When it comes to personal finance, nothing beats the simple adage that you should spend less than you earn. For many folks, budgeting is easy and they’re able to save without much trouble. For others, they need to use strategies like paying yourself first.

And for others, we have to gamify it a little bit for it to be effective. If this describes you, I have something that may do the trick.

Have you heard of the 100 envelope challenge? If so, you might be intrigued by saving that kind of cash in such a short period. But how does it work, and is it realistic?

In this article, I’ll cover everything you need to know about the 100 envelope challenge, including whether or not it’s a viable option in today’s economy.

Table of Contents

What Is the 100 Envelope Challenge?

Let’s start by defining what the challenge is. The 100 envelope challenge promises to help you save $5,000 in just 100 days.

In essence, every day you save an amount at random from $1 to $100.

At first glance, you might think it’s not possible. But the math adds up, friends. Then, the next question is, “Is the challenge doable for the average citizen?” To find out, let’s talk first about how the 100 envelope challenge works.

How the 100 Envelope Challenge Works

Here’s how the 100 envelope challenge works – start with 100 envelopes. I prefer cash envelopes that fit the size of a dollar bill perfectly but you can use anything. Then, number each envelope in order from 1 to 100. Put the envelopes in a box, shuffling them, so they’re not in a particular order. Here’s a hint – shoeboxes work well.

After that, commit to pulling one envelope out of the box daily for the next 100 days. Whatever number is on the envelope, you’ll put that amount of money in the envelope.

For instance, if you pull out the envelope with the number five on it, you’ll put $5 in the envelope and seal it. If you pull out the envelope with the number seven on it, you’ll put $7 in the envelope.

You get the picture. At the end of the 100 days, assuming you’ve used up all 100 envelopes, the total will add up to $5000.

100 Envelope Challenge Printable

This is how the 100 Envelope Challenge was originally constructed but you can do it however you like. You can skip envelopes and just transfer money from one account to another (or within buckets in a single account). It doesn’t really matter, the important part is saving money.

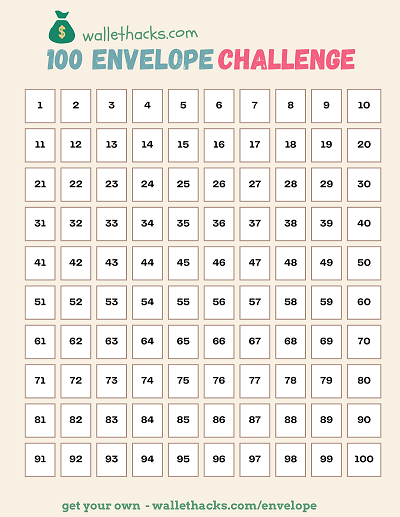

If you aren’t using envelopes, we have a printable that might help you keep track. It’s as simple as you think it might be, a grid with 100 boxes that you can color in when you complete that amount. Since you aren’t using numbered envelopes, you have to figure out a different way to pick the numbers but that’s pretty trivial. You could just flip a coin onto the printable. 🙂

The printable is a PDF and you can download it here.

This is what it looks like:

OK, what if you are concerned about whether you can finish this?

While the challenge sounds excellent in theory, you might be concerned about whether or not you’ll have the cash to complete it, especially when you draw the envelopes with bigger amounts. After all, many people live paycheck-to-paycheck, and inflated gas and grocery prices are putting an extra squeeze on everyone’s budget.

Don’t let this discourage you. There are ways to modify this so that it can be slightly easier and that’s totally OK. The goal is to save, not follow an arbitrary set of rules, so you can check out these modifications and suggestions to make the challenge more doable for you.

100 Envelope Challenge Modifications

If coming up with cash for your envelope every day feels daunting to you, you’re not alone. I mean, depending on the luck of the draw, you could end up hurting yourself financially.

What if you pull out envelope #100 on day one and #90 on day two? Unless you have $190 extra floating around, that could put a real damper on your budget and make the challenge difficult to complete.

Luckily, there are some ways you can modify the challenge to make it more realistic. Here are a few ideas.

Take Weekends Off

If you take weekends off your challenge, you’ll have $5,000 in about five months instead of in 3.5. Those two-day breathers can give you more time to come up with the extra cash. And saving $5,000 in five months is still a big accomplishment.

Modify the Length of Your Challenge in Other Ways

You can modify the length of your challenge in other ways as well. For example, you could change the days you pull envelopes and make more time between draws.

Or you could add more envelopes and put smaller amounts on some. For example, you can make two $50 envelopes instead of one $100 envelope.

Or trade in the $90 envelope for three $30 envelopes. Again, saving $5k will take longer if you do this, but you’ll still reach your goal if you follow the rules you set for yourself.

Use A Digital Envelope System

If handling cash and real envelopes isn’t for you, consider doing the challenge on a digital system.

Doing a 100 envelope challenge on a digital system takes only three steps:

- Use a 100 envelope challenge printable worksheet to keep track of the envelopes you’ve used.

- Use a random number generator to “draw” your daily number.

- Store your money in a financial institution that offers unlimited envelopes

The only possible flaw in the digital 100 envelope challenge plan is that you might need to roll several times with the random number generator if you keep getting numbers you’ve already used.

So, what are some pros and cons of trying the 100 envelope challenge? Here’s a list for you.

100 Envelope Challenge Pros and Cons

Pros

- You save $5,000 in a relatively short time

- You can modify the challenge to fit your goals or financial situation

- It’s easy to understand and takes little to complete

Cons

- Getting money every day for your envelopes might be tough

- You’ll need self-motivation to stick with the challenge

Overall, the challenge is a great concept. I think it’s fair to say that most people throw away at least some money nearly daily by spending it on coffee trips and random drive-through runs.

But even if you modify the challenge to reach half of the $5,000 amount, you’ll be in a much better position than when you started.

You can then use that money to build up your emergency fund, pay off debt, deposit in a retirement account, etc.

But what if coming up with all of that extra money will be too challenging for your budget?

How to Get Money for Your Envelopes

If coming up with enough money to stuff your envelopes seems like a daunting task, some income-boosting ideas may help.

Sell Unwanted Stuff

Nearly everyone has items in their home that they no longer want or need. Luckily, there is no shortage of apps you can use to sell your stuff online.

Craigslist and Facebook Marketplace are great places to start. Use community garage sale pages on Facebook to advertise stuff you want to sell to people who live in your community.

OfferUp is another excellent local app for selling online to buyers near you. Don’t hesitate to list everything you want to get rid of–you never know what people will buy!

Another tip: Find stuff for cheap or free on Craigslist and resell it for a profit.

Work Some Side Hustles

Another way you can get money for your 100 envelope challenge is to start doing some side hustles. The great thing about side hustles is choosing one or more that fits your lifestyle and skillset. And the ideas are limitless!! Here are some side hustle ideas to help you get you started:

- Advertise your handyperson or tasking skills on Taskrabbit

- Deliver restaurant food with DoorDash

- Advertise your freelance skills (or bid for jobs) on Upwork

- Mow lawns or do other landscaping jobs in your neighborhood

- Start a mobile car wash business

- Babysit kids or pets

- Become a dog walker

- Start a cleaning business and clean homes or offices

- Learn how to make money recycling

Other ideas for side hustles could include tutoring online, making and selling crafts, selling t-shirts on Redbubble, and more.

Or you can get a W-2 job at a restaurant, retail store, or other company. Server jobs (at the right restaurant or bar) can be incredibly lucrative when you start adding in tips. For more side hustle ideas, check out our guide to finding the perfect side hustle.

Cut Expenses

Need another idea? Another suggestion for getting money for your envelopes as you complete the challenge is to cut expenses.

For example, you could choose not to eat out for the duration of the challenge. Or find ways to save money on your grocery bills each month.

How about working to minimize utility usage for a few months? Cut down on water, electric, and gas usage where you can.

Other options for cutting expenses to get money for your envelopes include:

- Spending less on transportation by combining trips or walking/biking places instead of driving

- Go on a clothes shopping ban for a few months or choose to get clothes for cheap if you need to buy clothing

- Workout at home or outdoors instead of paying for a gym membership

- Ditch your cable or satellite bill, even if it’s just for a few months

Examine your monthly budget and look for costs that aren’t absolute needs, then reduce or eliminate those costs. For instance, you could browse the best car insurance companies to find lower auto insurance rates.

You might be surprised at how much money you could save by simply doing a line-by-line examination of your budget. Then use your savings to fund your envelope challenge money.

Final Thoughts on the 100 Envelope Challenge

The 100 envelope challenge is a great concept that could help you save thousands of dollars in a short time. The only possible flaw is the struggle for some individuals and families to find that much extra money in 100 days.

However, if those types of numbers seem overwhelming, leverage the tips I shared above to make the challenge more realistic. Stretch out the challenge, pick up a side hustle or cut expenses and see if you can get the job done and plush up your savings account. You can do it!

The envelopes-based saving concept can become a no-excuses approach to contribute to an IRA every year. The contributions need not be maximized, but something is better than nothing.