For years, cash management accounts were a popular addition to many fintech services.

It was nice to be able to offer a higher APY on your savings, available through partner banks, and layer those on top of whatever services you were selling. Whether it was paying off debt, increasing your savings, or building wealth through investing – cash management seemed like the next hot thing.

But when a brokerage adds it to its offering, I’m always a little surprised because when you’re a brokerage, there are options available to you that you wouldn’t get through a saving or budgeting app.

There are completely safe investing options, like federal money markets, that offer higher yields without the need for the brokerage to build new infrastructure.

But I’m a fan of Vanguard, an existing client, and so when I learned about their offer — the Vanguard Cash Plus Account — I wanted to learn more.

📓 Quick Summary: The Vanguard Cash Plus Account was a pilot program and not available to everyone, the pilot has now ended so you can’t open one up now. It is a cash management account that offered a 4.70% APY yield, which is lower than many high yield savings accounts. It’s an OK offer from Vanguard but you can’t write checks, you don’t get a debit, it’s just a place to store your money.

Table of Contents

What is the Vanguard Cash Plus Account?

The Vanguard Cash Plus Account is a cash management account similar to what is offered by firms like Betterment. They sweep your cash into Program Banks, which is how you get FDIC insurance, and you earn interest on your savings.

You get to use it similar to a checking account in that you get a routing number and account number. This lets you link it for direct deposits, transfers, and you can use apps like PayPal, Venmo and Cash App.

There is no check writing privileges and you do not get a debit card. This is typical for a cash management account.

There are no fees (if you elect for e-delivery of documents, otherwise $20 a year), no minimum balance, and you get $1.25 million in FDIC coverage ($2.5 million for joint accounts) – plus a yield of 4.70% APY.

It is currently in a “pilot” stage, meaning not everyone is eligible to open it because they’re testing it’s capabilities. They plan to expand who is eligible, so it’s not a program that they are simply testing and might go away. On the website, they state “While this is a pilot, the Vanguard Cash Plus Account is here to stay as an important part of our portfolio of offerings.”

Who are Vanguard’s Partner Banks?

They provide this list of partner banks:

- Valley National Bank

- Bank of Baroda

- First Foundation

- Citibank, N.A.

- NexBank

- Synchrony Bank

- American Express

- Synovus Bank

- The Huntinton National Bank

- Truist Bank

- State Street Bank and Trust Company (coming soon)

- HSBC Bank USA, N.A. (coming soon)

You can opt out of specific banks by calling 800-242-7455 – which is a nice touch!

I Am Not Eligible (Yet)

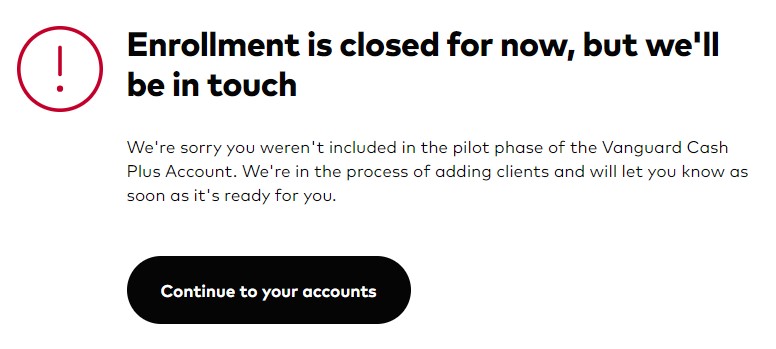

Sadly, I was not eligible.

I don’t know how they decide who is eligible but when I logged in, I saw this:

I checked a couple weeks later and it looks like the pilot has ended:

Vanguard Cash Plus Pros & Cons

Pros

- It offers a competitive APY, though you can find higher yields on savings accounts

- Cash is accessible via a routing and account number

- No minimums and no fees when you opt for e-delivery of statements

Cons

- You don’t get a debit card

- You can’t write checks

How Does This Compare?

Cash management accounts are always tricky to compare with others because they live in a weird spot between different deposit accounts. The main appeal is that they offer high yields while still being linked to whatever fintech that offers it, so you’re able to hold some of your money as cash without transferring it out of the service.

In this case, it’s a brokerage.

Brokerages have existing offers for cash and Vanguard’s settlement fund is a really attractive offer already. VMFXX is the Vanguard Federal Money Market Fund and this acts as the sweep account on my brokerage accounts – so all cash automatically goes into that fund.

The yield is 5.27% (7-day SEC yield as of 1/12/2024, w/ 0.11% expense ratio). Also, you can get check writing privileges on VMFXX if you wanted it.

If you compare it with Fidelity, they offer a Fidelity Cash Management account with a paltry 2.72% APY as of 1/9/2024. But you get a debit card, which makes it more like a checking account and that yield is pretty good for a checking account. Vanguard Cash Plus is better than Fidelity but slightly worse than VMFXX.

If you look to other companies that have offered cash management accounts, like Betterment or SoFi, they’ve all taken steps to become banks. They no longer offer cash management accounts and instead have gone fully into checking and savings accounts. The ability to access your cash through a card is really appealing.

Vanguard Cash Plus Alternatives

Since it’s just a cash management account with an 4.70% APY, it’s just a more restrictive high yield cash-equivalent account.

You’re better off opening a high yield savings account because they are offering greater yields. And with those accounts, you can even open certificates of deposit at those same banks to squeeze even greater yields.

Vanguard’s Cash Plus Account falls into the “nice to have” bucket but not something I need in my life right now.