Until this year, copper seemed close to being a sure thing, investment-wise. Demand for the metal had increased steadily with the ramp-up in the production of electric vehicles (EVs). But it seems that, at least for the moment, demand for the metal has stalled.

Contrarian investors would say that makes 2023 the perfect year to invest in copper. After all, it’s better to buy any investment or commodity when the price is low. But how do you invest in copper if you decide you want to take the plunge this year?

I share some ways to do that in this article and provide you with some background on copper and the forces that are affecting its price today.

Table of Contents

- How to Invest in Copper

- Where to Invest in Copper

- Factors Affecting the Price of Copper

- 1. Demand as an Industrial Metal

- 2. A Future Copper Supply Deficit?

- 3. Diversification from Stocks and Bonds

- 4. Copper is a Monetary Asset

- Other Factors that Affect the Price of Copper

- The Bottom Line: Is Copper a Good Investment?

How to Invest in Copper

You can invest in copper by purchasing copper bullion, stock in companies that produce copper, copper exchange-traded funds (ETFs), or copper futures. Here’s a closer look at each of these options.

Copper Bullion

Copper bullion can be purchased in coin or bar form through retail dealers. Examples include JM Bullion and Money Metals.

Bullion can be purchased as copper pennies, copper rounds, or commemorative coins. It’s even possible to buy copper bullets. Bars can be purchased in amounts ranging from one ounce to as much as 10 pounds.

Copper bullion can either be stored with the dealer where it’s purchased, or you can take delivery of it. But a $1,000 order weighs around 250 pounds, making it a problem from both a shipping and storage standpoint. You’ll pay a dealer markup for copper over the bullion price, as well as shipping costs if you take delivery.

Advantages:

- Bullion is a physical asset and not dependent on a promise to pay, like paper assets

- Don’t need to be concerned by the performance of copper companies

- Bullion is the most direct play on copper investing

Disadvantages:

- Dealer markups will put you immediately behind the price curve and are charged upon both purchase and sale

- Receiving large amounts of copper is cumbersome, and storing it with the dealer can get expensive

- Can be challenging to find a private buyer for a large amount of copper bullion

Copper Stocks

If you don’t want to hold copper bullion, you can invest in copper mining stocks. While you won’t own copper directly, you can benefit from rising copper prices.

Some of the largest copper-producing companies include Freeport-McMoRan (NYSE: FCX) and BHP (BHP).

Just be aware that copper stocks are affected not only by the price of the metal but also the overall direction of the stock market. Copper producers are also subject to complications with business cycles, suppliers, interest rates, labor disputes, and geopolitical issues.

Advantages:

- Copper stocks can outperform the metal itself, producing higher returns during bull markets

- You can diversify between various copper-producing companies

Disadvantages:

- Copper stocks are not a direct way of owning the metal itself

- A copper stock price can fall even while copper rises due to business issues within the company

Copper Exchange Traded Funds (ETFs)

Copper ETFs offer an opportunity to invest in funds that hold a portfolio of copper mining companies or copper futures. Examples include Global X Copper Miners ETF (COPX), which invests in the stocks of copper mining companies, and the United States Copper Index (CPER), which invests in copper futures. The iShares Copper and Metals Mining ETF (ICOP) holds copper stocks and the metal itself.

Advantages:

- You can invest in copper mining companies or futures without needing to be involved with individual investment selection

- Shares in an ETF can be easily bought and sold

- ETF shares are usually traded commission-free

Disadvantages:

- Though you will be holding shares in a copper ETF, that is not the equivalent of holding the physical metal

- Finding an ETF that invests exclusively in the metal can be challenging

Copper Futures

Futures are an opportunity to capitalize on the movement of the price of copper, both higher and lower. And because it involves leverage, you can make a small investment that returns big profits.

However, the reverse is also true. If the price of copper goes against you, your entire position can be wiped out. Copper futures are best reserved for those who are intimately familiar with the metal and who have a high-risk appetite.

Advantages:

- An opportunity to leverage a small amount of money for significant gains if your option position goes in your favor

- You can make money when the price of copper rises or falls

Disadvantages:

- Futures are not a long-term investment

- Your whole position can be wiped out if the option goes against you

- Not well-suited for beginner or novice investors

Where to Invest in Copper

If you are going to invest in copper bullion, it’s best to hold it with the dealer you buy from. Just keep in mind that there will be storage costs, which will vary from one dealer to another.

Unlike gold and silver, which have a much higher value, it’s probably not worth the effort to take possession of the metal. Even a small amount of money will buy a large pile of copper, which would be difficult to both ship and store.

If you want to invest in copper through stocks or ETFs, M1 Finance, Ally Invest, and SoFi Invest are solid choices. For copper futures and options, you may want to consider investing with larger brokers, like Charles Schwab or Fidelity.

Factors Affecting the Price of Copper

The price of copper is not currently trending in a clear positive direction. If you’re going to consider investing, you need to understand the variables that affect its price.

The chart below shows the historical price of copper, going back to January 27, 2012, nearly a dozen years. Based on the screenshot below from Google Finance, we see that the price has bounced around considerably during that time. But with a price of $3.89 a pound on January 27, 2012, and a current price of $3.80, it’s essentially gone nowhere, despite the recent rise in inflation.

The price of copper bottomed out at $2.17 a pound on March 27, 2020. But that was at the trough of the COVID-19 mini-crash when nearly every other financial asset and commodity also hit bottom. Copper recovered rapidly, then hit a peak of $4.94 a pound on March 4, 2022, just days after the Russian invasion of Ukraine, when nearly all other commodities exploded in price. It has since floated between $3.23 and $4.25 and currently sits at right about the middle of the range.

Keeping this history in mind, let’s look at the forces driving the price of copper.

1. Demand as an Industrial Metal

Copper has long been valued as an industrial metal, particularly for its uses in connection with electricity and plumbing. It’s also frequently used in the production of jewelry, musical instruments, doorknobs, and kitchen cabinet handles.

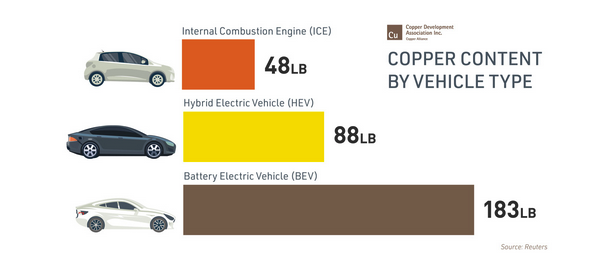

In recent years, copper has become even more sought after because of its use in electric vehicles. In fact, there is a significant amount of copper in virtually all types of motor vehicles. But in electric vehicles, in particular, copper is used in motors, batteries, inverters, wiring, and charging stations.

The screenshot below shows the typical amount of copper needed to make different motor vehicles:

With the increase in the production of both hybrid and electric vehicles, increased demand for copper seems inevitable.

2. A Future Copper Supply Deficit?

There’s been a lot of discussion in recent years about a copper supply deficit due to its use in EVs. But despite the increase in EV production, there was a surplus of copper in 2023. The decline is due to a drop in economic output in China, which is a major consumer of copper.

Going forward, keep a close eye on economic developments in China. If that country’s economy begins to rebound, demand for copper should increase. That might even restore the copper deficit, putting significant upward pressure on its price.

3. Diversification from Stocks and Bonds

Copper offers diversification from a portfolio of paper assets, like stocks and bonds. And if projections for the increase in demand for copper come to pass, it could prove to be one of the better alternative investments.

Just be aware that copper is not as reactive to world events in the same way other alternative assets are. For example, energy, gold, and silver tend to have much more dramatic price responses to major economic and geopolitical changes.

4. Copper is a Monetary Asset

It’s worth noting that copper has been a monetary metal for thousands of years. Because of its value as an industrial metal, it has historically served as the lowest common monetary denominator in various currencies. That includes the U.S. dollar, where a copper penny has historically been the smallest denomination of the currency.

Other Factors that Affect the Price of Copper

While the factors discussed above are specific to copper itself, there are big-picture factors that also play a role.

Interest rate changes: It’s hard to find an investment or commodity that isn’t affected by changes in interest rates to one degree or another. That includes copper. Rising interest rates tend to suppress demand, putting downward pressure on copper prices. Falling interest rates support demand and can result in increased prices.

The state of the global economy: Like oil, silver, and wheat, copper is an international currency. Its price is affected by supply and demand, which is a global phenomenon. As discussed earlier, the economic decline in China has turned a copper supply deficit into a supply surplus.

Geopolitical issues. The U.S. is only the world’s fifth largest producer of copper. Other major copper-producing countries include Chile, Peru, Congo, Russia, China, and Indonesia. Given the geographic diversity of production sources, it’s easy to appreciate how international instability can affect the supply of copper.

Natural supply. Copper is produced from underground mines. Prices can be affected by the discovery of new mines (or the lack thereof) or the exhaustion of existing mines.

The Bottom Line: Is Copper a Good Investment?

Copper is a commodity, and as such, it is not a mainstream investment like a stock or bond. Since it pays no interest or dividends, it’s a pure play on price growth. And while long-term growth is possible, there’s no guarantee.

If you want to invest in copper, it’s best to hold your positions at no more than 2% or 3% of your total portfolio. While copper may increase in value over the long term, other investments can provide better returns with less risk.