, and crypto under one roof. TradeStation’s pricing is also very competitive.

But while beginners can certainly get by with TradeStation, it’s not as user-friendly as some other online brokerages that target new investors. Live support is limited to business hours, it doesn’t offer fractional shares, and you need to maintain a $5,000 balance or place at least 10 trades quarterly (rolling 90 days) to avoid the inactivity fee.