In a recent article, I went over a few of the best travel insurance companies. I also chose World Nomads as our top pick because it offers the most flexibility in terms of coverage for adventure activities, price, and how they aren't just a corporate company, but are run by travelers themselves.

All of these things put together make them an extremely valuable travel insurance company. They have been recommended by various large travel sites such as Nomadic Matt and Lonely Planet. And, if you look up “World Nomads Travel Insurance” in Google, you'll see a ton of other blogs with review articles about them.

So what's the hype all about?

Are they really worth it?

In this article, I'll thoroughly go over the details of World Nomads travel insurance to see if we can answer these questions.

Who is World Nomads?

World Nomads is a travel resource site based in Australia. They have an extensive library of resources from travel insurance plans to comprehensive travel guides on a huge selection of countries.

The site was founded in 2002 by Simon Monk, who felt that the travel insurance industry was overrun with fraud. He knew what travelers really needed and for this reason, he wanted to create his own insurance plans that addressed three concerns: freedom, safety, and connection.

Today, the travel insurance plans have been created by travelers themselves that work for the World Nomads team. They've been carefully crafted to be flexible and convenient for anyone.

Who is World Nomads Travel Insurance For?

There isn't a specific type of person that World Nomads travel insurance is designed for. Anyone can buy it, whether you are travelling with a family, solo, with a friend, or on business.

What's so great about their plans is that they cover basically everything, leaving no room for questions like “Am I covered if I twisted my ankle while skydiving?”

Having said that, there is one type of traveler that would especially benefit from purchasing insurance from World Nomads: The adventurer. I mean, they even have a plan called “The Explorer Plan”. So if you're a traveler looking to partake in some very fun, yet risky activities, World Nomads has likely got you covered, as long as you're not incredibly reckless.

Here are just a few of the craziest high risk activities they cover:

- Canyon swing

- Dog sledding

- Sport shooting

- Bull riding

- Tough mudder

There are so many of these wild activities that I can't list them all here. So check this list out to see the other activities.

World nomads insurance is also good for anyone looking to get medical and travel insurance in one package. They combine the two to protect your health and your trip. With the Explorer Plan, you'll get $100,000 in medical coverage paired with $10,000 in trip cancellation and interruption all at a reasonable price.

Looking to extend your insurance or forgot to purchase beforehand? As travel plans often change, World Nomads allows you to extend your travel insurance. And if you somehow forgot to buy it beforehand or realized during your trip that it would be good to have, you can buy a new plan while you're in the midst of your travels.

I really value this, and I wish I knew about it when I was recently travelling through Mexico. I bought travel and medical insurance for a month, then ended up extending my trip for another month. I wasn't insured for the second month since most travel insurance companies have a policy that it can't be touched once you've already started your travels.

What Are Their Plans?

World Nomads offers two different insurance plans.

The Standard Plan and the Explorer Plan.

As you might imagine, the Explorer plan offers everything that the standard plan offers, just with additional financial and category coverage.

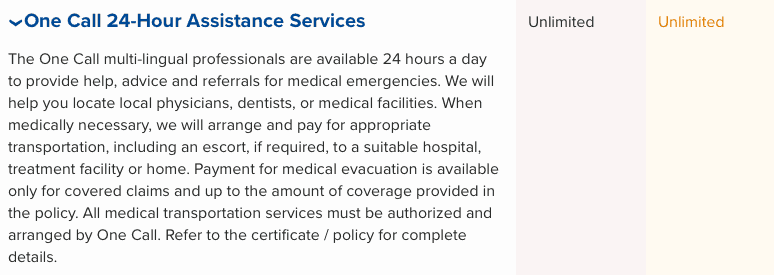

With both plans, you'll have access to a 24 hour worldwide assistance line through One Call Worldwide Travel Services Network in case you need to call and make a claim. You can also make claims online on the World Nomads website. But the assistance line is available for more than just making claims. You can also ask for help with emergency cash transfers, weather reports, travel document replacement, interpretation services, and legal assistance.

Let's dive into what the plans cover and some pricing details.

The Standard Plan

This plan is as straightforward as it gets. They cover all the travel insurance necessities (Emergency medical, trip delay, evacuation, etc.). And this is all at a reasonable price.

For example, if I were to travel to Mexico for 2 weeks it would cost me $71.53 USD. That calculates to $5.10 USD per day.

And generally speaking, if you're still wanting to do some risky activities, the Standard Plan can still cover you depending on what they are. It covers activities like bushwalking, canoeing, and deep sea fishing. If you aren't sure if the activity you want to do is covered, check this list.

The Explorer Plan

The Explorer Plan covers the same categories as the Standard Plan, just with more financial coverage in some categories, more risky activities covered, and it includes a collision damage waiver, which the Standard Plan does not.

The price for the Explorer Plan does go up quite a bit from the Standard Plan. Traveling through Mexico for 2 weeks, you'll pay $127.60 USD. That averages out to $9.11 USD per day. But the amount of coverage you'll receive is worth paying more.

EMERGENCY ACCIDENT & SICKNESS MEDICAL EXPENSE

World Nomads offers some very extensive medical coverage including up to $100,000 in emergency medical expenses. I think this is quite sufficient and in most cases should cover the entire bill. This also includes emergency dental treatment with $750 USD in coverage.

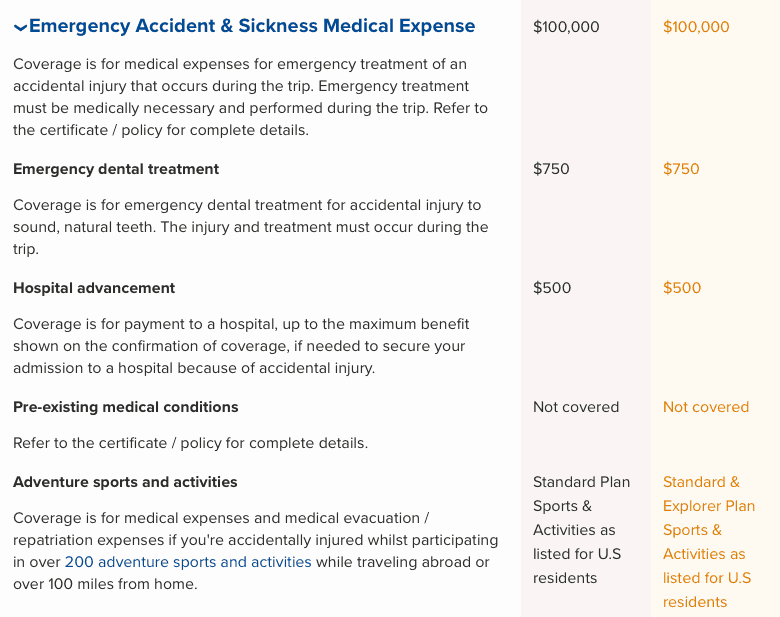

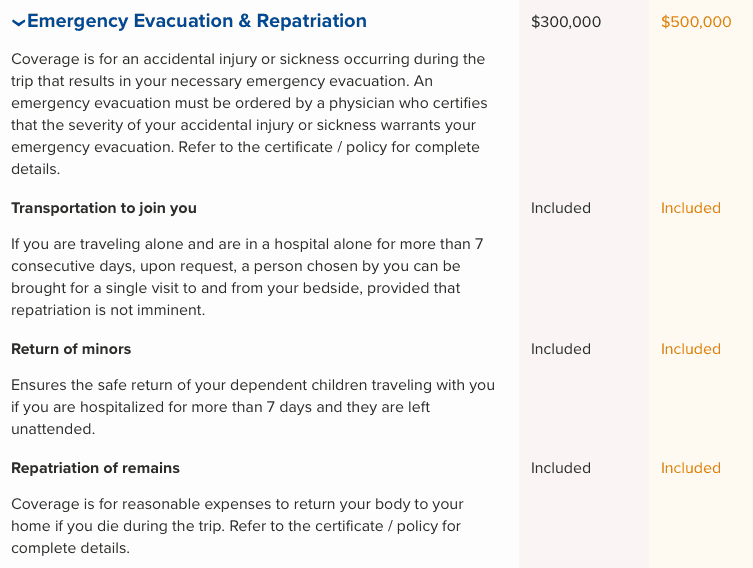

The Standard Plan is displayed in the left column and the Explorer Plan is displayed in the right column.

EMERGENCY EVACUATION & REPATRIATION

If you ever need to be evacuated because you broke your leg while dirt biking or bashed your head on a boat while snorkeling, this kind of coverage is necessary. And let's face it, these kinds of accidents happen all of the time. With the Standard Plan, you'll get $300,000 and with the Explorer Plan, you'll get up to $500,000 USD in coverage.

NON-MEDICAL EMERGENCY EVACUATION

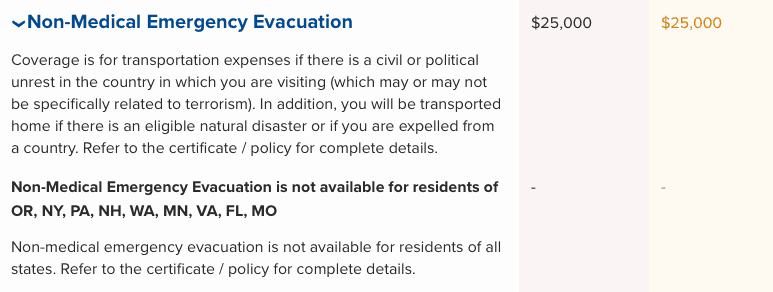

If there was ever a massive hurricane that made the country unliveable, or there was a political or civil situation which made it unsafe for you to remain in the country, you'll get $25,000 USD in coverage to be sent back home. Make sure to check that your state is eligible for this coverage.

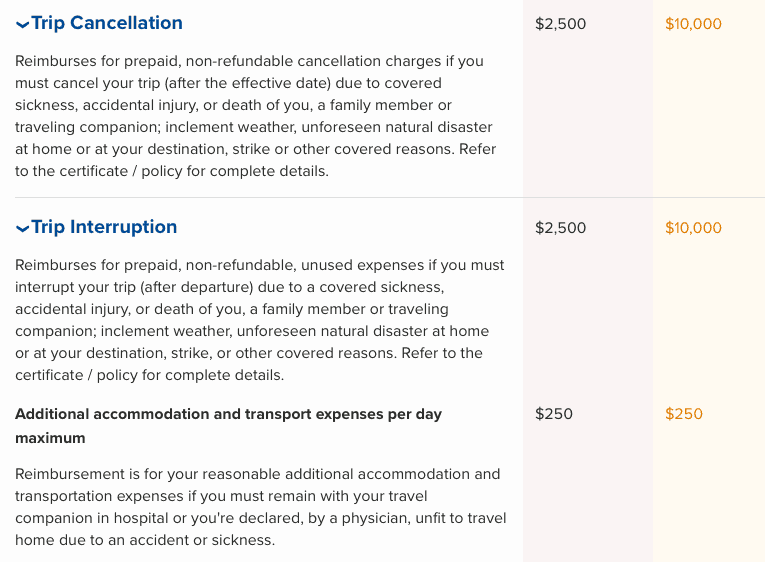

TRIP CANCELLATION & INTERRUPTION

This category of insurance is especially important. You never know when something serious is going to come up at home, like a family member passing away or a devastating flood, causing you to cancel your trip. If you don't have coverage and your trip is non-refundable, that could be a lot of money wasted. And any of these things can also happen while you're travelling. So make sure you're appropriately covered to make it easier on you.

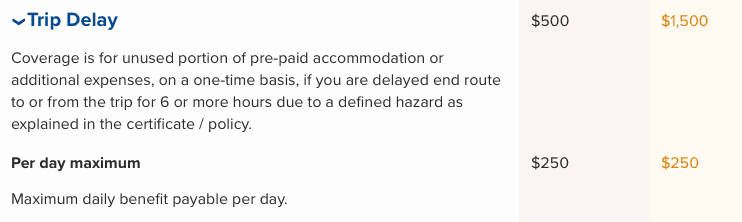

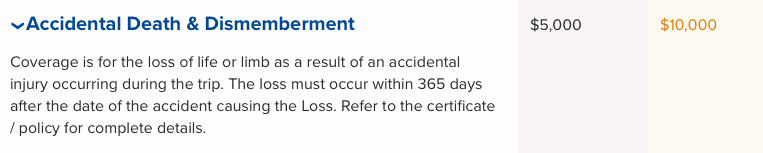

TRIP DELAY

If your flight is ever extremely late and you get stranded at the airport for more than 6 hours, any missed hotel nights or food that you had to buy will be covered. You get up to $250 USD per day and you'll need to submit a written confirmation from the common carrier that there was a delay due to a situation. Here is the certificate/policy they are referring to below.

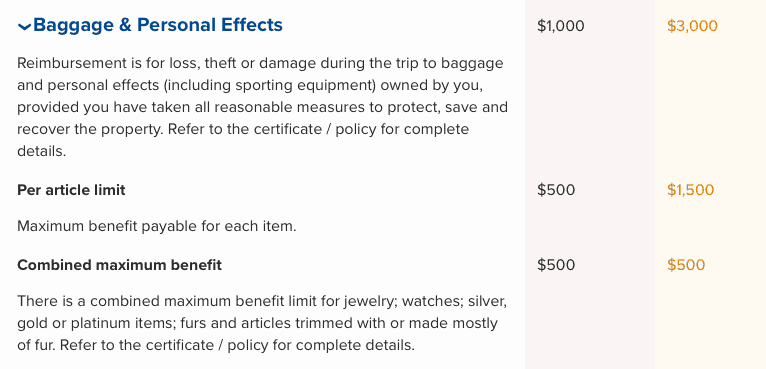

BAGGAGE & PERSONAL EFFECTS

Imagine looking away from your bag for one second, then looking back to see that it's gone. It's a mistake that travelers make all the time. All of your money, cards, and passport have been taken and there's no way you can pull a John Wick to chase the thief down to get it back. In this case, you'll need to contact World Nomads and make a claim. The payable prices are reasonable as they are per item. The only time this may not be enough is if you're carrying around some luxurious jewelry or you've got a ton of camera gear on you. With a $3,000 camera, you'd get it all back.

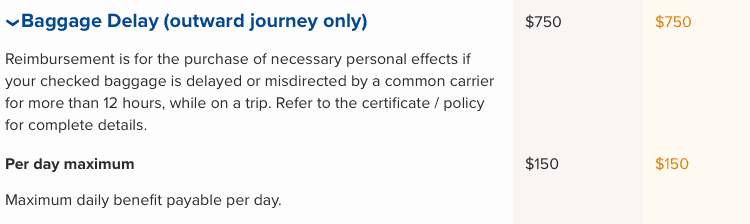

BAGGAGE DELAY

If you've made it to your destination and your bag never makes it on the carousel due to the airline losing it or directing it to the wrong place, you can get $750 USD of what you had in your suitcase. Personally, this wouldn't be enough. I'm usually traveling with all of my camera gear, laptop, lots of outfits, etc. All of those items put together would likely be around $5,000. But it's nice to know I could get a portion of it back.

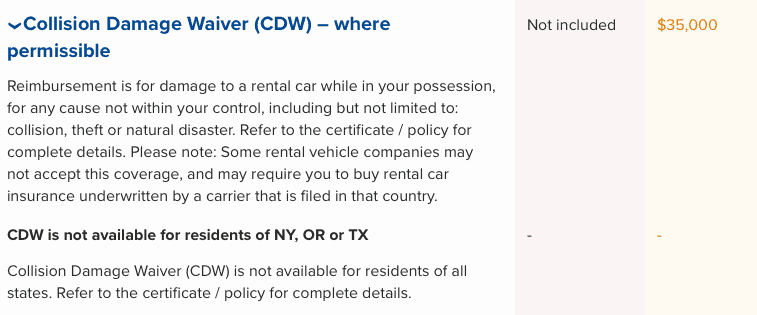

COLLISION DAMAGE WAIVER (WHERE PERMISSIBLE)

Usually if you decide to rent a car, you'll opt to purchase insurance from the car rental company as their insurance policies are more comprehensive and specific. If you're finding their policies to be too expensive, check to see if they accept third party insurance. You might save a bit knowing that you're covered under your travel insurance.

ACCIDENTAL DEATH & DISMEMBERMENT

In case you died or lost a limb during your trip, you'll be covered for the costs associated with handling this. There is quite a large difference in coverage between the two plans, doubling from $5,000 to $10,000.

What is not covered?

There's a fine line between being adventurous, and being reckless. If you're the second one, there's a good chance you won't be covered.

Here's what World Nomads insurance DOES NOT cover:

- Accidents occurred under the influence of drugs or alcohol.

- Pre-existing medical conditions.

- General hospital visits.

- Carelessness in handling your possessions and baggage.

- Theft due to leaving something left in plain sight, unattended.

- Replacement of cash.

- If a civil or political situation has made the country unsafe, but your government hasn't called for an evacuation.

- A few high risk activities including flying as a pilot or crew in an aircraft, free diving, bareback horse riding. See full list here.

Some Other Things to Keep in Mind

Unfortunately, World Nomads does not cover seniors ages 70+. Their Explorer and Standard Plans only cover up to age 69. However, they do partner with Trip Assure to administer insurance for ages 70+. That's definitely something worth considering. There are also companies like Allianz, which covers ages up to 99 years.

The packages they sell are already set in stone. Yes, you can always add more coverage with the difference between the two plans, but you can't build the initial package, or change and choose your coverage amounts. So if you're someone that needs it to be 100% customizable, you may want to look elsewhere. Consider looking at Atlas travel insurance for high customizable plans.

If you're someone who spends time in countries like Iran, Syria, Sudan, North Korea, Cuba or the Crimea region, World Nomad's won't cover you. But they cover over 150 countries, so it's likely that you're destination will be insurable.

Final Thoughts: Is it Worth it?

You might still be asking yourself “Is it really worth it? Why World Nomads and not the other companies?”

To help you answer that question, let's look at what World Nomads does well and where they could do better:

WHAT THEY DO WELL:

- The option to buy/renew once abroad on a user-friendly website.

- Full, comprehensive plans that include both trip and medical insurance.

- An extensive list of high risk activities are included in the coverage.

- No deductible.

- They only look back 90 days for pre-existing medical conditions.

- Support anytime, from anywhere, in any language.

WHERE THEY COULD DO BETTER:

- Not the best option for seniors, as they only cover up to 70 years old.

- The baggage delay coverage of $750 may be inadequate.

- Pre-existing conditions are not covered if they are from before 90 days before your trip.

- It's not customizable.

- The Explorer plan only covers up to $3,000 of lost personal items and $1,500 per item which may not be enough if you've got expensive items like cameras, drones, laptops.

WHY THEM?

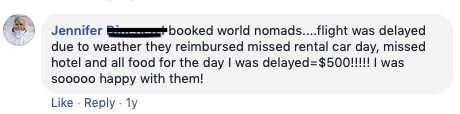

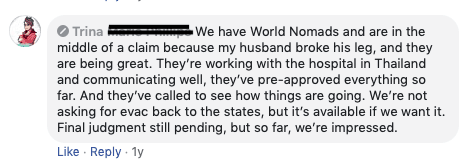

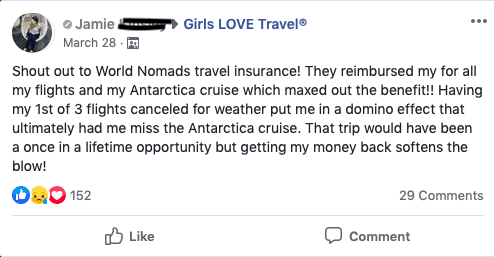

Finally, it's pretty clear that World Nomads is an excellent insurance provider and possibly the best out there. There's a reason why it's so appreciated. Take a look at what some travelers had to say about their experiences with World Nomads:

And it's no mystery that their packages are so great since they are crafted by like-minded, travel addicts just like us. They know exactly what we need and give it to us so we don't have to worry about financial consequences while partaking in something like rock climbing or kayaking. Or worry about not having insurance after extending our trip.

If you're looking for travel insurance for your next trip, get a quote from World Nomads here.

I made a non-covid related claim over 3 weeks ago with World Nomads Insurance, and still haven’t heard anything. No email, no call…. nothing! I cut my hand in Malaysia and have heard nothing after multiple…multiple requests via the website form, [email protected], calling tripmate, etc. etc.. It’s also shameful they don’t cover travel interruptions due to pandemic.