Gold.

It’s amazing the power it holds on our society. The California gold rush in the late 1840s and early 1850s has been the stuff of lore (if you have a chance to read about it, it’s fascinating). Even today, you can turn on Discovery Channel and watch a show about guys in Alaska mining for gold (I’ve taken a lot of Southwest flights and seen quite a few episodes!).

Gold also tends to appear in the news whenever there’s some economic or political upheaval. The price per ounce reached a nominal high in the summer of 2011, breaking $1,900 an ounce, which was staggering at the time.

Today, September 11th, 2023, it’s $1923.27 an ounce without nearly the same level of uncertainty in the world. ($1,900 in 2011 is the equivalent of $2,623 today, so we’re not nearly as high as back then)

If you’ve been tempted by the yellow stuff, and you’re thinking about picking up some gold bullion as an investment, I’m here to suggest a different way of thinking.

Physical gold bullion isn’t an investment. It’s an insurance policy.

Table of Contents

🔃 Updated September 2023 with the latest spot prices of gold, though the screenshots of the offerings at JM Bullion and APMEX were taken in June 2023. JM Bullion no longer offers volume discounts on the Maple Leaf Coin and is just $69.99 per oz. over spot.

How I Think of Gold Bullion

Gold has long been called a store of value. That’s a fancy little phrase to mean that it never depreciates. Gold doesn’t get old, it doesn’t break down or decay, it doesn’t need repair – it just is.

It provides no dividends or other payments. You can’t do anything with it. And it’s kind of heavy to lug around.

That said, even without any other financial benefits, it’s a useful financial instrument because it’s a recognized store of value.

It’s disaster insurance.

Back in 2017, think about the Syrian refugees who are trying to escape Syria and get into safer havens like the United States – they have little more than the clothes on their back and few worldly possessions. In 2010, the Syrian pound conversion rate was 57 SYP to 1 USD. Seven years later, you’d need over 514 SYP to get 1 USD. The value of their currency had been decimated. (In 2023, 1 USD = 2512 SYP)

If things hit the fan and we were in a similar situation, the value of the United States dollar would plummet. Perhaps to zero. In that case, you better make sure some of your worldly possessions have value in the country you’re escaping to.

That’s where physical gold plays a huge role.

As weird as it sounds, if there is a stable government somewhere, there’s a place you can go and turn your gold into the local currency. If the USG collapses and you’re left fleeing to a country like Canada or China or Russia, you can go there with gold and do more with it than worthless Federal Reserve Notes.

It’s not a pleasant thought but that’s what insurance is for. You don’t want it to happen but you also don’t want to be unprepared.

How to Buy Physical Gold Bullion

When you view it as insurance, you don’t care what it looks like. I don’t care about fancy coins. I just want gold as close to the spot price as possible.

It’s impossible to buy it exactly at the spot price, which is the current market price because you’re buying it from a company and they have to make money.

To make sure you aren’t ripped off, you need these three steps:

- Step 1 is to know the spot price, I like to use GoldPrice.org because it’s quick. Kitco has a live chart too, which shows a little more information like the bid/ask spread (but you won’t need that).

- Step 2 is to understand the spot price is shown in troy ounces and for .999 fine gold. A troy ounce is not the same as a “regular” ounce (it’s known as the avoirdupois ounce after the avoirdupois system of measurement), it’s 31.1 grams vs 28.35 grams in an avoirdupois ounce.

- Step 3 is to buy it from a place that will only put a premium of 5% on the gold and offers free shipping and insurance.

Where to Buy Gold

The simplest way to buy gold is through an app called Vaulted (full review of Vaulted here). Vaulted is an app run by McAlvany Financial Group and International Collectors Associates (short name is McAlvany ICA) based out of Colorado. The app lets you buy fractional gold that is then stored at the Royal Canadian Mint. By purchasing it fractionally, you don’t have to buy it by the coin (which is expensive per ounce) or wait until you can buy an ounce (which is expensive, period). When you get up to an ounce, you can request delivery for a small fee.

If you want disaster insurance, Vaulted is fine but you want to be able to hold onto the gold when you buy it. You may wish to look at one of the below options.

If you want delivery immediately, you can go with a merchant. It’s like ordering precious metals online.

But I’m liking JM Bullion (APMEX is good too). I like it because on every product page they show you the current live Gold ask price, the prices are fair, and there’s free shipping.

With gold at ~$1960 an ounce (as of June 2023, the time we took the screenshots), you can get this gold coin for just a premium of $69.99 – or 3.447%. (the higher credit card price is exactly 4.16% higher, which seems like they pass the credit card transaction fees onto you… fair enough)

In fact, JM Bullion offers this coin, at any quantity, at just $69.99 per oz. over spot. (as you’ll see below, APMEX starts at $99.99 per oz. over spot)

You can buy other gold coins:

But don’t pay a premium for a prettier design.

Companies like JM Bullion and APMEX routinely run sales where coins will be just a small premium over spot. That’s what you want to get.

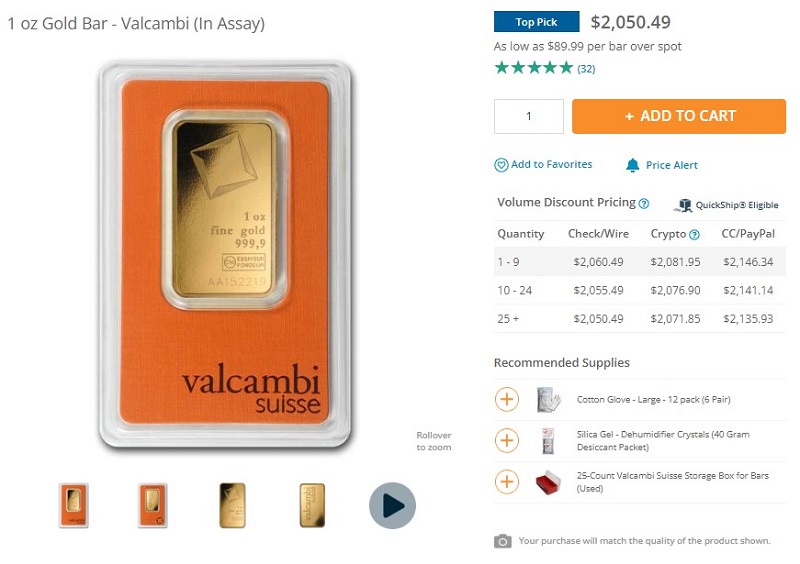

Here’s a listing on APMEX:

APMEX sets their prices against the spot price – with the lowest price for if you buy 25 or more. For a single one, it’s a $99.99 premium over spot. (they also have free shipping on purchases over $99)

If you’re going to use gold in a crisis, the person taking it will not care if there’s a Maple Leaf, Lady Liberty, or a kangaroo on it. Don’t pay extra for it.

How to Avoid Being Ripped Off

Sadly, there will always be scams in the world. If there’s money to be made, there’s the risk of fraud.

There are two ways to get screwed:

- The person you buy from fails to deliver the metal.

- The person you buy from gives you a fake.

Failure to Deliver

Years ago, I heard about a company called Tulving from a friend of mine. My friend had purchased large amounts of gold bullion from them and had a good experience. Their website was awful but they had good prices on gold — which is what matters.

While I never purchased anything, I was saddened to hear that the company collapsed in 2014 and still owed customers $40 million!

Am I worried that a purchase at JM Bullion or APMEX might end up this way? No, but you have to do your homework. Read that article and see how the warning signs are all there. Delayed shipments, complaints on BBB, and other huge red flags.

There are a lot of companies selling gold so if one triggers your Spidey-sense, move onto the next one. There are plenty.

Fake Gold

As for the gold itself, how do you know it’s legitimate? How can you protect yourself, especially if you use a check or wire transfer to save money on the purchase? (credit cards offer more protection)

If you purchase something from a private seller on a marketplace, like eBay, you need to do your homework. Study what they’re selling and see if you notice anything out of the ordinary. I wouldn’t buy something from an individual off eBay, it’s not worth saving a few dollars on a transaction where the purchase price is $1900 an ounce.

If you purchase it from a reputable dealer, you still need to do your homework but you can be reasonably assured they’re legitimate. Read the Tulving story I linked to above and then read reviews of the different merchants to see if perhaps you’re looking at a company in trouble. Read the complaints on their BBB listing and see if they apply to you (a lot of the ones for these gold companies involves selling transactions, where the customer sells gold to the company).

What about silver?

You can buy silver too, under the same logic, but it’s less valuable. An ounce of gold is ~$1900 and an ounce of silver is ~$23.

It only makes sense to invest in silver if you want some protection but you don’t want it in units of ~$1900. You’d need 82 ounces of silver to have the value of 1 ounce of gold!

Also, you could purchase gold in grams on some sites. There are 31.1035 grams in a troy ounce so when APMEX sells a 1 gram gold bar for $108.78, you’re overpaying for an ounce of gold (but you don’t have to shell out as much). That’s too high of a premium.

Have you purchased physical gold bullion before? Any suggestions for a novice buyer but a seasoned researcher like me? 🙂

Not quite the same, but the company I interned with back in the day used to sell gold nuggets to employees (I work in the gold mining industry). At some industry events you can buy gold at spot price. I never have…but it is fun to look.

A gold nugget would be fun!

Kitco is the one I have used in the past. They have a minimum order of $2,500 (may have changed) but when you’re buying gold, that’s pretty easy to hit.

Also, when I was stationed in Qatar in 2005, a buddy of mine bought a bunch of 100 oz silver bars and shipped them back to the US. It was hilarious watching him go to the base post office and put all this silver in a flat rate box. They hated him.

They stopped requiring a minimum order a few years ago, which makes sense because it’s hard to remain competitive in the less pricey metals.

Flat rate box! That’s hilarious.

I think this sounds like pretty poor insurance. It reminds me of buying Bitcoin. For those in some high-risk countries it might make sense as they might not have the option to invest in foreign countries. In the United States, you can invest in literally dozens of countries very easily. And while every market might catch cold like it did in 2008, if the US gets to the point that you need to flee with gold holdings a ton of other countries are going to be terrible shape as well. If they aren’t, then your diversified investments should be adequate… Read more »

It’s not insurance against financial calamity, it’s insurance against collapse. 🙂

And yes, they’re going to be in terrible shape but gold will have retained more value than Federal Reserve notes.

I have started buying from Bullion Vault. Super customer service and you even get a small amount of silver complimentary just for opening an acct and putting $50 in it to start. They send you great easy to read statements regularly as well showing the value of your investment and you can choose the country you wish your gold to be stored in from a selection of vaults. I highly recommend them.

I don’t know if I’d want to buy gold and have it stored somewhere else, I’d much prefer to have it here.

I’ve always thought of coins as a hedge against counterfeiting. The purity is set by the government of manufacture. The design makes it hard to forge. The reeding (the slots and ridges on the outer edge) prevents shaving (take a little off here and there). Try to get that from a natural looking, no two look the same, nugget. Unfortunately I’m not current with the state of coin counterfeiting. You do see all the work they do to keep our greenbacks safe from copiers.

Well, you’re not buying nuggets when you buy from these sellers. They’re sealed, stamped, and inspected by respected organizations. While it’s possible to fake, it’s less likely since you can check density… but I do agree with you coins.

The secret to buying gold on EBAY is to research the seller: how long has he been selling on the site, and how many positive feedbacks he has as opposed to negative over at least a 12 month period. If The seller as been on EBAY for a good long time and has a feedback of several hundred positive, I don’t think you would have a problem. Most buyers on the site are not stupid, if a seller was passing off phoney stuff, he would be called on it long before he had a chance to build any type of… Read more »

While I agree with you on your assessment of eBay, I don’t think it makes sense vs. buying from a reputable site. The spread is so small already, it’s like saving a few dollars on a thousand dollar transaction with a much higher risk.

From your (awesome) newsletter:

“What do you think? Am I nuts?”

I don’t think you’re nuts.

In fact, I thought you weren’t nuts long before it was cool to think that you weren’t nuts.

Nuts. 🙂

Hi Jim, We have had a remarkable 2 century run on US stocks. But in other countries in the world, gold may have done better for you than stocks. It hurts me to admit that, but it is a fact ( for example – gold outperformed french stocks between 1914 and 1982, though Parisian Real Estate did pretty well). Gold has outperformed Russian Stocks over the past century too 😉 You may not know this, but my family had a bunch of land taken over from them when the red army took control of Eastern Europe in the 1940s. While… Read more »

The stories I’ve heard from my grandparents about the level of political and social upheaval in China during World War 2 always sends chills down my spine compared to the peace we’ve enjoyed here in the United States in recent memory. They ran from war, so while no one “took their property,” it was pretty much abandoned. Having just an ounce of gold would’ve been such a huge boost once you made it to safety. It’s insurance, not an investment for me. I’m familiar with Browne’s permanent portfolio (25% of stocks, long term T-bills, cash and gold) but the idea… Read more »

If you want to buy locally or from someone in person, check out your local coin dealers. They sell gold coins and bars also. Be clear you want to buy gold coins just for the gold, not as collectible coins – you aren’t looking for any numismatic investment. I’ve purchased gold coins and small ingots from local dealers at a small increase over spot prices.

Why do fraction of ounce coins cost so much more per ounce than the same whole ounce coins?

I don’t know but I suspect it’s because of the production costs?

yes this is correct

to make a gold coin it cost about 50 bucks

no matter if its 1 oz or 1/10 an oz

also in there is a small fee

for the exchange

buy/sell