eToro

eToro was one of the first platforms for trading cryptocurrencies and has millions of users from over 140 countries. With its powerfully simple and user-friendly interface, it’s grown to become more than just an app to trade cryptocurrencies – it’s built up a thriving community where users get to engage, connect, and learn from one another.

It’s absolutely free to create an account, and you can dip your toe in by playing with a $100,000 virtual portfolio before putting in your own money. You can also use their CopyTrader technology that lets you mimic, in real-time, what popular traders are doing.

Since it’s free, you can sign up and test drive all aspects of the platform.

Table of Contents

What is eToro?

Founded in 2007, eToro claims to be the #1 social trading platform for cryptocurrencies. It has more than 15 million users worldwide, operating in 140 countries around the world.

The company operates internationally but has its US headquarters in Hoboken New Jersey. But it actually has three international offices located in Cyprus, London and Tel Aviv. The platform started out offering currencies and stock trading, but added cryptocurrencies in 2017. They began servicing the US market in 2018.

eToro operates as a diversified trading platform outside the US. You can trade stocks on foreign exchanges as well as currencies – in addition to cryptocurrencies. But for the time being, only cryptocurrency trading is available in the US.

The company has a Better Business Bureau rating of “B+” on a scale of A+ to F and 4.3 stars on Trustpilot. It also has a rating of 4.2 stars out of five by more than 41,000 users on Google Play and 4.2 stars out of five on The US iTunes App Store, based on 5.2K ratings.

How eToro Works

CopyTrader Technology

eToro puts a unique spin on trading with CopyTrader, a platform that lets you replicate trades made by top-performing traders. There are no additional fees for copying other traders, and the copy minimum is only $200.

The CopyTrader process is simple:

- View the public profiles of top-performing traders, and choose the one you wish to copy. You can filter your search by performance, assets, risk score, etc.

- Decide on the amount you want to copy (minimum is $200).

- Select “Copy” to instantly replicate their trades.

And just in case you’re feeling a little guilty over copying the work of top traders on the platform, know that those traders get paid directly under the Popular Investor Program.

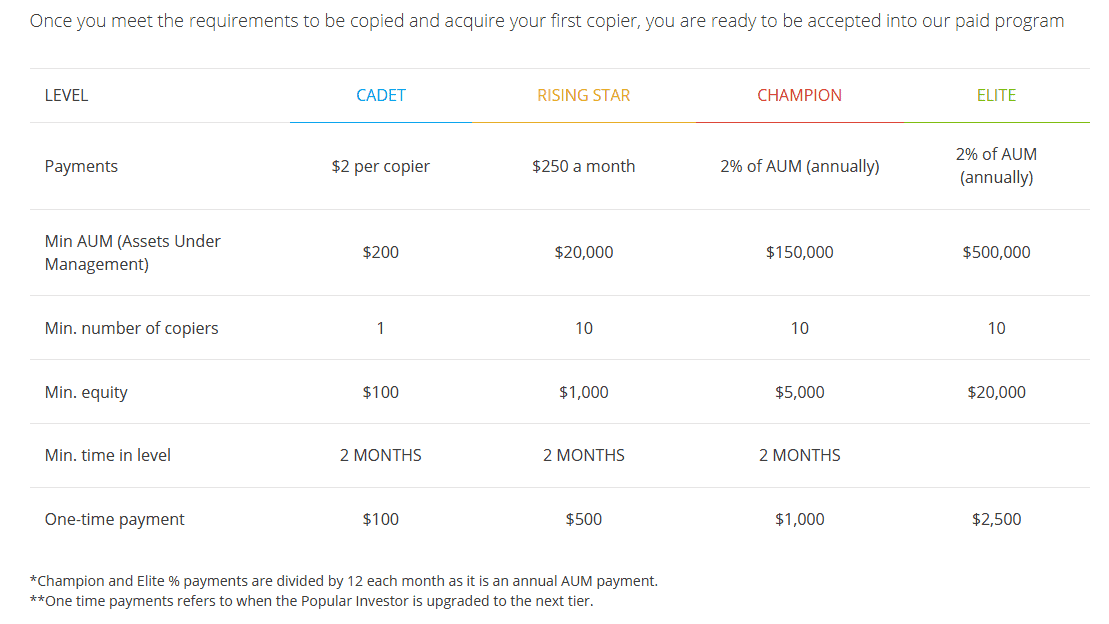

Once you become familiar with trading cryptos on the platform, you can become part of the Popular Investor program and earn income while others copy your trades. It’s an opportunity to earn extra income every month as well as to be featured prominently as a leader in the eToro community.

You’ll earn a fixed payment for each copier, as well as bonuses for moving up in rank. And naturally, the more people copy your trades, the higher your income will be.

The income hierarchy for the Popular Investor Program is as follows:

Virtual Portfolio

Like many large investment brokerage firms, eToro enables you to “paper trade” before you go live and risk real money. You’ll have access to a virtual portfolio of $100,000 to practice your investment strategies and learn how the platform works without risking your own money.

eToro USA LLC; Investments are subject to market risk, including the possible loss of principal.

eToro Wallet

In the cryptocurrency universe, a digital wallet is necessary to securely store your crypto. You can transfer your crypto from the trading platform to your digital wallet, as well as both send and receive crypto to and from other wallets. You can also use the wallet to convert one crypto to another.

Though you can always use an external digital wallet, there are obvious benefits to taking advantage of the same service with the platform where you trade crypto. You’ll have a wallet immediately available for easy transfers from the trading platform and also avoid the fees of having a separate wallet with a third-party provider.

There are no fees to send or receive transactions to and from the wallet. However, blockchain fees apply to all transactions.

Unfortunately, it’s not possible to send crypto back to the trading platform from the wallet.

Smart Portfolios

eToro offers Smart Portfolios, which are collections of securities handpicked by the eToro Investment Team using a predetermined investment strategy. Investors benefit from professional research and a low minimum investment amount of $500.

Here is a sampling of the available Smart Portfolios, along with the industry sectors represented in each investment:

- Renewable Energy: Tech/Manufacturing/Utilities

- Auto Industry: Manufacturing/Durable Goods

- Cancer-Med: Medical Technology

- AsianDragons: Tech/Financial Services/Durable Goods

eToro Features and Benefits

| Feature | Description |

|---|---|

| Minimum initial investment | $10, but you will need a minimum of $25 per trade. |

| Acceptable payment methods | Deposits through online banking or wire transfers only. |

| External payments | Cannot be made through the eToro account itself, but can be made through the eToro Wallet. |

| Availability | In addition to being available in 140 countries, eToro is available in 44 US states and the District of Columbia. The nine states where it is not yet available include: Delaware, Hawaii, Louisiana, Minnesota, Nevada, New Hampshire, New York, North Carolina, and Tennessee. |

| eToro Mobile App | Available on Google Play for Android devices 5.0 and up, and on The App Store for iOS devices, 10.0 or later. It’s compatible with iPhone, iPad, and iPod touch. |

| Customer service | Available only through the app. No phone contact is offered. You can open a ticket with a response time of up to 7 days or use live chat (available 24 hours a day, Monday to Friday) |

| FDIC Insurance | Funds held at eToro USA are fully FDIC insured. The funds in the account are held in an FDIC insured custodial account, which will be insured for up to $250,000 per depositor. This insurance coverage is available only to US residents. It covers your cash on deposit only, not the value of your cryptocurrency holdings. |

eToro USA LLC; Investments are subject to market risk, including the possible loss of principal.

eToro Supported Cryptocurrencies

As of 9/24/2022, eToro supports trading in 78 coins including:

- Bitcoin (BTC)

- Bitcoin Cash (BCH)

- Ethereum (ETH)

- Ethereum Classic (ETC)

- Ripple (XRP)

- Dash (DASH)

- Dogecoin (DOGE)

- Litecoin (LTC)

- Cronos (CRO)

- Stellar (XLM)

eToro Pricing and Fees

eToro offers a transparent pricing structure with low fees. There are no fees to open an account, no management fees, and no commission on stocks. Here’s a breakdown of the most common fees:

Stocks & ETFs: No commission fees (FX are charged for non-USD deposits and withdrawals.)

Crypto: 1% fee is added to the market price for all cryptocurrency transactions.

General Fees: Free deposits, $5 account withdrawal fee, $10 inactivity fee (12 months with no account login)

CopyTrader & Smart Portfolios: No management fees or commission, no hidden fees.

eToro Pros & Cons

Pros:

- No experience needed – you can learn the ropes by literally copying the trades of other investors on the platform through the CopyTrader program.

- You can open an account with just $50 and begin placing trades with as little as $25 each.

- You can earn additional income – over and above your trading profits – by becoming part of the Popular Investor Program.

- The app can be used to trade several different cryptocurrencies.

- The refer a friend program provides an opportunity to earn a $50 bonus for each referral who opens an account with at least $100.

- If you are a U.S. resident, FDIC insurance is provided on all cash deposits up to $250,000.

Cons:

- Cryptocurrency held in your account cannot be used to make external payments. However, those payments can be made through the eToro Wallet.

- Once a crypto has been transferred into the eToro Wallet it cannot be transferred back to your trading account.

- Not available in six US states.

- Customer service is available in-app only; there is no phone contact available.

- Though eToro offers trading in stocks and currencies outside the US, trading is limited to cryptocurrencies in the US.

Should You Invest with eToro?

One of the challenges of adding crypto to your investment portfolio is having to trade on multiple platforms. eToro solves this problem by allowing you to buy and sell crypto alongside stocks and ETFs. We like the straightforward pricing and no-commission stock trades, while the social trading capability of CopyTrader, and eToro’s Smart Portfolios are unique features that aren’t available on other platforms.

Unless you live in one of the six-US states not served by eToro, consider placing it on your shortlist of online brokers to consider.

eToro USA LLC; Investments are subject to market risk, including the possible loss of principal.