Trends are fun.

It’s great that Stanley is having it’s moment with their colorful Quencher travel mugs (and they’re $45 a pop!). An iconic brand with good products getting a massive boost because of marketing and social media? Absolutely wonderful.

Trends are good for increasing your enjoyment. It’s also really good at separating you from your money. A new trend means the old trends are out of favor… and you need to buy more stuff. I’m not against that.

This isn’t a post slamming buying more stuff. Buy whatever you want. 😁

But when trends start venturing into other areas, such as investing, that’s when things get dangerous.

Here’s what it looks like and how to avoid it:

Table of Contents

How Do Trends Start?

Trends are all about attention.

The media ecosystem is a simple one. Everyone wants attention. Those who have a lot of it want to keep getting it.

If you want to make money, you need to sell ads and to sell ads, you need attention.

“Trendsetters” become trendsetters because they identify trends before they become mainstream. With social media platforms like Instagram, with publicly available views and likes and comments, aspiring influencers can see what is getting attention and try to latch on. Those new folks are trying to become trendsetters, so they share and like and comment on popular posts and reels.

Eventually, this broadens to the “mainstream” television shows like the Today Show and Good Morning America. They are also trying to keep their existing viewership so they are doing the same thing as the aspiring influencers… they share what are seen as trends on social media.

They also have airtime to fill, so why not latch onto a new trend?

This means there’s a constant barrage of “new” trends. No one gets attention sharing old stuff. It has to be what’s new and fresh.

What Does This Look Like In Investing?

Stanley mugs are one thing, what does this look like in investing?

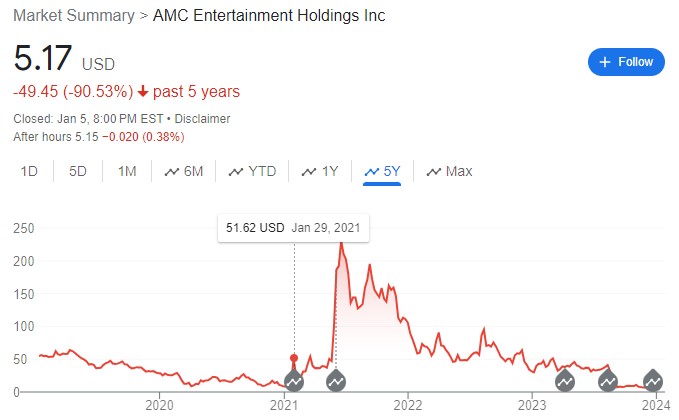

Do you remember Gamestop and AMC during the pandemic? There was a lot of attention paid to them because of everything happening in a Reddit subreddit called WallStreetBets. Amateur traders were using leverage to gamble on the stocks as they skyrocketed. There were congressional hearings involving the CEOs of Robinhood, trader Keith “Roaring Kitty” Gill, and others about Gamestop.

Absolutely bonkers.

They were able to pump up both stocks, get the attention of mainstream media, and even spawned multiple documentaries.

It brought a lot of attention back to the idea of day trading stocks and options (we last enjoyed that trend back during the dot com boom).

Heck, it might have even tempted you!

How Do These Trends Start?

There’s never a single way that a trend starts but there are patterns. And the most obviously one to identify is the one that has to do with money.

Buying index funds is a tried and true strategy that is both boring and not that profitable for brokers. You can buy shares of Vanguard’s 500 Index Fund Admiral Shares (VFIAX) without paying a commission and the expense ratio is only 0.04%. The minimum is a modest $3,000.

For every $10,000 of investment, Vanguard will collect $4.

Fidelity would only charge you only $1.50. (0.015% expense ratio)

That’s nothing. (but amazing for you, the investor!)

The commission-free brokers don’t charge for trades but they make money selling order flow. If you buy and hold, that’s not much activity (no order flow!) and they don’t make much money.

Brokers make way more money when you dabble in options. They might not charge you for the options trade but they will charge a per-contract fee. Most brokers charge around 65 cents per contract (which covers 100 shares). And when you open a contract, you have to eventually close it too. That’s where the money is.

If you trade on margin, they earn interest too. Another cash cow.

In summary, they don’t make much if you just buy and hold and they make even less on index funds.

The cynical view is that they make more when you chase trends and are a more active investor. This is why brokers are happy when there’s a lot of volatility in the market. Volatility equals action and actions equal commissions.

✨ Related: Don’t Personally Identify with Your Investments

Why Is This Bad For You?

There are essentially two ways to think about your advantage in investing. (this is a very basic summarization)

- If you have an edge, usually one based on knowledge, you want to take advantage of it. (informational advantage)

- If you don’t have an informational edge, then your only advantage is time. (time advantage)

Everyone has a time advantage, not everyone has an informational advantage.

A lot of people think they have an informational advantage, but they don’t. Actively managed mutual funds actually give up their time advantage because they have to show quarterly and annual returns. Most actively managed fund returns lag index fund returns.

There are three bad things when you chase trends:

- You think you have an informational edge because you know about it “early” (except you’re not early)

- You’re seeing everyone else’s success stories and think it’s easy (a bit of confirmation bias)

- You think the trend will end soon, so you feel pressure to jump on before it does. (scarcity effect)

Trends come and go.

The problem with investing with trends, especially if you do so with leverage, is that when they go, it can be devastating. In 2020, Alex Kearns was a 20-year old trader who was trading options using Robinhood and took his own life when he thought he had lost $730,000. When you trade options and on margin, it’s very possible to lose a significant amount if things turn on you.

And no one every tells you the story about how they lost their shirt on an investment, so you only hear stories about their fantastic gains (survivorship bias).

Remember, AMC was the darling of WallStreetBets when it was over $230 a share… it’s now just a few cents over $5. Ouch.

There are some folks still holding out hope that it’ll “rebound.” (it won’t)

What if I chase just a little bit?

Las Vegas makes billions of dollars each year because people like to gamble. There are shows and restaurants, of course, but people are there to wager.

And gambling a little bit can be fun and exciting. I get it. Get that dopamine hit.

If you really feel the itch, carve out a little fun money portfolio to invest in your hunches. Just recognize it for what it is – fun money to play with. It’s not an investment. It’s not prudent. It’s for fun.

(honestly, I’d probably rather gamble on sports than on stocks!)

You’re not quitting your job to gamble professionally, don’t liquidate your 401(k) to invest in the next hot sector.

If it really gets you excited, chase a little bit. Scratch the itch. But keep your nest egg in index funds.

It’s Not That Bad, Is It?

If you stay away from leverage and stay on the long side of investments (where you believe that the investment will increase in value), you won’t have massive losses that exceed your investment. The most you can lose with any investment is what you put in. The truly bad stuff only (typically) happens when you are short (hoping the investment goes down) or when you use leverage.

That said, losing money is still bad.

And spending your time to lose it makes it even worse. And those are years that the power of compounding could’ve been working on your behalf.

This is all to say that you should stick with boring index funds. Maybe a tried and true three-fund portfolio. Then live the rest of your life in peace knowing your investments are covered. Go fishing 🐟 or play golf. 🏌️

You won’t hear that advice on mainstream media because it’s boring.

But that’s the best approach to investing and has worked for decades.

And while you won’t be able to go to cocktail parties and tell stories about your wild investments, does anyone really like hearing those stories? (no) 😆

In my opinion, your insights on trends are accurate. However, my investment in BTC and blockchain technologies in December 2023 wasn’t driven by a trend; rather, it was based on the market being at a low point. I consistently practiced dollar-cost averaging (DCA) through April 2023, relying on a solid understanding of the fundamentals and metrics that historically influence these markets. While the approval of a spot BTC ETF today may not be guaranteed, even if it happens, its cash settlement nature could potentially limit its impact on supply and demand, thus affecting the price less significantly. Despite challenges from… Read more »