When I first started working, I remember the HR director ask me for a “voided check.”

It sounds silly when I think back on it because the answer is right in the name.

But at the time, it confused me so I asked him – it's just a personal check except I write “VOID” on it. It makes the check unusable.

He wanted it because that's how they would pay me. My paycheck would get direct deposited into that account and they needed the check for that information.

That's just one of the more common reasons why someone would want a voided check but not the only one. If you've been confused about what a voided check is, we'll go through it all in this article.

When Do I Need a Voided Check?

When someone needs your bank information, usually to establish some kind of electronic link to your bank account, they will often request a voided check. If you recall, a personal check contains a tremendous amount of information.

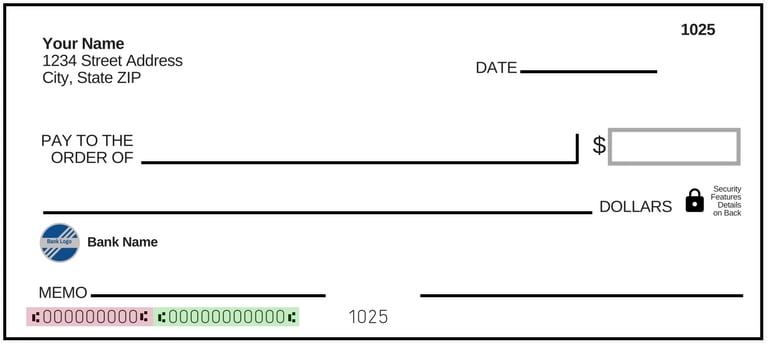

What the person really wants are the two numbers at the bottom, in red and green.

The red highlighted number (nine digits) is your bank's ABA routing number, which identifies your bank.

The green highlighted number is your account number at the bank.

That's what they want and they're asking for a voided check so they can read the number for themselves. If they ask you, the might have to explain what the ABA routing number is, how to find it, and then hope you don't somehow mistype or misspeak the number when you give it to them. They have to do the same with the account number.

A voided check avoids all that and that's why many companies request a voided check.

The most common situation where someone wants a voided check is if they are going to pay you on a regular basis. If you started a new job, someone in the human resources department may want it so they can direct deposit your paycheck. If you are setting up automatic electronic payments, like for rent or a mortgage, they may want a voided check to establish that link.

How Do I Get a Voided Check?

Just get a check, write VOID in black letters on it, and you have a voided check.

Don't worry about messing up, just avoid covering those numbers at the bottom and you're fine. Even if you do, it's still OK if they can read the numbers.

Since the person doesn't actually need the physical check, just the information on it, you can write VOID on a check and take a picture. Send the picture instead of the check and then rip it up. You can also save that picture for use in the future. (if you emailed it, you already have a copy in your email)

If you don't have a personal check, you have a few alternatives:

- Go to your bank and ask for a counter check. A counter check is just a check that the bank prints out for you and will have all the information you need. It also avoids buying a whole book of checks you don't need. Your bank may charge you a fee for this (more on this below).

- If you have pre-printed deposit slips, you could use that too because it contains the same information.

- You can also request the bank print out a letter, on bank letterhead, that shows your account number, routing number, and account type.

- Ask the person who requested the check if there is an alternative – they will usually be accommodating because they don't actually need the paper check, just the information.

On counter check fees, Chase will print out 3 counter checks for a $2 fee:

Thanks for reaching out. We understand you need counter checks, and we're here to help. We do offer counter checks at our branches. You can purchase 3 of them for $2.00 at your local Chase branch. Let us know if you have other questions. ^JV

— Chase Support (@ChaseSupport) February 6, 2019

Is VOIDing It Really Necessary?

Writing VOID in big black letters across the check makes it so that no one can use that check.

99.9% of the time, not writing void will be fine. You give the person the blank check, they get the information they need, and then they shred the check. But since the check is gone anyway and checks aren't valuable on their own, it really doesn't cost you much to write VOID.