In 1949, a man by the name of Frank X. McNamara was enjoying a meal with his clients when, as the bill arrived, he realized he’d left his wallet in another suit.

Yikes.

That embarrassing situation led him to an idea – why should people be tied to cash? Why not offer a way for people to pay for purchases based on what they could afford, rather than the cash they had on them?

That idea, and $1.5 million in funding, would form the basis of Diners Club, the very first charge card.

What started as a convenience has now become a powerful financial tool.

Back then, the appeal of not having to carry cash everywhere was enough.

Now credit cards pile on the perks to get your business. You have everything from reward points and cashback to zero liability to concierge services. If you travel a lot, you know which cards offer you free international currency conversions too. And, if you’re a true pro, you’ll know that a lot of cards provide rental car insurance (waivers) too.

But there’s more. Oh boy, there’s a lot more.

What if I told you that your card might have something known as Return Protection – if a merchant refuses to let you return an item within 60-90 days, your credit card will refund the purchase. Some cards also have a Price Drop Protection – if you find the price of a purchase has gone down in 30-90 days, your credit card will refund you the difference. This, and many more, are now standard on many credit cards.

If you thought reward points and zero liability were something, just wait to you check out this list.

Here’s how to read the lists below. We have card issuers (Citi) and card processors (like VISA, MasterCard). Card processors will list benefits that most of the cards they process will carry, but it will depend on the issuer as for the details.

For example, if you have a Citi card, it’ll be a Visa or Mastercard. To find out what the benefit is, you should check your Citi cardholder benefits to get the full details. Sometimes they will differ and the issuer’s (Citi’s) policy takes precedence.

Table of Contents

1. Extended Warranty

Most of the Extended Warranty benefits work the same – up to an additional year of the manufacturer’s written warranty as long as you purchase the product entirely with that card. In most cases, you need to keep the original receipt, your credit card receipt, and the warranty details. There are also product exceptions and that list varies by card, but most (reasonable) things are covered (for example, computer software is not covered).

- VISA: Warranty Manager Service with Extended Warranty Protection – You must register the purchase with the manager (free). If your warranty is for less than 1 year, VISA doubles the warranty. If it’s for 1 to 3 years, VISA adds one year.

- Citi: Extended Warranty adds up to 24 months of coverage on all qualifying purchases.

- American Express: Extended Warranty will add an extra year of warranty for warranties of five years or less. Coverage will be up to the amount charged to the card for the item, up to $10,000 and not more than $50,000 per Cardmember per year.

- Discover: No policy found, check your card to see if it’s included.

- Mastercard: Extended Warranty extends manufacturers warrany up to one year, specifics will depend on the card issuer.

2. Return Protection

Buy something and then decide you hate it and want to return it… but the store won’t take it?

Your card probably offers a version of “Return Protection.”

- VISA: Return Protection will let you get a refund on an item within 90 days of purchase. Limit of $300 per item, VISA Infinite cards only.

- Citi: No policy found, check your card to see if it’s included.

- American Express: Return Protection lets you get a refund on items you purchase entirely with an AMEX card, in like new condition, and the merchant won’t take it back. Purchase must also be made in the United States. Limit is $300 per item and $1,000 per card per year.

- Discover: No policy found, check your card to see if it’s included.

- Mastercard: Satisfaction guarantee will let you refund the cost of a purchase within 60 days if the store won’t accept your return, up to $250 per item. Specifics will depend on the card issuer.

The limits won’t work on something like a diamond engagement ring, but for most purchases it’s nice they have your back!

3. Theft, Damage & Loss Protection

Did you buy something and then immediately drop it? It happens… and your card could have your back.

Most cards call it some version of “purchase protection,” but I labeled the section this way to explain what it covers – if you mess up and break the thing you bought.

Some cards also protect you in the event you lose the item, but that’s rarer. Usually it only covers damage and the policy will first try to repair it, before replacing it.

- VISA & VISA Signature: Purchase Security will replace, repair, or reimburse you up to $10,000 within the first 90 days of purchase in the event of theft or damage. VISA Infinite cards only. Limit of $50,000 per year per card. If the item is stolen, you must file a police report within two days.

- Citi: Damage & Theft Purchase Protection will cover you if an item you purchase is damaged or stolen within 120 days of purchase (90 day limit for New York residents).

- American Express: Purchase Protection will cover you, up to the amount charged to the card, for up to 90 days from purchase if the item is stolen or accidentally damaged. Some cards offer coverage if the item is lost. Limits exist but vary based on the card. You must file a claim to qualify, and produce receipts or a police report if stolen.

- Discover: No policy found, check your card to see if it’s included.

- Mastercard: Purchase Assurance protects your items for 90 days, specifics will depend on the card issuer.

4. Price Protection

Price drop? Get a refund of the difference. You will usually have to keep a copy of your receipt and proof that the item is available for less.

If your card offers it, consider yourself lucky.

Of the protections listed in this article, Price Protection is the rarest.

- VISA: No policy found, check your card to see if it’s included.

- American Express: No policy found.

- Discover: They removed their policy in 2018

- Mastercard: Price Protection reimburses the cost difference if an item decreases in price within 60 days.

5. Travel Protection

Credits cards love travel-related protections and insurance because they’re the most useful and memorable. Auto rental collision damage waiver (we often call it “insurance” but it’s actually a waiver) is the most popular but lost luggage, roadside assistance, and trip cancellation are very common as well. Some, like American Express, also provide Flight Accident Insurance in the event you die while traveling. (yikes)

Before you go on your next trip, review your travel protections in case you need them. Hopefully you don’t!

- VISA: Travel benefits include auto rental collision damage waiver, lost luggage reimbursement, roadside dispatch, travel and emergency assistance service, and travel accident insurance.

- Citi: Car rental insurance, Trip Cancellation & Interruption Protection, Roadside Assistance is available but not free, and Travel & Emergency Assistance is available but again not free.

- American Express: Car Rental Loss and Damage Insurance, Baggage Insurance Plan protects you if your luggage is misplaced on a Common Carrier, and Roadside Assistance will get you help if you’re stranded but you pay the third-party costs. Oh, and Travel Accident Insurance.

- Mastercard: The laundry list includes lost/delayed baggage, trip cancellation and delays and Travel Accident & Medical.

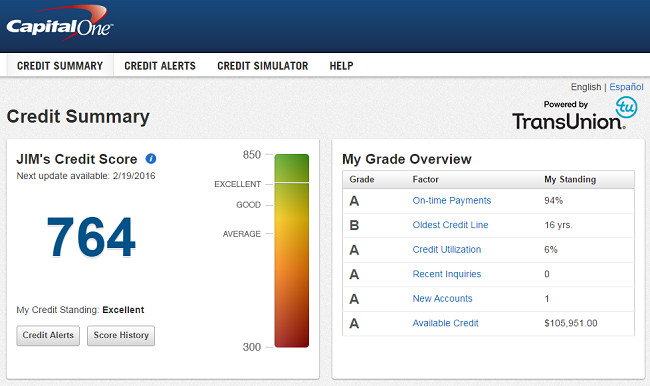

6. Free FICO Credit Score

Back in the day, we had to sign up for myFICO or a similar paid service to see our FICO score. I remember jumping through hoops, signing up for a myFICO trial, seeing my score, then cancelling it. Thankfully, they made it easy to cancel 100% online! (no pesky phone call)

Now, many credit card companies give it to you for free with data supplied from one of the credit report bureaus.

- Capital One: based on TransUnion credit report (learn more)

- Citi: based on your Equifax credit report

- Discover: based on your TransUnion credit report

- US Bank: based on Experian credit report

7. Dissatisfied?

Finally, if you are ever dissatisfied with the “quality of goods or services received,” the Fair Credit Billing Act gives you the right to “sue or assert defenses” against the credit company if you can’t get it solved by the merchant. The rule says you have to make a good faith attempt to get it resolved before going to the credit company.

There are a few restrictions – the purchase must be more than $50 and the purchase must have been made in your home state or within 100 miles of your home address. If the creditor is affiliated with the merchant, these restrictions don’t apply.

Remember these perks because knowledge reigns supreme over nearly everyone.

How’s that for a perk you probably didn’t know about?

Jim, Lots of good stuff in here. I’ve been a Capital One customer for years and didn’t know about the free FICO score. I also wasn’t aware of return or price protection on cards. Credit card companies are often spoken about in a negative light. But used wisely, they really add a lot of value to your financial life. And they take care of you. I’ve had multiple fraudulent charge attempts on my card (someone buying McDonald’s meals in Singapore), and the card company didn’t hesitate to refund my money and issue a new card. It’s a hassle, but at… Read more »

Thanks RBD!

Credit cards are such a powerful tool and the folks who use them responsibly get to reap the rewards.

Okay, what?! This is amazing. I genuinely didn’t know about half of these (so apparently the credit card company schemes are working!) Going to bookmark this for future knowledge and pass it along as well. Keep spreading the wisdom, Jim!

Damage protection has saved many a friend’s iPad… 🙂