CIT Bank is an online bank that offers a full suite of deposit products – checking, savings, money market, and certificates of deposit (CDs). They are a no-fee bank that offers some of the highest interest rates available on savings products, as well as some of the most innovative CDs from any bank.

They were acquired by First-Citizens Bank & Trust Company in a merger with the merger completed on January 4th, 2022 but still operate as CIT Bank.

This is an online bank that, and like every bank we review, is covered by FDIC insurance (FDIC #11063) of up to $250,000 per depositor. While they don’t offer credit cards, auto loans, or even IRA accounts, but it does have a full range of mortgage products, as well as small business financing programs.

Continuing reading this CIT Bank review of their eChecking product, a high yield money market, multiple savings accounts, and several high-yield CD products. Each of these products are available for custodial accounts. Note that interest on all deposit products is paid daily and credited monthly:

It’s important to note that in early 2022, CIT Bank because a division of First Citizens Bank through a merger. So far, nothing has changed (from what I can see anyway) with the operations of CIT Bank.

Table of Contents

CIT eChecking

This checking account has a $100 minimum and pays out 0.10% APY on balances under $25,000 and just 0.25% APY on balances with over $25,000.

CIT Bank is one of the few online banks that doesn’t work with an ATM network but you get reimbursed $15 in ATM fees charged by other banks each month. It’s “mostly fee-free” with no monthly fees.

CIT Bank Money Market

This account is currently paying a rate of 1.55% APY on all balances and requires just $100 to open. The account comes with PeoplePay, a free service that allows you to send money to just about anyone with an email address or a mobile phone number.

This money market account is one of the best money market accounts you can get because you earn the interest rate regardless of your balance. Most money market accounts require you to meet a minimum balance before they will pay you the high rate. This account only requires you to open it with $100 and then you earn the best rate possible.

CIT Bank Savings Connect

This is their standard savings account product and it pays a rate of 4.65% APY on all balances. The minimum to open the account is $100 and there are no fees to maintain it.

If you open a CIT Bank account and are deciding between the different “savings” accounts – you want the Savings Connect. I’m not sure the purpose behind Savings Builder, with the two tiers (and the higher tier paying a low interest rate).

CIT Bank Savings Builder

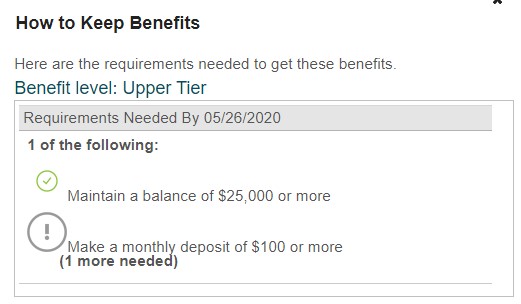

This is their most well-known account – it’s a savings account with a tier boost. The base savings builder interest rate is 1.00% APY with a $100 minimum to open. If your daily balance is under $25,000, you earn 0.40% APY.

If your daily balance is under $25,000 and you have a monthly deposit of $100 or more, you earn 1.00% APY.

If you have a daily balance above $25,000, you also earn 1.00% APY. These rates are as of 3/15/2023.

CIT Bank CDs

Term CDs. Requires a minimum initial deposit of $1,000, with terms running from 6 months to five years.

Rates are tiered, based on the term of the certificate:

| Term of CD | Interest Rate |

|---|---|

| 6 Months | 5.00% APY |

| 12 Months | 0.30% APY |

| 18 Months | 4.60% APY |

| 36 Months | 0.40% APY |

| 60 Months | 0.50% APY |

No-Penalty CD. This is an 11-Month CD, currently paying up to 4.90% APY on all balances, with a minimum opening deposit of $1,000. The major feature of this CD is that you can withdraw funds penalty-free, any time after the first six days after the start of the certificate. That includes both partial and total withdrawals.

Jumbo CDs. These CDs require a minimum investment of $100,000 and offer rates based on the term, anywhere from two to five years.

CIT Bank – Pros and Cons

Pros

CIT Bank pays some of the highest interest rates available, even compared to most online banks. They pay those interest rates along with no-fee banking. They also provide innovative, high yield CDs. These include the No-Penalty CD, which allows penalty-free withdrawals after just six days, and the RampUP CD that allows you to make a one-time upward rate adjustment if rates increase after you open the certificate.

CIT Bank is a no-fee bank platform. That includes savings and money market accounts, as well as CDs.

Fees that may apply under certain circumstances include:

- Outgoing wire transfers for accounts with an average daily balance of less than $25,000: $10 per transfer

- Money market account overdraft fee: $25

- Money market account excessive transactions fee (more than 6 withdrawals per statement cycle): $10 per transaction, subject to a monthly cap of $50

- Money market account Bill Pay (which is currently unavailable) stop payment: $30 per check

Early Withdrawal Penalties on CDs are as follows:

- Terms up to 1 year – 3 months interest on the amount withdrawn

- Terms more than 1 year up to 3 years – 6 months interest on the amount withdrawn

- Terms more than 3 years – 12 months interest on the amount withdrawn

Customer service is available 24 hours a day, seven days per week for both Online Banking and Mobile Banking by email or by Automated Telephone Banking.

Live phone contact is available (855-462-2652) during the following days and times (all times Eastern):

- Monday through Friday: 8:00 AM to 9:00 PM

- Saturday: 9:00 AM to 5:00 PM

- Sunday: 11:00 AM to 4:00 PM

Cons

CIT Bank does not offer other products like credit cards or auto loans. And despite paying very high-interest rates, they’re currently not offering IRA accounts. What’s more, account access for withdrawals is very limited. Since they don’t work with an ATM network, you’re stuck paying fees beyond the $15 reimbursement per statement cycle. There are no local branches available, but that’s typical for online banks.

My Experience

Opening an account was super easy and very fast. They’ve streamlined that part of the process so that you can do everything online and without any headaches.

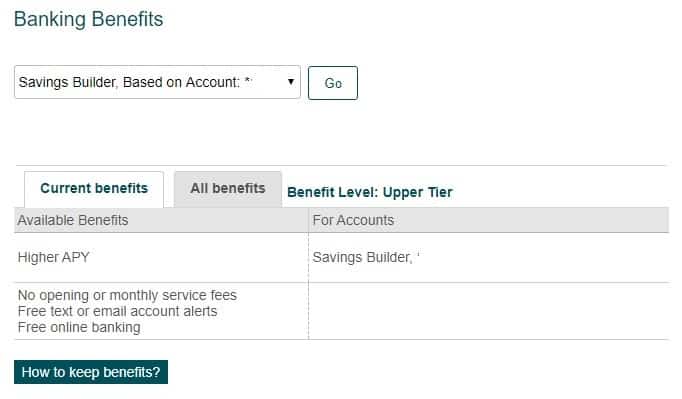

The rest of the online banking experience is what you’d expect, it has everything you could need in an online bank. One nice feature is that since the account pays higher interest for higher balances, sometimes it’s not clear what tier you’re in. Fortunately, CIT Bank will tell you under benefits:

Plus how to keep those benefits:

This is great because then you don’t have to go searching to see what you need to do to maintain the benefits you’ve grown accustomed to!

CIT Bank is a pure, online, no-fee bank that provides some of the very highest yielding savings products available with any bank. And high-yield accounts are available with initial deposits as low as $100. Since it doesn’t offer traditional banking services like credit cards and auto loans, it’s best used for its primary purpose only – a high yield online savings bank.

If you’d like more information, visit the CIT Bank website.

The interest rate on accounts that maintain over $25,000 is incorrect here. It is actually 2.45 APY.

Thanks Alan! We’ve made sure to update this.