If you need to send money to a friend or receive payment, chances are you’re using PayPal or Venmo. Millions of people use these two payment apps to transfer money every day. But while both platforms offer a similar service, and PayPal actually owns Venmo, there are some key differences.

For example, PayPal operates internationally, while Venmo is only available in the United States. Venmo, on the other hand, is considered easier to use and is more prevalent among Gen Z (born in 1997 or later).

In this Venmo vs. PayPal comparison, I’ll compare the key features to help you decide which peer-to-peer (P2P) payment service is better for you.

Table of Contents

- Venmo vs. PayPal: At a Glance

- User Demographics

- What do PayPal and Venmo offer?

- Venmo and PayPal Business Accounts

- Are PayPal and Venmo transactions taxable?

- What Is Venmo?

- How to Join Venmo

- How Does Venmo Work

- Venmo Fees

- Venmo Debit Card

- Venmo Credit Card

- What Is PayPal?

- How to Join PayPal

- How Does PayPal Work?

- PayPal Fees

- Adding Money to Your PayPal Account

- Withdrawing Funds from PayPal

- Cryptocurrency

- PayPal Mastercard Fees

- PayPal Rewards

- PayPal Debit Card

- PayPal Credit Card

- Why Venmo is Better Than PayPal

- Why PayPal is Better Than Venmo

- Venmo vs. PayPal: Final Thoughts

Venmo vs. PayPal: At a Glance

Here is a quick comparison to highlight the similarities and differences.

| PayPal | Venmo | |

|---|---|---|

| Compatible Devices | Android, iOS, Web | Android, iOS, Web |

| Countries Available In | Over 200 countries and 25+ supported currencies | United States only |

| Account Types | Personal and Business | Personal and Business |

| Cost to Join | Free | Free |

| Fees | Send money to friends: Free for most methods but 3% when using a credit card. Receiving funds: Usually free but 2.99% plus a fixed fee Goods and Services Withdrawing funds: Free (1-3 days) or 1.75% for Instant Withdrawals. | Send money to friends: Free for most methods but 3% when using a credit card. Receiving funds: Usually free but 1.9% plus $0.10 for business accounts and Goods and Services transfers. Withdrawing funds: Free (1-3 days) or 1.75% for Instant Withdrawals. |

| Transaction Limits | Linked bank account: Up to $25,000 per transaction. Instant transfers: Up to $5,000 per transaction and $15,000 per month | Unverified accounts: $299.99 per week. Verified accounts: Up to $60,000 per week |

| Special Features | International Transactions: Can transfer money abroad and make purchases from non-U.S. merchants. PayPal Rewards: Earn points at online merchants for shopping credits or cash back. Payment Options: Can pay directly through many online merchants. Rewards debit and credit cards are available. | Social Feed: Interact with friends through social sharing updates. Venmo Debit Card: Free check card to earn cash back at participating merchants and free in-network ATM withdrawals. Venmo Credit Card: No annual fee, earn up to 3% back on purchases |

| Best For | International transactions and receiving side hustle app payments | Reduced fees for purchases, user-friendly mobile app, rewards debit card |

User Demographics

The better app may depend on which one your friends and colleagues use. For example, 83% of Venmo users are younger than 35 years, compared to approximately 48% of PayPal users.

PayPal’s user base is older, but the payment platform dates back to 1999 as one of the first services to settle online transactions between individual buyers and sellers. Statista reports that the largest age group is from 50-64 years old, which is 29% of PayPal’s active users.

Additionally, PayPal has a significantly larger customer footprint consisting of 435 million users compared to 83 million active Venmo users at the end of 2022.

What do PayPal and Venmo offer?

You can use both apps to complete the following tasks:

- Send money to friends

- Pay for in-store and online purchases

- Trade cryptocurrency

- Rewards credit cards and debit cards

- Personal and business accounts

It’s possible to transfer funds for free with both apps, but there are limitations, which I’ll cover in detail a bit later.

Venmo and PayPal Business Accounts

Both services offer business profiles, allowing you to provide customers with more payment options, whether you operate locally or online.

Venmo has a more intuitive user interface, but it has limitations:

- Only one user per business account

- No built-in invoicing tools

- You cannot send money overseas (i.e., if you hire out-of-country freelancers)

- Can only send up to $25,000 per week with identity verification ($2,499.99 without)

PayPal offers invoicing tools and website integration tools that can make it easier for customers to “Pay with PayPal.” It also supports international transactions. However, here are some drawbacks to beware about:

- The interface is clunkier and harder to navigate

- Doesn’t have a social media feed to publicize your business

- Transaction fees are higher (up to 3.49% plus a fixed fee vs. 1.9% + $0.10)

Are PayPal and Venmo transactions taxable?

Both platforms will generate a tax form (1099-K) when you receive at least $600 per calendar year in transactions labeled as goods and services. Seller fees apply to these transactions as they qualify for buyer and seller protection benefits.

To avoid tax reporting issues and unnecessary fees, verify your friends and choose the Friends and Family option. (This transfer option is only available in personal accounts and can be used for things like splitting purchases or sending money as a gift).

Only the sender incurs fees on Family and Friend money transfers if they use a credit card to fund it. To avoid the fee, use your Venmo balance or a linked bank account and debit card.

Related: 10 Best Check Cashing Apps

What Is Venmo?

Venmo was founded in 2009 and acquired in 2013 by PayPal. Its platform is geared toward in-app social interaction. In other words, it’s a payment app and social media platform under the same umbrella.

For instance, users can have their transactions and personalized notes posted to a public feed visible to friends and businesses. Don’t worry, you can opt out of public sharing if you desire privacy.

This P2P app is a popular way for friends to split purchases when going out, although a number of businesses also accept Venmo QR code payments, similar to Square or Cash App checkout kiosks.

How to Join Venmo

You must live within the United States and be at least 18 years old. This app cannot be used outside of the USA at this time. The app hopes to expand internationally in the future.

You can join Venmo via Venmo.com or download the Android or iOS mobile app.

You must currently be in the United States and have a phone to receive SMS text messages to join. The app also requires your full legal name to verify your identity.

As you create your profile, you can link these accounts to fund transfers:

- U.S.-based bank account

- Debit card

- Credit card

All users must create a personal account first. If you’re a freelancer or business owner, you also have the option of opening a business profile to access additional payment tools.

If you haven’t joined yet, you may qualify for a Venmo new account bonus. Typically, new users can earn at least $5 by making an eligible purchase within 14 days after linking their bank account or a payment card.

How Does Venmo Work

The most convenient way to use Venmo is through its mobile app, which is packed with features. For example, it allows you to scan QR codes in-store to pay for purchases, saving you from having to pull out a credit card or debit card or paying with cash.

Venmo’s desktop app is also easy to use. You can send or receive payments and schedule account transfers to increase your Venmo balance.

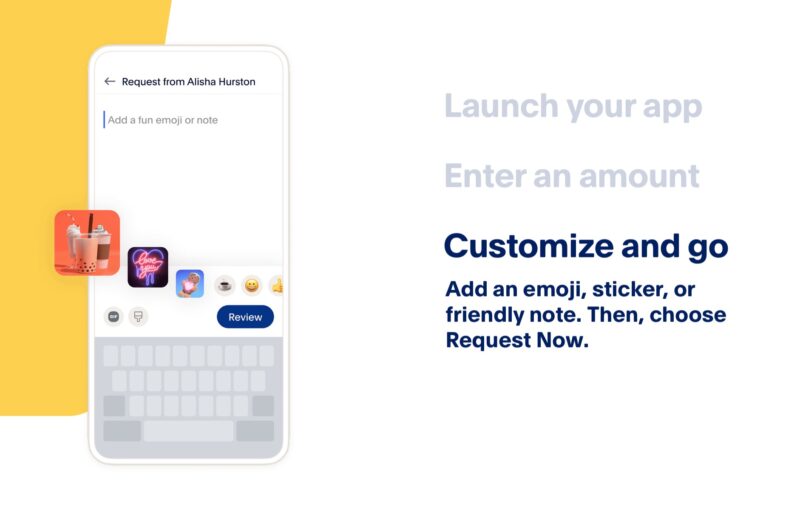

If you choose to publicize your transactions, you can type out a personalized note with emojis.

Receiving Payments

With Venmo, either party can request payment through the app. A built-in calculator makes it easy to split purchases accurately before sending your money request. You can also have another Venmo user scan your personal QR code that appears on your phone screen upon request.

Online Shopping

While more and more online merchants are accepting Venmo payments, the list remains smaller than merchants with a PayPal checkout button.

Some of the most popular merchants include:

- Boxed

- DoorDash

- Grubhub

- Lyft

- Poshmark

- Uber

- UberEats

You can also pay through a Venmo-issued debit card or credit card when the “Pay with Venmo” option is unavailable.

Venmo Fees

It’s possible to use Venmo without paying any fees to make purchases or to send money to friends.

Account Service Fees

- Account Setup: $0

- Monthly Service Fee: $0

Fees for Spending or Sending Money

- Online purchases: $0 (regardless of the payment method)

- Sending money to friends from your Venmo balance, bank account, or debit card: 0%

- Sending money to friends from your credit card: 3%

Adding Money to Your Venmo Account

You won’t incur fees when receiving money from the following sources (excluding Goods and Services and business/charity payments):

- Funds received in your personal account from another Venmo user

- Linked bank account

- Direct Deposit

- Merchant refunds

Mobile check deposits are subject to the following charges:

- 0%: When waiting ten days for your funds to become available

- 1% (minimum $5 fee): Deposit clears within minutes for pre-printed payroll and government services checks

- 5% (minimum $5 fee): “In minutes” deposits for non-payroll and non-government checks

Note that a flat fee of 1.9% plus $0.10 applies to all payments received in business profiles, charity, or Goods and Services transactions in a personal profile.

Withdrawing Funds from Venmo

Transfers to your linked bank account are free but require 1-3 days to complete.

Instant transfers that clear within minutes to your debit card or bank account cost 1.75% (minimum fee of $0.25 and a maximum fee of $25).

The following transfer limits also apply:

- Unverified Accounts: Up to $999.99 in weekly withdrawals

- Verified Accounts: Up to $19,999.99 per week and $5,000 per withdrawal

Cryptocurrency

A fee applies each time you buy or sell cryptocurrency within your account:

| Purchase or Sale Amount | Fee |

| $1.00 to $4.99 | $0.49 |

| $5.00 to $24.99 | $0.99 |

| $25.00 to $74.99 | $1.99 |

| $75.00 to $200.00 | $2.49 |

| $200.01 to $1,000.00 | 1.80% |

| $1,000.01 or more | 1.50% |

Venmo Mastercard Fees

If you choose to use the optional Venmo Mastercard debit card, the following fees apply:

- In-network ATMs (MoneyPass network): $0

- Non-network ATMs: $2.50

- Over-the-counter withdrawals (banks and financial institutions): $3.00

There are no fees to make purchases or check your balance unless the network operator or merchant tacks on additional charges.

Venmo Debit Card

The Venmo Mastercard® debit card is optional. It has no annual fees and works at any merchant accepting Mastercard payments in the United States.

Unfortunately, you cannot shop with overseas merchants even if you’re shopping from within the U.S.

You can earn cash back at select merchants through shopping offers, and withdrawals at MoneyPass ATMs are no-fee. The Venmo Debit Card funds purchases from your current Venmo balance but won’t pull from your linked bank account or encounter overdraft fees.

Venmo Credit Card

A no-fee Venmo Credit Card is available. It offers cash back on every purchase, although you must pay your balance in full to avoid interest charges.

Your earning potential is as follows:

- 3% back on your top spend category each month

- 2% back on the next highest spend category

- 1% back on all remaining purchases

What Is PayPal?

PayPal launched in 1998 and began facilitating digital transactions in 1999. Today, it’s a digital wallet that lets you send money to friends domestically or overseas, receive PayPal Cash payments from freelance customers, or pay for online shopping excursions.

PayPal has purchased several financial and retail services, including:

Like Venmo, PayPal offers debit and credit card products that are optional and free to apply for. You can also split purchases through its buy now, pay later services, although the fees can be expensive.

Many people have a PayPal account as it’s entrenched in the online commerce sphere. In many cases, it’s still the only way to send or receive money to a business or individual, although several PayPal alternatives exist.

There is a lot to like about PayPal, but some users have complained that it’s more challenging to navigate than other digital wallets.

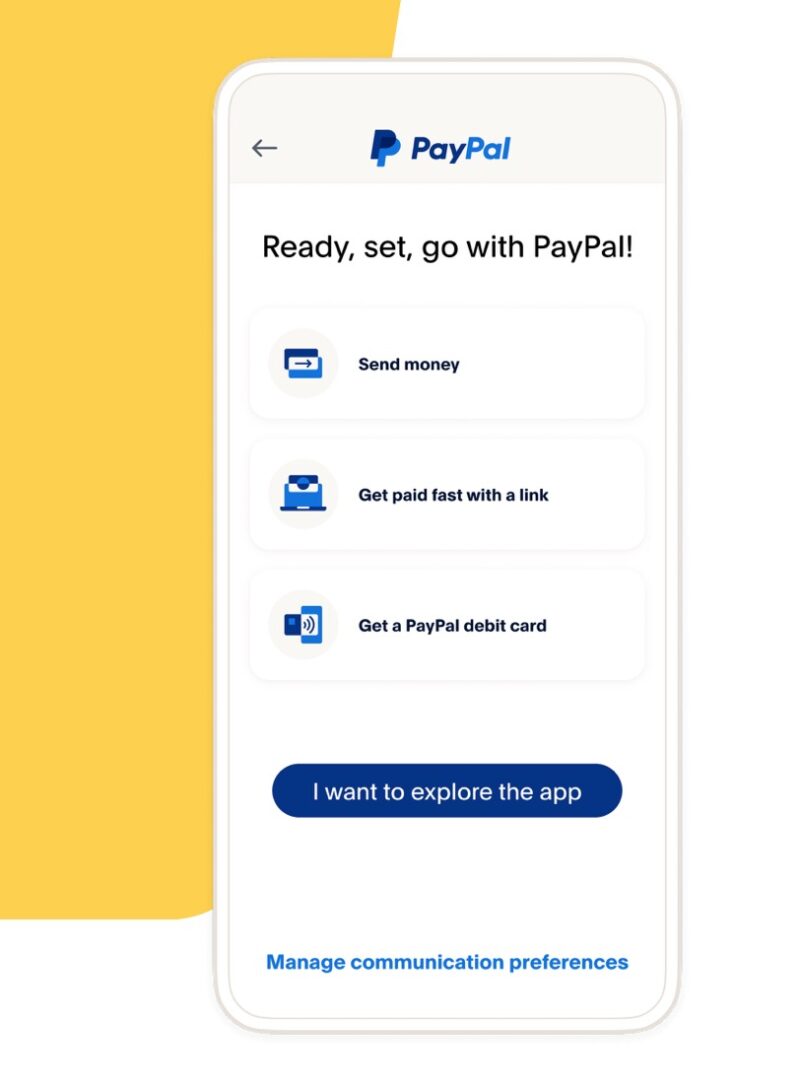

How to Join PayPal

You must be at least 18 years old and live in one of the 200+ supported countries. The platform lets you create a personal or business account.

Start the enrollment process from the PayPal website or download the app to your Android or iOS device.

You’ll need to provide your mobile phone number, legal name, home address, and email. It’s possible to link a bank account and debit or credit card once your account is active.

How Does PayPal Work?

You can send or request money from the mobile app or online dashboard. There is also an online shopping section to browse the latest cashback offers and earn rewards points through PayPal Rewards.

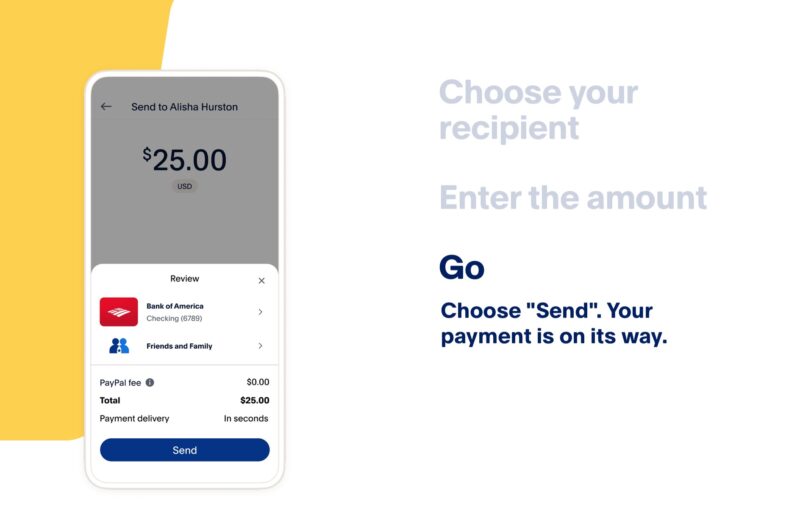

Sending Money

You can send money on PayPal to nearly any country worldwide by entering the recipient’s name, PayPal username, email, or phone number.

Transfers between personal accounts are free for both parties when the sender chooses “Friends and Family” and uses their current PayPal balance or a linked banking account as the funding method.

Fees apply for international transfers or when funds come from a credit or debit card.

You can also attach a personal note. However, unlike Venmo, there isn’t a social feed for your network to see the activity.

Receiving Money

You can request money by initiating a Family and Friends transfer to another user. It’s also possible for freelancers and businesses to send an invoice, although transaction fees occur.

It’s also possible to send a PayPal.Me link to request payment.

Paying for Purchases

There are several ways to shop online and pay for in-store purchases. If you initiate shopping sessions through your PayPal account, you can earn cash back.

Many merchants also have a PayPal payment option to use your existing balance or a linked payment amount to complete the transaction.

PayPal Fees

It’s possible to use PayPal without paying any fees to make purchases or send money to friends. In general, the fees tend to be higher than Venmo when you’re selling products but it has more selling tools and international money features.

Account Service Fees

- Account Setup: $0

- Monthly Service Fee: $0

Spending or Sending Money

- Online purchases: $0 (regardless of the payment method)

- Sending money to friends with your balance, bank account, or Amex Send: 0%

- Sending money to friends with your credit card: 2.90% plus a fixed fee

- International money transfers: 5.00% (minimum $0.99) for all funding methods

Adding Money to Your PayPal Account

These account funding sources won’t incur a fee (excluding Goods and Services and business/charity payments):

- Funds received in your personal account from another PayPal user

- Linked bank account

- Direct Deposit

- Merchant refunds

Mobile check deposits are subject to these charges:

- 0%: When waiting ten days for your funds to become available

- 1% (minimum $5 fee): Instant deposits for pre-printed payroll and government services checks

- 5% (minimum $5 fee): Instant deposits for non-payroll and non-government checks

A flat fee of 2.99% applies to Goods and Services transactions in a personal profile compared to 1.9% plus $0.10 through Venmo. You may encounter this fee if you’re selling stuff online as the sale is eligible for buyer and seller protection benefits.

Withdrawing Funds from PayPal

Standard electronic withdrawals to your linked bank account are free but require 1-3 days to complete.

Instant transfers that clear within minutes to your debit card or bank account cost 1.75% (minimum fee of $0.25 and a maximum fee of $25).

The transfer limit is $25,000 per transaction to a linked bank account and $5,000 for instant withdrawals.

Currency conversion fees can also apply for international withdrawals.

Cryptocurrency

A fee applies each time you buy or sell cryptocurrency within your account:

| Purchase or Sale Amount | Fee |

| $1.00 to $4.99 | $0.49 |

| $5.00 to $24.99 | $0.99 |

| $25.00 to $74.99 | $1.99 |

| $75.00 to $200.00 | $2.49 |

| $200.01 to $1,000.00 | 1.80% |

| $1,000.01 or more | 1.50% |

PayPal Mastercard Fees

The optional PayPal Debit Mastercard charges the following fees on cash withdrawals:

- In-network ATMs (MoneyPass network): $0

- Non-network ATMs: $2.50

- Over-the-counter withdrawals (banks and financial institutions): $3.00

- Foreign transaction fee: 2.5%

There are no fees to make purchases or check your balance unless the network operator or merchant tacks on additional charges.

A full list of PayPal fees is accessible here.

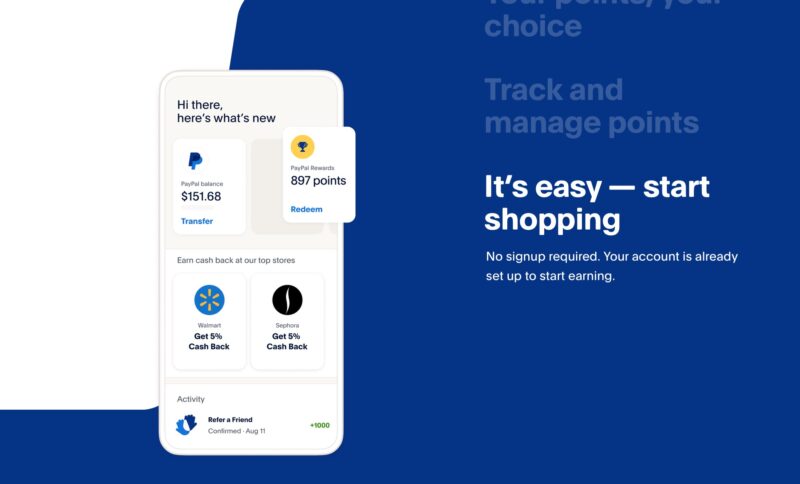

PayPal Rewards

The digital wallet has an in-house shopping rewards program called PayPal Rewards (previously PayPal Gold). You can earn points on qualifying purchases through the PayPal app, website, or PayPal Honey browser extension.

It’s free to earn and redeem rewards. Your redemption options include shopping credits on future PayPal purchases or cash back.

PayPal Debit Card

The PayPal Debit MasterCard doesn’t have a monthly fee and works worldwide, although foreign transaction fees apply. In addition, you can make free ATM withdrawals at over 37,000 MoneyPass network ATMs.

This card also earns PayPal Rewards points at participating merchants to save money on future shopping trips.

PayPal Credit Card

PayPal’s Cashback Mastercard, which is issued through Synchrony Bank, doesn’t have an annual fee. It earns 3% back on PayPal purchases and 2% on all remaining purchases.

You can use the card worldwide, but a 3% foreign transaction fee applies for international transactions.

Why Venmo is Better Than PayPal

Consider using Venmo instead of PayPal for these reasons:

- Easier-to-use platform

- Easily split purchases with friends

- Like the social feed to share transactions with friends

- Lower fees on Goods and Services transactions

As a reminder, Venmo only works in the United States at this time and cannot be used to send money or make purchases overseas.

Why PayPal is Better Than Venmo

PayPal is superior for these reasons:

- Can shop or send money internationally

- Many online merchants accept PayPal payments

- More business tools to receive or send funds

- More rewards shopping offers

PayPal may have a slightly harder-to-use platform, but it works almost anywhere in the world, making it the easiest way to send or receive money. It can also be more versatile for businesses and individual sellers despite the higher fees for Goods and Service transactions.

Venmo vs. PayPal: Final Thoughts

PayPal and Venmo get the job done if you need to send or receive money. Both platforms are also suitable for shopping, although PayPal’s Checkout Button is more recognized, and they support international purchases.

However, Venmo can be the better option for personal accounts within the U.S., as you can easily send money without fees. When charges are incurred, the total cost is slightly lower than PayPal, and its purchase-splitting tools and app are more user-friendly and interactive.