Challenges are fun.

One of our good friends does something called the Workweek Hustle. It’s a really simple challenge – whoever has the most steps in the week, wins. They all own Fitbits (the Workweek Hustle is a Fitbit name for the competition). The Fitbit tracks their steps, syncs it to a group, and the weekly winner is crowned on Saturday. There’s no actual prize – just bragging rights.

Every week, almost without fail, our friend ends up dancing to music on Friday night to catch up on steps. Or pad her lead. Or she just wants an excuse to dance.

It’s silly but everyone walks more because of it.

Everyone walks more = Everyone wins.

You can use this same principle to improve other areas of your life.

What do you think is the biggest problem with saving & retirement in America? Is it that people don’t have proper asset allocation? Is it investing in high fee mutual funds or day trading? Or perhaps it’s gambling and chasing after bitcoin?

It’s none of that. It’s far simpler.

People are not saving enough.

The Bureau of Economic Analysis reported that for December 2017, the personal savings rate of Americans was a mere 2.4%. The U.S. Census reported the median income for 2017 was $59,039 – which means the median income household is saving just $1,830 a year.

Can a challenge help us do better? Maybe. It certainly can’t hurt.

Two of the more popular savings challenges are the Penny Challenge and the 52-Week Challenge.

They’re super easy — let’s see how they work.

Table of Contents

What is the Penny Challenge?

The penny challenge is simple – save a penny on January 1st, 2 cents on January 2nd, 3 cents on January 3rd… all the way to $3.65 on December 31st.

If you save every day on schedule, you will have saved $667.95 by December 31st. A 36% increase in annual savings to the median household.

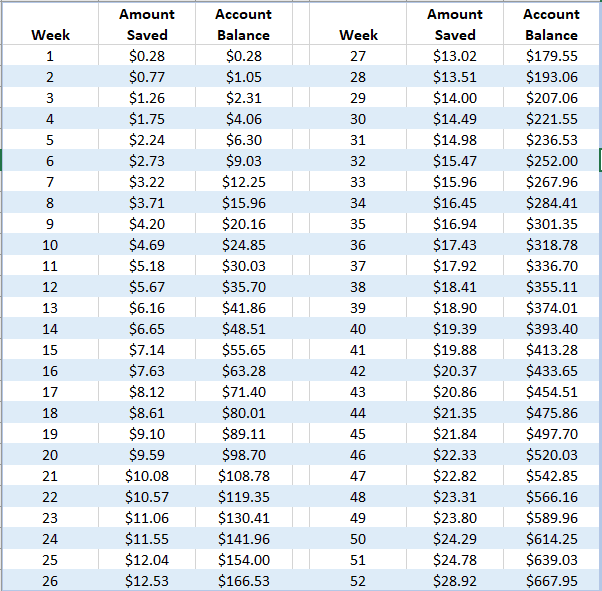

Here’s what the schedule looks like (days compressed into weeks for clarity):

What is the 52 Week Challenge?

The 52 Week Challenge is the same idea except instead of saving every single day, it’s saving on a weekly basis. You save a $1 on Week 1, save $2 on Week 2, $3 on Week 3… all the way to $52 on Week 52.

If you save every week on the schedule, you will have saved $1,378.00 at year’s end. A 75% increase in annual savings to the median household.

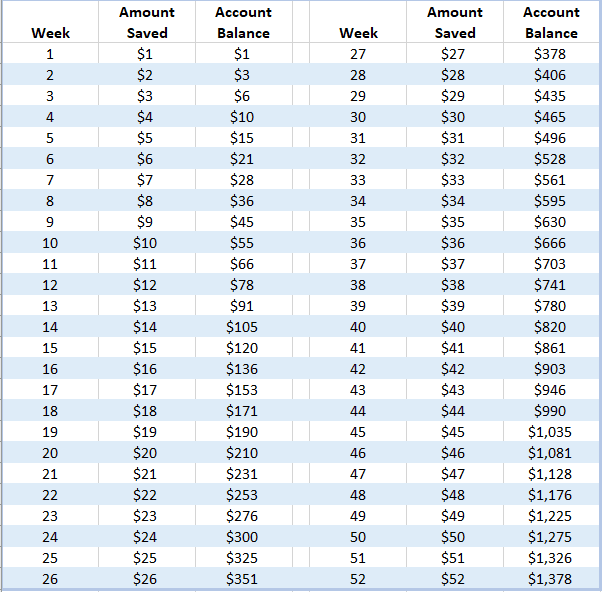

Here’s what the schedule looks like:

How to Beat the Challenge

You can give yourself an edge in beating the challenge by taking a few simple steps.

The first step is how you save. You have two good options.

You can deposit it into a high interest savings account. This way you’ll be earning a little bit of interest and you can watch the balance grow. This is mathematically optimal… but psychologically the least powerful. You’ll see why when I explain option #2.

Or, put the money into a clear glass jar. This one has two extra benefits. The first one is you have to physically put money into the jar when you save. That action will help cement the habit in your mind. The second benefit is that you can see the coins in the jar. It’s more powerful than a bank balance on a screen.

If you go the jar route, here’s how to get free coin counting so you don’t go crazy at the end of the year.

Regardless of how you save, print a calendar and mark off each time you make a deposit. This has a powerful psychological effect (more on this shortly).

If you don’t want a calendar, you can print out this checklist:

For the 52 Week Challenge, the week is how many dollars you need to save. Week 32 = $32.

(If you’re doing the penny challenge, you’re on your own! :))

- Fill out your reason for saving in the blank spot at the bottom – having a reason helps. It makes it a tradeoff, rather than “save money for the future.” The future is nebulous. A concrete target or reason is not. If you have a picture, tape it on there – it makes the reason even more powerful.

- Then, cross off the weeks as you go with a thick marker so you see the week with a line through it.

That’s it!

Why Money Challenges Work

These challenges work for three reasons:

- You do not like breaking patterns. This is a good thing! Jerry Seinfeld famously wrote comedy every single day. When he would write jokes, he’d put an X in a calendar. That motivated him to write every day because he didn’t want to break the chain of Xs. The calendar is almost as important as saving the money.

- You develop a habit. Developing a new habit is hard because you are starting from zero. These savings challenges start small. It’s just a penny. It’s just a dollar. It’s not a huge amount so you find a way to drop that money into a jar.

- You build momentum. Success breeds success. As you start saving, it builds up momentum and you gain confidence. You’re saving more money!

These are the exact same reasons why the debt snowball works.

The debt snowball is a popular debt payoff strategy first promoted by Dave Ramsey. Most experts recommend you pay off higher interest debt first. Ramsey recommended you pay off the smallest loan balances first.

When you completely pay off the smallest debt, take those extra payments and add them to the amount you’re paying to the next smallest debt. Repeat until you’re debt free.

The debt snowball works well because you build momentum. When you pay off a debt, you get a win. The money rolls over to the next debt, so you pay it off even faster. It “snowballs.”

The debt snowball is not financially optimal. Everyone knows this. But this approach works because people pay off all their debt.

We know it’s is “better” to pay off your highest interest debts first. But the highest interest debt may have a massive balance and you never get the “win” of paying off an entire debt. It feels like you’re fighting the tide. The debt snowball lets you gain some wins, even if you lose a little money in the process. You gain momentum and the confidence to pay it all off and not give up.

Don’t let perfect be the enemy of good!

Where Can You Find Savings?

I got you – here are 105 ways to save money.

Within that massive list of ideas will be at least a dozen you can use, right now, to save the pennies and dollars you need for the next savings cycle.

What do you think of these types of challenges? Love them or hate them?

I love the idea of doing a saving challenge. I like it especially because you can see your progress compound over time with small investments. Put that into a higher interest savings account or an investment account and you’re well on your way to a more secure financial future. Now I want to save some ????

I am a bit late to this post but I wanted to share. I read in Readers Digest about the $5 savings plan where every time you get a $5 bill in your change, you put it aside for savings. (This next part is a bit morbid so please excuse that.) When my Mom passed, I grabbed those $5 bills and went to the funeral home. The director was mortified when I handed over $6,000 in fives, (the look on their faces was priceless) but it covered what I needed without having to go into debt to help with her… Read more »

Anything that gets you to save, no matter how “silly” it sounds, is a good thing!