Investing in the stock market can be intimidating.

If you've stuck with mutual funds, you've never had to wade into all the different ways to buy and sell shares of stock.

There IS a wrong way to do it and today I hope I can show you the different types of stock orders and which ones you should use.

(If you're new to investing, I suggest you read this guide on how to invest your first $1,000)

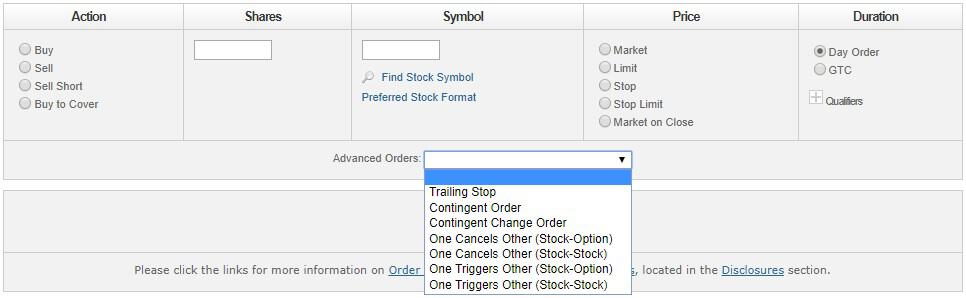

Here's a screenshot of the different types of orders you can put in on Ally Invest, the broker I use.

(if you need a broker, here are the best brokerage promotions available right now)

Market Order

A market order is the simplest. You tell the brokerage that you want X shares of Company A and they go out and buy it from the market.

You get whatever the market price is at the time they fulfill the order.

Almost never do this.

Think of the market as a literal marketplace of people buying and selling oranges. There are people who want to buy and people who want to sell. The sellers aren't all selling at the same price, the buyers aren't all willing to buy at the same price, but they're yelling their numbers out loud and matching up when the price matches.

When you place a market order, you're saying I want X shares at whatever the lowest price might be. What if the market is a little slow and all you have left is a guy with super expensive oranges at 5x the price? You buy it because you told your broker you wanted those stupid oranges… so they buy it.

There are situations where you might want a market order. If you absolutely need to sell the shares and speed is of the essence, the market order is the fastest way. You may get hosed a little on the price, especially if you're unlucky, but you get the best price at that particular moment in the market.

If, say, the market is in free fall, a market order gets your shares sold whereas a limit order may get missed and just sit out there as the market continues to fall. So there is a place for market orders, it's just not something you want to do as your standard practice.

Limit Order

A limit order is when you tell your brokerage that you want X shares of Company A at a specific price, then they go out and buy it from the market.

You get shares at your price or better. On a buy, it's your price or lower. On a sell, it's your price or higher.

Always do a limit order.

You can change your order but setting a price avoids the expensive oranges problem in the above example. You won't get screwed because of a funny situation in the market.

Stop-Loss Order

A stop-loss order, also known as a stop order, is when you tell your broker to buy or sell X shares of Company A when they reach a certain price, the stop price. When the stop order hits the stop price, it becomes a market order.

Since it turns into a market order, you usually want to set a limit and this makes it a Stop Limit Order. This makes it so that when you hit the stop price, it becomes a limit order and not a market order where you are subject to the thrashings of the market.

With a stop-limit order, you set two prices – the stop price and the limit price. They can be the same.

The risk of this is that based on price movements, you could hit the stop price, trigger the conversion of the order, but never execute the purchase or sale because of how the stock price moves. You also run the risk of having a partial fill of the order, so you wanted 100 but the broker was only able to get you 50 shares. If you keep it a market order, you're guaranteed of a transaction but no control over the price.

Trailing Stop Order

A trailing stop order is a stop order that's defined as a percentage or dollar amount away from the stock's current market price. The point of a trailing stop is to lock in profits or limit your potential losses. So you might say that you want to sell the stock if the price ever drops from 10% from a particular point.

If shares of Company A are trading at $50 a share and you set a trailing stop order of 10%, then the broker will sell your shares if they ever drop to $45. The price will move up and down as the market takes its random walk, but the trailing stop order's stop price will only move up to 10% from the high. So if the price goes up to $60, then the stop price will move to $54 (10% down from $60).

Brokers that offer trailing stops are a little harder to find, compared to the other order types on this list, so you'll want to check with your broker to see if they even offer this. Vanguard doesn't (at least from what I can tell).

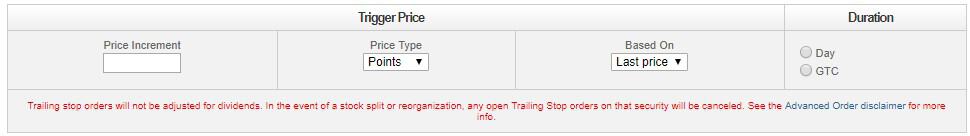

My other broker, Ally Invest, does:

As you can see, you can customize every aspect of the trailing stop order from the price type (points or percentage from the peg) to the increment to how long you want the order active (until you cancel or just the day).

Market-On-Close Order (MOC)

A Market-On-Close Order is a market order but it's executed as close to the end of the market day as possible. Your broker will submit an MOC order close to the end of the day and it'll be filled with the last price transacted at the end of the trading day. There's no target price.

I've never used this type of order myself but the idea behind it is that if you expect some activity after the bell (earnings or some other announcement), an MOC would get you out of a stock before the end of the day.

One-Cancels-the-Other Order (OCO)

A One-Cancels-the-Other Order (OCO) is actually two orders – and if one order executes, the other is canceled.

This is typically used when you see a stock trading in a range and want to make a trade if it goes one way or the other. So you might put in a buy stop order if the price goes above a certain amount and pair it with a sell stop order if it falls below.

For example, if Company A has been trading between $50 and $55, you might put in an OCO order with a buy stop order at, say, $55.50 and a sell stop order at, say, $49.50. If the price goes above $55.50, then the buy stop order is triggered and the sell stop order is canceled. If the price drops below $49.50, then the sell stop order is triggered and the buy stop order is canceled.

Since the original stop loss order has been canceled, you may want to set a new stop loss order to limit your downside risk.

There is a variation of this called a One-Cancel-All Order and that's similarly structured except it's for more than two orders.

Personally, I've stuck with limit orders my entire stock buying career have never had a reason to use some of the others.

Hi Jim, Can you give a little more guidance on choosing the price with a limit order? While i like your rationale here, it misses the unfortunate point of setting your price too low and missing out on a great stock that jumps up in price. As an example, I see the price on Stock A is $72.05, and I think, “Great, I’ll buy it! Company A is a great company that I plan to hold long term and $72.05 is a great price for it.” So I put in my market order for 1 share and my limit order… Read more »

Hi Savannah – there isn’t any guidance, setting a limit price just sets a floor/ceiling (depending on the order) for the transaction. The point is that a market could have you, especially in a thinly traded security, get screwed on price very easily. There’s no way to offer up guidance because the situations are all so different. There are folks who set super high/low orders on the off chance the market things out and their order can get filled by an unsuspecting person who set a market order. Set the price to whatever you wish to pay and don’t try… Read more »