Banks need accounts. You need more cash.

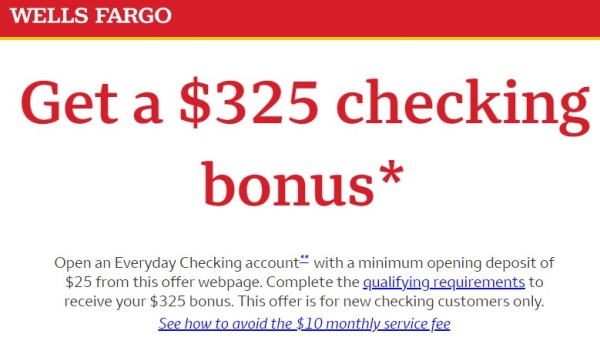

How about getting a $325 sign-up bonus to make a Wells Fargo Everyday Checking account your main bank account?

That’s right, Wells Fargo will give you money for opening an account. Open an account and within 90 days, receive a total of $1,000 or more in qualifying direct deposits into the new checking account within 90 days from account opening. It’s reported as interest, so you’ll owe taxes on it, but that’s a nice little bonus to switch banks.

This looks similar to other high dollar bank promotions. Check them out after reading through this article.

Definitely worth a look if you’re in a state where the offer qualifies (there are a few restrictions, listed below) but you can apply online so you’re not even required to change out of your jammies to visit a branch!

Read on to figure out how you sign up for the offer as well as how long it takes to see the bonus. I’ve also compiled other Wells Fargo bonuses and promotions you can take advantage of below the $325 bonus review.

💵 U.S. Bank – up to $700

Earn up to $700 when you open a new U.S. Bank Smartly® Checking account and a Standard Savings account and complete qualifying activities. Subject to certain terms and limitations. Offer valid through June 27, 2024. Member FDIC.

Offer may not be available if you live outside of the U.S. Bank footprint or are not an existing client of U.S. Bank or State Farm.

Table of Contents

- Wells Fargo Checking Bonus – $325

- Who is Eligible for this Bonus?

- Reader Experiences with the Wells Fargo offer

- Does Wells Fargo Really Give You $325?

- How to Get an In-Branch Sign Up Coupon Code

- How to Avoid Checking Account Fees?

- Take Advantage of These Account Perks

- Wells Fargo Savings Account – $525

- Wells Fargo Premier – $3,500

- How Does This Offer Compare?

- Frequently Asked Questions

🔃 Updated April 2024: Updated with the latest expiration date and details of the $325 Checking Bonus promotion which now expires on 5/21/2024 (nothing else changed about the offer except the date). The savings bonus has been updated too as well as and the Wells Fargo Premier offer has increased if you have $500,000 sitting around. 🤪

Wells Fargo Checking Bonus – $325

Wells Fargo $325 Checking Account Bonus Summary

- What you get: $325 cash bonus

- Who qualifies: Nationwide

- Where to open: Online or in-branch

- How to get it:

- Open a Wells Fargo Everyday Checking account,

- Make a minimum opening deposit of $25 to fund your account,

- Next, receive a total of $1,000 or more in qualifying direct deposits into the new checking account within 90 days from account opening (the “qualification period”),

- Collect $325 after the qualification period!

- When does it expire: 5/21/2024

This is what you need to do to earn the $325 Bonus:

- Open an Everyday Checking account online or in a branch by 5/21/2024.

- Make a minimum opening deposit of $25 to fund your account.

- Next, receive a total of $1,000 or more in qualifying direct deposits into the new checking account within 90 days from account opening (the “qualification period”).

After the 90 day qualification period, you’ll see the $325 bonus deposited into your account within 30 days if you met all the offer requirements.

If you want to open this offer in a branch, you must set up an appointment. Some branches will not take walk-ins.

Click the green Learn More button below to find out more:

Who is Eligible for this Bonus?

New checking customers are eligible and all consumer checking accounts are eligible. There does not appear to be a geographic restriction.

If you don’t qualify for Everyday Checking but can get an Opportunity Checking account, this offer still applies.

The following people are NOT eligible:

- Current consumer checking account customer (if you only have a business or mortgage account, it appears you are eligible)

- You have received a bonus for opening a Wells Fargo consumer checking account within the past 12 months

- Wells Fargo employees

Reader Experiences with the Wells Fargo offer

We’ve had generally positive reports from readers about this offer, here’s one recent accounting:

I applied for the account near the end of October 2023. I was initially denied, but after talking with customer service I was told I needed to have my credit bureau reports thawed before applying. They mentioned Equifax specifically, but I’m not sure if you can still apply with Experian and TransUnion frozen. I thawed all three reports 24 hours before applying again and was approved with no further issues.

They do require an initial deposit of $25 to open the account. At the time, I only opened a checking account. I would like to get a bonus from opening a new savings account with them as well, but I found out that to get the bonus from that, the savings account must be opened in person at a branch and there are none in my state (Michigan).

I changed my direct deposit paycheck to go to my new Wells Fargo checking account, and received my first direct deposit paycheck on November 15, 2023. This amount was also over the threshold to qualify me for the new account bonus. The bonus was deposited into my account on January 29th, 2024.

From using the account using both the webpage and mobile app versions, the only real issue I’ve come across is that their outgoing transfer limits for next business day transfers are kind of low. Only a maximum of $5,000 per day, and $6,000 within 30 days, which could be an issue when earning the bonus (like having your direct deposit paycheck go to the account to qualify for the bonus, and then transferring it out to your main account with a different bank afterwards). These limits are only for next business day transfers though, the limits for 2 business day transfers are much higher. $15,000 per day and $25,000 for 30 days.

Does Wells Fargo Really Give You $325?

Yes, Wells Fargo will give you $325 because they’re trying to get new customers and this welcome bonus is a nice little carrot. This is one of the simplest bonuses to get and you only need to open it with $25 and receive a total of $1,000 or more in qualifying direct deposits into the new checking account within 90 days from account opening.

They can afford to do this because it’s like any other kind of marketing. They can buy ads or they can simply offer a promotion and rely on word of mouth to get people’s attention. You found this $325 offer today and they didn’t have to pay for an ad right? 🙂

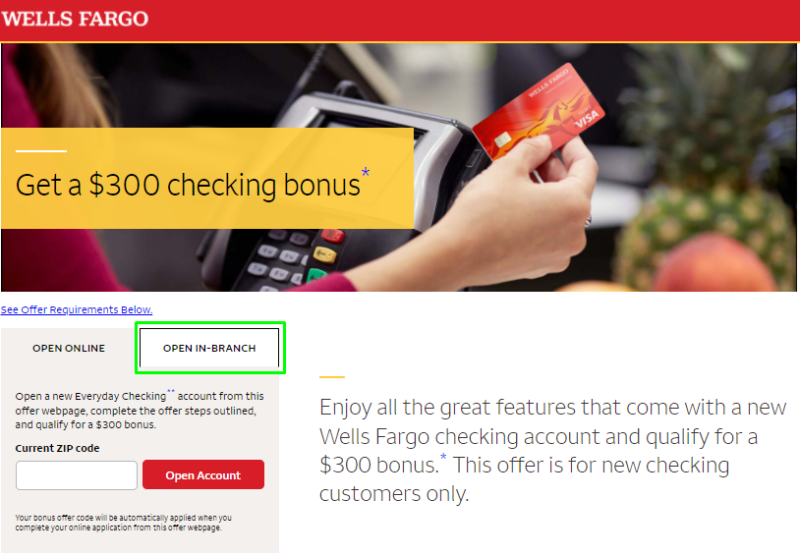

How to Get an In-Branch Sign Up Coupon Code

If you want to open your account in a branch or simply don’t like opening bank accounts online, you can get a promotional code emailed to you.

Click the orange button above and on that next page, you want to click on Open In-Branch (I drew the green box to show you where it is. It won’t have a green box on the actual page and the page may look slightly and enter your name, email, and ZIP code to get a promotional code via email:

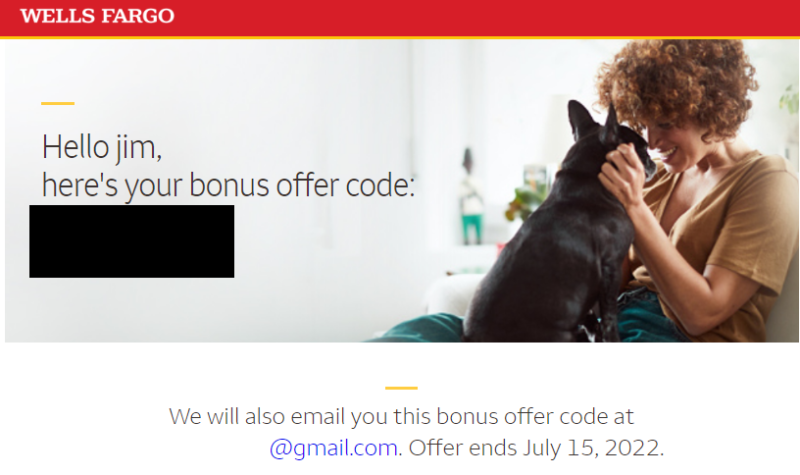

Once you click “Get My Code” you will be redirected to a page with your unique code, it looks like this:

You will also get an email with the subject “Your $200 bonus offer code is here” with the code in the body of the email. Then you just go to the nearest branch and open the account.

NOTE: You do NOT have to open the account in person. You can do it entirely online.

How to Avoid Checking Account Fees?

The account has a $10 monthly service fee. You can avoid it quite easily.

To get the fee waived, you need to do only one of the following each “fee period” (statement period):

- $500 minimum daily balance

- $500 or more in total qualifying direct deposits

- Primary account owner is 17-24 years old. (When the primary account owner reaches the age of 25, age can no longer be used to avoid the monthly service fee.)

- Linked to a Wells Fargo Campus ATM or Campus Debit Card.

Check the full details when you click through to the promotional page.

Take Advantage of These Account Perks

The account itself is pretty standard for a checking account.

They do promote three features that are quite rare:

- You can turn off your debit card in the event you lose it, so it’s not an outright closure unless you’re 100% sure you’ve lost it. If you are 100% sure, you need to report it stolen. If you’ve misplaced it (say at a bar or something) and you know where it is, you can disable it until you get it back.

- Access ATMs without your card by requesting a one-time access code via the app.

- Overdraft Rewind lets you avoid an overdraft fee if you overdraft your account but receive a direct deposit the following day that replaces the amount you overdrew by.

>> Related: Here’s how to find your Wells Fargo routing number

Wells Fargo Savings Account – $525

Wells Fargo has a savings account bonus – open a new savings account with a minimum opening deposit of $25 and complete the steps outlined below to receive your $525 bonus.

There are two steps to get the bonus:

- Open a new eligible consumer savings account at a Wells Fargo branch with a minimum opening deposit of $25 by June 25, 2024. You must provide the bonus offer code to the banker at the time of account opening.

- Bring $25,000 or more in new money to your new savings account by Day 30 and maintain at least a $25,000 balance through Day 90 after account opening.

Wells Fargo deposits your bonus within 30 days after meeting all requirements. You must be a new savings customer.

You must do this in branch because you have to enter your email and they email you a personalized bonus offer code. You must have this code when you go to the branch or you won’t get the bonus.

(Offer expires 6/25/2024)

Wells Fargo Premier – $3,500

If you have more than $500,000 cash, you may want to consider the Wells Fargo Premier bonus which is a massive $3,500.

To get this bonus, you need to:

- Open a new Premier Checking account at a Wells Fargo branch with a minimum opening deposit of $25 by 5/21/2024. You must provide the bonus offer code to the banker at the time of account opening. (they email it to you when you fill out the form on the promo page)

- Bring $500,000 or more in new deposits to qualifying linked accounts by Day 45 and maintain at least a $500,000 balance through Day 90 after account upgrade or opening.

- They will deposit your bonus into your new Premier Checking account within 30 days after you have met all offer requirements.

This offer has to be completed in a branch so you need to enter your email on the promotion page to get your code and instructions.

The account has a $35 monthly service fee that can be avoided if you have $250,000 or more in account balances with them.

👉 Learn more about this promotion

How Does This Offer Compare?

Wells Fargo has a competitive offer. $325 is higher than many of the other banks and Wells Fargo has a huge geographic footprint so almost everyone qualifies for it.

This is a direct deposit style bonus, so you’ll need to change your direct deposit, but it’s a nice bonus amount for that effort. You don’t need a high amount either, just receive a total of $1,000 or more in qualifying direct deposits into the new checking account within 90 days from account opening. It’s totally doable.

The Premier offer, which is in-branch only but gets you $3,500 is less appealing because you have to deposit a quarter of a million dollars and the account doesn’t earn interest. That’s a lot of money to tie up without earning interest.

Here are how a few other offers stack up:

Barclays – $200

Barclays Bank will give you a $200 if you open a new savings account and deposit $25,000 or more within 30 days and maintain at least $25,000 for the next 120 days. The savings account also pays a competitive interest rate of 4.35% APY while you wait.

BMO Relationship Checking – $400

BMO Bank is offering a $400 bonus* when you open a BMO Relationship Checking and when you have at least $7,500 in qualifying direct deposits within the first 90 days. It is a very straightforward offer that is available nationwide.

*Conditions apply

Bank of America – $200 Bonus Offer

Bank of America offers a $200 Bonus Offer cash bonus if you open a new account and Set up and receive qualifying direct deposits totaling $2,000 or more into that account within 90 days of account opening. It has a monthly fee that is easy to have waived.

Chase Total Checking® – $300

Chase Bank will give you $300 when you open a Total Checking account and set up and receive direct deposits totaling $500 or more within 90 days. There is a $12 monthly fee that is waivable with a monthly direct deposit of just $500, so no gotchas on this deal!

HSBC Premier Checking – up to $4,000

HSBC has an offer where you can get up to $4,000 for eligible new customers who open an HSBC Premier checking account, make a sizable deposit, and make recurring monthly qualifying direct deposits of at least $5,000 for 3 consecutive months.

Make sure to review this guide on bank account bonuses to ensure you know what to watch for when it comes to these types of offers.

Frequently Asked Questions

Yes, new Wells Fargo customers can get $325 when they open a new account with $25 and receive a total of $1,000 or more in qualifying direct deposits into the new checking account within 90 days from account opening.

Once you open your account and satisfy the requirements, you will receive the cash deposited into your accounts within 30 days.

Yes, Wells Fargo frequently offers promotions for new customers and you can check this page for the latest available bonuses and promotions.

Antwan Choice says

Hey Jim quick question, what do you mean by “it is reported as interest so you’ll pay taxes”? Taxes on what?

The money that you get in this promotion is considered interest income so you’ll owe ordinary income taxes on that amount.

Michelle says

Do you know an estimate of the tax rate or how much the taxes could be on the bonus?

The tax rate would be your ordinary income tax rates, which you can look up on our page about the federal tax brackets.

Jacky says

So I received the bonus last June but I closed my account last October, do I need to wait until October to open a new account and get the bonus or I could do it now in June?

I’d call the bank to find out, I’m not sure what their requirements are for a “new customer.”

Sandra says

I understand that to avoid checking account fees I must keep a $500 minimum daily balance in my account, but how much ARE the actual fees if my account falls below $500?

As of February 2022, the monthly service fee is $10. You can avoid it by having $500+ in qualifying direct deposit too.

Diane Davolio says

It’s nice to have the research done and presented in an easy to understand format so I that can choose the course that’s best for me to deposit my money and earn more at the same time. Thank you Mr. Wang!

Laurel Sather says

Just an FYI, I opened a Wells Fargo Everyday checking account at a local branch on March 28, 2022. I was emailed this code using the steps provided on this site, but they did not honor it When I opened my account. The banker at Wells Fargo said that because this bonus offer came from a 3rd party site and not directly from Wells Fargo that it was not legitimate.

But you didn’t get the code from our site, you got it from Wells Fargo directly when you click through the link. Their explanation is fraudulent, you visited a Wells Fargo website to get the code in the first place.

Laurel Sather says

I do understand what you are saying now. It should not have been denied by the WF banker. Yesterday I contacted an associate from another local branch and she is looking into this. She is requesting to see the email I received that contained the promo code (which expired 3/31/22). But unfortunately for me, it is nowhere to be found.