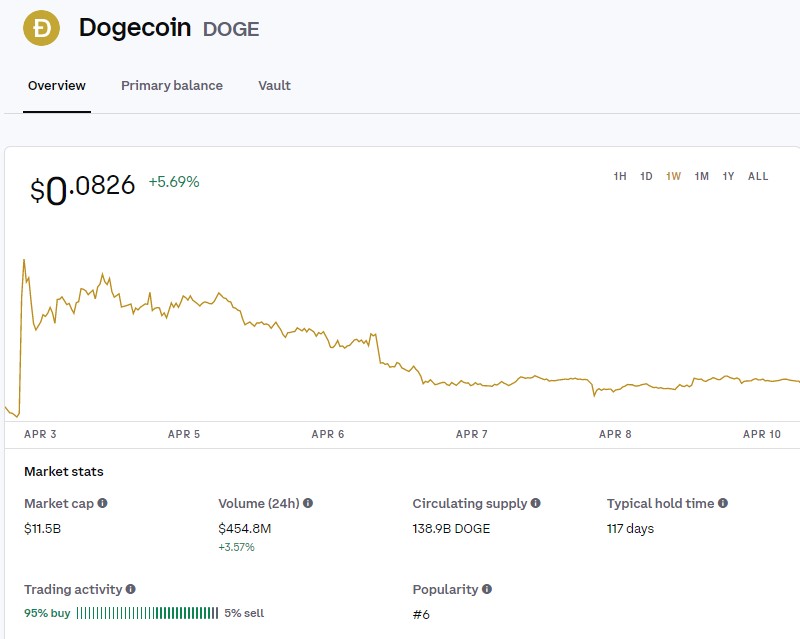

Dogecoin started as a joke but with a market cap of $11.5 billion (yes, billion), it’s no longer a joke.

The price of each Dogecoin may be small, under 10 cents as of this writing, the market cap (and volume, which was around $450 million in the last 24 hours, means it’s a coin that’s seen a lot of activity.

If you’re interested in buying some Dogecoin, one of the best places to do so is eToro especially since they have a small bonus for new accounts.

(another place is Coinbase, where you can spin a wheel to get $3 – $200 after you make your first purchase)

Table of Contents

How to Buy Dogecoin on eToro

Buying Dogecoin is really easy on eToro, plus you get a bonus for opening an account.

- Create an account by going to eToro and clicking on the black Join eToro button

- Create an account, which includes uploading your ID and proof of address

- Fund your account

- Then, find DOGE (the ticker name for Dogecoin) on your dashboard and buy!

👉 Open a free account on eToro

1. Create a New Account

Creating a new account is really easy, you just need to click on the black Join eToro button and start entering all the typical information you’d expect to enter for an investment account.

Here’s our review of eToro in case you were curious about the brokerage overall.

2. Upload ID & Proof of Address

eToro will require you to upload a photo of your ID, anything government-issued will suffice. This is part of KYC (Know Your Customer) laws and typical of investment accounts these days, it’s to prevent money laundering and other illegal activity. You can use your driver’s license, passport, or another state issued ID for this. If you use a license or state-issued ID, then they have your proof of address too.

It will take a bit of time for them to review your photo before you can proceed.

3. Fund Your Account

Once approved, you can fund your account with at least $10 in a variety of methods including credit and debit cards, PayPal, Neteller, or a bank wire.

4. Purchase Dogecoin

There’s a search bar at the top where you can type in DOGE or dogecoin, select it and you can click Trade to buy it. Note that there is a 1% fee and you can set your purchase amount in dollars, it’ll just give you fractional coins if necessary.

Selling Dogecoin on eToro

Selling Dogecoin on eToro is pretty easy too, just open up a new order and click Sell at the tom. Enter the amount you wish to sell – done!

There are a few limitations with eToro when it comes to cryptocurrencies. You can’t trade coin to coin, so you can’t buy Bitcoin with Dogecoin. You have to liquidate one into cash before you can buy into another coin.

You can transfer your coins out of your eToro account to a digital wallet but it’s one way. Select the coin you want and send it to your digital wallet’s address. You can’t send coins to your eToro account though, so once it is out, it’s out of the eToro ecosystem.

Should You Buy Dogecoin?

Personally, I’m not. I think cryptocurrency is too volatile an asset for me but I know plenty of people who have ridden its massive ups and down, even with coins that started off as a joke like Dogecoin.

If it’s for you and you want to know how to do so on eToro, I hope this quick guide helped!