My friend Larry shared a harrowing story with me recently. Someone managed to get access to his Fidelity account and was trying to transfer out his funds!

This wasn't someone getting his credit card and buying something. You're protected in that kind of situation and you're not liable for more than $50 on unauthorized charges (most credit cards won't make you liable for anything). This was his investment account. His retirement account. His savings account. Yikes.

This was a big and scary deal. Fortunately, financial institutions see fishy behavior all the time. The security team at Fidelity saw the suspicious activity, stopped it, and was able to reach him to clear things up. A scary few moments for Larry but this is a very important for the rest of us.

Turn on two factor authentication on your financial accounts.

(In a previous version of this article, I confused the term authentication and authorization. I meant to use authentication.)

What is two-factor authentication?

Two-factor authentication, often shortened to 2FA or TFA, is when you're required to provide another layer of authentication in addition to your password (also, a password manager like 1Password can help too!). There are three main categories of authentication – something you know, something you have, and something you are.

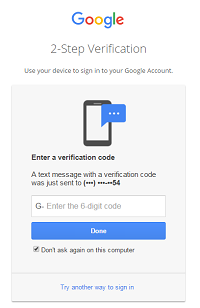

If you use GMail, chances are you are familiar with how it works. When you try to log into your email, do you ever see the screen to the right? That's two factor authentication. They are confirming it's really you trying to access your account. That's 2FA.

At an ATM machine, your ATM card is something you have and your PIN is something you know. Adding a retina scan or fingerprint would be something you are. The “something you are” part, biometrics, is often left out because you can't change it easily if you have to. If the bank stores it and that information is stolen, you can't change something about you as easily as a password or an ATM card. 🙂

Why is this important? One factor authentication is less secure than two factor authentication because … well, two is more than one. 🙂

If you rely only on a username and password, you open yourself up to a lot of risk because that's all someone needs to get access to your account and wreck havoc on your finances. With two factor authentication, in its most common form, you would get a text message with a PIN. When you log in, you have to provide that extra PIN to get access. It's a minor inconvenience for you, it's a major inconvenience for someone looking to break into your account. They would need your phone too.

Is 2FA perfect? No – it's still possible to break into your account but it's made a little bit harder. A little bit harder means thieves might move onto the next account.

Check here to see if your financial institution offers it. Many will offer 2FA with a text message, phone call, or email. If your financial institution offers it, I recommend doing it.

I went through this process the other day with Vanguard and the basic flow will be similar.

Setting up Two-Factor Auth on Vanguard

After checking twofactorauth.org and learning Vanguard offered 2FA, I went to set it up. Very easy.

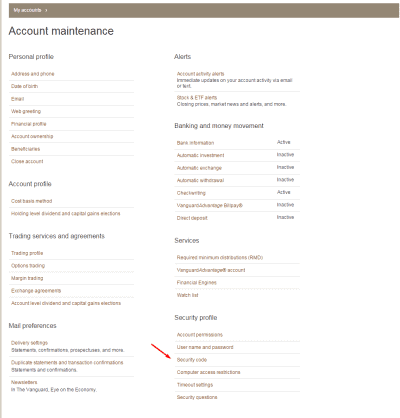

To do it, log into your account and click on the My Accounts drop down in the top menu.

Then click on Security Code in the Security Profile section in the lower right.

You'll be prompted with a sign-up page followed by a Security Code Service Terms and Conditions page.

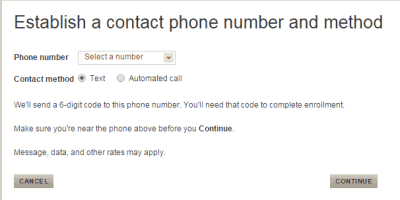

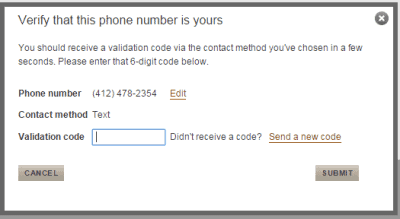

Next, you select your Phone Number and Contact Method (I chose Text).

You'll get a text with the six digit number and ten minutes to enter it before it expires.

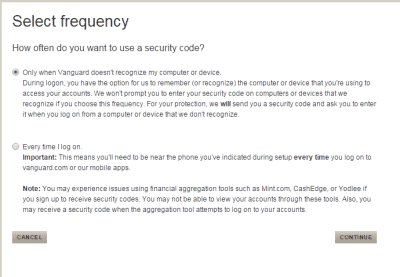

Finally, set the rules for when to use 2FA – your choices are only one new computers or all the time.

I chose only when Vanguard doesn't recognize my computer or device.

There's a big NOTE on there that will have an impact on us – this added security breaks financial aggregators like Mint and Yodlee and I assumed it would break Personal Capital. I just logged in and unless I'm mistaken, Personal Capital was still able to updated as normal. Even if it didn't, it would have been unfortunate but security trumps convenience.

This isn't a perfect solution, there never will be, but it'll be one more layer of security. If nothing else, it's an early warning system too since you'll start getting text messages for login attempts you didn't make!

Remember to “Number Lock” Your Phone Number

Now that you have two-factor authorization, it's important to secure your phone. Many people use their phone for 2FA and thieves know this – so they may try to steal your phone number by porting it without your permission.

Fortunately, there's a simple solution – Number Lock (that's what Verizon, my carrier, calls it). By locking your number, it cannot be ported without you “unlocking” it first.

Here is the Verizon's FAQ answer explaining how it works:

What is a Number Lock?

If a scammer gets your personal information, they could transfer your mobile number to another carrier. This may be referred to as an unauthorized port out. Then, they could get your calls and texts to take control of other accounts, like banking and social media.You can set up a Number Lock for free to protect your mobile number from an unauthorized transfer. Once a lock is set up for a number, that number cannot be ported to another line/carrier unless you remove the lock. You can set up a Number Lock with the My Verizon website and app or by calling Customer Service at *611.

This isn't usually turned on by default, so you'll have to log into your account and turn it on.

Thanks for the tip. I have TFA on a few accounts, but not at Vanguard. That’s my biggest account so I’ll set it up today. Security is paramount. I really hope it doesn’t screw up Personal Capital.

It hasn’t been a problem for me yet…

Hi Jim,

Thanks for the post. Do you think using a financial aggregator that actively links your accounts puts your information at greater risk of being misused or falling into the wrong hands? I have not used one in the past, but was just looking into personal capital because of your post.

It will increase it but I don’t think it increases a lot versus the value of the aggregation. I haven’t heard of a breach yet and companies like Mint have been around for many years. It’s just not valuable enough, thieves are better off trying to steal credit card information.

Yodlee works with many 2FA accounts.

What a scary story–and a great take-away. Thanks for walking us through how to set this up in Vanguard.

You’re welcome! And yes, it’s very scary… glad things didn’t get worse for Larry but this is a great lesson for all of us.

Thanks for the reminder. I’ve been meaning to do this but wasn’t actually sure how to go through the process. I will set these up on my investment accounts today.

Don’t wait! It’s a bigger pain after you’ve been breached. 🙂

That sounds very scary! These days you should have two factor authentication for your email as well.

Yes for sure, your email is often the hub of communication so someone with access to your email would learn a tremendous amount about you.

My credit card number just got stolen a couple days ago, makes me more weary of issues like this. Right now, my online accounts are protected with ridiculously long passwords, but i’ll have to look into 2FA. Thanks

2FA should be standard and required everywhere, the only reason it isn’t is because some people aren’t as good with technology and would have trouble getting a text message or some other verification method. 🙂

I set this up on my of my financial accounts – several after hearing about Larry’s scare. I use long/complex passwords, which also helps, but isn’t infallible.

I also subscribe to identity theft protection. My belief is identity theft is a matter of when, not if. There have been too many data breaches for me to believe my information is safe. That would be naive.

Yeah I was more diligent once I heard Larry’s story, 2fa is a most nowadays.

I’m with you on identity theft, I don’t have the protection (at least paid… it seems every few years some breach gets it to me for free…) but I’m always checking my reports to make sure.

For what it’s worth, the two-step verification on USAA is incompatible with Personal Capital. I’ve worked with tech support and everything, and they just won’t play nice together. But the 2-step works just fine with PC for Vanguard and Ally. Totally with you on this — better to go through an extra step each time for the added security!

Yeah, so far Vanguard hasn’t been an issue and I can always manually track it…

FYI Fidelity I had no issue with Personal Capital. With Betterment I initially had an issue with them, but they were able to get it to work with Fidelity.

The irony is that USAA is an investor in Personal Capital.

Re: SECURITY… Here is my experience with Yodlee/Personal Capital over the last 14 months. My greatest concern is their apparent failure to protect my login credentials. In short: > On 2016-12-12, I removed my credit union from the Personal Capital system because failed attempts by Personal Capital/Yodlee caused me to be locked out of my credit union account. Yes, 14 months ago in 2016. > On 2016-12-15, Yodlee kept trying to access my credit union, I contacted Personal Capital and the logon attempts ceased. > On 2018-02-15, FOURTEEN MONTHS after I deleted the account from Personal Capital, Yodlee again attempted… Read more »