I remember the first time I saw the American Express Centurion Card.

Matte black and heavier than any other card – it looked amazing.

My friend did a lot of online advertising, to the tune of six figures a month, and the “American Express Black Card” (no one called it the Centurion card!) suited his spending. When you spend that much, there aren’t too many cards that will happily process six-figure charges each month!

We were in San Diego at the time and people were joking about flying to Las Vegas just for the evening. He called up the concierge number and learned that he and twelve friends could fly out of a small private airstrip for the low low price of $17,000 (or somewhere about that). There was never any risk of us actually going but I was a little surprised to learn it wasn’t as expensive as I thought it would be.

I suppose that’s the benefit of having one of the world’s most exclusive credit cards!

The Black AMEX isn’t even the most exclusive card in the world – there are a LOT of these types of cards and some of them seem pretty boring except for a high price tag. Some of the cards on this list are no longer available but who cares? The fun is in seeing what they were. 🙂

Table of Contents

- 1. Dubai First Royale Mastercard

- 2. The Coutts Silk Card

- 3. Sberbank Visa Infinite Gold Card

- 4. Eurasian Diamond Visa Infinite Card

- 5. Merrill Lynch Octave Black Card

- 6. JP Morgan Reserve Card

- 7. American Express Centurion Credit Card – Black Card

- 8. Citigroup Black Chairman Card

- 9. Stratus Rewards Visa Card

- 10. Mastercard Gold Card

- 11. Chase Sapphire Reserve

- 12. Chase Ink Business Preferred Card

- 13. DBS Insignia Visa Signature Card

- 14. Citi Ultima

- 15. Hilton Honors American Express Aspire Credit Card

- 16. U.S. Bank Altitude Reserve

- Summary

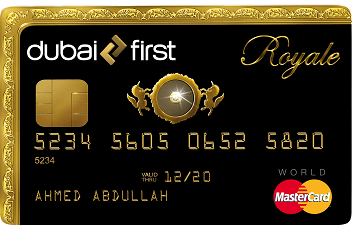

1. Dubai First Royale Mastercard

The Dubai First Royale Card has a freaking .235 carat diamond embedded in the center of the card. Forget black, forget metal, this baby has a DIAMOND. Oh, and it’s trimmed in gold.

Invitation only, this card is for high net worth individuals and supposedly you need to be a resident of the United Arab Emirates (don’t quote us on that one, details aren’t exactly publicly available for peons like us!).

Card Benefits:

- No credit limit

- Dedicated relationship manager

- Lifestyle manager that – it’s rumored – can get you anything you want (Super Bowl tickets? Easy as pie)

- No other benefit details provided, but we can only imagine…

Expect a $2,000 initiation fee and an annual fee “available upon request” – and since we haven’t been invited, we can’t say.

2. The Coutts Silk Card

TheCoutts Silk Card is a charge card that is issued by Coutts Bank, a UK private banking and wealth management firm. There is no annual fee but you’re expected to spend at least high five figures each year.

There is no interest, because it’s a charge card, and it comes with some sexy benefits.

Card Benefits:

- 0% non-sterling transaction fees

- Generous cash rewards (up to 25%!) for purchases with select merchants, including Barneys New York, Bloomingdale, Brooks Bros., Hilton, and Uber

- 24/7 concierge service (in 20 different languages)

- Gifts of luxury food and wine, getaways and private tours as your spending increases

- Access to over 700 VIP lounges in over 300 airports around the world via LoungeKey

You don’t need to be a VIP to access airport lounges for free – here’s how.

3. Sberbank Visa Infinite Gold Card

The Kazakhstan-based Sberbank Visa Infinite Gold Card makes the express “pure gold” a reality. This card consists of pure gold, has 26 diamonds and mother of pearl inlay. Here’s the catch, you must have Kazakhstan citizenship and Sberbank only issued this card to 100 of its most loyal clients.

When this card first launched in 2012, the lucky recipients also got an iPhone 5 and a Montblanc card case. However, getting this card isn’t free – or even cheap. There is a $100,000 initiation fee of which $65,000 paid the production costs. The other $35,000 goes into an account balance.

Card Benefits:

- $250,000 in life and health insurance

- Airport lounge access

- Travel discounts

- Personal concierge service

Card Pricing: $100,000 initiation fee and $2,000 annual fee.

4. Eurasian Diamond Visa Infinite Card

So, what’s up with Kazakhstan banks and exclusive cards? The Eurasian Bank Diamond Visa Infinite Card has a 0.2 carat diamond encrusted in the center. While it appears this card is no longer available, you could only get an invite to this card from two current cardholders or members of the Eurasian Bank’s management board.

Card Benefits:

- Travel concierge

- Translator services

- Butler services

The annual fee is between $395 and $1,185 depending on your membership status.

5. Merrill Lynch Octave Black Card

Another mysterious invitation-only card, the Merrill Lynch Octave Black Card is no longer available today. This card was available only to Merrill Lynch clients with at least $10 million in assets with the company, plus a few other stiff requirements (I suppose these aren’t that bad if you have ten million in assets!).

Other than the annual fee, this card doesn’t seem all that exciting!

Card Benefits:

- No pre-set credit limit

- 2.5X points on all purchases

- Select airline and private jet discounts

- Premium concierge service

- $350 annual travel credit

Card Pricing: $950 annual fee

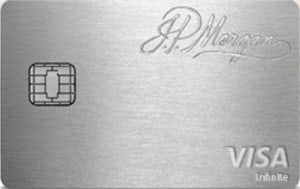

6. JP Morgan Reserve Card

How exclusive is this card? It’s obviously invitation only and it’s assumed you must have at least $10 million with JP Morgan Private Banking to qualify. $10 million seems to be a common sweet spot for these types of cards!

This card used to be called the Chase Palladium and was actually one of the first cards to use smart chip technology. The card is made of gold and palladium plating and weighs about an ounce. There’s something about having some heft and weight to a card that gives it more oompf – double points if it’s gold and palladium! (TIME estimated that the card itself cost about $1,000 to make in 2012).

Card Benefits:

- 100,000 Chase Travel℠ points after spending $4,000 in the first three months

- 3X Chase Travel℠ points on travel and dining, and 1X all other purchases

- No blackout dates or restrictions

- VIP access to events

- $300 annual travel credit

Card Pricing: $595 annual fee. No foreign transaction fees.

7. American Express Centurion Credit Card – Black Card

Another card so exclusive you must be invited to apply. You’ll also have to be a proven high spender – using an American Express card, of course!

Card Benefits:

- 1X membership rewards, 1.5X for purchases over $5,000

- 24/7 personal concierge program

- Elite status with Delta Airlines as well as hotels and rental car companies

- Free in-flight Wifi and a $200 annual travel credit

- No pre-set spending limits

Card Pricing: The initiation fee is $7,500, and that’s followed by an annual fee of $5,000. It’s a card that you pay monthly. There is no foreign transaction fee.

8. Citigroup Black Chairman Card

This card is open only to customers with a Citigroup brokerage account. In fact, this card is so exclusive that little is known about it.

Card Benefits:

- Credit limit up to $300,000

- Travel upgrades

- Access to private airport lounges

- 24 hour concierge service

Card Pricing: $500 annual fee.

9. Stratus Rewards Visa Card

This is another “by invitation only” card (from another card holder). And it targets known high spenders.

Card Benefits:

- Free nights and upgrades at luxury hotels

- 1X for all purchases

- Redeem points for private jet airfare

- Points can be combined with other cardholders

- Other perks this card is too exclusive to reveal to the general public

Card Pricing: $1,500 annual fee.

10. Mastercard Gold Card

How’s this for exclusive – a stainless steel card with 24 carat gold plating?

Card Benefits:

- 2X points on airfare, 1X on other purchases

- 100% points bonus when redeemed for airfare

- Priority Pass Access

- $100 Global Entry fee credit

- $200 annual airline credit

Card Pricing: $995 annual fee, no foreign transaction fee.

11. Chase Sapphire Reserve

Card Benefits:

- 60,000 Ultimate Rewards points after you spend $4,000 in purchases within the first three months

- 5x points on air travel and 10x on hotels and car rentals purchased through Chase Travel℠, 3x points on other travel, 1x on everything else

- Complimentary airport lounge access

- Global Entry/TSA PreCheck credit of up to $100 every four years

- $300 travel credit

Card Pricing: $550 annual fee, no foreign transaction fee.

12. Chase Ink Business Preferred Card

This card seems almost ordinary until you look at the bonus offer.

Card Benefits:

- $300 after you spend $3,000 in the first 3 months from account opening and earn an additional $400 when you spend $6,000 on purchases in the first six months after account opening, redeemable for a princely sum toward travel rewards through Chase Travel℠

- 5% cash back on the first $25,000 spent at office supply stores, internet, cable, and phone services each account anniversary year; 2% cash back on the first $25,000 spent at gas stations and restaurants each account anniversary year; 1% cash back on all other purchases

- Points can be transferred to nine different airline partners, including Southwest and United

Card Pricing: $0 annual fee, no foreign transaction fees.

Compare this card with others.

13. DBS Insignia Visa Signature Card

The DBS Insignia Visa Signature Card is one of Singapore’s most exclusive credit cards. You can receive an invite with a minimum annual income of S$500,000 (+/- $367,640 US dollars) or an account balance of at least S$3 million (+/-$2.2 million US dollars).

You can get a card limit of up to S$1 million, dedicate personal ambassador service, and a host of travel benefits including access to catamaran cruises and the Grand Hyatt Singapore.

Card benefits:

- 100,000 welcome air miles

- 2x miles for overseas purchases

- 1.6x miles for local Singapore purchases

- Priority Pass Select airport lounge access

- Airport Speedpass expedited airport security access throughout Asia

- Special perks at Grand Hyatt Singapore and Damai Spa

- Luxury yacht access

The annual fee is S$3,210 (US$2,360) and no foreign transaction fees or initiation fee.

14. Citi Ultima

Another world-exclusive from Singapore is the Citi Ultima. Citi® is rather secretive on their website about what it takes to get this invite-only card. However, you can “Expect impeccable services delivered with finesse that only connoisseurs of the good life can appreciate” according to Citi.

Online data points indicate you can get the Ultima with an annual income of S$500,000 or have under S$3 million in assets under management at Citi.

Three of the most exciting benefits include getting a free first class flight companion fare, complimentary airport limousine service, and waived green fees at pristine golf courses.

Card benefits:

- 150,000 airline miles upon approval and each card renewal

- Complimentary companion fare when you purchase first class or business class ticket

- Priority Pass Select lounge access

- Complimentary golf course green fees (up to three per year)

- Airport limousine service

- “Buy one night, get one free” at Visa Infinite Luxury Hotel Collection

The annual fee is S$4,160 with no initiation fee.

15. Hilton Honors American Express Aspire Credit Card

The Hilton Honors American Express Aspire Credit Card gives you some of the best hotel and air travel rewards. You get automatic Diamond status which is Hilton Honors highest loyalty tier giving you access to Executive lounges and gifting elite status to your friends.

Card benefits:

- 150,000 Hilton Honors bonus points after spending $4,000 in the first 3 months, worth up to 30 free nights.

- Earn up to 14x Hilton Honors points on purchases

- One free weekend night certificate upon card approval and each card anniversary

- Hilton Honors Diamond status

- $250 Hilton Resort annual statement credit

- Up to $100 Hilton on-property credit at Waldorf Astoria or Conrad properties

- $250 annual airline fee credit

- Priority Pass Select airport lounge access

The annual fee is $450 and there is no foreign transaction fee.

16. U.S. Bank Altitude Reserve

Although the U.S. Bank Altitude Reserve isn’t invite-only, it is one of the most exclusive credit cards as you must have a qualifying U.S. Bank account. The Altitude Reserve benefits are on par with the Chase Sapphire Reserve and American Express Platinum Card. These cards are hard to get yet are the best cards to have while you wait for an invite to a luxury card.

Card benefits:

- Earn 50,000 bonus points by spending $4,500 in the first 90 days, worth $750 in travel

- 5x points on prepaid hotels and car rentals you book in the Altitude Rewards Center

- 3x points on travel and mobile wallet purchases

- 12 complimentary Gogo in-flight wifi passes per year

- Priority Pass Select lounge access

- GroundLink Black Car chauffeur service discounts

The annual fee is $400 and there is no foreign transaction fee.

Summary

The most exclusive credit cards can be as extravagant as the interior of a royal palace. Others make it easier and more rewarding to live the lifestyle of the rich and famous–even when you’re not a Forbes list.