I graduated from college with ~$35,000 in student loans.

I was lucky because they were subsidized Stafford loans. My servicer was the oddly named ACS Education Services… ACS stood for Affiliated Computer Services. I got interest rate breaks for direct debit and electronic statements, both of which are common even today, and didn’t have too many problems with them.

They were not being serviced by Fedloan – which has developed quite a reputation.

Unfortunately, if you want to take advantage of the Public Service Loan Forgiveness Program (PSLF), FedLoan is the only game in town. The PSLF, in sort, is when you enter full-time public service employment for a qualified employer and make 120 qualifying monthly payments (10 years). After that time, your direct Federal loans are forgiven (loans made under the Direct Loan Program). It was created under the College Cost Reduction and Access Act of 2007.

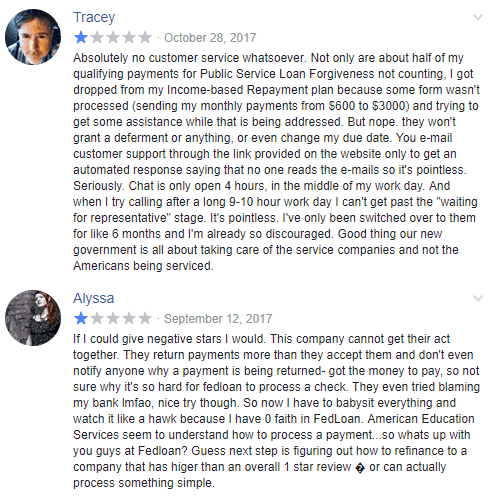

When I emailed readers about their experiences with student loans, one name and the word “nightmare” kept coming up. Fedloan.

My friend Travis is a Student Loan Planner and he’s created over a thousand custom student loan plans that will have you out of debt faster than you can imagine. He knows all the different programs, how they work together, and what you need to do to take advantage of them.

His average client saves a projected $59,000 over the life of their loans. If you want to find out more and see if a plan might help you, check out his service.

Table of Contents

Who is FedLoan Servicing?

A little background… Fedloan is a student loan servicer. A student loan servicer is a company that collects loan payments and, if necessary, help borrowers sign up for repayment plans set up by the Department of Education. This includes income-based repayment plans (IBR plans), income-contingent repayment plans, the PSLF Program, as well as others.

The Pennsylvania Higher Education Assistance Agency (PHEAA) is FedLoan Servicing’s parent company. Another name you might also see is Amerian Education Services, which is also owned by PHEAA and they manage private loans as well as those under the Federal Family Education Loan Program. These two companies service the most federal student loans in the United States.

FedLoan wasn’t always the only game in town for federal student loans. The Department of Education decided in early 2017 that they would move from nine different servicers to just one. Yep, you gussed it – FedLoan. The DOE estimated that it would save $130 million over five years, though it’s inclear how much borrowers will see in savings given the increase in volume of student loans, payments, and administrative burden.

Common FedLoan Servicing Problems

When I asked readers, they all had similar stories – “If you’re just making the regular payments and never miss any, never want to pay more, and don’t want to talk to someone… FedLoan is great!” If you want to do more than that, like making an extra payment to principal, good luck.”

In other words, if you have to actually deal with any student loan servicing issues… you will be dealing with servicing issues.

So, here are some of the common FedLoan servicing problems and how to avoid them:

Forced Switch for Public Service Loan Forgiveness

If you apply for the Public Service Loan Forgiveness program, you are forced over to FedLoan Servicing from whatever servicer you were previously using. One of our readers was a little surprised by this because they didn’t realize that only FedLoan handled the PSLF (this is a more recent development, as you expect, Fedloan news isn’t on anyone’s list of high priority items!).

The trouble with this is that with no other student loan servicer for PSLF, you’re stuck with FedLoan. If you want to enter the PSLF, FedLoan is the only game in town.

If you aren’t doing PSLF, make sure you compare rates and check out the latest student loan refi cashback offers from the top refinance banks.

Direct Debit Takes Two Billing Cycles

If you set up a direct debit, expect it to take two billing cycles before it goes into effect. For those two billing cycles, you need to manually make payments and stay on top of the payments to Fedloan to avoid any type of credit issues.

This is a common complaint and one that makes a little bit of sense, direct debit isn’t instantaneous but FedLoan doesn’t seem to make it easier to confirm these issues. Also, whenever the amount changes (such as for IDR), you need to redo the entire process again.

One reader told me – “When your taxable income changes (as mine did after we had a child) I had to start over again with direct debit. Even though I had just done it a year earlier. Add on that my wife also is in the same programs, also direct debit, and twice a year I am potentially sending in new forms just to pay them and get the .25% reduction of interest rate.”

Recertifying Income Takes A Long Time

Another reader is on the Income-Driven Repayment Plan and each year he needs to recertify his income. “What I like about FedLoan is that they have a dedicated paperwork upload system where I can upload my paperwork online so no need to fax or physically mail any documents. They process the information I send to them usually within a couple days and send an email about the status of my uploaded paperwork. Emails for all my questions have usually been answered or at least responded to within a few days. The paperwork for the PSLF takes a little longer, maybe a couple months but once it is processed, they send a hardcopy letter and an email stating all the information about my current status within the PSLF program.”

While the process has improved, Fedloan has an abysmal response time. One reader told me they sent the forms in April and only heard back in late August. It’s been like that for years.

It’s gotten so bad, the Massachusetts Attorney General Maura Healey sued FedLoan Servicing (technically, they sued the Pennsylvania Higher Education Assistance Agency)!

They allege:

- “PHEAA’s [Fedloan’s parent company] servicing failures have harmed Massachusetts student borrowers, depriving them of months that should have counted toward their loan forgiveness, causing them to lose financial grants and further saddling them with debt”

- <“In addition, PHEAA has made it more difficult for student borrowers to manage their debt by overcharging them and misprocessing their applications for Income Driven Repayment (“IDR”) plans that make borrowers’ monthly payments more affordable.”/li>

So keep that in mind!

Clarify Extra Payments

If you make extra payments but do not specify which loans your payments are meant for, they will spread it across all of your loans. If you make a payment on one loan and do not specify, it will be applied to the next payment. If you paid more than your regular payment, the next regular payment will not be debited.

If you are on an Income-Driven Plan, you can’t make payments ahead of your IDR anniversary or recertification date. Any payment overage at that date is applied to the loan itself, not a future bill. These are key distinctions to remember because you may want your payment applied to your student loan different.

Contact Customer Service

Don’t use email – the best way to get an answer is to hop on the phone:

- US Toll-free number: 1-800-699-2908

- International number: 717-720-1985

They’re open Monday through Friday from 8 AM to 9 PM Eastern.

If you want to email, you will need to log in to use their secure email system. I recommend calling and talking to someone on the phone though.

Do Not Trust Their Advice

I think it’s safe to say that the customer service representatives you talk to at any company, Fedloan or otherwise, are rarely going to be the folks you want to take financial advice from. It’s not their job to know the intricacies of student loans, student loan options, and all the vagaries of debt and forgiveness. I’d expect them to be experts in their own systems, being able to apply payments properly and navigating the menus of their own computer systems.

A few of the stories I’ve heard involved folks being put on plans they shouldn’t have been on. It’s hard to give financial guidance and even harder when you don’t have a complete picture. Do not trust the FedLoan customer service reps if they give you advice or steer you in a certain direction – they’re not necessarily qualified to give that advice. They’re not being purposely deceptive and they’re not trying to trick you, they can’t possibly know the full picture.

Your Turn

Did you have an experience with Fedloan that you wanted to share? Are they like this laundry list of nightmares and student loan problems? I’d love to hear it and others would too!

I am (and was) basically ignorant about student loans, but back in 2010 when I was 60 years old, I decided to complete my AA degree (don’t ask). I got 3 Stafford loans to do so. I completed the first semester with flying colors, but then I had a big interruption in my life when a friend with two foster children had to move in with my husband and me. I decided I couldn’t handle the school work with all the uproar in our home. I was 2 days late in deciding to drop the courses. I asked for forgiveness… Read more »

i have been with fedloan for about 6 months and i have no complain about the services received, very nice customer service.

Just found this piece after searching ‘Fedloan never came out’ since I just got an email from them saying I’d missed my payment that was due January 12th. I logged in and made that payment on January 5th! Each month in my planner, by my note reminding me when it’s due, I check it off and write down the date I pay it. Usually when I get confirmation pages after making online payments anywhere, I don’t bother to print them, but I sure wish I had this time! It makes me feel better to know that I’m not just losing… Read more »

Wow, so when did they apply the payment? After the 12th even though you made it on the 5th? The 5th is a Friday, they can’t even claim it was a weekend.

I qualify for the PSLF program and was able to enter it with relative ease. The payment plan I was put on was one listed for the PSLF program. A few years went by and I started getting a random email every few months saying that the plan I had been paying on wasn’t one that worked with the PSLF program. I would log on and very plainly it would say at the top of the screen, it was an eligible plan. Not being sure if I was receiving a phishing email, as it didn’t line up with what their… Read more »

I entered the PSLF with ICR with FedLoan a couple of years ago. I’m less than 2 years away from meeting the forgiveness possibility. I received in the mail a letter stating that I needed to recertify or my payment would remain the same. It also stated that I HAVE to recertify once a year, so I did so. What a huge mistake! Now my payment has more than doubled! I’ve called them a couple of times. First time was advised to do the paperwork again and use a pay stub for proof of income, which I did. It was… Read more »

Wait so they mailed you a letter about recertifying and then told you that you shouldn’t have? That makes no sense whatsoever. Did you try to escalate it and what happened?

Apparently, they don’t process payments on weekends on holidays. So even though our direct deposit went through the day before my husband’s bill was due, since it was on a weekend, his loan was listed as being in “Default” on the website the following week.

That was last month. I checked back today, and now his loans are apparently in “Forbearance” for no reason I can ascertain. I’ve never had this many issues with other student loan companies (and, sadly, I’ve dealt with several).

I switched to this company after wanting to access the PSLF program. After spending nearly an entire year trying to get certified and my payment plan changed, I actually decided the hassle wasn’t worth it an accessed a state bank to consolidate my student loan debt. Now I have one remaining loan with them because the interest rate was so low. I am now in a position to pay that off earlier than anticipated. I made a $430 extra payment to my loan and when I looked at it, they applied $3.73 to a loan that has been classified as… Read more »

6 years with Mohela on properly consolidated loans, under qualifying employers, and in qualifying payment plans – but no running count of the number of PSLF payments made. So I submitted a PSLF form and was auto-switched to FedLoan in July 2017. FedLoan started processing my payments 2 months later, but has yet to give me a count of qualifying payments towards PSLF and it is April 2018! They have certified that my employers qualify but keep telling me that nothing “pre-conversion” counts. So 7 years in, each bill I receive notifying me of an auto-payment to FedLoan says that… Read more »

I attended undergrad from 2009-2013, taking advantage of both unsub and subsidized Stafford loans, totaling approx. $25,000 borrowed over my 4 years of study. I had made payments on the accrued interest while I was in school (based on the quarterly statements I received) and in September of 2012, I made a payment of approximately $7500 (that I had saved while working 2 jobs during school) to reduce the astronomical interest that accrues. In December of 2012, I received a statement from Myfedloan that was quite perplexing- it showed that I had a balance of $25,000 and no record of… Read more »

I have been with Fed Loans for the PSLF since 2013. I have worked full-time except for 6 months. It is now 2018, so 5 years since I have started these qualifying payments. I got off of the phone yesterday and they told me that I only have 27 qualifying payments. I asked how that can be in 5 years and they kept saying oh well these two months they were in forbarence and looking into renewing your income contingent plan. They had BS reasons why most of my payments were not qualifying and I kept recertifying my employment! This… Read more »