Unifimoney

Strengths

- Banking services, including high interest checking, as well as multiple loan options

- Ability to invest in stocks, ETFs, ADRs, precious metals, and cryptocurrencies on the same platform

- No commissions to invest in individual stocks, ETFs, precious metals, or ADRs

- Two robo-advisor portfolio options available

- Access cash at more than 55,000 surcharge-free, in-network ATM locations across the country

Weaknesses

- You cannot invest in options or mutual funds

- The number of stocks and ETFs you can invest in is more limited than it is with large investment brokers

- It typically takes between three and five days to transfer funds from liquidated investments into your checking account

- Monthly service charge applies to checking account balances of less than $20,000, or those that don’t receive monthly deposits of at least $2,000

- Customer service limited to in-app email

If you’re looking for a financial app that will enable you to handle your entire financial life – checking, investing, and borrowing – all on the same platform, then you will want to check out Unifimoney.

Unifimoney will provide a high-yield checking account, as well as the ability to invest in stocks, exchange-traded funds, precious metals, and cryptocurrencies. You’ll even be able to take advantage of financing through the app, including student loan refinancing, home loans, and auto loans, as well as other services.

🚩 We’ve received notice that Unifimoney will be shutting down. They are no longer taking new customers and if you try to sign up, you will see the following pop up:

Table of Contents

🔃 Updated May 2023 with news that Unifimoney will be shutting down. The review below reflects what the service was offering when they were still operating as normal. It’s obviously not obsolete but we have no plans to update it until the company officially shuts down and we will offer up alternatives.

What is Unifimoney?

Based in San Francisco, Unifimoney is a comprehensive financial app. It brings banking, investing, borrowing, and other financial services together in a single platform.

That means you’ll be able to save, spend, borrow, and invest through the same app. Virtually all the services provided on the platform are offered in partnership with third-party providers.

As noted above, Unifimoney is currently in the beta testing phase, with no specific date set for its official launch to the general public.

Unifimoney is currently available for download at The App Store for iOS devices, 11.0 or later. It’s compatible with iPhone, iPod touch, and Mac devices, with macOS 11.0 or later and a Mac with Apple.

How Unifimoney Works

Unifimoney starts with the Unifimoney High-yield Checking account. You’ll need to open a checking account to be able to take advantage of Unifimoney Investing. That’s because funds for investing are held in your checking account. Funds are withdrawn from the account upon the purchase of investments, while proceeds from investment sales are transferred into the checking account.

The use of the checking account as the financial base for your investment activities can limit your access to cash proceeds. It typically takes between three and five working days for funds to be transferred from your investment account into your checking account.

Unifimoney High-yield Checking

Unifimoney’s basic account is their High-yield Checking account. You’ll need to open a checking account to be able to access investment accounts and loan services.

High-yield Checking requires a minimum of $100 to open an account, but it currently pays 0.20% APY on all balances. You’ll enjoy the benefit of up to $750,000 in FDIC insurance.

The checking account offers remote check deposits, bill payment capabilities at more than 20,000 merchants, and money transfers by both ACH and wire. You can set up automatic investments of $25 or more into your investment portfolio from the account.

And even though Unifimoney functions entirely online, you’ll be provided with a checkbook to make payments the old-fashioned way.

The account comes with a Visa debit card, that will allow you to access more than 55,000 surcharge-free, in-network ATM locations across the country. You can also access cash at more than 1 million ATMs around the world.

Monthly service fees are indicated, though the amount isn’t specified. However, the fee is waived with a monthly deposit of $2,000 or more, or a minimum balance of $20,000.

Unifimoney Investing

With Unifimoney Self Managed Trading, you’ll enjoy commission-free trades in US equities, exchange-traded funds (ETFs), and American Depositary Receipts (or ADRs – used to trade securities listed on foreign exchanges).

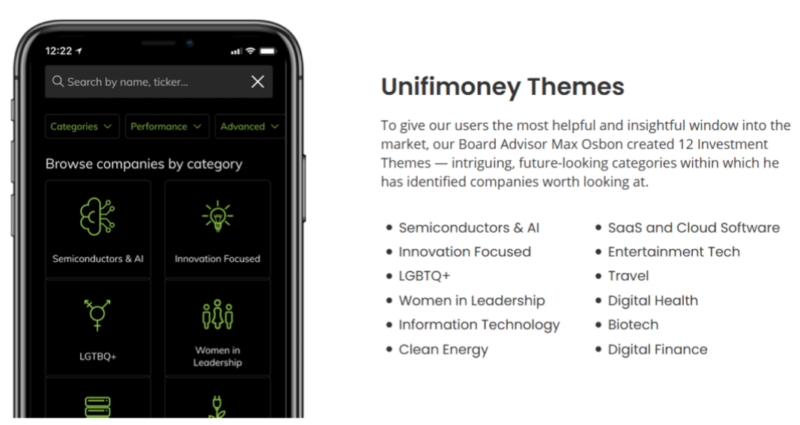

You can begin trading with as little as $1, since Unifimoney offers fractional investing. You can either engage in self-directed investing, or take advantage of one of 12 investment themes, built around the following categories:

Unifimoney offers trading in 3,000 individual stocks, 1,000 ETFs, and 300 ADRs for globally listed companies. (The number of stocks and ETFs is limited by restrictions from the investment partner, Drivewealth.)

Cryptocurrencies. Unifimoney offers trading in 33 virtual currencies, including Bitcoin, Ethereum, and Litecoin. Cryptocurrency trading is handled through Gemini, where you can buy, sell, and store your virtual currencies.

Precious metals. You can invest in gold, platinum, and silver through Unifimoney. Metals can be purchased in the same “good delivery bars” traded on physical metals markets around the world. However, the bars can be converted on demand into individual coins, including US Gold and Silver Eagles, and Canadian Gold and Silver Maple Leafs.

You’ll enjoy direct ownership of the metals, with instant liquidity. In addition, your metals positions are fully insured. What’s more, you can take delivery of your physical metals at any time.

Precious metals are held in multiple vaults in the US, operated by independent third-party security firms, like Brinks, Loomis and IDS.

Unifimoney Robo-advisor Service. If you’re not comfortable engaging in self-directed investing, you can take advantage of Unifimoney’s AI Quant -based investment platform. It currently offer two different portfolios, and you can auto invest into each with as little as $25 per month.

The two portfolio options are as follows:

Robo-advisor portfolios are conducted in a partnership with TenjinAI. Your portfolio will be invested in a mix of individual stocks and ETFs, based on your risk preferences. As is typical with robo-advisors, your preferences will be determined by completing a questionnaire when you open your account. Initially, you’ll be enrolled in the Basic plan, with the option to change to Advanced anytime you like.

If you choose, you can also select an environmental, social and governance (ESG) portfolio model for socially responsible investing.

Unifimoney Credit Card and Loans

Unifimoney offers a credit card and several loan options.

Unifimoney Premium Visa Signature Credit Card. The card comes with cash back redeemable in gold, Bitcoin or equity investments. It provides valuable services, including auto rental insurance and identity theft protection.

Student loan refinancing. You can refinance existing student loans for up to $250,000. They’re even offering a 1% bonus – up to $2,500 – based on the size of the loan you take. There are no application fees for the refinance.

Home loans. Unifimoney is offering loans for purchase and refinance. But the loans are designed specifically for high earning professionals. You can be eligible for a 0.5% discount on your loan, as well as free home management platform access.

Loans are available up to $5 million, for primary residences, vacation homes, and even investment properties. You can save up to $10,000, with discounts for Unifimoney customers.

Car loans. Unifimoney offers auto financing from $5,000 to $100,000, with an easy online application. There are no vehicle restrictions applying to age, make, model, or mileage. No lien is required on the vehicle itself, and funds can be used to purchase or refinance new, used, or classic cars, as well as RVs, boats, aircraft, and power sport vehicles.

Unifimoney is currently offering a 0.50% bonus on your loan amount, up to $500.

Other Unifimoney Services

Unifimoney will be offering health savings accounts (HSAs). In a partnership with UMB Healthcare Services, they’re offering the account with no monthly fee and 1% cash back on your first transfer. There is no account minimum balance requirement, and you’ll have unlimited access to your account with a Visa debit card.

You’ll earn interest on your account, ranging from 0.01% to as much as 0.15% APY. And once your account balance passes $1,000, you can choose to invest some or all your account in a self-directed investment account with no trading or commission fees on mutual funds.

Unifimoney will have car insurance, though they don’t provide details as to exactly what they’ll be offering.

However, they indicate you’ll be able to compare multiple offers from top insurance companies in as little as two minutes. You’ll also be able to get a $15 Bitcoin credit just for applying for a quote. Car insurance will be provided through a partnership with Gabi.

Here’s our full review of Gabi to learn more about them.

Unifimoney Investment Fees & Pricing

There are no fees for trading in stocks, ETFs and ADRs.

Cryptocurrencies

Unifimoney doesn’t indicate fees for trading in cryptocurrencies. But according to Gemini, which is the platform that handles cryptocurrency investing for Unifimoney, the fees that will apply based on your monthly trading volume are as follows (on trading volume up to $1 million):

Taker Fee, 0.35%

Maker Fee, 0.10%

Auction Fee, 0.20%

Fees work on a sliding scale, stair-stepping down with higher monthly trading volumes.

Precious Metals

Fees are charged based on spreads at both purchase and sale of precious metals. There are no commissions or other fees added for transactions.

However, there are storage fees involved. The rate is 0.70% annually for gold or platinum, and 0.80% for silver. For example, if you purchase and hold $10,000 in gold with Unifimoney, you’ll pay $70 per year for storage.

Unifimoney Robo-advisor Service

There is an annual advisory fee for the robo-advisor service, which is charged on a monthly basis. For the Basic portfolio, the annual advisory fee is 0.15%, or $15 on a $10,000 portfolio.

For the Advanced portfolio, the annual advisory fee is 0.30%, or $30 on a $10,000 portfolio.

Unifimoney Promotions

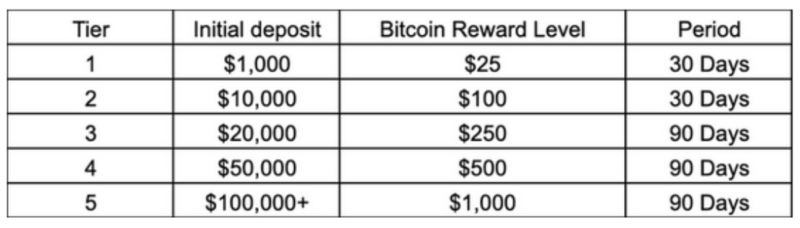

Unifimoney is currently offering a promotion of up to $1,000 in Bitcoin when you sign up for the service. The reward is based on tiers determined by the amount of your initial deposit, and how long the funds are held in your account.

The bonus schedule is as follows:

The bonus is available only to new Unifimoney depositors, and requires depositing the funds within 14 days of opening your account. Your Bitcoin reward will be paid into your crypto account within 14 days of qualification.

Referral fee: You can earn a $25 Bitcoin reward for each friend you refer to Unifimoney qualifies to open an account.

Unifimoney Features & Benefits

Minimum initial investment: $100 minimum to open a checking account; begin investing with as little as $1; robo-advisor portfolios require a minimum of $25.

Available accounts: Taxable trading accounts only (no IRAs indicated).

Available investments: Stocks, ETFs, ADRs, precious metals (gold, silver and platinum), and 33 cryptocurrencies. Earn 0.20% APY on your cash holdings.

Customer service: Currently available only by in-app email; no direct phone contact is available.

Mobile app: Unifimoney is available on The App Store for iOS devices, 11.0 or later, including iPhone and iPod touch, as well as Mac devices, with macOS 11.0 or later and a Mac with Apple. It is not yet available for Android devices.

Unifimoney security: Investments with Unifimoney are held with Drivewealth, which is registered in all 50 states and provides SIPC insurance on investors accounts. That coverage will protect investors from broker failure, but not losses due to market factors. Funds held in your Unifimoney High-yield Checking account have FDIC insurance through UMB Bank.

How to Sign Up with Unifimoney

There is no application process for Unifimoney since it’s currently in beta testing. You can download the app on The App Store for iOS devices, but you will need to be added to a wait list to be eligible when the app is available to consumers.

Unifimoney Pros & Cons

Pros:

- Banking services, including high interest checking, as well as multiple loan options.

- Ability to invest in stocks, ETFs, ADRs, precious metals, and cryptocurrencies on the same platform.

- No commissions to invest in individual stocks, ETFs or ADRs.

- Gold, silver, and platinum are also available commission-free.

- You can invest in 33 cryptocurrencies, with more being added to the list regularly.

- Two robo-advisor portfolio options available, as well as a socially responsible model for each.

- Access cash at more than 55,000 surcharge-free, in-network ATM locations across the country.

- Earn up to $1,000 in Bitcoin for opening a new Unifimoney account.

Cons:

- You cannot invest in options or mutual funds.

- The number of stocks and ETFs you can invest in is more limited than it is with large investment brokers.

- Cryptocurrencies purchased through Gemini cannot be transferred to third party wallets, nor can externally acquired cryptos be transferred into your Unifimoney account.

- It typically takes between three and five days to transfer funds from liquidated investments into your checking account, where they can be available for personal use.

- A specified monthly service charge applies to checking account balances of less than $20,000, or those that don’t receive monthly deposits of at least $2,000.

- Currently not available for Android devices.

- Customer service limited to in-app email.

- No margin trading offered.

Unifimoney Alternatives

There are other providers that offer services similar to Unifimoney, though none are quite as comprehensive. But each has the advantage of being available for consumers right now.

Robinhood

Robinhood comes the closest to Unifimoney as a self-directed investment app. Not only do they charge no commissions on trades, but they also offer investing in cryptocurrencies, as well as commission-free options trades.

Here is our full review of Robinhood.

Betterment

If you prefer comprehensive investment management to self-directed investing, check out Betterment. They provide complete investment management, including regular rebalancing and dividend reinvestment, at a low annual fee of just 0.25%.

You can open an account with no money whatsoever, then begin investing as you add funds to your account. Betterment also provides a checking account and a cash reserve currently paying 0.30% APR on your uninvested funds.

Here is our full Betterment review.

Kraken

If you’re primarily interested in investing in cryptocurrencies, check out Kraken. There, you can trade in more than 50 cryptocurrencies, and even trade on margin or in crypto futures. And Kraken even pays staking bonuses of up to 7%.

Here is our full review of Kraken.

Should You Open an Account with Unifimoney?

If you’re looking for a comprehensive financial platform where you can literally manage your entire financial life in one place – banking, investing, borrowing, and other services – and you don’t mind waiting until it comes out of beta testing, Unifimoney is well worth considering.

But if you don’t feel like waiting, or if your interests are more specific – like self-directed investing, cryptocurrencies, or a fully managed investment program – check out the alternatives listed above.

Leave a Comment: