If it feels like the rich play by a different set of rules, it’s because they do.

I recently learned about the concept of “Buy, Borrow, Die” and it’s fascinating. I’m not an expert on estate planning or taxes or am I rich enough to do this (yet!), but it highlights how different parts of tax law can come together to something (likely) unintended.

As far as I can tell, the origin of this framework (or at least the fun name) comes from Professor Edward McCaffery of the University of Southern California Gould School of Law. It’s outlined on his site People’s Tax Page on Tax Planning 101: Buy, Borrow, Die.

This strategy has three parts – buy, borrow, and die.

If you need to create an estate plan, consider Trust & Will. They can help you set up an estate plan that’s a fraction of the cost of hiring a lawyer to help you draw up a will. It’s certainly worth a look if you haven’t set this up already.

There are also several free online will makers you can use instead.

Table of Contents

1. Buy

First, you buy something.

You have a big slug of money and you want to invest it in appreciating assets so you can retire forever. It’s also important that those appreciating assets do so tax-free (or more accurately, tax-deferred).

You’ll want to put this money into the stock market, real estate, or another asset class that appreciates. Buying a car would be a bad idea for this because the value of a car goes down over time. It’s also better if you pick an asset class that enjoys the tailwind of inflation pushing up its nominal value.

Real estate is almost perfect for this because:

- its value tends to go up,

- it is not volatile

- you can depreciate it, which reduces your income tax

- it’s easily accepted as collateral.

And the collateral is important for the second step. You want to pick an asset that can be used as collateral for a loan. Investing in your friend’s business is bad for this. Investing in your own business would be better, but not as good as real estate.

A bank may not want to use your business as collateral but they’ll all take real estate.

2. Borrow

Next, you borrow against your asset.

Typically, if you are asset rich and cash poor, you might sell some of your assets for cash to live. When you do, it triggers capital gains.

To avoid this, you don’t sell your assets to get cash. Instead, get a loan from the bank with your assets as collateral. By keeping the assets as they are, where they keep growing value, you don’t trigger a taxable event. You still get cash, it’s just a loan.

The best part about this is that when you get a loan, it’s not considered income. Since you’re borrowing against an asset, you’ve received cash in hand but you are also holding a loan that you must repay.

Use some of the proceeds of the loan to make the loan payments.

This is NOT a 401(k) Loan

If this sounds a little like taking a loan from your 401(k), it’s not the same. When you take a loan from your 401(k), you’re reducing the value of the account by the amount of the loan. You pay interest to yourself, which is kind of nice, but you miss out on any gains (or losses) that occur when the money is out of your 401(k).

We avoid any capital gains taxes because of the 401(k)’s tax-deferred status.

With the Buy Borrow Die strategy, your assets are used as collateral and never touched. It can continue to appreciate.

You get your cake and eat it too! (though you have to carve off a little slice to the bank as interest – so there’s no free lunch)

3. Die

Every good plan requires a good exit strategy and this one relies on the ultimate exit strategy – death.

You die.

When you die, your estate goes to your heirs. The loans are paid off with the assets and then the assets get a step-up in (cost) basis when they pass to your heirs. When your beneficiaries get those assets, their current cost basis in that asset is the current market price (at the time of your death). That step-up can save your heirs a ton in taxes.

For example, if I bought shares of Apple for $15 in 2011 and I died today (with it priced at ~$172), my beneficiaries get the step-up in cost basis. If they sell those shares today at $172 each, they will pay no capital gains tax because they had no gains. (They may have to pay estate taxes as a result of getting those shares.)

The strategy works because of the step up in cost basis of the asset. I paid $15 per share and if I sold it, I’d owe taxes on the gains. Because they got the shares after I died, they “paid” the higher price and if they sold it that day, they owe $0 because they had no gains.

What about the loan? You pay it off with the proceeds of the sale. Easy peasy.

Is There A Catch?

No catch.

Well, the catch is that your assets have to keep appreciating. And you have to die.

But we all do that so you might as well take advantage of it! (also, that part is in the name so if that comes as a surprise then good luck)

The advantage of this strategy is that when you borrow money from the bank instead of selling an asset for the cash, you pay the bank some interest and the government doesn’t get its capital gains tax. You have to go through a few more hoops because of the loan but it’s not hard to borrow against your stock portfolio. Selling an asset and reporting the sale on your tax return is easy and requires no application – but you pay taxes.

The other consideration is that it might not be the most efficient way of acquiring an asset in the first place. You can typically own real estate by paying a fraction of the cost of buying it. You can get a piece of property for a 20% down payment (sometimes less).

While there is no catch, there are two realities that make this strategy effective:

Low Interest Rates

Since you are borrowing against your assets, you need interest rates on that loan to be relatively low or you’re just paying interest instead of taxes. If you’re reading this in 2022, we’ve experienced some of the lowest interest rates we’ve ever seen in the last decade or so.

If they creep up, it makes this strategy less and less effective. The loans are almost always variable rate loans so if that rate goes up, your costs go up and this is not as appealing as it once was.

Stepped Up Basis

This strategy works so well because of the stepped-up in basis “loophole.” If that didn’t exist, this plan isn’t as effective (but is still helpful from a tax planning perspective). The step-up in basis removes a potentially huge chunk of gains from taxes.

If the step-up in basis were removed, you still benefit a little bit because you still get cash while retaining the asset so it can appreciate. You just have to keep paying the loan’s interest rate in the meantime so you need the asset to appreciate more than the interest rate on the loan. It’s really no different than borrowing money to invest, which is not unheard of, but you’re doing it in a way that avoids capital gains.

💵 U.S. Bank – up to $700

Earn up to $700 when you open a new U.S. Bank Smartly® Checking account and a Standard Savings account and complete qualifying activities. Subject to certain terms and limitations. Offer valid through June 27, 2024. Member FDIC.

Offer may not be available if you live outside of the U.S. Bank footprint or are not an existing client of U.S. Bank or State Farm.

This Isn’t That Crazy of an Idea

If the strategy sounds like a really crazy idea, it isn’t – we actually do this already with our homes.

You buy a home, which is generally an appreciating asset, and you can get a loan against the value of the home (home equity loan). When you go to sell, you can ignore $250,000 of gains as long as it was your primary residence (similar to step-up in basis). If the loan is still outstanding when you sell, you can pay back the home equity loan with the proceeds and it doesn’t impact the cost basis on your home.

Ever refinance the loan on your home after it’s appreciated? Cash out refi? It’s basically this same strategy.

The only thing missing is that you can’t depreciate the value of your home and use it to offset your income. 🙂

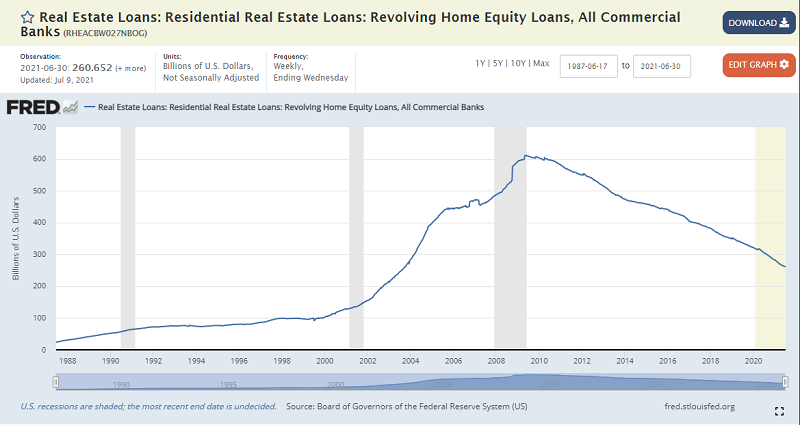

There are over $263 billion revolving home equity loans according to The Federal Reserve (data is from July 9th, 2021):

Home equity loans are simply loans taken out against the equity in your home. Buy Borrow Die is just a riff off this very popular idea.

The only wrinkle is that most people don’t take home equity loans for everyday spending money – they typically do it for major purchases but money is fungible. It doesn’t matter what you use it for.

Want to do this with your stock portfolio? Some, but not all, brokerages offer this. For example, Schwab calls it a Pledged Asset Line.

Now you know the Buy Borrow Die Strategy!

Go impress your friends at the country club. 🙂

I like parts one and two!

Not so excited about part three, but if the step-up in cost basis remains, it’s an important part of the estate planning strategy.

After being debt-free for more than 5 years, I’m contemplating taking out a mortgage. Tough to say No with rates on a 15-year fixed close to 2%.

Cheers!

-PoF

So true… rates are so crazy low right now.

Thank you for sharing this tidbit, quite fascinating how the rich can skirt taxes. Quick question: are estate taxes calculated on the current value of the asset or what what paid for the asset? In your example with Apple stock is it calculated on the $15 or the $120 for estate taxes?

It’s calculated based on the stepped-up basis. In this way there’s no “free” lunch, so to speak. You get the step-up but you pay estate taxes if you’re above the exclusion.

Will this concept work in California? Due to proposition 19 that passed recently, inherited residential properties are reassessed to current market rate values. Before proposition 19, assessment of residential property tax in the event of a transfer to an heir (parents to children or grandparent to grandchildren) was based on the original purchase price of the home. For example, a married couple buys a home in San Francisco in 1975 for $100,000 at 1%.property tax rate. In 2025, that same couple passes on and their children inherit the home. The children are now responsible for the property tax at 1%… Read more »

I am not familiar with California tax law so I’d consult a tax attorney to know for certain… but it sounds like Proposition 19 steps up the basis of the home for property tax reasons? That’s bad only because, I guess, in California the step up wouldn’t happen and the heirs would get super-low property taxes based on the (smaller) basis?

I live in the state of Texas and like the TX tax Free bonds. I graduated from California University of Pennsylvania which is part of the Pennsylvania Higher Education. Cal. U is jokingly called Harvard on the Mon(Monongehela River). I tend to have a great distrust for some of these hungry financial agents who want to make you rich. Ken Fisher sued one of his clients long story but now he claims to be a Fiduciary –Yeah sure. I once got a blog of mine published in Forbes Magazine and I got a letter from Ken’s attorney threatening a suit.… Read more »

I like the Warren Buffet method–If I do Not understand it–I do not invest in it… It saved me from losing big time with the CMO rackets.. I asked the defintion of a TRANCH–They could not tell me what was a tranch.. So I said as I left with my checkbook intact Warren Buffet saved me.

It was the CA real estate market that ruined the Real estate market in Oregon.. The Californians had purchased a home years ago for 25K,, worked for the state and retired with a very nice pension–sold the 25K home in CA for 250 K then move to OR and begin the bidding wars for a much larger newer cheaper home. They ended up driving all real estate prices much higher in the state of OR. People never dreamed real estate could devalue but as a small child in Iowa during the Great Depression–land and farms were devalued to the point… Read more »

Really interesting. I just learned about this myself while researching the rumored increases in capital gains tax rates. A lot of people speculate that if the capital gains tax rates increase, this practice will become even more common than it already is.

Like you said, it’s always crazy to see the unintended consequences when so many different laws come together!

Especially when interest rates are so low!

Or maybe these “unintended” consequences are really “intended”?

Maybe 🙂

I appreciated your article. There are always drawbacks to borrowing. Since I began my working career in Pittsburgh, PA– it was in the late 50’s and it was felt that married women needed. to have no benefits as they were married. My Husband was a combat veteran of the Korean Conflict and he was not well when he returned after serving 2 years in the Army. It seems he had pneumonia several times and was treated and returned to the front lines. It was 40 degrees below zero and they were surviving in below ground bunkers along with the rats… Read more »

You brightened my day Ms.Libra! What a life/financial story! So sorry about your husband and his health issues that you had to witness. But your strength, intelligence and forward and clear thinking through it all is simply amazing. I applaud your strategic planning and you as a person. WOW! I would love to hear your financial story and all the details of each little golden nugget you inserted through out your reply 🙂 What’s truly remarkable is you did all that and gained all that knowledge when everything was manual(no internet or google!)

Theres a danger of these so called tax avoidance schemes or even perceived unfairness to the masses. They go to the voting booth with the intent of “burning the house down” with all of us in it! Now THAT’S unintended consequences!

For real estate asset borrowing, does one need a steady income in order for banks to lend? This strategy may not work for people already in retirement if they do not have income even though the property is there as collateral.

Typically no because your loan is secured by the real estate.

If you have a lot of appreciated assets you borrow against to finance your lifestyle, how are you going to be paying off the loan? Don’t you have to sell some of you are appreciated assets in order to be current on your loan, triggering capital gains taxes?

You don’t spend all of the money at once – so you pay the loan with the loan itself. Let’s say you borrow $25,000 at 5%, that’s a monthly payment of about ~$135.

Got it, thank you. So you just keep on refinancing those outstanding loans based on increased value of assets to maintain this game?

Exactly – that’s why your assets must appreciate otherwise you have to get a job! (or sell the asset)

To be clear, Professor McCaffery was not advocating for this framework and it did not originate from him. Rich people have been doing it for years. The point of Professor McCaffery’s book is that we need a consumption tax because the current tax system does not account for the framework.

I didn’t dig deeper into the origins, or Professor McCaffery’s broader point, but I didn’t mean to imply that Professor McCaffery was an advocate.

Actually does work ..in 2017 I refinanced my hotel from 4 m loan to 7.5 m based only ltv of 60 percent ..I pulled out 2.5 m tax free bought 3 nzd house in New Zealand and bout 800 k house ocean in Cook Islands …and retired Loan 4.65% .. now three yrs later owe 6.8 m on loan .. property now appraises at 13-14 m I hoping refinance at 3.5-4 percent save 8 k month monthly payment . But most importantly with higher appraisal expect pull out another 1-1.5 m tax free . The savings on monthly payment increases… Read more »

Amazing! Thanks for sharing your personal experiences Michael!