Titan Invest is a unique investment product that uses hedging in its investing strategy. It’s not for everyone, but if you’re willing to take on more risk in search of higher returns, it can be an excellent choice for a portion of your overall investment portfolio.

If you’re looking for an opportunity to outperform the market – and not just match it the way most robo-advisors do – consider Titan Invest. It’s not a robo-advisor at all – or even an investment fund. Instead, it’s an actively managed portfolio focusing on growth.

It is riskier than robo-advisors, but it may be suitable for a small portion of your portfolio. And though it does tend to be higher risk, Titan Invest attempts to reduce that risk by using a hedge in each portfolio.

Table of Contents

What is Titan Invest?

Titan Invest is an active investment management service, designed specifically to outperform the market. They have a target goal to earn average returns of 15% or more each year, which will enable your investment to double about every five years.

They currently offer two investment strategies, though they plan to launch more. These are not funds, but investment strategies. Using a mix of quantitative and qualitative analysis, each strategy attempts to identify about 20 of the best companies in the US, then hold on for the long run.

When you invest with Titan Invest you receive daily updates through the app, so you’ll know exactly what’s going on with your money.

Titan Invest currently has over 25,000 clients, with nearly $500 million in assets under management.

The company was named the “Top Investment Advisor of 2020”, by US News, and “Best Advisor of 2020” at the Benzinga Global Fintech Awards. The company was also named “#1 Ranked Robo-Advisor” by Robo Report for equity returns and total portfolio returns for all four quarters in 2020, as well as the fourth quarter of 2019.

Titan Investment Methodology

Titan Invest uses investment strategies you typically won’t find with robo-advisors. Your portfolio will hold approximately 20 stocks deemed to be the best candidates for performance over the next 3 to 5 years.

And to minimize the risk inherent in investing in a small group of stocks, Titan Invest adds a hedge to your portfolio that will minimize downside risk in turbulent markets.

Hedging

This is a strategy used by Titan Invest to reduce losses during a market downturn. This is done by using short positions against a stock index based on the portfolio strategy you choose. When you have a short position in a stock you will earn money when the stock goes down in value.

Titan Invest uses the technique when they believe their strategies are at a higher risk of experiencing an extended downturn.

This is an attempt to time the market – which is what actively managed funds ultimately try to do to get higher than market returns. Note that timing the market for higher returns is extremely difficult to do over the long run, which is why we recommend only having a small percentage of your portfolio in actively managed funds.

If you invest in the Titan Flagship portfolio, the S&P 500 index will be shorted based on a certain percentage of your holdings. For the Titan Opportunities strategy, the Russell 2000 index will be shorted, again by a certain percentage of your portfolio.

The percentage of your portfolio that’s hedged increases during a downturn, and decreases when it’s believed the downturn has ended. The hedge is used in both investment portfolios currently offered by Titan Invest. However, the company is very specific on pointing out that though they make use of a hedge strategy, their investments are not categorically hedge funds.

The percentage of your portfolio that’s hedged depends on a combination of your risk tolerance and market conditions. The general parameters are as follows:

| Risk Tolerance / Hedge Percentage | When the Market is NOT in a Downturn | When the Market IS in a Downturn |

|---|---|---|

| Conservative | 10% | 20% |

| Moderate | 5% | 10% |

| Aggressive | 0% | 5% |

As you can see from the table above, the hedging strategy is higher for conservative investors, who will find market losses less volatile. It’s minimal for aggressive investors, due to their greater appetite to ride the market in either direction.

Rebalancing

Investment portfolios are rebalanced as necessary, rather than at specific intervals. To maintain equal weights of each stock in a portfolio, rebalancing takes place when the value of the security within the portfolio moves outside a 4% to 6% weighting band.

Titan Invest currently offers two investment funds, with the prospect of more being added going forward.

Titan Flagship

This is Titan Invest’s first investment strategy. Launched on February 20, 2018, it’s a US large cap growth fund seeking to invest in companies with more than $10 billion in market capitalization. The objective of the strategy is to outperform the S&P 500 over 3 to 5 years.

When you invest in this portfolio, a personalized hedge is included, based on your individual risk tolerance. The purpose is to reduce market exposure during downturns.

The portfolio holds about 20 stocks in approximately equal weighted, long-term positions. It focuses on companies with durable competitive advantages, strong growth prospects, excellent leadership, and attractive valuations.

The portfolio features “fairly low annual turnover” and occasional rebalancing. That happens only when weights deviate widely between positions.

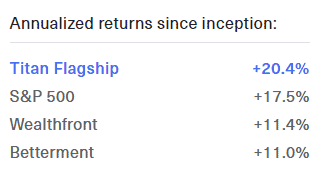

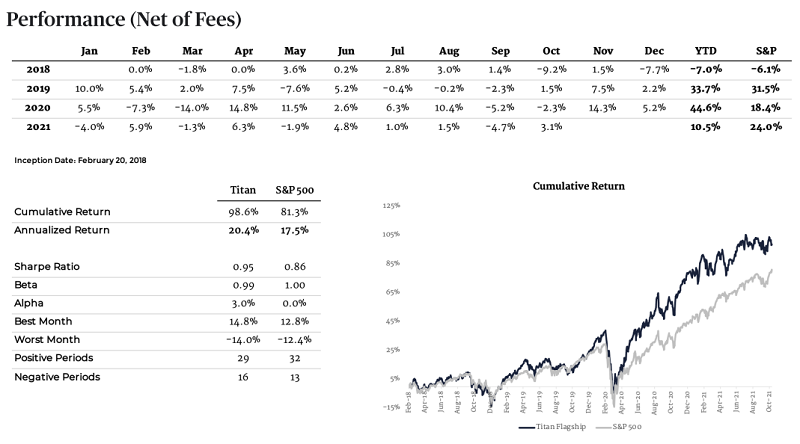

The portfolio performance since inception is as follows, net of fees:

The investment performance of the strategy, going back to its launch in February 2018, is as follows:

- 2018 – (7.0%), compared with (6.1%) for the S&P 500

- 2019 – 33.7%, compared with 31.5% for the S&P 500

- 2020 – 44.7%, compared with 18.4% for the S&P 500

- Through January 31, 2021 – (4.0%), compared with (1.0%) for the S&P 500

Minimum investment: $100

Advisory fee: $5 per month for account balances less than $10,000; 1% on balances over $10,000

Titan Opportunities

With Titan Flagship focused on large cap stocks, Titan Opportunities concentrates on smaller US companies. The portfolio began on August 17, 2020, and invests only in US stocks. The average market capitalization of each of the 20 stocks held in the portfolio is $7 billion. More specifically, it seeks to invest in companies with a total market capitalization under $10 billion.

More broadly, while Titan Flagship seeks to outperform the S&P 500, Titan Opportunities targets outperforming the Russell 2000.

Similar to the Flagship strategy, each investor has a hedge on a portion of their portfolio based on their personal risk tolerance.

The portfolio performance is shown below. However, the annualized return of 219% is skewed by how it returned 57.4% between August 17, 2020, and December 31. The annualized return reflects the 57.4% actual return achieved in about 4 ½ months, then applied to the entire year. (the chart is from this tearsheet)

For 2020 (August 17 through December 31) the portfolio had a year-to-date return of 57.4%, compared to 25.2% for the Russell 2000. Through January 31, 2021, the portfolio returned 7.4%, compared to 5% for the Russell 2000.

Minimum investment: $100

Advisory fee: $5 per month for account balances less than $10,000; 1% on balances over $10,000

Titan Invest Features

Account types: Taxable investment accounts, as well as traditional, Roth, and rollover IRA accounts.

Minimum initial investment: $100 for taxable investment accounts, $500 for IRAs.

Investments used: About 20 individual stocks in each investment portfolio, plus a hedge to reduce volatility.

Account custodian: Apex Clearing.

Mobile app: Available on Google Play for Android devices, 5.0 and up, and on The App Store for iOS devices , 11.0 or later. Compatible with iPhone, iPad, and iPod touch. Also available for Mac devices with macOS 11 or later, and a Mac with Apple M1 chip.

Account security: Each account is covered by SIPC for up to $500,000 in cash and securities, including up to $250,000 in cash. The coverage is protection from broker failure, not from losses due to market conditions. It also employs 256- bit encryption and secure sockets layer (SSL) to protect your money, personal information, and identity.

Fees: There is a $5 per month fee for account balances less than $10,000; 1% on balances over $10,000. There are no transaction fees or performance fees.

Referral program: Titan Invest will reduce the advisory fee they charge on your account by 0.25% for each qualified person you refer to the service. The person you refer will similarly receive a 0.25% advisory fee discount. You can earn the advisory fee reduction on four referrals, lowering your fee all the way to zero. The reduction will remain in place for as long as the person (people) you refer maintains an active account with Titan Invest.

Customer service: Available by email only ([email protected]). A chat feature is available but the response time is one day.

Tax software integration: Titan Invest provides direct integration into TurboTax, H&R Block and other common tax software services.

How to Sign Up with Titan Invest

To qualify for an account with Titan Invest , you must meet the following requirements:

- Be at least 18 years old.

- Have a valid Social Security number.

- Have a legal US residential address within the 50 states.

- Be a US citizen, green card holder, or a valid visa holder.

You’ll need to provide the following information:

- Your full name

- Email address

- Date of birth

- Social Security number

- Home address

- Phone number

- Employment status

You’ll need to connect a bank account to your Titan Invest account for funding purposes. A checking account is preferred to avoid ACH transfer limits. When you first link the bank account, two test deposits will be performed for verification purposes. Once they have been completed by Titan Invest, and confirmed by you, your bank account will be fully linked.

Once your account has been opened, you can set up automatic deposits. These can be established on a weekly, biweekly, monthly or custom basis. Each automatic deposit must be at least $250.

As an alternative to a linked bank account, you can fund your account with wire transfers.

The maximum that can be transferred into your account is limited to no more than $50,000 per day.

Account withdrawals can be completed within 2 to 4 business days.

Titan Invest Pros and Cons

Pros:

- Actively managed investment portfolios that charge much lower management fees than traditional, human guided investment advisors.

- Investment strategies target outperforming the S&P 500 and Russell 2000 indexes.

- A hedge is placed in each portfolio to minimize the damage from market declines.

- The advisory fee can be lowered all the way to zero by referring the service to four people who open and maintain an active account.

Cons:

- Invests only in individual stocks – there are no mutual funds, exchange traded funds, bonds or other “safe” investments.

- Attempts to time the market which is historically extremely difficult to do over the long run.

- Customer service is limited to email; there is no phone access. A chat box is available, but the response time is one day.

Should You Invest with Titan Invest?

Titan Invest focuses on outperforming popular stock market indexes, like the S&P 500 and Russell 2000 indexes. While this adds to the long-term investment potential, it also adds greater risk to your portfolio.

The companies each investment portfolio invests in is limited to only about 20 stocks. The limited number of securities involves greater risk when compared with broad indexes. And as an actively managed investment account, your returns will be no greater than the ability of the portfolio manager to successfully invest your money.

Titan Invest invests entirely in stocks, which means it doesn’t provide proper diversification. You’d be wise to maintain other investments and asset classes, including bonds and cash, in other accounts.

Considering all the above, Titan Invest is recommended for no more than a small percentage of your portfolio. The focus is completely on growth, not capital preservation, which could make it volatile in declining markets.