When I was younger, I loved going to the street markets in Taiwan because it was a masterclass in negotiation.

Only tourists paid the price written on the placard.

In fact, this is true in a lot of places outside of the United States. People are more comfortable negotiating and it’s just part of the dance. Sellers want to sell, buyers want to buy, and everyone wants to get a good deal. If you’re willing to learn a few tips, you can knock off a few bucks.

The last time I really remember this was while we were in Bermuda with some friends. There was a guy selling conches on the side of the road. Me and my friend Dave were sitting there drinking out adult beverages and watching as people would buy conches from this guy.

His opening price was $20 a pop. $20 for a conch is ridiculous. This was a tourist area so the guy knew he’d find some fish here. Of the twenty or so sales he made in a 30-minute span (our wives were wandering the market, we just sat there chatting and drinking, and this guy was good), half were for the full price. A couple of people knocked it down to as low as $15.

In a few minutes of negotiation, we were able to get two for $20 and I bet he would’ve gone lower if we really wanted to press.

Negotiation is a game and whether it’s for a conch in Bermuda or your cable TV, you play the game whether you like it or not. If you don’t like it, you pay more. If you study it, get good at it, you pay less and save that money for other things.

(and if you really don’t like it, you can pay someone to do it for you for a cut of the savings! more on that below)

Here’s how to do it:

Table of Contents

Know What You Can Negotiate

There are some bills you can negotiation and some you can’t. You can’t negotiate with your utility company. You can call them as much as you want, use all the tactics below, but they can’t just change the rate you pay per kilowatt hour of electricity.

If, however, you live in a state with Electric Choice – you can switch your electricity supplier and get better rates. You can use these ninja negotiation skills on those companies because they have flexibility in what they charge.

What can you negotiate? As a general rule, any service that is “optional,” has multiple suppliers, and not under contract is negotiable. If you’re under contract with Verizon, they won’t negotiate because they know you’re under contract. To break the contract would cost you an early termination fee, which might be worth it depending on the fee and the cost savings, but they know they have a decent hand.

Some of the bills you can negotiate:

- Television services, like cable or satellite service

- Phone services, both home phone and mobile phones

- Any bundled services, usually includes the above, like “Triple Play” type packages

- Interest rates on revolving debt, like credit cards

- Insurance policies – auto, home, liability

- Home security services

- Subscriptions – newspaper, magazine

- Gym and fitness center memberships

If you aren’t sure if you can negotiate it, just try. Worst case is you can’t and you learn for the future. No company will raise your prices because you ask them to lower it. 🙂

Gather Your Records

Before you can negotiate our plan, you need to fully understand what’s in your plan.

You’ll want to know the services you’re signed up for, to make fair comparisons, because you want to compare apples to apples.

You also want to collect loyalty information, which you can use in your negotiation, and companies want to keep their loyal customers. Know how long you’ve been a customer, how many bills you’ve paid on-time, and make sure to keep that in the back of your mind.

Right-size Your Plans

When I was in high school, I felt like we had thirty channels to watch. I only watched a handful but the options were limited to fewer than fifty channels.

When I graduated college and looked at cable TV packages, I was shocked that there were hundreds of channels out there.

I watch maybe five channels, most of which are your local ABC, NBC, CBS, and Fox affiliates. Those are available over the air for free!

The point of my story is that the first step in any negotiation is understanding what you want. If you are paying hundreds of dollars a year for cable TV that you aren’t even watching, consider downsizing your cable package to a cheaper one. It’s an easy win, easy savings, and you don’t even need to negotiate. Just pay less for a cheaper package.

Research Your Alternatives

There are always alternatives and they want your business too.

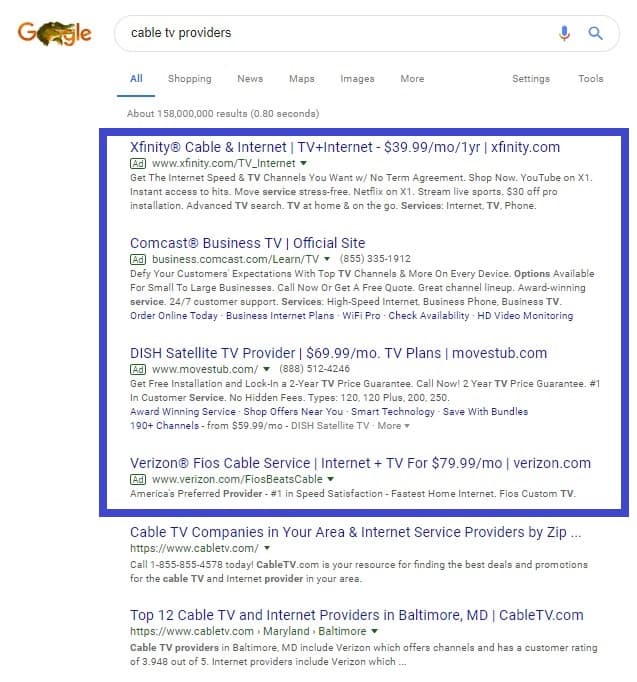

Just google the name of the service and check out the ads that appear at the top – all of those companies have promotions that they are willing to give to you if you switch. This work best for services you can sign up for online, like cable.

All these guys – Xfinity, Comcast Business, DISH, and Verizon – all have new promotions available. That took two seconds to google and now I know what I can get.

It will take a few minutes to get a fair comparison (these “prices” are all for their lowest tier of service so the number looks super cheap), to get a similar package for my needs and what I can go at my current cable provider with.

With in-person services, like a gym membership, I’d search for the local gyms and then collect their new member offers. Since a gym is a place you’ll need to drive to, location becomes more important. No sense paying a little less for a gym that takes you an hour to get to. (while you’re at it, take advantage of any free trials they have – that way you get a sense of their quality of service too)

Making the Call to Negotiate

Get a pen, a pad of paper and your phone – it’s time to make the call.

Let’s talk briefly about your mindset – you should be polite and firm and willing to walk away. Being friendly is more than just an issue of politeness (and you should be polite, the customer service rep is a human being and should be treated with respect) but people help those they want to help. Your rep doesn’t make more money if they keep you on the same plan, they’re not an adversary. If you’re polite, they’re more likely to be able to help you or find ways to help you.

Being willing to walk away is key because you can always call back and get someone else. It will cost you more time but it won’t “ruin” the negotiation.

Finally, try to ask and answer questions that offer wiggle room – my wife loves to ask “is there anything you can do to help me?” This gives the rep some leeway in trying to find a solution. And they’re more likely to look for one if you’re nice.

During the call, ask for what you want. You want a lower price, you want added services for free, … whatever it is you want, ask for it. Then give reasons why you should get it – you’re a loyal customer, you’ve seen another offer, you want to know if they’ll match a competitor’s offer, etc.

Sometimes the rep will give you something lesser – like free X months of premium service, like Showtime or HBO or whatever. If that makes you happy, take it. If not, let them know.

If you aren’t getting anywhere… you may need to play the power card that moves you into the retention department. (if you haven’t started the negotiation process yet, you can always just start with this – some people don’t like going there from the start)

Threaten to Cancel (or Cancel)

This is your ace in the hole.

I only have one cable TV and internet option – Verizon. You may be in a similar situation, where only one provider services your location, and it feels like you lose a lot of leverage because you can’t rely on the competition.

Wrong! Canceling service is always on the table.

This is why it’s so simple to negotiate a service like SiriusXM satellite radio service. There isn’t another satellite service besides SiriusXM. But there is regular radio. And Spotify/Pandora. And podcasts. And all those alternatives are free(ish).

If you threaten to cancel and they say “OK cancel” – then cancel!

You can live for a month or two without whatever service that is. If it’s the gym, cancel in the spring and just spend more time outdoors. If it’s cable, cancel and find other sources of entertainment. You may find that canceling is better than negotiating down the bill! (which is what those services fear the most)

If you want it back, just sign up again on the new customer promotions. Those are always good offers and always available.

Pay Someone to Fight For You

Does this seem like too much work? Or too much work right now?

There are a lot of companies that will fight on your behalf and you only have to pay them if they win. Do a quick google search to find the one that will do it for you and for your specific situation.

Do it yourself, pay someone a success fee to do it, it doesn’t really matter – as long as you negotiate, you save money!

Cox won’t let you sign up as a new customer for 90 days after you cancel. Since they are a monopoly in my city, and the mountains block the over-the-air broadcast signals, we’re stuck.

That stinks… I suppose you have to play the retention game with several CSRs and hope you get lucky or live without them for 3 months?

Something to shoot for… my son got mail from Sirius XM with an offer of three years of service for $99 with no reactivation fee. I’m guessing it’s the “mostly music” plan, but it does say “music, live sports, comedy and talk.”

On my first call, they told me MY radio was not eligible for the offer (?)… I’m going back in again today!