If you’re looking for a robo-advisor for your investment portfolio, Wealthsimple offers some unique features that you may find attractive. Like most robo-advisors, Wealthsimple asks its customers questions to determine their risk appetite and then automatically spreads their money across low-cost investments, typically ETFs.

The best part about robo-advisory services is that they’re known for charging much less than you’d pay for a professional investment advisor. Wealthsimple is affordable tool but adds icing on top of the cake by also giving its customers unlimited access to human certified financial planners.

Below, we’ll discuss everything else you need to know about Wealthsimple to decide if it’s the right robo-advisor for you.

Table of Contents

About Wealthsimple

Wealthsimple was founded by Michael Katchen in 2014. The company began with a simple spreadsheet of investing principles that Katchen had drafted up to help some of his colleagues.

The spreadsheet was, surprisingly, a huge hit and it inspired Michael to start Wealthsimple based on these “simple” (but research-based) ideas.

After launching in Toronto, Wealthsimple quickly began to dominate the robo-advisory service market in Canada. In 2017, they expanded into the U.S. and, since then, have continued to regularly add features and services.

How Wealthsimple works

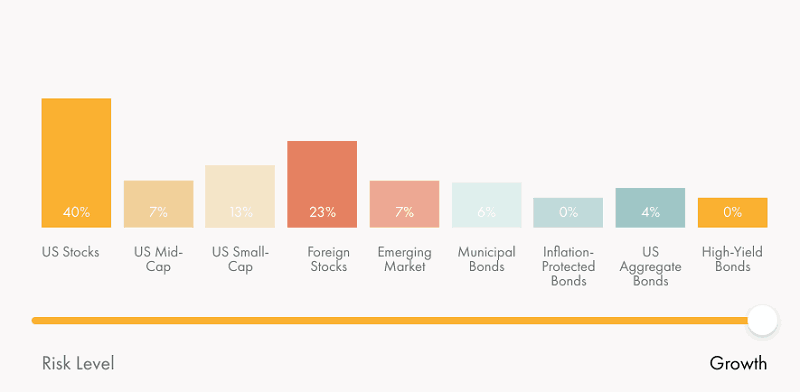

Once Wealthsimple has identified your risk level, they will diversify your portfolio throughout 9 different asset classes to minimize risk.

Those 9 asset classes are:

- US Stocks

- US Mid-Cap

- US Small-Cap

- Foreign Stocks

- Emerging Markets

- Municipal Bonds

- Inflation-Protected Bonds

- US Aggregate Bonds

- High-Yield Bonds

On Wealthsimple.com, they’ve included a tool that will give you an idea how your portfolio would be spread out if you have a high-risk tolerance:

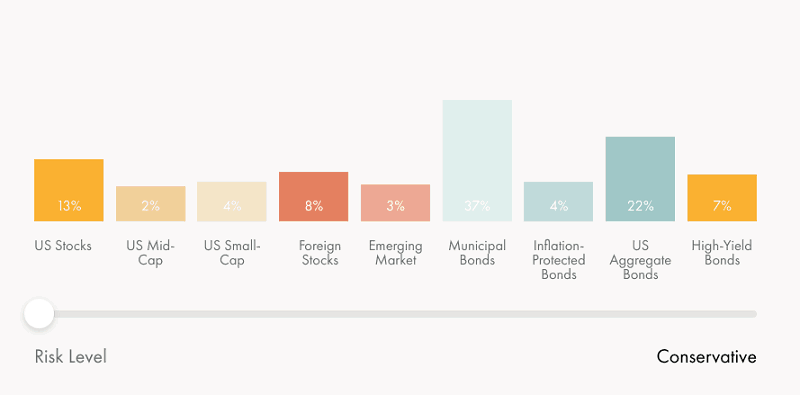

On the other hand, if you have a low-risk tolerance, you’re portfolio could look more like this:

Wealthsimple’s algorithms take care of all the heavy work that goes into making sure that you’re in the appropriate ETFs for your risk level and will automatically rebalance your portfolio as the market changes.

How Wealthsimple Differs from Other Robos

In addition to giving customers unrestricted access to certified financial planners, regardless of portfolio size, Wealthsimple has another key feature that sets them apart from the crowd.

They give customers the opportunity to invest according to their values. Here’s how they do that.

Socially Responsible Investment (SRI) Portfolios

Would you like to know that you’re investing in companies that are working to solve important social issues or improve the environment? Wealthsimple makes that possible with their SRI portfolio.

Through careful screening, Wealthsimple makes sure that their SRI portfolio includes only the following types of ETFs:

- Low Carbon: Global stocks with a lower carbon exposure than the broader market

- Cleantech: Cleantech innovators in the developed world

- Socially Responsible: American companies that are socially responsible

- Gender Diversity: Companies with more gender diversity among their leadership

- Local Initiatives: Bonds issued by municipalities to support local initiatives

- Affordable Housing: Government-issued securities that promote affordable housing

If investing in socially responsible response causes is an idea that excites, Wealthsimple could be the robo-advisor for you.

Halal Investing Portfolio

If it’s important to you that you only invest in companies that comply with Islamic laws, Wealthsimple’s Halal portfolio could be exactly what you’re looking for. The portfolio is monitored by a committee of Shariah scholars who screen each and every investment.

If you choose to invest in the Hala Investing portfolio, you can be sure that your money will never go to support companies that profit from gambling, arms, tobacco or other restricted industries. The portfolio will also exclude companies that profit significantly from interest on loans.

Wealthsimple Portfolios

Wealthsimple says that they scan over 1,400 ETFs and rank them for each asset class. But they say that their current primary ETFs are the ones listed below:

- U.S. Stocks: VTI (0.04% expense ratio)

- Foreign Stocks: VEA (0.07% expense ratio)

- Emerging Markets: VWO (0.14% expense ratio)

- Real Estate: VNQ (0.12% expense ratio)

- Natural Resources: XLE (0.14% expense ratio)

- U.S. Government Bonds: BND (0.05% expense ratio)

- TIPS: SCHP (0.05% expense ratio)

- Municipal Bonds: VTEB (0.09% expense ratio)

- Dividend Stocks: VIG (0.09% expense ratio)

Wealthsimple’s current secondary ETF choices are:

- U.S. Stocks: SCHB (0.03% expense ratio)

- Foreign Stocks: SCHF (0.06% expense ratio)

- Emerging Markets: IEMG (0.14% expense ratio)

- Real Estate: SCHH (0.07% expense ratio)

- Natural Resources: VDE (0.10% expense ratio)

- U.S. Government Bonds: BIV (0.07% expense ratio)

- TIPS: VTIP (0.07% expense ratio)

- Municipal Bonds: TFI (0.23% expense ratio)

- Dividend Stocks: SCHD (0.07% expense ratio)

Wealthsimple Fees & Costs

When it comes to pricing, Wealthsimple has three tiers: Basic (up to $100k), Black ($100k+), and Generation ($500k+). Below is a quick synopsis of the costs and features associated with each pricing level.

Basic (up to $100k)

- Wealthsimple Invest – 0.5% fee

- Wealthsimple Save – 2.0% annual yield

- Personalized portfolio

- Expert financial advice

- Auto-rebalancing

- Auto-deposits

- Dividend reinvesting

Black ($100k+)

- All Basic plan features

- Pay 0.4% fee for Wealthsimple Invest

- Financial planning session

- Automatic tax loss harvesting

- Tax efficient funds

- VIP airline lounge access

Generation ($500k+)

- All Black plan features

- Dedicated team of advisors

- Asset location

- In-depth financial planning

- Individualized portfolios

Wealthsimple’s 0.5% fee is a smidge high for a robo-advisory service. Management fees for robo-advisors typically hover around the 0.25% range (0.40% for premium services).

Why is Wealthsimple.com on the higher end? I can think of two possible explanations:

- They offer unlimited access to human advisors which is something that many other robo-advisors do not. This can’t be understated – it’s valuable and more expensive to offer. (computers don’t take breaks, use the potty, or are able to help with complicated and specific financial scenarios)

- Wealthsimple’s values-based portfolios (especially their Halal Investing portfolio) require more hands-on work to make sure that companies are properly screened.

However, if you are able to qualify for Wealthsimple’s Black tier, the portfolio management fee drops slightly to 0.4%.

We partnered with Wealthsimple to offer you no management fees on the first $10,000 you invest with Wealthsimple in the first year. This way you can try them out for free for an entire year.

Wealthsimple’s Strengths and Weaknesses

Here are a few more pros and cons of Wealthsimple.com that you’ll want to be aware of:

Strengths

- $0 account minimum: No matter how much money you have to invest, Wealthsimple wants your business

- Invest in fractional shares: If you deposit an amount of money that’s not large enough to buy an entire share of an ETF, you don’t have to wait to invest. Wealthsimple will buy a portion of an ETF equal to your deposit amount so that your full deposit is always invested.

- Tax-loss harvesting: While tax-loss harvesting is often an add-on service or restricted to clients who meet portfolio minimums, Wealthsimple offers this service for free to all its customers. If you’re a Basic customer, you’ll need to ask for tax loss harvesting, but Wealthsimple does it automatically for Black clients.

- Roundup: Make a purchase with your connected debit or credit card and Wealthsimple will invest the change in a Wealthsimple Invest or Save account.

- Wealthsimple Save: Wealthsimple customers get access to a low-risk investment account with a 2% annual yield (20 times higher than the average savings account) and no account minimums, low balance fees, or transfer and withdrawal fees.

Cons

- Management fee: As mentioned earlier, Wealthsimple’s starting fee of 0.5% is a bit expensive — especially when compared to other popular robo-advisors.

- Expense ratios of value-based portfolios: Since values-based portfolios naturally involve more work, they will also cost you more. For instance with their SRI portfolio, Wealthsimple says that “the fees…are modestly higher than the fees for regular ETFs – a weighted average of 0.24% to 0.28%, compared with around 0.1% for standard Wealthsimple portfolios.”

Alternatives to Wealthsimple

Not sure Wealthsimple is the right choice for you?

Here are a few alternatives that you may want to consider:

Wealthfront

Wealthfront charges a 0.25% management fee and boasts an average expense ratio on its ETFs of 0.08%. They also offer daily tax-loss harvesting and portfolio rebalancing for free. However, with Wealthfront you won’t get access to a human advisor and you cannot invest in fractional shares. You’ll need an initial deposit of at least $500 to invest with Wealthfront.

Read our full review of Wealthfront.

SoFi

SoFi started out as a student loan refinance company, but they have visions of becoming the Amazon of the financial services industry — a one-stop shop for all your financial needs, including investing.

While their wealth management service, called SoFi Invest, is relatively new, it could quickly become a force to be reckoned with in the robo-advisory service space. It offers an eye-popping 0% management (yes, you read that right) and you get access to certified financial planners. And SoFi also has no account minimum balance requirement.

Betterment

Like SoFi, Betterment has no account minimum and a 0.25% management fee. And like Wealthsimple, they do allow customers to invest in fractional shares.

Betterment is also known for its goal-setting tools. Once you set a goal and target date with Betterment, it will suggest asset allocations that will help you meet your goals and will even allow you to set up auto-deposits into each goal. However, if you want to get financial planning advice from an actual person, you’ll need an account minimum of $100,000 and your management fee will increase to 0.4%.

Read our full review of Betterment.

Ellevest

While anyone can invest with them, Ellevest is a female-centric robo-advisor. Ellevest’s “gender-based” investing factors in differences in pay, career breaks, and lifespan between men and women. The membership also gives you access to banking*, learning resources and discounted coaching sessions.

In addition to offering these tools built specifically for women, Ellevest also has a $0 account minimum and their fee is based on the membership level.

- Ellevest Essential ($1/month) includes the Build Wealth goal, which offers only an individual taxable investment account, banking with a spend & save account and debit card, learning, plus 20% off coaching..

- Ellevest Plus ($5/month) adds the Retirement goal, which allows you to open an IRA and lets you see how your progress toward retirement impacts your ability to build wealth as your primary goal. You get 30% off coaching.

- Ellevest Executive ($9/month) adds access to the rest of the goals, such as buying a house or starting a business. The Executive level, like Plus, also provides a dose of reality in terms of trade-offs that may be necessary to achieve multiple goals — for example, how buying a house this year might delay starting a business. You also get 50% off coaching.

**Banking products and services are provided by Coastal Community Bank, Member FDIC, pursuant to license by Mastercard International.