When I look back to our wedding several years ago, I remember it with great fondness.

There's something special about weddings because it's all about love, happiness, and family.

It's about celebrating the happy couple as they formally intertwine their future lives together.

As the happy couple, the wedding is just the beginning. Just as planning the wedding was a production, you also have quite a bit of work to come. Luckily, people have been getting married for quite some time so the work you have after the honeymoon is well understood.

Whether you're already married or are going to get married soon, this guide outlines everything you will need to do with respect to money.

Talking About Money

It's important to sit down with your future partner and have a frank discussion about money.

You don't have to agree but you have to understand each other's viewpoint and where you each see yourselves going together. Communication, not necessarily agreement, is the most important thing here because you'll need to work things through together.

Obvious (and some non-obvious) financial subjects to talk about:

- Your savings (incl. retirement) goals

- Your work goals (including where you want to live long-term)

- Do you want children and how many?

- Do you have joint or separate financial accounts (banking, brokerage, credit cards)

- Who will be “in charge” and be accountable for the finances

- Should there be a prenuptial agreement?

That's just a starter list… get a bottle of wine (or two), cozy up, and just have a conversation. If you've nailed these questions, here's another list (and this one!) you can work on. 🙂

If you don't have a habit of doing this, one of the great conversations each couple should have is about one of their biggest financial decisions prior to marriage – how much to spend on an engagement ring and the wedding event. Sit down with that bottle of wine and just chat about what you and your partner would like. When it comes to “decisions,” this is one of the easy ones because it's just one day. The decision to have kids is an 18+ year commitment MINIMUM. 🙂

The Big Day

I won't say much except that you must avoid debt when it comes to your wedding. Use your finances to determine a budget and then stick to it. It's a very emotional time so it's easy to “pull out the stops” or feel the pressure to spend a lot of money.

Here's the reality — People won't remember much about your wedding except “did we have a good time?”

A good time doesn't have to be expensive.

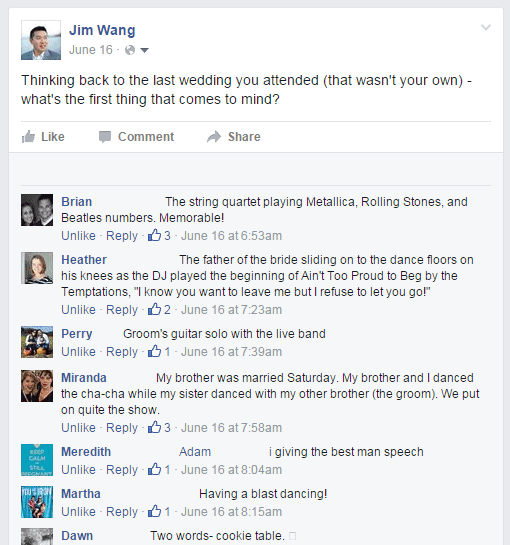

In fact, I asked a few of my friends and this is what they said:

The most memorable moments had nothing to do with money. They were fantastic surprises and unexpected moments of delight that cost nothing. Funny best man speeches to dancing to the father of the bride sliding on the floor.

Plus, for what it's worth, it's better to spend that money on the honeymoon. 🙂

Taxes

Now that you're hitched, you might be wondering how taxes work.

Don't – get tax software like TurboTax or TaxACT. They will run the scenarios.

If you just want knowledge, here it is. Your tax filing status will change from Single to Married Filing Jointly (MFJ) or Married Filing Separately (MFS). Now that you are married, you can no longer file Single.

Which should you pick? Unless you're planning on getting divorced, it's Married Filing Jointly. When you file as MFS, pretty much every deduction and limit goes into the crapper.

Example of a limit going into the crapper? The Roth IRA is a retirement account where you contribute money after taxes but that grows tax free and distributions are tax free. The amount you can contribute depends on your income.

A MFJ can contribute the full amount if their income is less than $181,000. It becomes to phase out from $181,000 to $191,000.

A MFS's phase out range is $0 – $10,000! There are plenty of similar phaseouts. It sucks to file as a MFS and there are usually very good non-financial reasons.

As for how much you'll pay in taxes, it depends on your combined income. The married tax brackets are not double that of single filer tax brackets, which is known as the marriage penalty. Only the first two brackets, 10% and 15%, which cover combined income up to $74,900, are double. Beyond that it starts to merge and the penalty kicks in.

Changing Your Last Name

Changing your last name is easy, it just takes time since you're relying on the speed and quickness of government agencies. Order is important here, earlier steps generate documents you'll need in later steps.

You must do this within two years of getting married (date on marriage license) or it gets slightly harder.

- Get a certified copy of your marriage license from the county clerk. This will be the county you were married in, in case it was different than the one you live in. It will have a raised seal and your new last name. If you don't have one, you can always call and have it mailed to you. (index of states and where to request vital records, including marriage)

- Change your Social Security Card. Fill out the SS-5 application for a new card. You are getting a Corrected Card, because you are legally changing your name, and here is a list of documents (choose Corrected from the “Type of card” options) you will need besides the marriage license. The application is free.

- Update Your Driver's License. Check with your state's department of motor vehicles for the exact process but at a minimum you will need your certified marriage license and your new Social Security card.

Once you have your driver's license in your new name, the process of updating every other account is easy. Every account will accept a combination of those documents for a name change. In many cases, you can just call.

A special case — Your U.S. Passport.

Unfortunately, you need to renew the whole thing, you can't just change your name. If it was issued within the last 12 months, you can renew it for free. If it's been over a year, you'll be subject to fees. Here are the full instructions.

Here's a short list of things to update (and while you're at it, for accounts with beneficiaries, update it to include your partner):

- Employer HR records, including payroll

- Bank accounts, including any loans such as your mortgage

- Retirement accounts

- Credit cards

- Utilities

- Insurance companies (homeowners, renters, auto, life, liability)

- Voter registration

- Legal documents (estate)

Build a Joint Financial Plan

A financial plan is a plan that outlines your goals and figures out how you're going to get there. The value in the plan is in making it – sitting down with your partner to hash it all out.

You can hire a fee-only financial planner to help or you can do it yourself. Talk to your partner about your future goals, his or her future goals, including major financial milestones like buying a house, starting a family, etc. Those major financial milestones will require funding and that's where the plan comes in.

You can calculate how much you need to save to meet those milestones. The plan can help you get there by helping you understand whether you're ahead, behind, or on track.

For example, if you want to buy a house in 5 years and know you'll need $30,000 down payment, you'll need to save $500 a month assuming zero growth. Review your budget and see if that's feasible and adjust your plan accordingly.

The value is in creating the plan – it lets you and your partner get on the same page for your joint future and does it in a very real way. Maybe you thought you'd buy a $300,000 house in 5 years and your partner figured $500,000 in 8 — the plan will reveal that and reveal what's realistic in quantitative terms, rather than emotional ones.

The plan has another hidden value – it offers trade-offs. Now that you have a goal, it becomes easier to be more disciplined in your spending. If you need to save $500 a month to reach your financial goals, your plans to increase income or cut spending are motivated by this goal.

Do you want to spend $50 going out to dinner or save it towards your goal of buying a house? Would you rather go out to dinner tonight or wait an extra week before moving into your new home? That's a decision you're able to make with a clear mind.

Establish a Joint Budget

With the financial plan, the next step is to establish a joint budget. It doesn't matter what system you use, whether it's a tool like You Need a Budget or it's a series of envelopes, the key is establishing a joint spending plan and reviewing it on a regular basis.

It's easy to spend money and not realize it, it's funny how capitalism is designed that way, isn't it? But when you establish a budget and have shared goals, it becomes much easier.

Here's the hidden value of a budget – when you plan it out, it gives you the ability to spend guilt-free. If every dollar is accounted for and you are hitting your savings goals, then spend your money without guilt. If you budgeting $50 for dinner, you can spend it without guilt.

That's liberating.

That's the sneaky reasons why budgeting is valuable.

Adjust Your Investment Assets

Armed with a financial plan, you should review your respective investment assets as a single pool of resources. Chances are you each had asset allocations that made the most sense for you as individuals. As a couple, your assets are pooled and should be used to further your married pair.

Be sure to diversify those assets and allocate them appropriately given your risk tolerance and shared goals.

Schedule Regular Meetings

Finally, schedule regular meetings to sit down and talk with your partner about finances. The more often you can do it, the better. Let it be a place where you can talk about the positives and the negatives.

Celebrate the wins on a regular basis, whether it's milestones or achievements, but also let it be a chance to release a little steam when things aren't going according to plan. The celebrations keep you moving forward, the pressure releases make sure that feelings don't stay bottled up until they explode; both are extremely valuable.

As I'm sure you've heard over and over again, communication is critical in any team, especially a two-person team intended to last several decades. 🙂

Good luck!