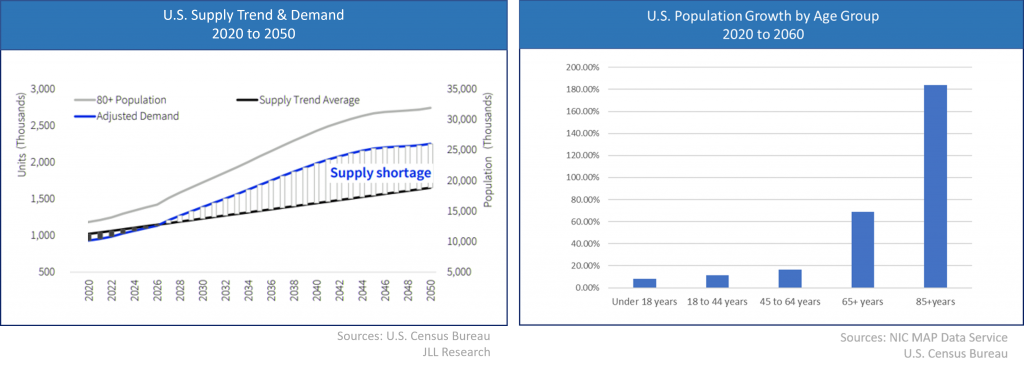

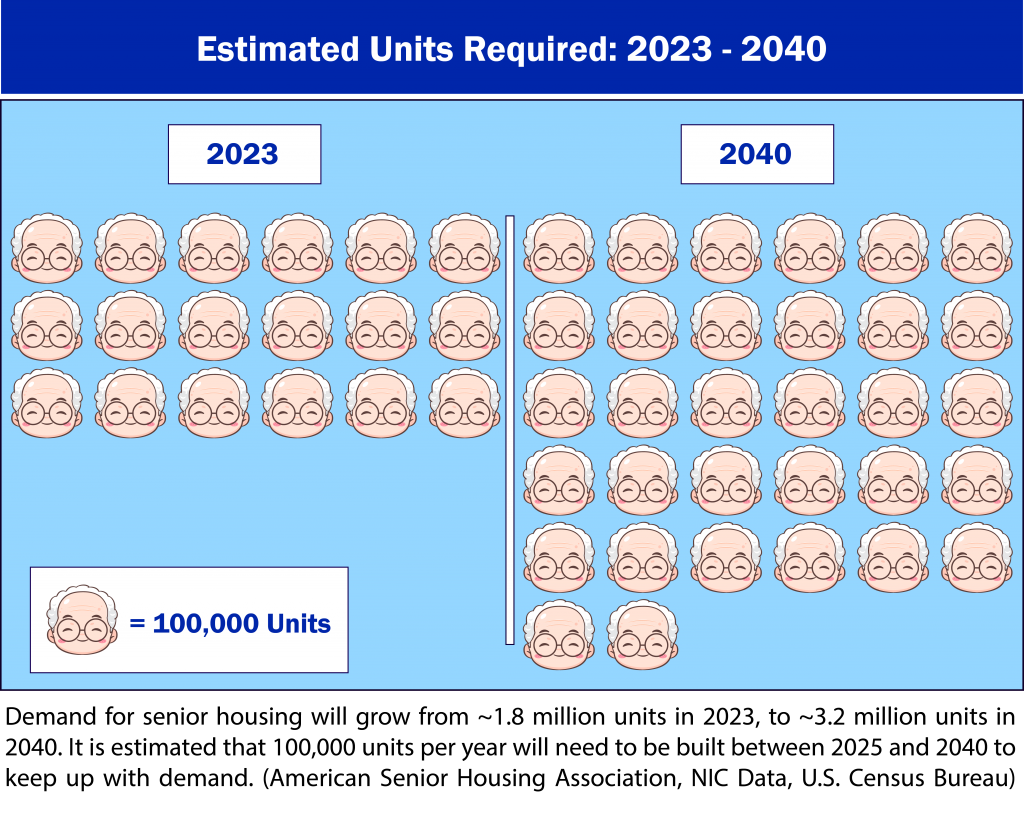

There is already a large shortage of necessary senior housing units in the U.S. This disparity was furthered by the events of the 2019-2020 pandemic, in which new construction of senior housing units significantly slowed, while the older population continued to age. The U.S. supply shortage will be greatly amplified beginning in 2026, as the 80+ population begin vastly outpacing the current senior housing supply trend.

Why Senior Housing is Real Estate’s Most Recession Proof Asset Class ?

HIGH DEMAND

The rate at which American Seniors are retiring is truly staggering. The number of Americans 65 and older will increase from 56 million in 2020 to 79.2 million by 2035, due to the emergence of Baby Boomers into the age of retirement. Such a vast increase only creates a greater demand for Senior Living Facilities.

LOW SUPPLY

As the elderly population grows, the rate of senior housing new construction is not keeping pace. Units under construction began a significant decline in 2008 and continued to fall through 2011 with only modest growth through 2014. As new construction regained pace through 2018, declines were experienced again 2019-2021.When these two dynamics are married, the need that is left unaddressed is the growing market for newer and better facilities/communities tailored to emerging retirees.

10000 Baby BoomersBaby Boomers Turn 65 Each Day

Baby Boomers Turn 65 Each Day

60000New Senior Housing Units Required Per Year

New Senior Housing Units Required Per Year

173Percent Increase Per Year In Senior Housing Units is Necessary To Meet The Projected Demand

Percent Increase Per Year In Senior Housing Units is Necessary To Meet The Projected Demand

–

You Can Earn

7.50%-21.00% Annualized Projected Rates of Return

By Participating with Senior Living Fund in the Funding & Development of New Senior Housing Communities!

–

–

Senior Living Facilities are well positioned for success in all phases of the real estate cycle

Each Senior Living Development is Carefully Evaluated & Vetted

A detailed examination of all the risk elements are evaluated, managed and mitigated.

–

Market demand, facility design & construction, location intelligence, operations management, financial reserves, sound economics/business model and an executable exit strategy all must be present before any senior living development project is considered. Senior Living Fund gives investors insider access to these pre-vetted developments.

Senior Living as an asset class has been historically difficult for average investors to access until now. Institutional investors and specialized operators have been the primary beneficiaries concentrating on an asset class whose demand has been driven by major demographic trends. Now astute individual investors can also capitalize on these trends and earn strong yields in a proven niche.

On a national macro level the demographic trends are clear. The rapidly aging population is fueling demand for senior living facilities that are in short supply. This is the main driver for growth and why senior living has continuously proven to be a strong asset class regardless of the condition of the overall economy.

On a micro level a much more detailed Due Diligence process takes place on each and every project to ensure every new senior living development is a success for investors and residents alike. The projected returns of 7.50% – 21.00% are exceptional given the relative low risk of the investment.

Location Selection: On every project sponsored by Senior Living Fund an independent 3rd party consultant is brought in to look at the local supply and demand and conduct absorption studies to insure facilities only get built in the highest demand micro markets.

Facility Design: Facilities are designed to highest standards for residence and for each project we bring in consultants on facility design that are known throughout the industry. Our facility designs are state of the art properties that are held in high regard by leading health care REITs which assist in executing exit strategy. More importantly our facility designs meet the demands on senior Baby Boomers, creating communities with multiple social destinations, restaurant style dining, spacious private rooms and baths, as well as therapy & wellness. The bottom line is Senior Living Fund encourages designs that afford the quality lifestyle that aging Americans deserve.

Developers: A detailed inquiry into each development team looks at the experience and track record of the developer. Our typical developer always has a seasoned team often with decades of experience in construction, development and management experience in the assisted living field.

Long Term Operators: This is where Senior Living projects differ from other real estate classes like multifamily, office or retail. The management of the facilities are highly specialized to the care of seniors. Having the right long term operator is possibly the most critical factor in a project’s success. Senior living Fund only works with long term operators with a track record of successful operation of senior living facilities in multiple states and multiple markets. Having high quality well respected Long Term Operators is one of the most essential elements in any senior living development.

Pre-Market Activities: Our operators start marketing occupancy during the development cycle. These Pre-market activities help minimize the time needed for stabilization and gets our properties to full occupancy and operational stabilization in short order.

Investor Exit Strategy: Senior Living Fund conducts the utmost due diligence when evaluating prospective developers, long term operators, location intelligence, and facility design. The majority of our facilities are built on demand to be acquired by a REIT or refinanced via HUD. Definitive timelines and exit strategies help to mitigate and insure successful outcomes for all partners and investors

–

–

Senior Housing Is A Recession Resilient Asset Class

A major benefit for investors in the Senior Housing space is the resiliency of this particular sector of the commercial market. A key component of the Senior Housing market’s success is its lack of reliance on a particular economic or real estate environment. Senior Housing has been a top performing commercial real estate sector for the last ten years. This includes the period encompassing the 2007 capital market collapse, in-which returns among other commercial sectors fell as much as 20%.

Senior Housing Has Been a Top Performing

Commercial Real Estate Sector For the Past 10 Years.

–

—

Learn more about investment opportunities in the Senior Housing sector

Senior Living Fund will not disclose your contact information to third-party vendors.